Prostock-Studio/iStock via Getty Images

While THG Plc (OTCPK:THGPF) has done a great job establishing itself in attractive categories such as online beauty and nutrition in recent years, its outsized exposure to macro challenges (on the demand and cost side) weighed on the H1 2022 results. Management hasn’t reset the bar either – instead, the mid-term growth targets for the beauty and nutrition businesses remain intact, as well as the nascent Ingenuity e-commerce solutions segment. Given the worsening consumer backdrop globally and the pressure from key operating cost items like higher energy and labor, though, I suspect the current guidance numbers (neutral FY23 FCF and an FCF inflection in FY24) could prove optimistic.

While THG has long been singled out as a potential takeout target, this seems unlikely anytime soon -the founder/CEO’s golden share is a key stumbling block until the September 2023 expiry, while the rejection of a bid in May at a significantly higher stock indicates limited appetite to sell. All in all, I would stay neutral – the valuation is a lot more attractive today, but rightly so, given profitability and sustainable FCF generation are likely a long way off amid the ongoing macro headwinds.

Revenue Slowdown Weighs on H1 2022 Numbers

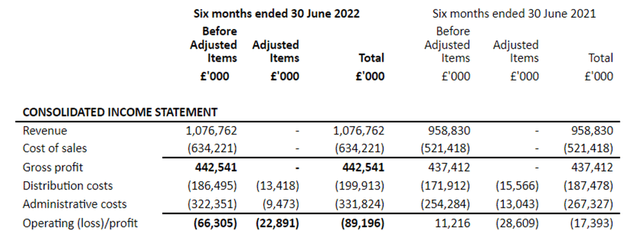

Half-year sales came in well below expectations at +12% YoY (vs. the 13-21% guidance range), led by a steep YoY decline in nutrition segment sales in Q2. More worryingly, the result implies a sharp deterioration in June numbers – recall that management had previously reported sales were trending “in line” at its last trading update.

By segment, nutrition sales were the key drag at +1.1% YoY (+3.3% on an FX-neutral basis) on broad-based demand weakness. Ongoing investments into price protection for consumers (in reaction to the cost of living challenges) also weighed on growth. The only silver lining here was the resilience of the core protein categories.

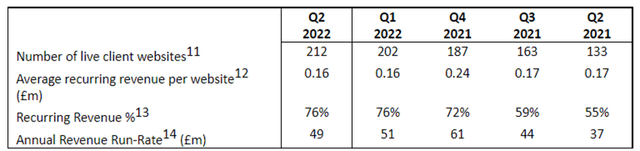

Elsewhere, H1 sales growth for the beauty segment was strong at +20% YoY (+17.7% FX-neutral), though this was largely due to contribution from the recent Cult Beauty acquisition. The nascent Ingenuity segment also posted 21.4% YoY growth (+20.2% FX-neutral), with e-commerce leading the way at +25.1%. While the double-digit % growth is welcome, the underlying trends are cause for concern. In particular, management cited a sequential slowdown in website launches in Q1/Q2, as online sales dipped following COVID-driven highs. Given recurring website revenue offers higher margins, a lower annual revenue run-rate does not bode well for the FY22/23 earnings outlook.

Intensifying Margin Headwinds

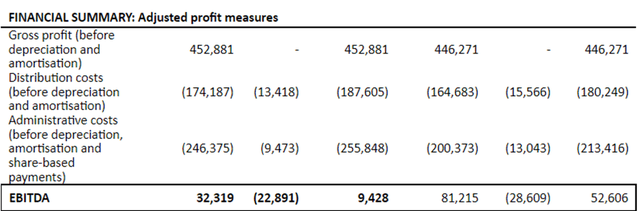

Along with the below-par sales result, THG also saw its margins come under pressure from whey price inflation and FX headwinds (mainly from the JPY), leading to a ~450bps YoY gross margin decline for the half-year. On the opex side, investment in automation (~15% of THG’s global fulfillment network is now automated) helped drive distribution costs lower by ~100bps. However, this was offset by higher payroll expenses to support post-acquisition integration and one-time investments in governance and infrastructure. All in all, H1 2022 adj EBITDA came in at ~GBP36m, although the impact of IFRIC adoption and the recovery of SaaS costs brought EBITDA closer to ~GBP32m.

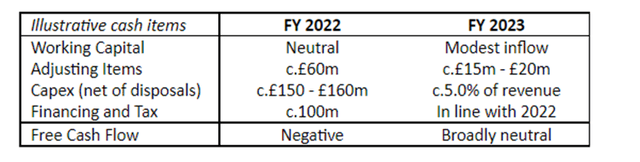

While THG posted a headline net cash outflow of ~GBP271m, this was mainly driven by a ~GBP157m increase in working capital that should reverse in H2 2022 (in line with seasonality). Still, there remains an ample cash buffer at ~GBP266m on hand. Even factoring in the net debt (before lease liabilities) of GBP226mm, the net cash balance at GBP44m provides sufficient runway. Also boosting the liquidity position are an incoming ~GBP44m from the disposal of non-core freehold assets in September 2022, as well as a new (credit-approved) GBP156m three-year facility.

Latest Guidance Cut Signals Trouble Ahead

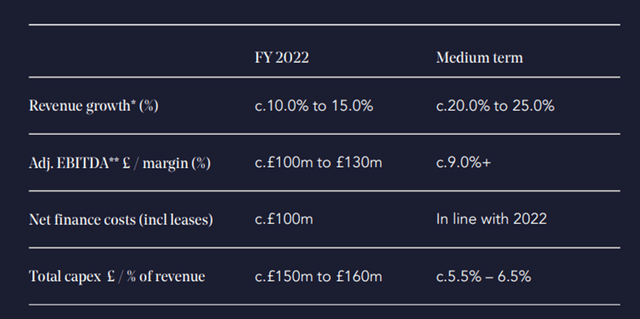

Building off the H1 2022 weakness, THG has revised its guidance lower, citing the impact of rising interest rates and energy costs on the consumer. On revenues, management has cut its FY22 growth guidance to 10-15% (down from 19-24% previously). The underlying assumptions continue to incorporate some optimism, though, with nutrition sales growth projected to improve despite a negative Q2 exit run rate. Similarly, THG is penciling in improved growth at Ingenuity, despite a slowdown in new website launches across the client base (enterprise and small/medium businesses). Given the YoY deterioration in recurring revenue per website and the annual revenue run rate as well, the FY22 e-commerce revenue guidance of GBP108-112m strikes me as a lofty bar.

The extent of the downward revision for FY22 EBITDA to GBP100-130m (down from ~GBP160m prior) is an even bigger concern. Post-adoption of IFRIC, the implied EBITDA guidance stands at GBP92-122m, which implies a hefty >30% cut at the midpoint (or a >40% cut at the lower end). Key margin drivers include pressure from elevated raw material costs, which will more than offset progress on lowering fulfillment costs and the below-inflation price increase in Nutrition. To compensate, THG will cut capex to 5.5-6.5% of FY23 revenue to drive a (rather optimistic) FCF-neutral outcome in FY23, followed by positive cash generation from FY24. In the meantime, THG’s mid-term guidance for 20-25% revenue growth and 9% adj EBITDA margins have not been reset lower, which could entail more downward revisions in the coming quarters.

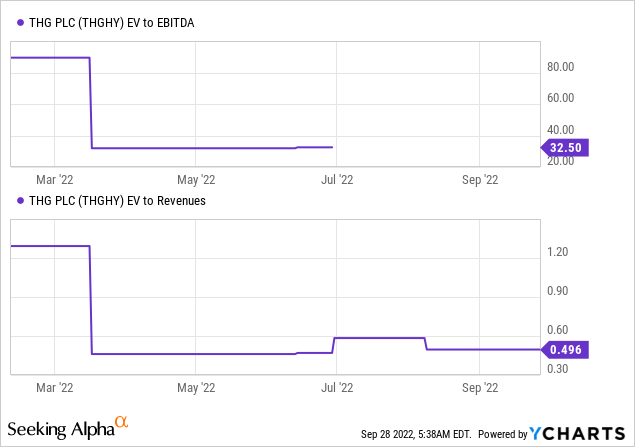

Slowing Earnings Momentum Justifies the Lower Valuation

Net, THG’s H1 2022 miss and the subsequent revenue and earnings guidance cut point to a meaningful slowdown in the underlying earnings momentum. As things stand, the updated full-year guidance also implies some rather optimistic assumptions – sales growth is guided to hit double-digits in the second half, but without any M&A contribution (which helped the H1 2022 numbers), while the ~6% implied EBITDA margin at the midpoint implies greater resilience despite the macro challenges ahead. In a base case scenario of worsening consumer demand and higher opex, guidance for FCF numbers (neutral in FY23 followed by significant FCF generation in the next year) could be revised downward as well.

The valuation is a lot more attractive today, though, and the case for THG being an acquisition target makes a lot of sense. Yet, there are near-term hurdles, including the founder/CEO’s golden share, which grants veto power over any prospective bid until the September 2023 expiry. Having already rejected a bid well above the current stock price in May, a takeout scenario seems unlikely anytime soon.

Be the first to comment