Sundry Photography

Over the last few weeks, it was a roller coaster for STMicroelectronics’s stock price (NYSE:STM). On the one hand, according to Bloomberg on the 12th of September, iPhone delivery times in the premium model were supposed to take longer than expected. We emphasized how significantly important was the US strong demand coupled with the Chinese one, “where delivery times would have reached seven weeks and the JD.com (JD) website would have had problems managing payments due to the high traffic”. On the other hand, the same agency on the 28th of September released a new announcement that explained how the Cupertino-based company had a decrease in iPhone demand. According to the latest news, it seems that Apple (AAPL) will stick with its summer guidance of 90 million models in total. This would represent the same production figures as it was in 2021. Wall Street consensus estimates were forecasting an additional 6 million new iPhone 14s. As a consequence, this might impact semis suppliers’ volumes by 2.5% y-o-y.

Looking at the data, the Chinese market which is currently the world’s largest smartphone market has impacted the Apple drop in demand. In the first 3 days, new iPhone purchases decreased by approximately 11% compared to the iPhone 13 data in the previous year’s comps analysis. At the aggregate level, the entire phone market is in trouble and would probably shrink to 1.2 billion units or by 6.5 as a percentage in 2022.

At first thinking, we can conclude that Apple already knew this outcome. Some phones are more resilient, especially high-end ones. Indeed, the Cupertino strategy is to shift production capacity to the iPhone Pro.

As we already mentioned, Apple is STM’s most important client and accounts for almost 20% of the company’s total sales. The iPhone turnover is certainly STM’s main product; however, during the years, iPhone sales weight has decreased thanks to the supply of other Apple products.

In 2022, we are not forecasting any impact on our internal numbers in light of STM and Apple’s strong relationship coupled with the fact that production capacity is already fully capped for months. Having recently listened to the City’s Global Technology Conference, we are also excluding repercussions for 2023.

On the positive news for the whole sector, today there were optimistic release forecasts from Foxconn and Samsung Electronics chip division.

The Taiwanese group Foxconn, the world’s largest electronics manufacturer, said it is “cautiously optimistic” about revenue estimates for the fourth quarter of this year after posting record sales in September of more than 40%.

Foxconn itself is a major supplier to Apple and is also vulnerable to slowing consumer demand for technology. But the company maintained its August forecast of full-year revenue growth from previous flat revenue guidance.

Conclusion

These flash news articles are noisy rumors on what we believe is a strong buy opportunity set for the long run in our universe coverage. We are not translating one-off (positive or negative) into real impacts in our internal estimates. The weakness of smartphones and personal electronics is well known; however, high-end iPhones are usually well protected and more resilient to the business cycle.

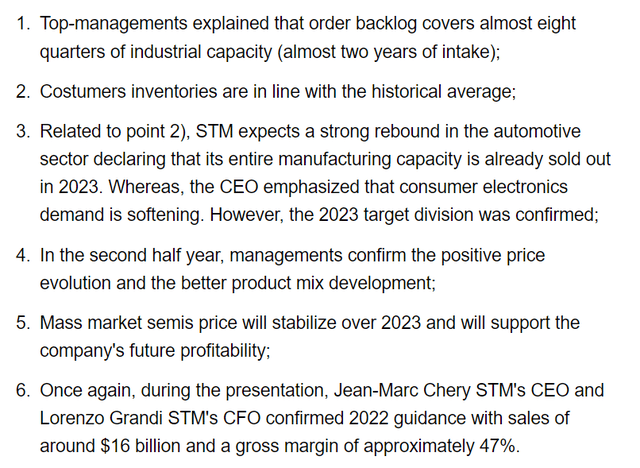

We do not add anything more, the buy target is confirmed and once again we emphasize our previous article’s key takeaways:

STMicroelectronics: Looking Ahead

If you are interested in our latest coverage on European semis, please have a look at our recently published articles:

- FormFactor Vs. Technoprobe: A Clear Winner Part 2

- Infineon Is A Screaming Buy

Be the first to comment