Hello my names is james,I’m photographer.

Introduction

I own one dividend stock that benefits when metals like gold and silver do well: Caterpillar (CAT), the machinery giant from Illinois. That decision was based – among a lot of other reasons – on this quote:

In a gold rush, sell shovels.

– Unknown

In this article, I want to highlight another stock that may be interesting for dividend-seeking investors in the gold industry. Royal Gold (NASDAQ:RGLD). This Denver-based gold company is an asset-light gold streamer, which means it benefits from rising gold prices without having to take on all risks that come with the process of mining gold. Besides that this means that investors benefit from rising gold prices, it also provides downside protection during times of weaker gold prices as well as a way to achieve outperforming total returns. This is on top of a dividend yield, which benefits from steady hikes.

While there are countless ways to invest in gold (physical, gold ETFs, miners, junior miners, and streamers), I think this is a great way to (indirectly) invest in this precious metal – especially for people looking to avoid high ETF expense ratios.

So, let’s look at the details!

Why Streamers? And What’s Royal Gold?

There are many ways to invest in gold. In fact, there are so many ways and philosophies that we could spend at least 10 thousand words on the pros and cons of every method.

While there are some really good gold mining stocks on the market, I believe that low-cost alternatives are the best long-term investments. This includes physical gold (I don’t own any) for safety reasons – especially in non-US dollar countries with less stable currencies – and gold streamers.

To use the U.S. Global definition:

Royalty companies serve as specialized financiers that provide upfront capital to help fund producers’ exploration and production projects. In return, they receive royalties on whatever is produced or rights to a “stream.” A stream is an agreed-upon amount of gold, silver, or other precious metal at a fixed, lower-than-market price.

Reasons for miners to work with streamers is because the borrowing terms are usually leading to faster deals. Moreover, streamers have expertise that they bring to the table as consultants.

This is how Royal Gold puts it:

We acquire and manage precious metal streams, royalties, and similar interests. We seek to acquire existing stream and royalty interests or to finance projects that are in production or in the development stage in exchange for stream or royalty interests. We do not conduct mining operations on the properties in which we hold stream and royalty interests and are not required to contribute to capital costs, environmental costs, or other operating costs on the properties.

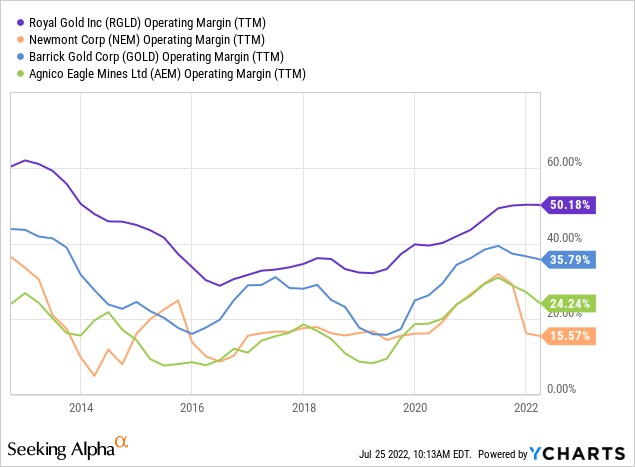

As the price of gold still matters to streamers, operating margins tend to be cyclical. However, RGLD operating margins are far higher than the margins of major mining companies engaged in physical mining operations as the chart below shows. Moreover, the company has an 80% adjusted EBITDA margin.

Roughly one-third of the company’s revenues are royalties. Royalties are taxed as passive income and:

Typically structured as gross smelter return (“GSR”), net smelter return (“NSR”), net value return (“NVR”) or net profits interest (NPI). The difference is the amount of deductions permitted prior to calculation of the royalty, ranging from zero deductions (“GSR”) to all costs (NPI).

Two-thirds of total revenues are streams, which:

Typically structured as the receipt by the streaming company of a percentage of metal produced in return for an upfront cash investment and an ongoing cash price per ounce delivered.

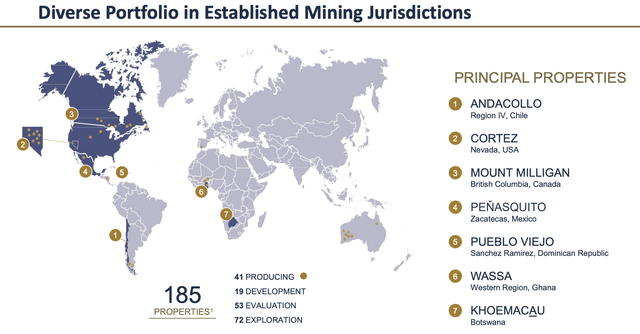

As of July 2022, the company has 185 properties in 12 countries. 73% of its revenues come from gold assets followed by copper, silver, and others. In light of ongoing geopolitical unrests like war, it helps that the company has no exposure in Russia and limited exposure in countries that tend to be prone to social and political unrests.

Moreover, after 2023, at least five more major mines will start production, which will help income tremendously.

The Dividend & Relative Performance

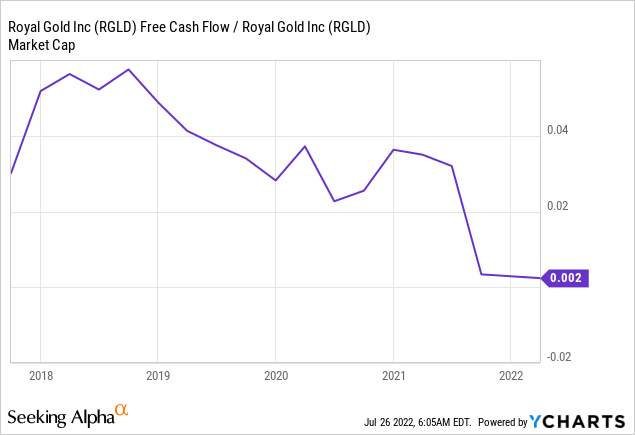

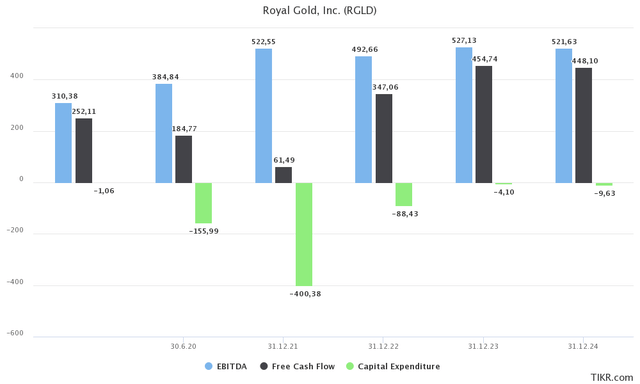

Thanks to its business model, the company generates high free cash flow in years when CapEx is low – which is only the case when large investments occur, not on a regular basis.

For example, next year, the company is expected to do $455 million in free cash flow, up from $347 million in 2022E. This implies a 6.8% FCF yield for 2023.

This not only supports the company’s dividend, but also future hikes.

The current dividend is $0.35 per share per quarter. That’s $1.40 per share per year. This implies a 1.4% dividend yield. This yield is roughly in line with the 1.5% yield of the VanEck Gold Mining ETF (GDX).

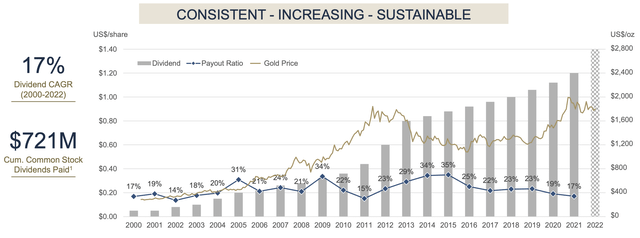

It’s not a yield to get exciting about, but it’s consistently rising. Since 2000, the dividend has grown by 17% per year. However, I like to exclude the early years of the company. It may be biased, but back then the company was far from mature and I doubt that most current (retail) investors bought during the early years. Over the past 10 years, the annual average dividend growth is 5.7%. However, the most recent hike announced in November of 2021 was 16.7%, which shows that higher gold prices do indeed end up benefiting the cash flow towards investors.

It also helps that the company has no positive net debt. This year, Royal Gold is expected to end up with $330 million in net cash, meaning it has more cash than gross debt on its balance sheet.

Currently, the company has $180 million in net cash, which is expected to rise due to the aforementioned surge in free cash flow, which ends up boosting cash after the payment of dividends. Additionally, RGLD has roughly $1.0 billion in available credit from its credit facility, which puts total available liquidity at $1.2 billion.

Moreover, the company is indeed outperforming its peers, hence ending up delivering what investors expect from good streaming companies.

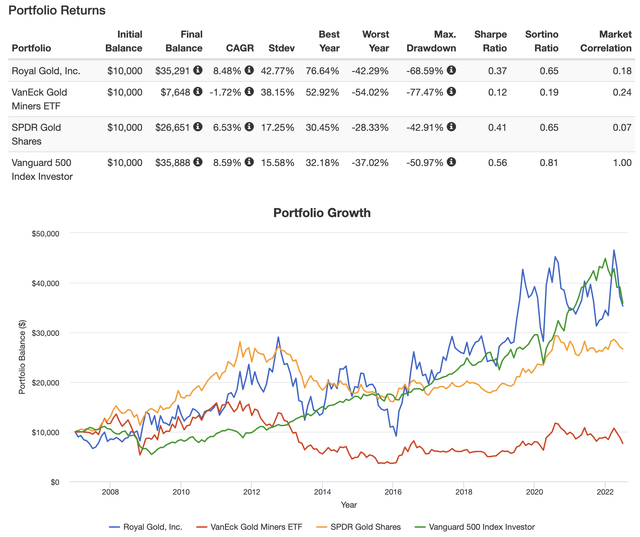

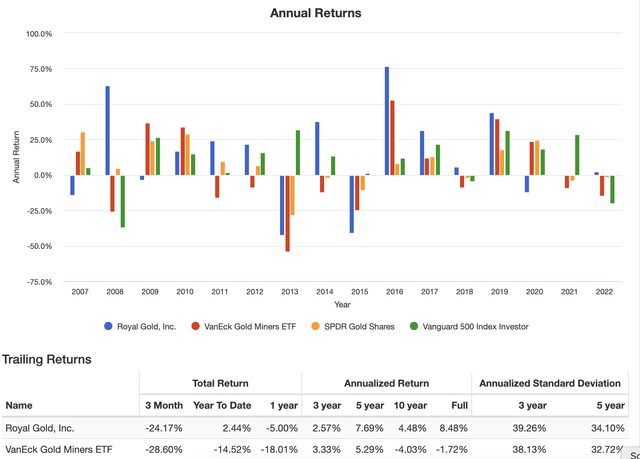

Since December of 2006, Royal Gold has returned (including dividends) 8.5% per year. This is roughly in line with the performance of the S&P 500. However, the standard deviation was much higher at more than 40%. The good news is that it beat the VanEck Gold Mining ETF by a mile as this ETF was costing investors 1.7% per year during this period – on top of almost 40% volatility. Moreover, this ETF has an expense ratio of more than 0.50%. Royal Gold does not have an expense ratio as it’s not an ETF.

The price of gold rose 6.5% during this period, using the SPDR Gold Shares ETF (GLD) as a benchmark. It also came with a much lower standard deviation, but no dividends.

Moreover, RGLD beat the GDX ETF in most years and on an annualized bases in all periods except for the past three years.

With that said, there’s another reason to like streamers.

Another Reason To Like Streamers – Production Costs

In a recent report, CME Group (CME) highlighted an issue that – I believe – is underreported: gold supply.

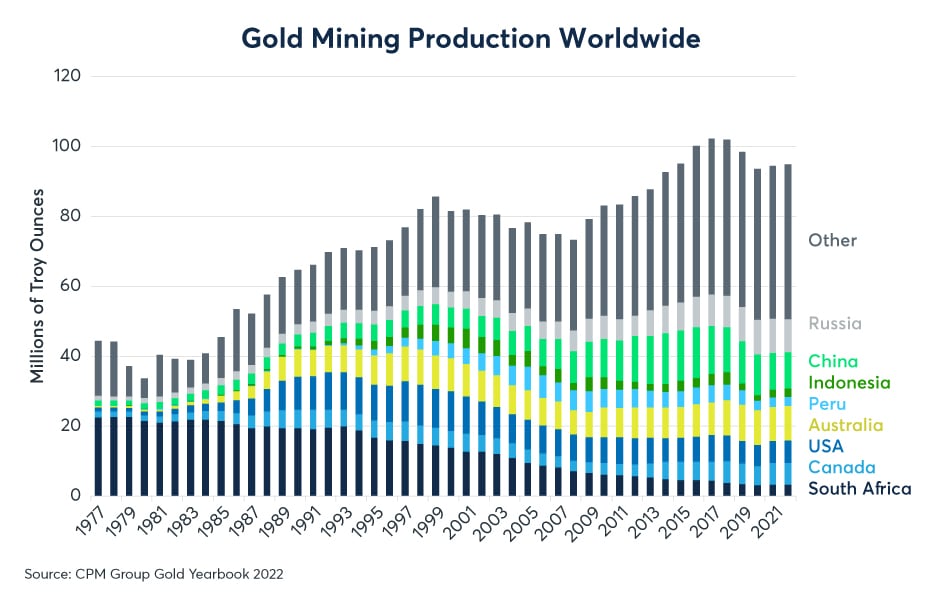

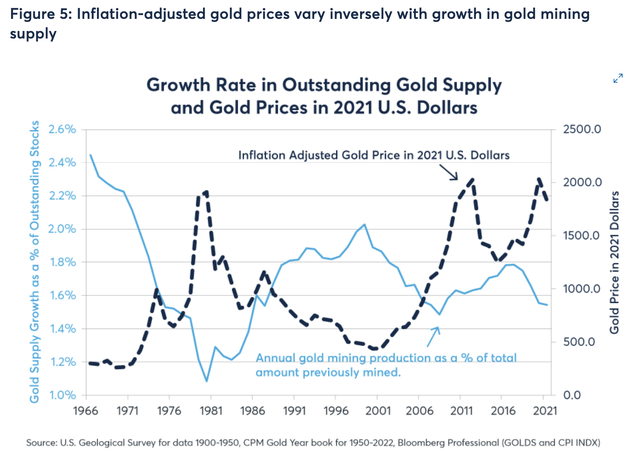

While I have written a lot on the supply side of metals in general, I’ve neglected precious metals. As CME Group shows, global gold production is down 7% since 2016.

CME Group

Silver production is down 8.5% during this period.

As the company notes:

Mining supply appears to have a strong impact on precious metals prices over time. There appears to be a strong inverse relationship between the annual growth rate in the total amount of gold supply (current year production divided by cumulative supply from previous years), and the real price of gold expressed in 2021 U.S. dollars (Figure 5).

The good news is that mining gold is very profitable right now. With all-in sustaining costs at roughly $1,070, the “average” mining company makes $650 per ounce of gold.

CME Group

While this is a good basis for a thesis that expects production to be boosted, there are environmental and political reasons keeping mines from hiking output.

Moreover, given inflationary pressures, I believe there is a strong case for asset-light streamers with growth potential who benefit from both strong pricing and higher future output.

That’s where Royal Gold shines.

Valuation

Royal Gold has a 2022 implied FCF yield of 5.2%, and 6.8% in 2023. While these numbers are subject to change based on gold price fluctuations, it’s rather high. The current multi-year high is in the high 5% range.

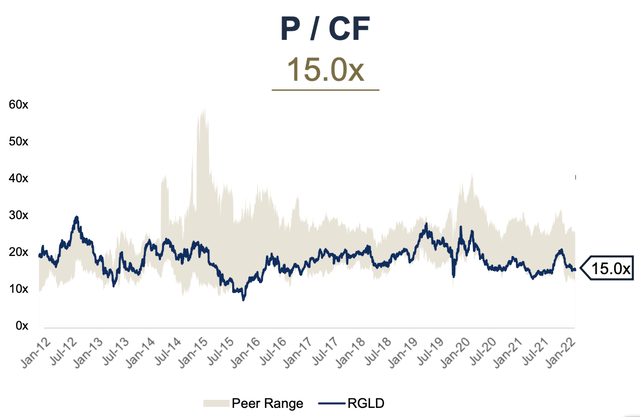

The price/cash flow ratio is at 15.0x. This is close to one of the lowest levels in years and much cheaper than other streaming peers according to Royal Gold.

Takeaway

There are many ways to invest in gold. For example, physical gold coins and bars, physical gold ETFs, miners, equipment producers, and streaming companies.

Royal Gold, one of the world’s largest streamers is a low-asset company benefiting from high gold prices and very strong free cash flow used to reward investors with steadily rising dividends – throughout multiple gold price cycles.

The company looks like a much better investment than miners and physical gold as it has shown outperforming returns and downside protection (versus miners) due to a very healthy balance sheet, and an asset-light business model.

It also helps that the company is expected to see higher volumes due to new projects in an industry that is not expected to boost output anytime soon.

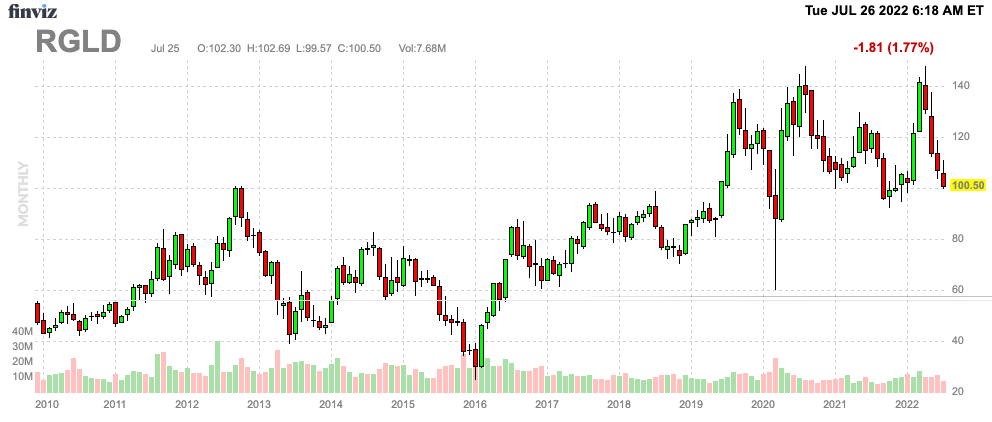

Moreover, the company is very attractively valued after dropping from roughly $150 per share to $100 per share.

FINVIZ

I believe that RGLD is now in the buy zone, which has provided the stock with a lot of support over the past 3 years.

While RGLD is a solid dividend stock, I do not consider the stock a must-own stock. The dividend yield is still low compared to the basic material and industrial peers. And volatility is extremely high.

However, it’s a great stock for investors looking specifically for long-term gold exposure.

(Dis)agree? Let me know in the comments!

Be the first to comment