noel bennett/iStock Editorial via Getty Images

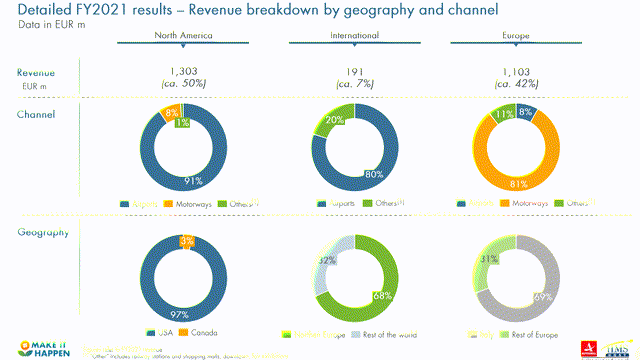

We already informed our readers of a possible business combination between Dufry (OTCPK:DUFRY) and Autogrill (OTCPK:ATGSF; OTCPK:ATGSY). Today is the day and the Swiss group finally announced the acquisition. Autogrill is an Italian group with an international presence that operates in the catering service on motorways and airports. Looking at the latest company documentation, we see that Autogrill works in more than 30 countries, managing more than 3,300 points of sale and employing more than 33,000 staff members with a current portfolio of more than 300 proprietary and licensed brands.

Autogrill’s shareholder, Edizione s.r.l., a holding of the Benetton family, will transfer the entire 50.3% stake to Dufry with an exchange ratio of 0.158 new Dufry shares for one Autogrill share. In the meantime, the Swiss group has also launched an offer of €6.3 for the remaining shares. Depending on the acceptance of Autogrill minority shareholders in the public offer and their choice to receive Dufry shares, Edizione’s shareholding may be in a range of between 20% and 25.2% of Dufry’s share capital. Looking at the deal-specifics, we see similarities with Essilor-Luxottica operations.

From the merger of Autogrill and Dufry, a new group will be born with combined top-line sales of over €12 billion and an EBITDA of around €1.3 billion (these data are taken from the pre-pandemic level in 2019). The new group will be present in 60 countries. Eugenio Andrades and Xavier Rossinyol, respectively president and CEO of the Swiss group, will join the board of the new company, as will Alessandro Benetton, head of Edizione. Gianmario Tondato Da Ruos, the current CEO of Autogrill, will take care of the American division, which currently has the Hudson and Hms Host Autogrill businesses, two brands that make up half the sales. The operation will allow “the birth of a new giant, capable of responding to the needs of road tourism, offering important synergies in a post-pandemic restart moment” explains Autogrill.

The new group will build a broadly diversified global platform “with a strong presence in the United States and Europe and a significant base in high potential Asian markets: this platform will benefit from significant opportunities for growth and synergies in cost” according to Autogrill in the company press release.

The new business combination

Looking at our previous publication, we already found some answers. We were the first believers in a Dufry deal “more likely to happen” with respect to the English SSP or the French group Lagardere (OTCPK:LGDDF). As already explained, this was mainly due to Hudson, one of the largest travel retail operators in North America with 2019 revenues of around €2 billion that it has always been the natural target for Autogrill. Again, we reaffirmed our internal estimates leading to a deal that would create a global company with €12.5 billion in sales in 2019, a significantly diversified reality not only at a geographical level but also for its business lines and channels. We again confirmed our preliminarily estimated value of the combined synergies. At the EBITDA level, we are looking at $80-$100 million when fully operational, or 0.7/0.9% of the 2019 combined cost base. Thus, not many synergies could arise.

To sum up, the integration would generate the following results based on the consensus estimates for 2023: top-line revenue at €12 billion (35% Autogrill, 65% Dufry), adjusted EBIT at €0.74 billion (26% Autogrill, 74% Dufry), profit adjusted net €0.29 billion (23% Autogrill, 77% Dufry) and net debt of €4.9 billion (39% Autogrill, 61% Dufry).

Valuation

We understood that the two companies were working on the deal for a few months. Our internal team was not surprised by the recent announcement and we were already adjusting some internal estimates on the business combination. Despite highlighting that there are not many synergies, we see Autogrill as a positive catalyst for Dufry. To reinforce our analysis, we see support for the summer season bookings and recent trends. Thus, we reaffirm our target price based on a three-stage DCF model (with a WACC of 8% and a long-term growth rate of 2%) leading to a CHF 50 stock price valuation.

Be the first to comment