AK2

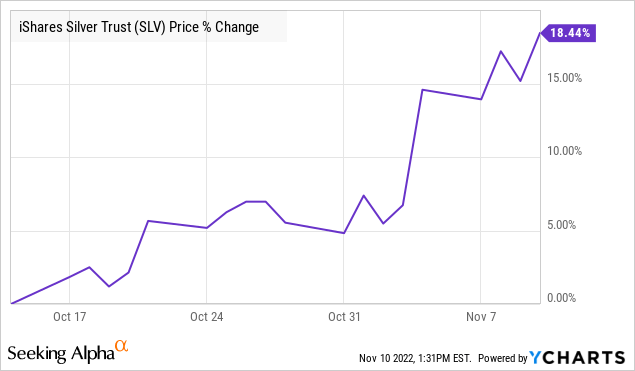

The iShares Silver Trust ETF (NYSEARCA:SLV) has quietly rallied to a 5-month high, up nearly 20% over the past month. We’re seeing an ongoing reversal of the U.S Dollar strength and a pullback in bond yields that had pressured precious metals all year. Indeed, the latest U.S. inflation data coming in softer than expected has added momentum to these emerging trends as a positive tailwind for silver. We are bullish on the SLV ETF with several reasons to expect more upside in 2023.

Why Is SLV Climbing Higher?

The market has captured improving sentiment amid some important developments this month. The first point here goes back to the November FOMC where the big headline was an apparent “pivot” by the Fed, suggesting smaller rate hikes going forward. Our read was that the impact of the increases to the Fed Funds rate over the last several months was still moving through the economy and further aggressively hawkish policy actions may not be necessary to reach stabilizing consumer prices.

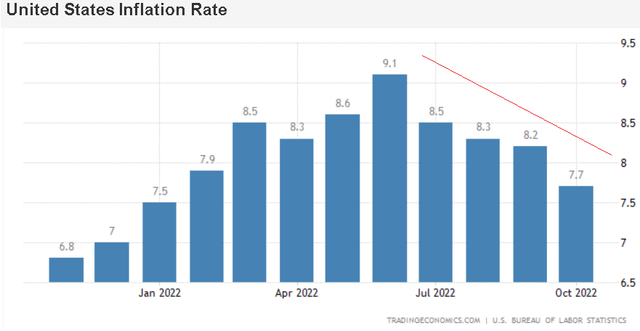

This line of thinking likely gained some support with the October CPI report confirming inflation is cooling off. The headline annual rate at 7.7% declined from 8.2% in September and surprised lower compared to the 8.0% estimate. The core-CPI measure that excludes food and energy also cooled off from its record high last month.

Favorably, key components are rolling over into tough comparables in the period last year which should lead to a string of lower data points into 2023. The early results from the U.S. midterm elections pointing to a split congress suggest some constraint in the Democrat expansionary fiscal policy and also keeping further inflation contained.

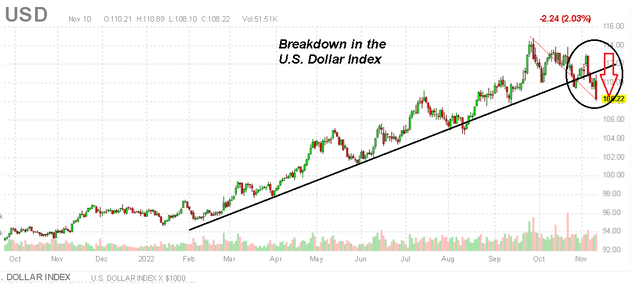

The main implication here is an outlook for a lower terminal rate in the Fed tightening strategy. Simply put, inflation trending lower provides some confidence that the Fed’s strategy is working where the final rate hike in the cycle is closer to the horizon. Notably, bonds have rallied evidenced by the yield on the 10-year Treasury under 3.9% from a high above 4.3% in October. The result is pressure on the Dollar against foreign currencies that begin to appear more attractive as interest rate differentials narrow.

As it relates to silver, the metal priced in Dollars is gaining alongside more competitive foreign currencies. Here we can bring into the conversation silver’s industrial demand component which generally benefits from stronger macro data. Reports that China is looking at ending its “zero-Covid” policies, marking a reopening of its borders, could add a boost to global trade into next year. From the U.S., signs that the economy has held up, despite the higher interest rates, with a better-than-expected Q3 GDP and ongoing labor market gains is also positive for the global outlook particularly as inflation cools off.

Silver Market Fundamentals

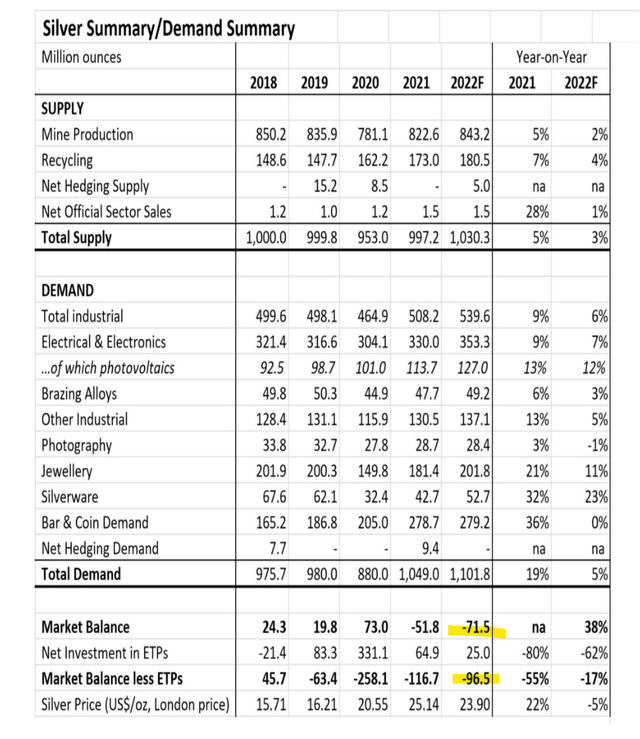

The upside here is an environment where the silver market balance is already in a deficit. According to The Silver Institute, the 2022 market balance on physical silver is forecast to reach -71.5 million ounces amid 5% demand growth above a 3% increase in total supply. Stronger macro data and a weaker Dollar from here add to the demand growth estimates outpacing supplies. Separately, we can also expect the current rally in silver to support higher demand for exchange-traded products like SLV which adds to the pricing momentum.

SLV Price Forecast

Putting it all together, the call here is to be positionally long on silver which has room to rally higher. In our view, silver can gain momentum as the Dollar weakens further and interest rates at least stabilize. While many of the bullish themes with silver can be applied to gold (GLD) and other precious metals, the argument we make is that silver is well-positioned to outperform to the upside considering its larger market supply deficit and its connection to improving industrial demand.

Notably, nearly a quarter of silver’s industrial demand comes from the solar industry as a component of photovoltaic panels. This is one industry we have been particularly bullish on based on the shift towards renewables that has accelerated this year amid the energy crisis. In the U.S., the recently passed “Inflation Reduction Act” incentivizes the adoption of solar power technology which can be seen as an incremental boost to long-term silver demand.

We like SLV as an easy way to capture exposure to the combination of positive market fundamentals set to drive silver prices higher. While there is a case to be made regarding the opportunities in silver mining stocks, the attraction of SLV is simply its more balanced risk profile compared to silver equities which are typically more volatile.

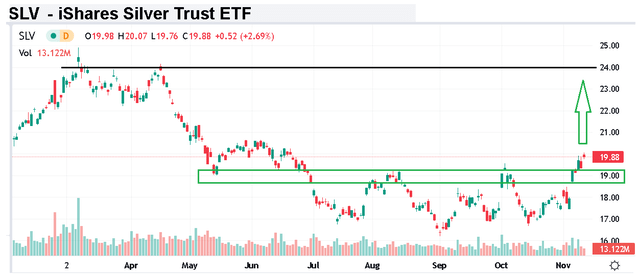

Assuming the commodity price of silver can reclaim its Q2 level back above $25 per ounce, we see SLV retesting the ETF price of $24.00 as a target over the next few months. It’s worth mentioning SLV is now above its 200-day moving average as a bullish signal. In terms of risks, a sharp deterioration in the macro conditions would likely kick up renewed volatility with a rebound in the Dollar. To the downside, as long as SLV can hold the $19.00 area of near-term support, the bulls are in control.

Be the first to comment