baona/E+ via Getty Images

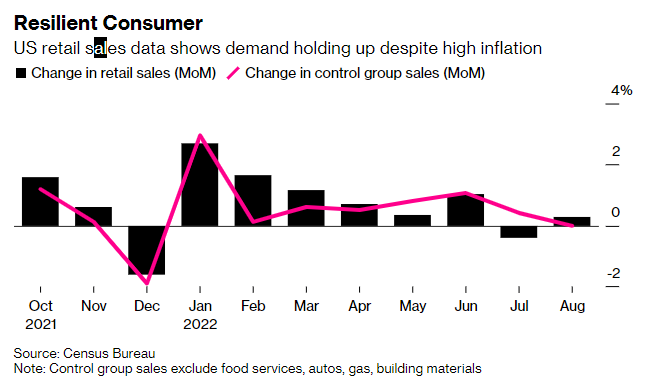

Stocks struggled yesterday in the face of more dire forecasts from market pundits, despite economic reports that showed our economy is weathering the inflationary storm exceedingly well. Weekly unemployment claims fell 5,000 to 213,000 when they were expected to rise to 225,000. While industrial production slipped 0.2% in August, due to a weather-related decline in utility output, overall manufacturing activity expanded from strength in capital spending. Lastly, retail sales for August rose 0.3% when the consensus was expecting a decline of 0.1%, and the annualized gain of 9.1% exceeded the inflation rate of 8.3%.

Yet, optimism can’t seem to overcome the doom, gloom, and misery that a growing consensus wants to spread. Good economic data, even if it is weakening as hoped, is viewed negatively, because it suggests that the Fed will continue to tighten financial conditions. Disappointing economic data, which should assuage tightening concerns, fuels recession fears. The growing consensus appears to be positioned and looking for only the worst of all possible outcomes.

Finviz

The retail sales report reflected a consumer whose preferences are shifting from month to month but continues to spend at a rate just modestly ahead of inflation. Last month’s largest declines were at gas stations, due to falling prices, and online retailers, due to the comparison with Amazon’s Prime Day in July. In lieu of those purchases, consumers spent more on autos and in bars and restaurants. While sales growth is slowing, real retail sales, which are adjusted for inflation, remain positive. This is exactly what we want to see for a soft landing. Regardless, it seems there is no number that will satisfy the consensus.

Bloomberg

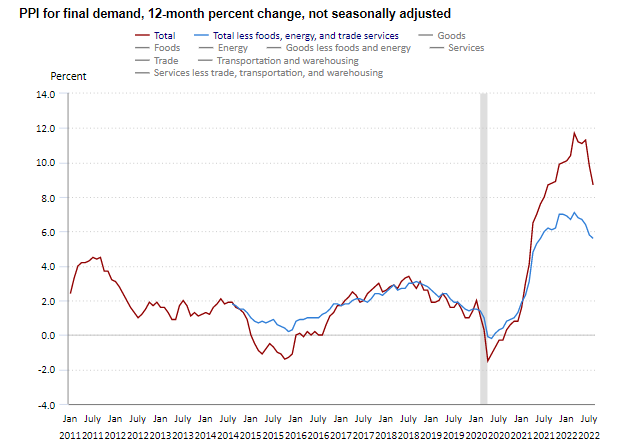

The same could be said for the Producer Price Index report from the day before, where the annual rate of increase fell to 8.7%, which was below the estimate of 8.9% and the peak rate of 9.8%. Producer price declines are a precursor to consumer price declines, but that reality is not putting a dent in the bearish narrative. You don’t have to be a Ph.D. to see prices rolling over in the chart below. The shocks to the global economy from the war in Ukraine and the zero-Covid-19 policy in China are abating, while the impact of fiscal stimulus in the U.S. is waning as monetary policy tightens. Inflation expectations have fallen in line with the Fed’s target, but the current rate does not decline overnight. The Fed’s soon-to-be 300 basis points of short-term rate increases combined with quantitative tightening have yet to fully impact economic growth, which has already slowed substantially.

BLS

Chairman Powell needs to now balance his hawkish rhetoric, intended to manage inflation expectations, with the reality on the ground. If not, he runs the risk of repeating his blunders in 2021 when he claimed inflation was transitory and left the Fed’s policy rate at zero way too long, but in the opposite direction. There is no need to feed the bearish narrative at this point.

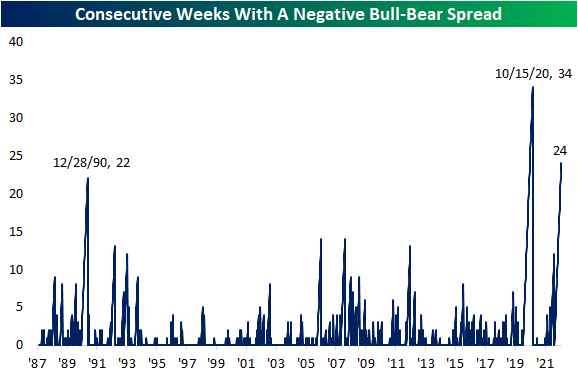

The pessimism out there is stifling. The long list of market pundits and legendary investors who have called for some combination of soaring interest rates, high inflation, recession, and another bear market decline of 20% or more is endless. Again, the doom, gloom, and misery are overwhelming.

Bridgewater founder Ray Dalio thinks that the inflation rate over the next decade will be double the 2.6% that the markets are currently forecasting. He thinks the Fed will raise short rates to 4.5% and long rates will soar to 6%, resulting in a 20%-plus decline in stock prices.

Billionaire real estate investor Barry Sternlicht thinks that the economy is “braking hard,” due to rate hikes that he thinks will cause a major crash in the housing market. He asserts that a major recession is imminent.

Jeremy Grantham, who co-founded GMO Asset Management, is calling for the bursting of a “super bubble” in all asset classes and believes the summer rally was typical of bear markets that should end with a 50% decline in the S&P 500.

These are just a few of the experts who have espoused dire outlooks for the economy and markets in recent days, which leads me to two thoughts. The first is that recessions and bear markets are largely psychological in that they are fueled by negative sentiment. If the consensus of investors can be convinced to sell risk assets on the premise that the future will be much worse than the present, then a bear market is a self-fulfilling prophecy. If the consensus of consumers can be convinced to stop spending on the same premise, then a recession is very likely to follow.

The second is that the titans of finance have no problem with bear markets or recessions, because they tend to be extremely lucrative events for those who have tremendous amounts of wealth and no issues accessing credit. Extreme levels of fear and volatility create once-a-decade opportunities for the wealthy to become even wealthier. The last such opportunity occurred following the bursting of the housing bubble, which caused the Great Recession in 2008.

The reality is that the economy is on a much stronger footing than the doomsday machine would lead one to believe. The bears are convinced that strength is the cause of the inflation we have seen year-to-date, but I think that strength has served as a buffer, allowing consumers to rise above it. Investor sentiment and positioning are at such bearish extremes that I still think it is very unlikely the S&P 500 falls below its June low. Next week’s Federal Reserve meeting will be pivotal in that process.

Bespoke

Be the first to comment