JasonDoiy

Recap

Way back in 2015, I wrote an article entitled The Purple Swan, which predicted the imminent announcement of what would be known as 3D XPoint (aka “Optane”), the Micron (NASDAQ:MU) and Intel (NASDAQ:INTC) joint venture on persistent, byte-addressable, high-speed memory (not slow, block storage like flash – there is a huge difference that few investors appreciate), which was announced with nervous haste a little over a month later.

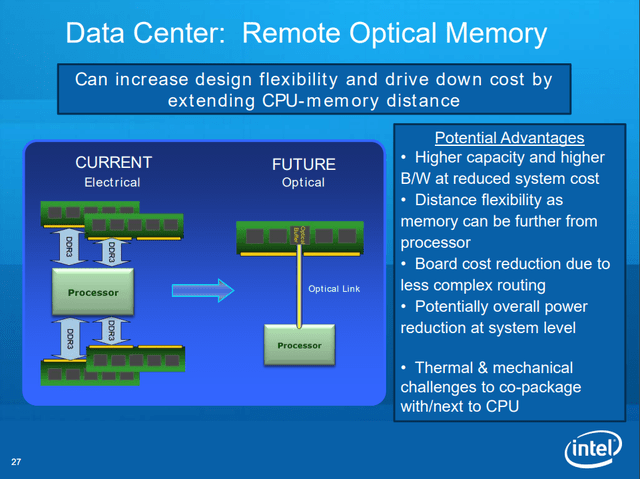

I speculate now that they likely had no plans to announce it that early but did so in order to convince the market that it wasn’t the PCM, of which I had speculated. While they were supposed to release the technology in 2016 “from the data center down to low-power ultra books“, they didn’t. 3D XPoint was delayed for well over a year while they continued to deny that it was PCM. Curiously, 2016 was the year when Intel was to release their 10 nanometer process. Related? I don’t know but, then again, I’m the guy wearing the tinfoil hat. Intel had already told the industry that they were moving to an optical memory interface at least for their data center products. It is possible that they went all-in on with remote optical memory.

Intel Remote Optical Memory (Andrew Alduino / Hotchips 22 Conference)

Those who have followed my articles since 2015 know that it is my opinion that Intel and Micron were required to backtrack their 3D Xpoint strategy because the underlying technology was the phase change memory (“PCM”) technology that they had developed at Energy Conversion Devices, Inc (“ECD”), which was mysteriously put into bankruptcy – and subsequent fire sale – despite a high cash position.

Micron purchased the lion’s share of the PCM subsidiary from ECD for just $12 million. This included more than 300 patents pertaining to PCM, photonic communications, cognitive computing (“AI”), and more. Shortly after the announcement of 3D XPoint, Micron established a subsidiary known as “Carlow Innovations, LLC” and transferred into it all of the patents from Ovonyx. After I wrote about this here on SA, Micron (presumably) had the Carlow Innovations name changed to “Ovonyx Memory Technology, LLC” (“OMT”). Why the transfer in the first place? Why the subsequent name change (use entity ID of S5668043)?

If you haven’t already, you can read all about it in the myriad of articles that I’ve written on the subject as well as the ongoing court case, a 146 page opinion of which was released in October of 2020. The long story short: it appears to me that Intel and Micron were trying to wait for the ECD bankruptcy to close before releasing the product, which would undoubtedly be torn down, exposing, in fact, that it was ECD’s PCM tech after all. After much delay, the 3D Xpoint product was finally shipped by Intel as “Optane”. The TechInsights teardown revealed that it was all ECD tech (PCM with Ovonic switches).

It’s Takin’ Forever

In 2018 (four years ago), the ECD bankruptcy trust, which had only a couple hundred thousand dollars remaining at that time, hired Quinn Emanuel Urquhart & Sullivan, a high-dollar litigation firm that previously represented Micron against Rambus (RMBS). They were successful in this endeavor and it only took a decade. Since then, the comments in my articles are peppered with “the lawyers will only be there until the ECD money dries up”. Well, guess what? Quinn Emanuel would have eaten all the remaining money from the trust in a month or two. But they’re still going somehow (draw your own conclusions).

It is nearly 2023 now and the case is still going strong – day to day filings. I used to monitor these filings but, recently, the US Bankruptcy Court for the Eastern District of Michigan put up a big red warning:

US Bankruptcy Court for the Eastern District of Michigan

And I thought that “Pacer” was an acronym for “Public Access to Court Electronic Records”. I don’t have the time or money for barratry right now so I will just glean what I can from the titles in the third-party Pacer scrapers. From what I gather, Intel and Micron dropped Optane / 3D Xpoint because they aren’t legally allowed to use it anymore (“actual fraudulent transfer”, as described by the court opinion linked above). For some reason, the various opinions seem to be available on Google:

- ORDER DENYING, WITHOUT PREJUDICE, EX PARTE MOTION BYOVONYX, INC., MICRON TECHNOLOGY, INC., AND OVONYXMEMORY TECHNOLOGY, LLC, CONCERNING HEARINGS ONPENDING MOTIONS TO DISMISS (01/18/2019)

- OPINION REGARDING DEFENDANTS’ MOTIONS TO DISMISS (10/01/2020)

- OPINION AND ORDER DENYING MOTION TO DISMISS FILED BYDEFENDANTS OVONYX, INC. AND MICRON TECHNOLOGY, INC. (11/24/2021)

- OPINION AND ORDER GRANTING PLAINTIFF’S MOTIONFOR LEAVE TO FILE SECOND AMENDED COMPLAINT (11/24/2021)

- OPINION AND ORDER GRANTING PLAINTIFF’S MOTIONFOR LEAVE TO FILE THIRD AMENDED COMPLAINT (12/15/2021)

- OPINION AND ORDER GRANTING PLAINTIFF’S MOTION TO COMPELPRODUCTION OF DOCUMENT FROM DEFENDANT MICRON TECHNOLOGY,INC. (07/08/2022)

There’s a lot of mourning coming from the industry experts with respect to the fact that there is now no real option for persistent memory. CXL and CCIX were developed for byte-addressable persistent memory, of which Optane was the only option. Battery-backed DRAM will now likely find the top seat in data center installs. DRAM makers such as Micron will benefit greatly in this case as CXL is a serial interface so the per-card memory limits will be quite high.

Sure, in terms of NVRAM, there are a bunch of expensive, low-density curiosities that still have one foot in the lab (e.g. FeRAM, MRAM, CBRAM, etc) but one would be better off with the battery-backed DRAM on their CXL add-in card. Gamers, no doubt, will fill them with flash in order to have bragging rights on synthetic benchmarks but that does nothing for practical computing.

People need to stop comparing flash to real memory (like Optane, FeRAM, and MRAM). Flash is block-addressable storage while memory is byte-addressable data that can be used directly by a processor. It is like comparing a boulder to a grain of sand – the latter is much easier to move around.

Side note: in the past, I had mistaken CXL and CCIX as competing technologies – they are not. Rather, they are intended to be used together (a must-read for techies) in order to solve certain needs. Intel’s massive investment in RISC-V is one of these use cases – SmartNICs, where much computing is done on the CXL/CCIX network/memory card. I had discounted RISC-V in the past but it is no slouch and I look forward to the fruits of their new partnership with Intel.

Why no news about Texas Instruments in Lehi?

As we all know, Micron sold their Lehi 3D Xpoint fab to Texas Instruments (TXN) in June of 2021. But Texas Instruments has been awfully quiet about their plans for the site. They’ve got plenty of job postings for Lehi but none of them reveal what product will be made there. Here’s a quote from one of the postings:

Knowledge of SiGe, SMT, DSL, SRAM and also NVM such as embedded Flash and FRAM is desirable.

TI does have a commercial FRAM product but it is expensive, low-density, and hasn’t caught on in any mainstream market (it may, now that 3D Xpoint is gone). Why did Micron buyout Intel’s half of IMFT and Lehi for $1.5 billion only to turn around to sell the whole thing to TI for $900 million? Is TI maintaining the 3D Xpoint roadmap at Lehi, only to sell product back to Intel and Micron once the litigation is wrapped up? Could be. If there were any other viable NVRAM (again, flash isn’t memory) candidate, then it would exist.

I don’t know where the patents went. The OMT/Carlow entity seems to retain ownership. From what I can gather, Intel never transferred any of their related patents anywhere (this might be complicated by licensing agreements since Intel and ECD started their relationship in 2001). Micron appears to have transferred nearly 850 patents into OMT/Carlow (here and here). But we don’t know who owns OMT/Carlow.

Conclusion

It seems clear to me that the results of this protracted court battle may have stripped Micron and Intel of rights to 3D Xpoint / Optane. However, as I’ve expressed previously, I believe that much of the value from ECD/Ovonyx is AI, photonics, and non-silicon computing. I believe that Intel’s much-delayed Loihi AI and Micron’s much-delayed Automata AI are next on the chopping block as they may very well be leveraging ECD technology in the form of Ovonic Cognitive Computing.

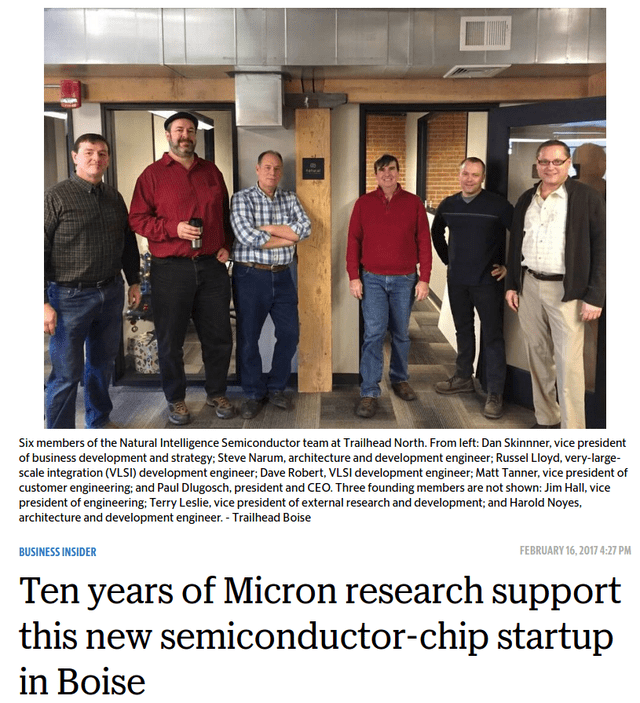

We know that both Automata and Loihi are in production but they aren’t available to the general public due to their top-secret nature. Micron went so far as to spinoff the Automata tech without telling shareholders. There was only one announcement (now removed) in the local Idaho Statesman newspaper and nothing else.

The only public announcement of Micron’s spinoff. (Idaho Statesman)

You can check out the near decade-old Automata technology (too bad for shareholders) over at the Natural Intelligence spinoff. From what I gather, you can only use the technology through the cloud (lest they risk another potentially damaging teardown). If you work for “select members of the Intel Neuromorphic Research Community”, then you can leverage Intel’s Loihi AI tech, which is now on Gen2 and more than 5 years old. Again, you can only use it through the cloud unless you’re doing space projects for the US government.

When I first started writing about 3D Xpoint, there were a lot of people who came out of the woodwork in attempt to discourage me from writing more about it. These were mostly in the form of article comments but I think that some went beyond that. Just after writing Purple Swan, I was having lunch with my family in a quiet Chinese restaurant when an impeccably well-dressed man got up from his table-for-one (tea only), walked over to my table, leaned over and said, “you have a beautiful family” before exiting. Maybe it was a coincidence and he was just being nice? Maybe not.

The US Patent Office recently replaced their search interface. With the old one, I had a script set up to run every Thursday (when the new applications were published) and sift through to find the relevant curiosities. I’ll figure out how to do that with the new one at some point. Until then, keep an eye on all of them – Texas Instruments, Intel, and Micron. It very well might be the courts that are keeping 3D XPoint off of the market. It is also important to note that Samsung (OTCPK:SSNLF) and SK Hynix are elbows-deep with PCM patents, with Toshiba (OTCPK:TOSYY), and Sony (SONY) on the radar as well.

For now, I’m going to take off my tinfoil hat and start writing articles on other subjects. My disdain for conventional investing knows no bounds.

Be the first to comment