Sundry Photography

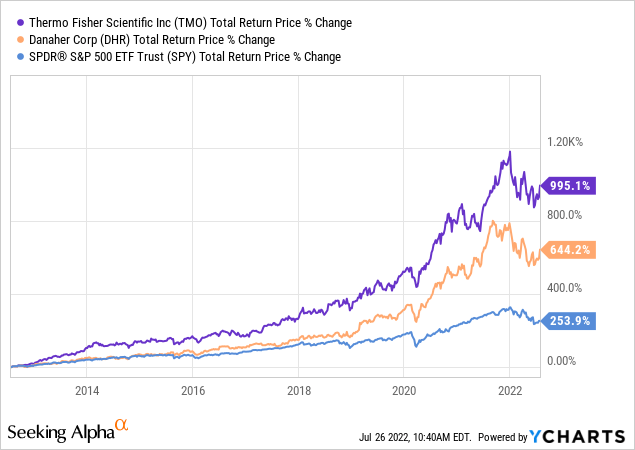

Thermo Fisher Scientific Inc. (NYSE:TMO) made roughly $7.7 billion in net income last year. Ever heard of them? Most people haven’t, but the Massachusetts-based company is among the largest suppliers to the global healthcare industry. Along with its competitor Danaher (DHR), TMO stock has delivered powerful market-beating returns over time with little drama or fanfare. Roughly 89% of TMO stock is owned by institutions, so there isn’t a lot of speculative trading activity going on. You should consider picking some up.

All eyes will be on Apple (AAPL) and Amazon (AMZN) this week, but Thermo Fisher reports earnings as well on Thursday, and their report is likely to be quietly good.

So how are they doing it?

First, Thermo Fisher benefits from the demographic tailwinds of an aging population and increased medical research. Demographics are not something investors should overlook– the aging of the world’s population is a megatrend that spans countries and continents. Much of TMO’s business is in the “picks and shovels” category, meaning that they’re less vulnerable to political changes than say health insurers like UnitedHealth Group (UNH) or drugmakers like Pfizer (PFE). Thermo Fisher gets roughly half of its revenue overseas, so the company is directly plugged into global trends and increased willingness to do research and development.

Second, the company is relatively M&A-oriented, acquiring small competitors on a regular basis. But they don’t limit themselves to small deals– they acquired PPD (a clinical research company) for $17.4 billion last December. Rolling up smaller competitors and combining the back-office functions is a classic business strategy that has worked across industries and countries.

Third, TMO has proven to the world that it’s one of the only companies that have the manufacturing prowess to rapidly produce diagnostic tests. COVID brought a boom for TMO’s revenue – the company disclosed that they made roughly $1.7 billion in the last winter quarter from COVID tests in their most recent earnings conference call. Much of the mandated COVID testing was over-the-top and wasteful, but demand for COVID tests seems that it will stay seasonally high for years as patients need confirmed tests to know whether they should take antivirals. As of my writing this, the US is still seeing more than 100,000 daily cases of COVID and roughly 400 daily deaths, basically in line with this time in 2021. We’ll all hope for a better winter, but for your investments, I’d avoid airlines and cruise stocks and be buying companies like TMO.

To these points, the combination of organic growth driven by demographics, M&A, and the revenue boom from the pandemic make TMO an attractive stock to own.

TMO Earnings and Valuation

TMO isn’t the cheapest stock in the world, but it isn’t expensive either, trading for roughly 25x 2022 earnings estimates of $22.73. For 2023, analysts expect earnings to grow to $24.40, and for 2024, analysts expect earnings to grow to $27.53. I believe these earnings estimates are too low because the market is pricing in a steep decline in COVID test sales, which I somewhat doubt will happen for another year. And the organic growth trend is roughly 8%-9% annually, per management.

TMO was able to grow earnings by 20% annually over the last 10 years (yes, the pandemic helped them). Combining their M&A track record with organic growth of 8-9% expected for the near future, I think TMO is perfectly capable of continuing to grow earnings at ~20% annually until the end of the decade. Winners keep winning! If the multiple is stable, this implies that TMO will hit $1 trillion in market cap sometime around the year 2030. If the multiple falls, it may take a year or two longer. But the growth should be there. Analysts have consistently underestimated the company’s ability to grow revenue and profit. This is due to a huge demographic tailwind, so all management has to do is execute competently, which they so far have.

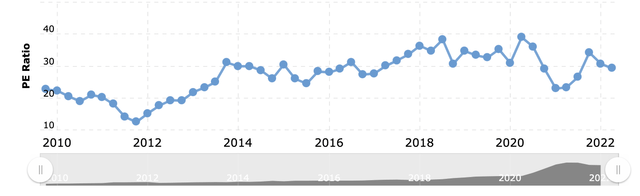

For a quick litmus test, here’s the rough trend in PE ratio for TMO stock (note that it won’t correspond to the earnings numbers above since the earnings inputs are slightly different). TMO roughly doubled from 2012 to 2014, but the PE ratio has been more or less stable since.

TMO PE Ratio (MacroTrends)

I always like to do this test to see whether a rising stock has been driven primarily by rising earnings or a rising multiple on earnings that investors are willing to pay. As an investor, you always prefer that your stocks are rising because the underlying business is successful rather than because of hype. As a trader, maybe you’d prefer the hype so you can dump your shares are the top! TMO passes this test nicely because the multiple is roughly the same as it was seven years ago. And paying 25x earnings for a growth company doesn’t require you to do mental gymnastics to justify the purchase price – if growth comes in lower than expected you end up making less money rather than losing your shirt. This is known as “growth at a reasonable price.” TMO also pays a small dividend.

Bottom Line

TMO faces similar risks to many tech-focused companies, the main one being that they can’t sustain the levels of growth that investors have come to expect. But the issues that so many stocks in the marketplace have – like operating losses, debt loads, dilution, and sky-high multiples ,simply aren’t an issue at Thermo Fisher Scientific. The company is of the girl-next-door type, not flashy or popular, but a winning choice for the long run. All signs point to TMO stock approaching and eventually exceeding $1 trillion in market cap. The overall market environment is unfavorable for stocks at the moment, but I would feel good buying some TMO now and potentially picking up more on a market downturn.

Be the first to comment