LIVINUS/iStock Editorial via Getty Images

Introduction

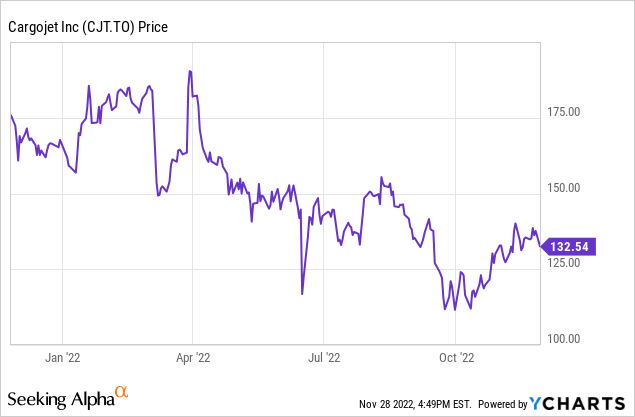

Cargojet (OTCPK:CGJTF) (TSX:CJT:CA) is Canada’s largest freight airliner. With several widebody cargo planes and long-term agreements with UPS, DHL, Amazon and Canada Post which include minimum revenue guarantees and cost pass-through provisions, the business model is robust as long as its long-term partners remain solvent. While Cargojet’s fleet is quite old, it is in the middle of a fleet renewal and expansion program in order to meet its 2026 guidance. New planes are added on a quarterly basis thanks to and on the back of the long-term contracts.

Another strong quarter thanks to the long-term agreements

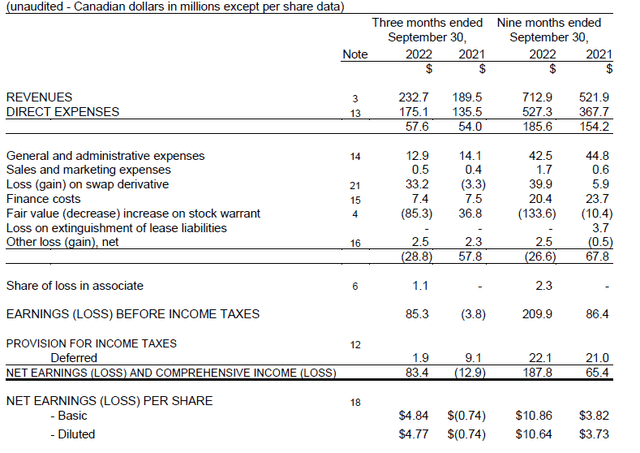

The total revenue in the third quarter came in at just under C$233M with a gross profit of just under C$58M. While you would think a 7% gross profit increase on a 22% revenue increase doesn’t sound good, keep in mind the revenue increases the pass-through provisions. Compared to the third quarter of last year, Cargojet was able pass through in excess of C$20M in additional fuel expenses and this skews the reported gross profit margin (and the operating margin).

The company reported a pre-tax income of C$85M and a net income of C$83M but keep in mind this was related to the decrease in the value of warrants it issued to its long-term contract partners. As Cargojet’s share price goes down the value of the warrant liability goes down as well (as it is less likely these warrants will be exercised if they are out of the money). This works in both directions and an increasing share price will result in an additional loss on the value of these warrants. Additionally, there was a C$33M loss on swaps as well. Excluding these two elements, the pre-tax income would have been just over C$34M with a reported net income of just over C$25M or C$1.46 per share.

That’s why I don’t care too much about the reported net income as these non-recurring items result in an unreliable reported net income. The cash flow result appears to be a more consistent metric to determine how interesting Cargojet is.

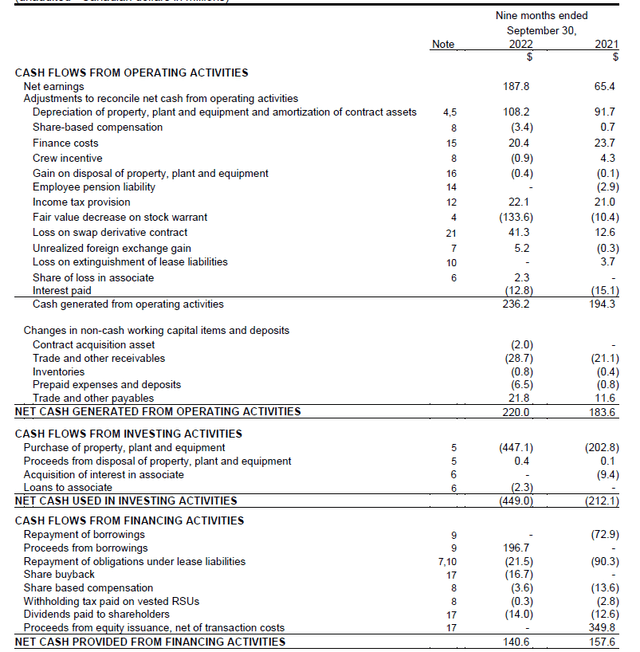

In the first nine months of the current financial year, Cargojet reported a total operating cash flow of C$236M. After adding back the C$13M in working capital changes and deducting the C$22M in lease payments, the adjusted operating cash flow was C$227M.

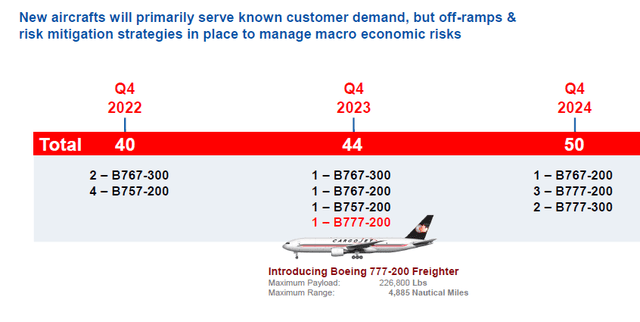

While the total capex was C$447M, it’s important to understand almost 80% of the total capex bill was related to growth: the maintenance capex was just C$101M, and this means the underlying free cash flow result in the first nine months of the year was C$126M. Divided over the 17.2M shares outstanding, the free cash flow result per share came in at just over C$7.3 and Cargojet will likely generate close to C$10/share in sustaining free cash flow this year. It obviously will have to replace its fleet so we can’t just completely ignore the depreciation expenses, but Cargojet is generating enough cash to gradually rejuvenate its fleet when it needs to. The capex is now extraordinarily high as the company is adding new planes to its fleet. Two more planes will be delivered in the current quarter and will start to contribute to the top-line result.

Also keep in mind 2022 will be the last year with high growth capex. As you can see below, the growth capex will fall off a cliff from next year on, and given Cargojet’s strong free cash flow performance, the net debt will only increase at a slow pace while the debt ratio will decrease as the EBITDA should increase as well.

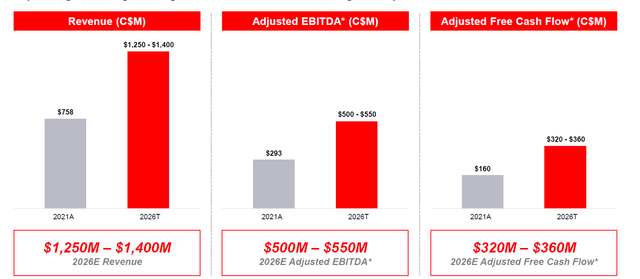

The company reiterated its 2026 guidance

Investing in new planes backed by long-term contracts with reliable customers usually is a good move and this allows Cargojet to be pretty optimistic for 2026. It plans to almost double the revenue while the adjusted EBITDA result should increase in tandem. Cargojet is now openly aiming for a C$500-550M EBITDA in 2026 which should result in an adjusted free cash flow of C$320-360M.

To achieve the total fleet growth, I anticipate the net debt will increase by just C$200-300M from the current level (and likely at the lower end of that range based on the current cash flow performance and cash retention). This means I expect the total net debt to top out at C$700-800M while the debt ratio (defined as EBITDA versus net financial debt) should remain below 1.75 and well within the company’s own targeted range of 1.5-2.5 times the EBITDA.

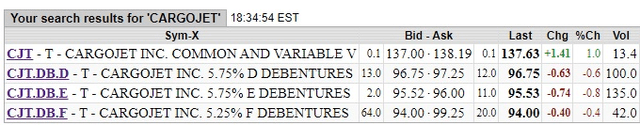

The recent jump in interest rates makes the debentures more attractive than ever

In my previous articles I always zoomed in on the debentures as well, and I still think the three listed debentures offer a very attractive yield to maturity. Cargojet has the option to repay the debentures in shares (at a 10% discount) but that is just a standard clause you see quite often in Canadian debentures.

I think the D-series offer exceptionally good value for money because A) they mature first, in April 2024) and B) they mature before the term loan. Meanwhile, these bonds can be purchased at 97.25 cents on the dollar (based on the order book as of the end of the trading day last Friday) resulting in a YTM of 7.8%.

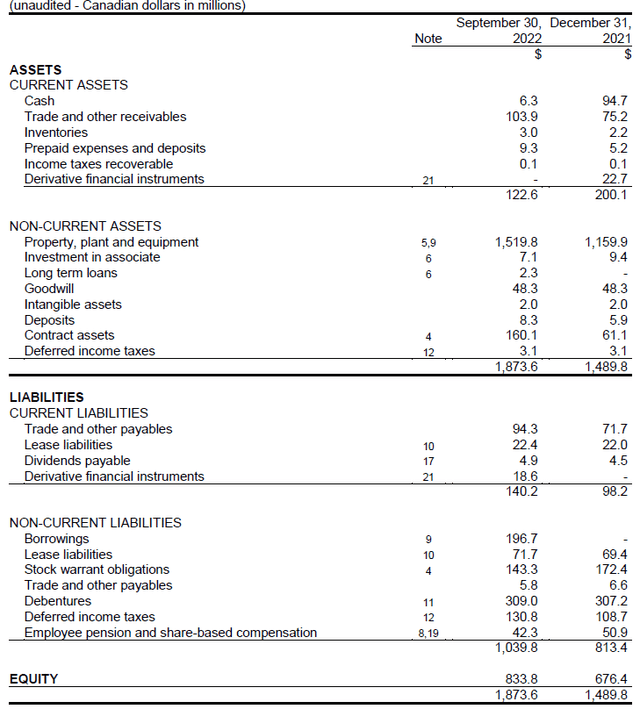

The one caveat is that Cargojet is drawing cash from its term loan facility to purchase new planes. This means the bank debt obviously ranks senior to Cargojet’s debentures but that’s fine as the cash is used to buy more assets. As you can see on the balance sheet below, the bank debt increased by just C$197M while the total value of the property, plant and equipment increased by in excess of C$350M in the same nine-month period. Granted, the cash position was depleted as well, but keep in mind Cargojet retains the majority of its free cash flow on the balance sheet.

The total net debt increased from C$215M at the end of 2021 to C$500M as of the end of September, while the balance sheet expanded by almost C$400M and the total amount of equity increased by in excess of C$150M. The ratio of equity versus total assets remained stable at around 45%, so I wouldn’t say the balance sheet has become less safe. Debenture investors will just have to realize bank debt ranks senior to the debentures.

Investment thesis

While I have been focusing on the debentures in the past and while those debentures are still a very attractive fixed income security, the common shares are also getting quite interesting as the official guidance for 2026 seems to imply a free cash flow result of C$300M or C$17.5/share is quite achievable. Of course, a portion of that free cash flow will have to be ‘put aside’ to fund the rejuvenation of the fleet but it’s not difficult to see a C$200 share price once Cargojet continues to deliver on its expansion plans.

While interesting, I am sticking with the debentures as I like the risk/reward ratio very much.

Be the first to comment