Ethan Miller

QUALCOMM Incorporated (NASDAQ:QCOM) is a leading semiconductor name that hasn’t gotten the bullish attention it deserves in 2022. While we all debate what Intel (INTC) is worth, and the masses remain focused on the growth stories at Advanced Micro Devices (AMD) and NVIDIA (NVDA), Qualcomm’s strong ties to smartphone sales seem a little boring. On the news front for the company, Apple (AAPL) is trying to invent and utilize its own chipsets for manufactured gadgets, cutting out a sizable chunk of Qualcomm sales, but success has been slow in arriving. In addition, a recession will likely hurt business performance later in 2022 and most of 2023, but this macro problem is affecting all semiconductor enterprises.

However, the valuation and growth story at Qualcomm are still quite bullish over the long run. Entering new markets all the time (car electronics lately) and with thousands of existing customers, its valuation on current and projected numbers is getting quite interesting. My view is another 10% decline under $120 a share, where it has found support over the last 12 months of trading, would provide another great buy opportunity (even if $110 or $100 happens into the fall months). At that point, an earnings yield of better than 10% on your investment and 2.3% forward cash dividend yield may be available (assuming a small increase in the payout this year). Both numbers stack up positively against the major semiconductor concerns on planet earth.

My last article on Qualcomm was a bullish forecast at $90 per share in June 2020, linked here. For the most part, I have been in the bull to hold camp ever since. For investors, QCOM’s +55% total return from my previous article has bested the equivalent S&P 500 +30% gain by almost double. My current bullish argument is explained like this.

Undervaluation and Growth in One Pick

Qualcomm is not the cheapest Big Tech stock I can find, and it is not the fastest growing company with its enormous size. However, the stock setup is somewhat unique when combining these two investment goals for intelligent buy-and-hold investors.

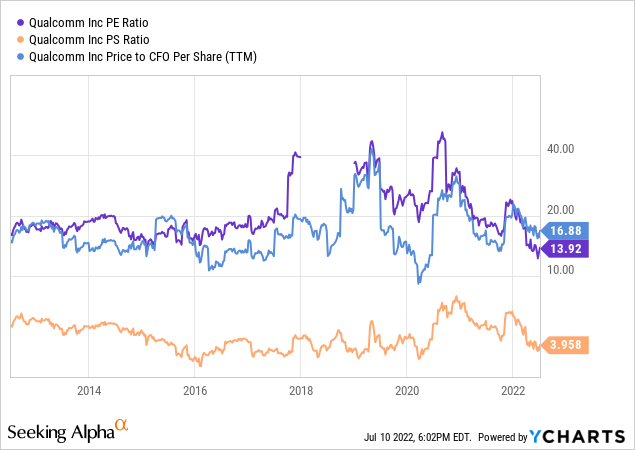

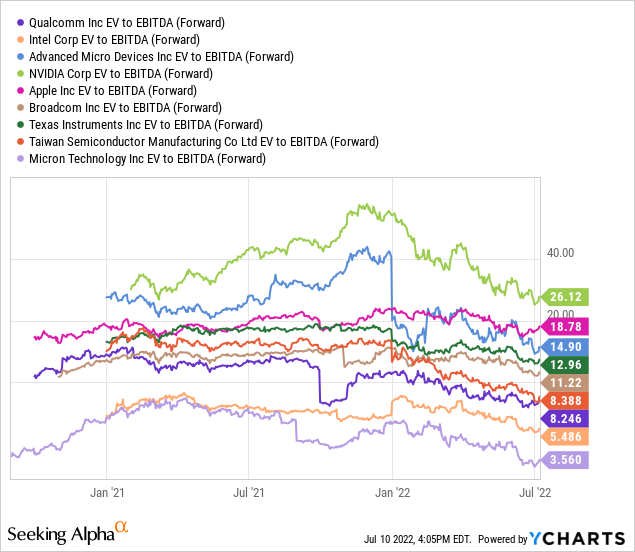

For starters, QCOM is trading under its 10-year averages on basic price to trailing earnings, sales, and cash flow results. It’s incredibly difficult to find another technology peer with a similar low valuation background in July 2022 (absent a declining EPS forecast), even after the tech wreck since late 2021.

YCharts

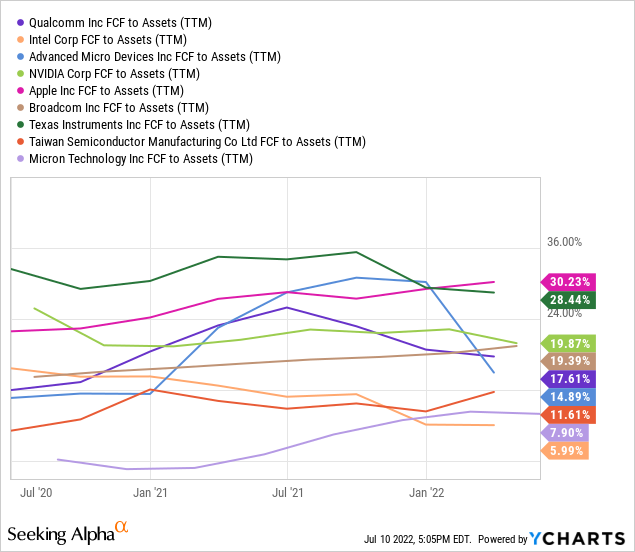

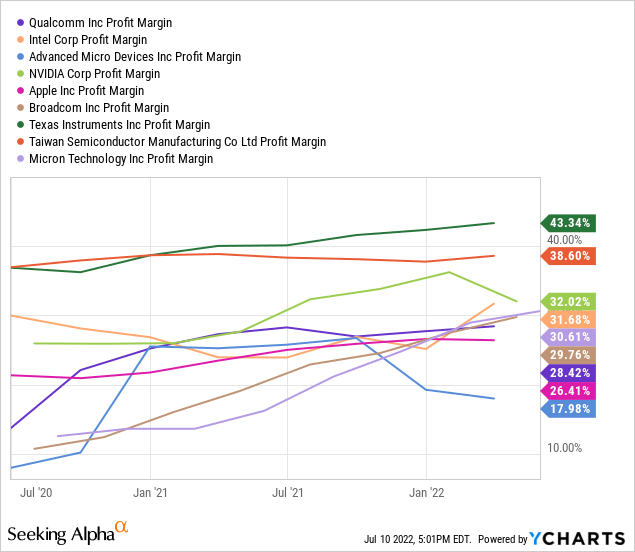

Free cash flow to assets and final profit margins are relatively average when measured against competitors and peers in the large-cap semiconductor space. My peer group includes Intel, AMD, NVIDIA, Apple, Broadcom (AVGO), Texas Instruments (TXN), Taiwan Semiconductor (TSM), and Micron (MU).

YCharts YCharts

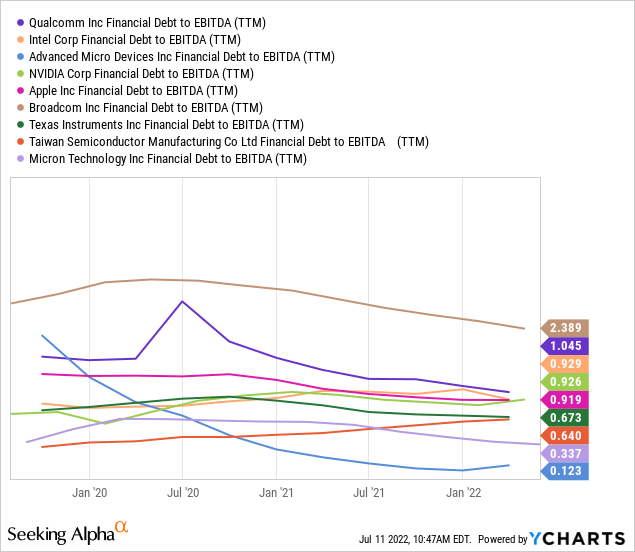

If I have any knock against Qualcomm’s financials, I would recommend management work harder on shrinking debt and leverage on the balance sheet. Slightly better returns/margins and operating flexibility would help Wall Street valuations of the business. In a grand summary of financial debt to EBITDA (earnings before interest, taxes, depreciation and amortization), QCOM holds extra unnecessary leverage vs. the peer group.

YCharts

Growth Expectations

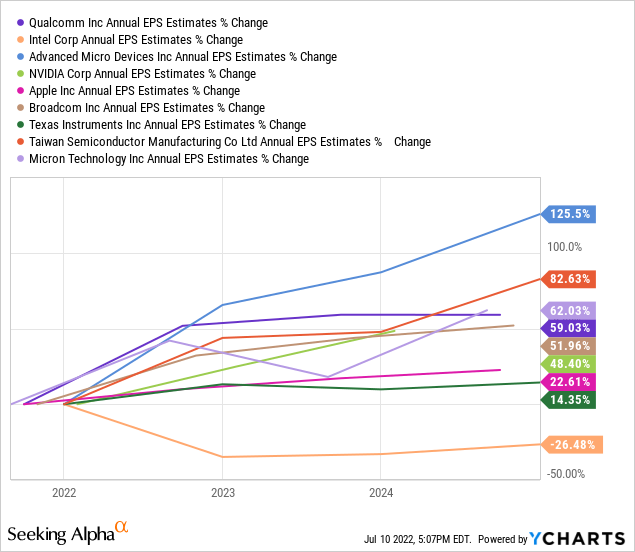

The best news for Qualcomm shareholders is projected growth in the business is excellent, near the top of the class for the industry in 2022-23. So, today’s low valuation looks closer to a bargain when turning our attention to likely future results.

YCharts Seeking Alpha Table – Consensus Estimates – July 10th, 2022

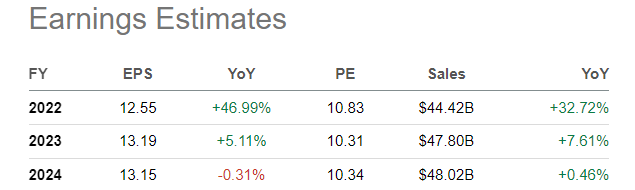

The forward earnings yield is hovering just under 10% at $133 a share, meaning further price drops could push this number well above the 40-year high CPI inflation rate of +8.6%. Few other growth-oriented semiconductor organizations can claim such.

YCharts

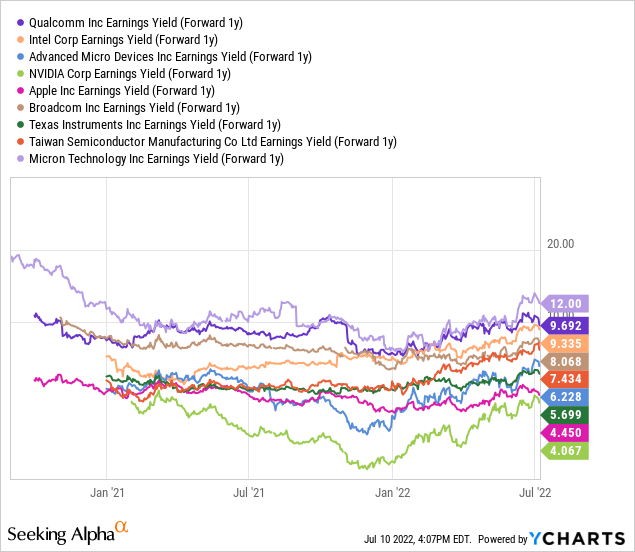

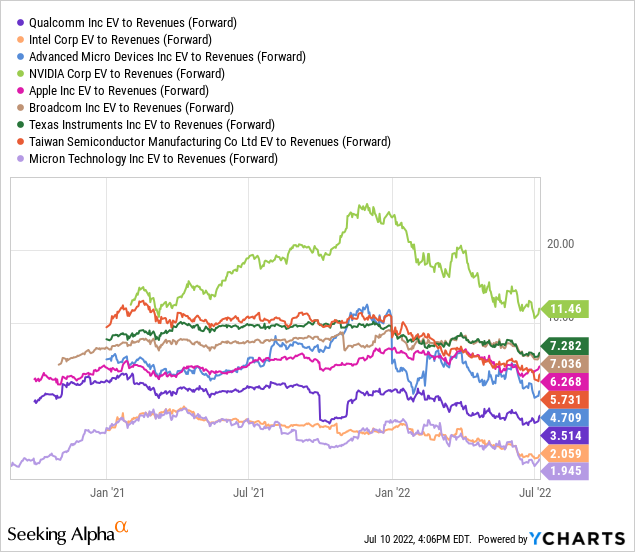

On enterprise value calculations, adding Qualcomm’s debt into the equation, the stock still looks incredibly inexpensive vs. peers holding so-so growth potential. EV to forward EBITDA and Revenues ratios are trading at rough 30% discounts to the median peer averages.

YCharts YCharts

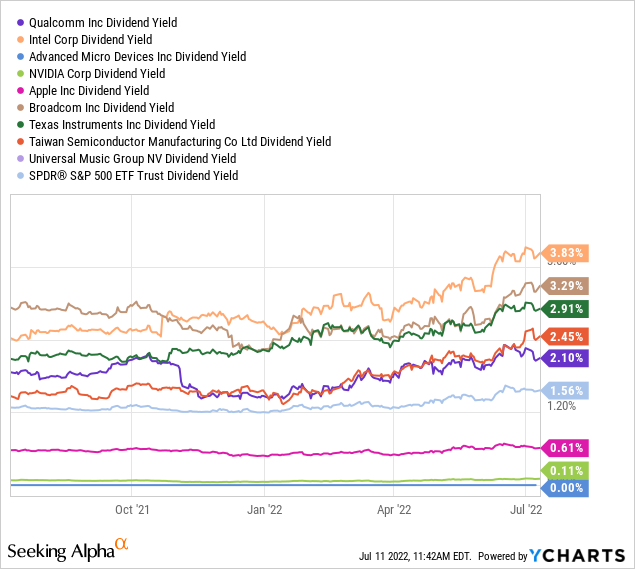

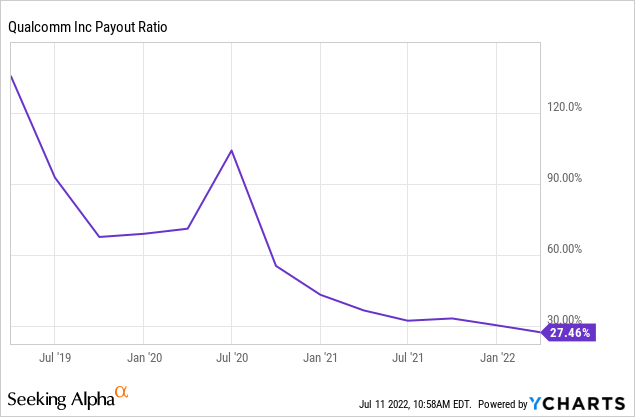

Lastly, the dividend story is excellent for Qualcomm. The payout ratio out of earnings has fallen from over 100% of income generation in early 2019 to less than 30% currently. So, management has plenty of room for both hikes in the cash distribution and debt reduction. The “trailing” 2.1% dividend yield is above normal for the Big Tech industry, and the S&P 500 rate under 1.6%. If income expands faster than anticipated into 2024, forecasting a near-future 3% dividend yield on QCOM seems within reach, given the possibility to purchase under $120 per share in coming months (strong buy territory).

YCharts YCharts

Final Thoughts

Just rambling off topic. Unrelated to my investment analysis, I do personally feel the company name Qualcomm is one of the coolest sounding business names ever. When I ran a small investment research boutique with my brother many years ago, I came up with the name “Quantemonics” as a way to explain our computer-based analyzing techniques crossed with macro-economic forecasts. All five standard vowels of the English alphabet were also part of the name.

Anyway, Qualcomm appears to be on the low end of the spectrum for upfront and future pricing compared to peers. And, further price drops should open an even stronger buy opportunity. If you are hunting for growth-at-a-reasonable-price [GARP] ideas, Qualcomm should be near the top of your research list.

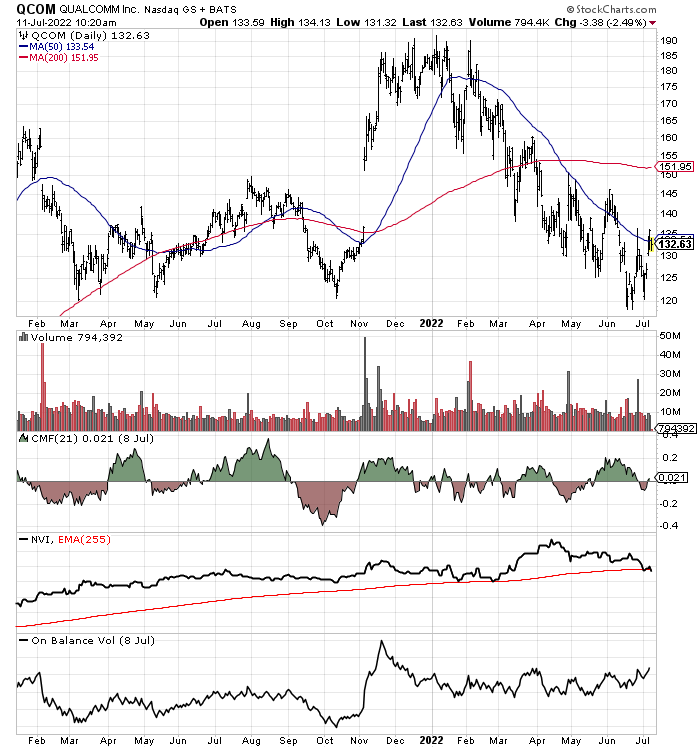

The stock chart does not show any outsized selling activity in 2022. I would characterize the 30% price drop from last year’s peak as something of an arbitrage move following the semiconductor sector’s weakness overall. As represented on the 18-month chart below, the 21-day Chaikin Money Flow, Negative Volume Index, and On Balance Volume numbers are actually performing better than the vast majority of Big Tech equities I track. In fact, NVI and OBV movements since March have been quite positive inside a price downtrend.

QCOM 18-Month Chart, StockCharts.com

Seeking Alpha computers also rate Qualcomm as a terrific selection, even with rotten intermediate-term price momentum. The current Quant Ranking is a top 4% score, out of a universe of 4,622 equities.

Seeking Alpha Quant Rank – QCOM – July 10th, 2022

In my view, the biggest investment risks for Qualcomm are “big picture” related. At continuing bear market in the stock market and/or a deep recession could send the stock quote far lower than $120. Yet, as long as smartphone and wireless gadget demand remains robust, the company’s chips and modem royalty contracts should deliver above-normal growth vs. the general global economic rate. There are even rumors Apple’s effort to replace Qualcomm chips is not meeting expectations. If true, QCOM earnings and sales estimates past 2022 may be on the low side vs. reality.

Outside of an all-out stock market crash or worldwide depression, I peg worst-case scenario downside in QCOM at $100 per share. From $133 now, that amounts to total return risk of -25% over the coming 6-12 months. On the upside, if the economy survives, demand remains strong for company chips, and lower inflation allows for higher valuation multiples, best-case upside is back to modern record highs around $200 during 2023. Such represents +50% for total return potential. I rate shares a Buy currently, with a Strong Buy view under $120.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment