JimVallee/iStock via Getty Images

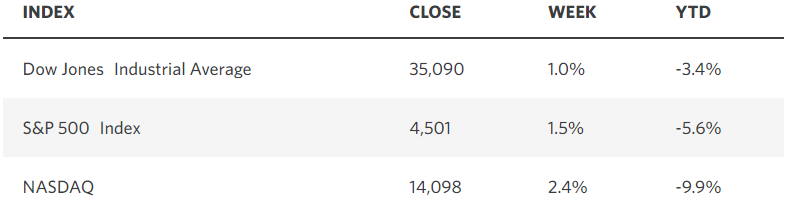

Aside from one pothole called Meta Platforms (FB), the road to recovery for the market was relatively smooth last week with the major market averages posting gains for a second week in a row. Corporate earnings have been better-than-expected, beating estimates in aggregate by 8.2%, which is consistent with the five-year average. Amazon (AMZN) put an exclamation point on upside surprise with its blowout earnings report on Friday. The market’s performance was all the more impressive considering the sharp move higher in bond yields that followed Friday’s jobs report. The two-year yield rose to 1.31%, factoring in five rate hikes by the Fed this year, while the 10-year yield climbed to a two-year high of 1.93%. I expected good news on the economic front to be bad news for the market, but it appears that the jobs data was so good that investors believe the economy is strong enough to absorb the impending rate hikes. A recession is clearly out of the question.

edwardjones.com

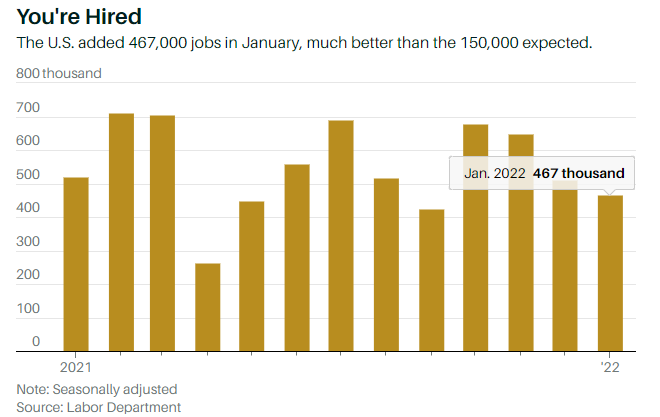

Despite the Omicron wave, the Labor Department reported that the economy created 467,00 jobs in January, which was more than triple the number expected. Additionally, the two prior months saw upward revisions that added another 709,000 jobs. The unemployment rate rose from 3.9% to 4% for all the right reasons—the labor-force participation rate rose from 61.9% to 62.2%. Average hourly earnings increased 5.7% over the past year. The job growth should continue as the pandemic wanes, considering 1.8 million said they were unable to look for work in January due to the pandemic. That number would bring us back to pre-pandemic levels of employment.

barrons.com

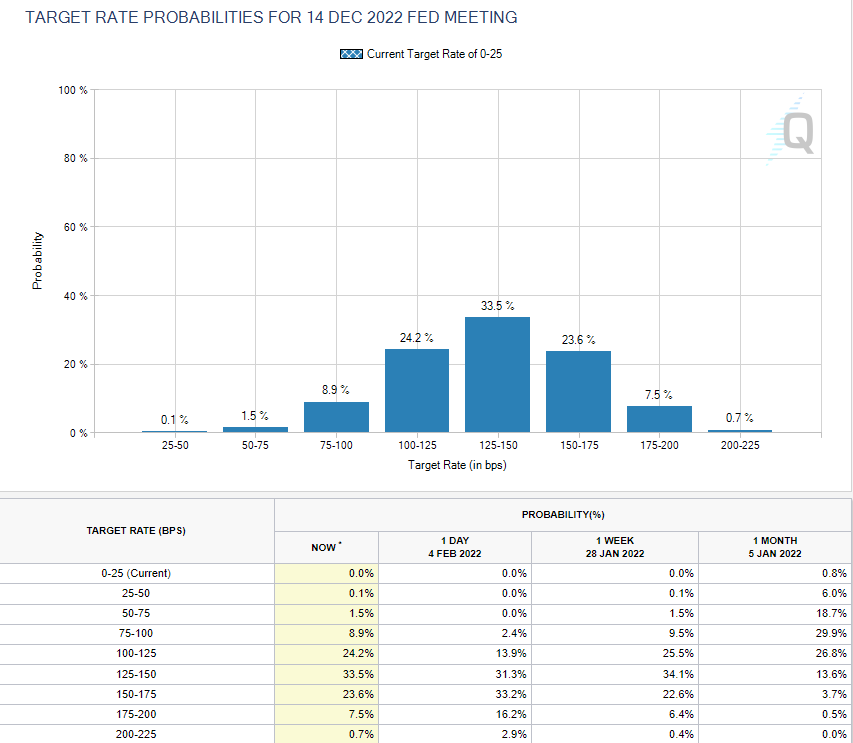

The market’s performance on Friday was all the more impressive, given that the probability of six rate hikes (150-175) rose to more than 33% immediately following the jobs report, but that reversed later in the day with five (125-150) becoming more probable. That gave stocks a lift as the day progressed with help from technology sector earnings reports.

cmegroup.com

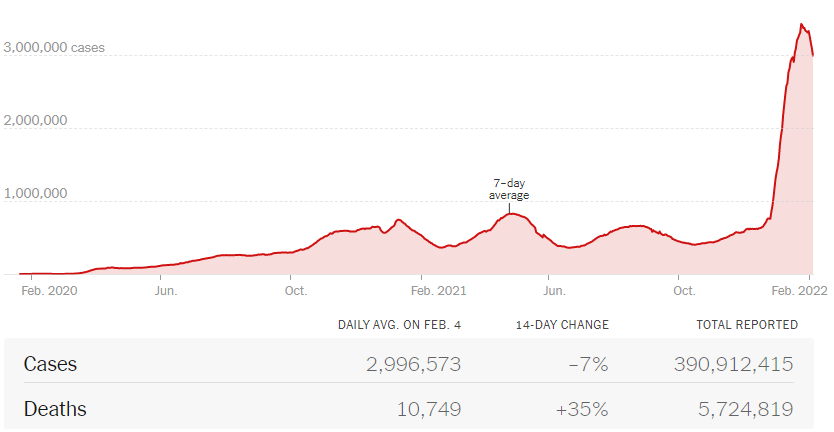

There was more good news last week that received little attention. I surmised not long ago that the global peak in the pandemic was likely behind us, as the rest of the world was bound to follow in our footsteps, and it looks like that has happened from the chart below. The 14-day rate of change is now declining. I bring this up because I think it’s deflationary from the standpoint of lifting economic restrictions, allowing people to return to work, alleviating the bottlenecks in supply chains, and increasing the supply of goods that are in such high demand. These things should collectively bring down costs and lower the rate of inflation moving forward. We probably won’t see an indication of that in January’s inflation data.

nytimes.com

Still, investors fear the coming rate-hike cycle and shrinking of the Fed’s balance sheet, which the bear camp asserts will drive stock prices significantly lower. I would qualify that by saying it will pressure certain segments of the market, while others benefit, and it will be a gradual process rather than an abrupt event. Let’s review a similar scenario from 2016 through 2018.

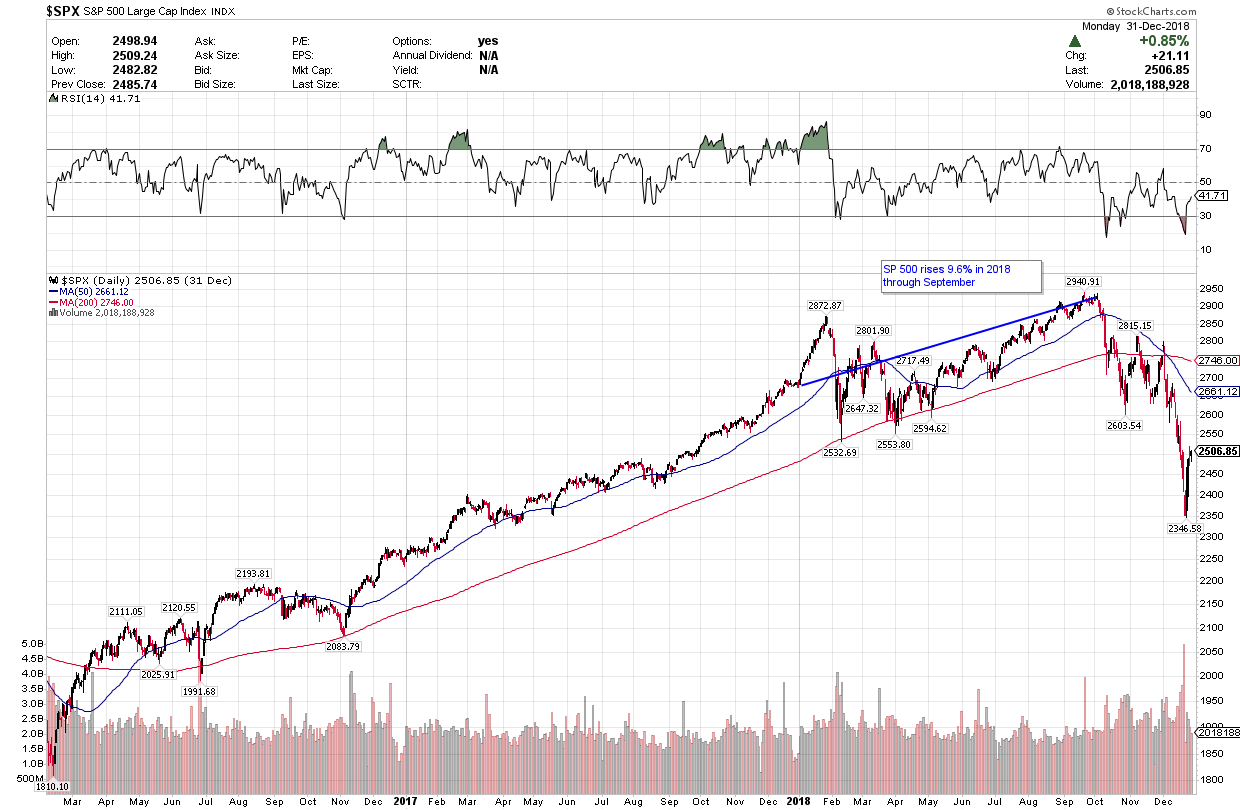

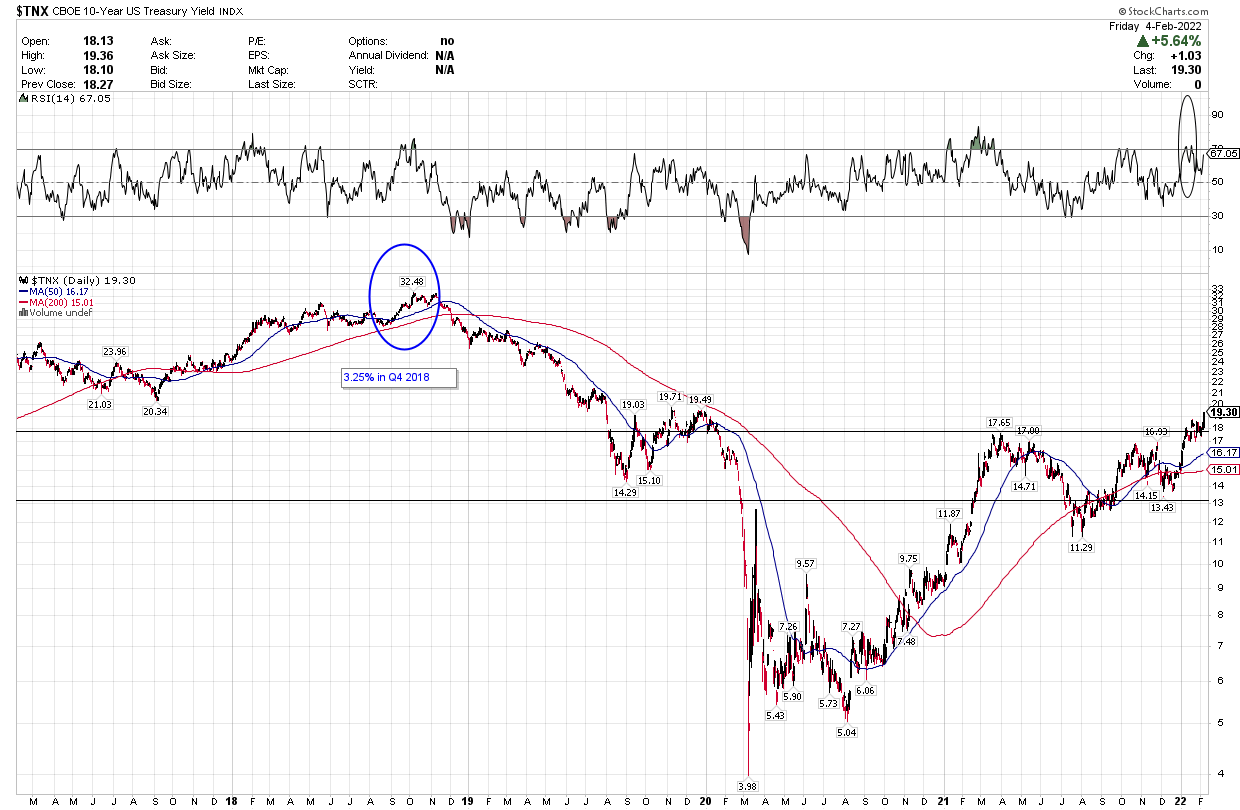

The Fed commenced lift off from zero-interest rates in 2016 and the Fed Funds rate was 1.5% by the end of 2017 when Fed Chair Powell took over and started to reduce the size of the Fed’s balance sheet. The economy continued to grow, and the stock market performed well during those first two years of rate increases. Volatility rose when balance sheet runoff began in early 2018, but the S&P 500 rose another 9.6% through September of that year. What led to a near-bear-market decline in the fourth quarter of 2018 was not balance sheet reduction, but the continued increase in short-term rates. Fed Funds went from 1.5% at the beginning of that year to 2.5% by the fourth quarter, and long-term rates (10-year Treasury yield) rose to 3.25%! That was too much for the market to bear, and we had a rapid valuation adjustment until Powell affirmed rates would not go higher.

stockcharts.com

I see Powell and markets following a similar path this time, but at an accelerated pace that gets us to peaks in Fed Funds and long-term rates at some point in 2023. At the same time, I think we need to expect far more subdued returns for the S&P 500. Similarly, I also think it will be interest rates that stumble the market rather than the reduction of the balance sheet, which should be very gradual.

At the beginning of this year, I stated that my main concern was that the rate of inflation would decline but settle at 3%-4%, which is well above the Fed’s target of a long-term average of 2%. If that became the consensus view on Wall Street, markets would start to price in a much more aggressive tightening by the Federal Reserve, which could lead to a correction of 10% or more in the S&P 500 index and far worse for the most highly valued stocks and speculative segments of the financial markets.

Five weeks later that is the consensus view and we have had our 10% correction in the S&P 500, while the Nasdaq Composite dropped 15%, and the Russell 2000 small-cap index suffered a bear-market decline of 20%. Bitcoin lost half its value as did the ARK Innovation ETF (ARKK), which is comprised of some of the most expensive growth names in the market.

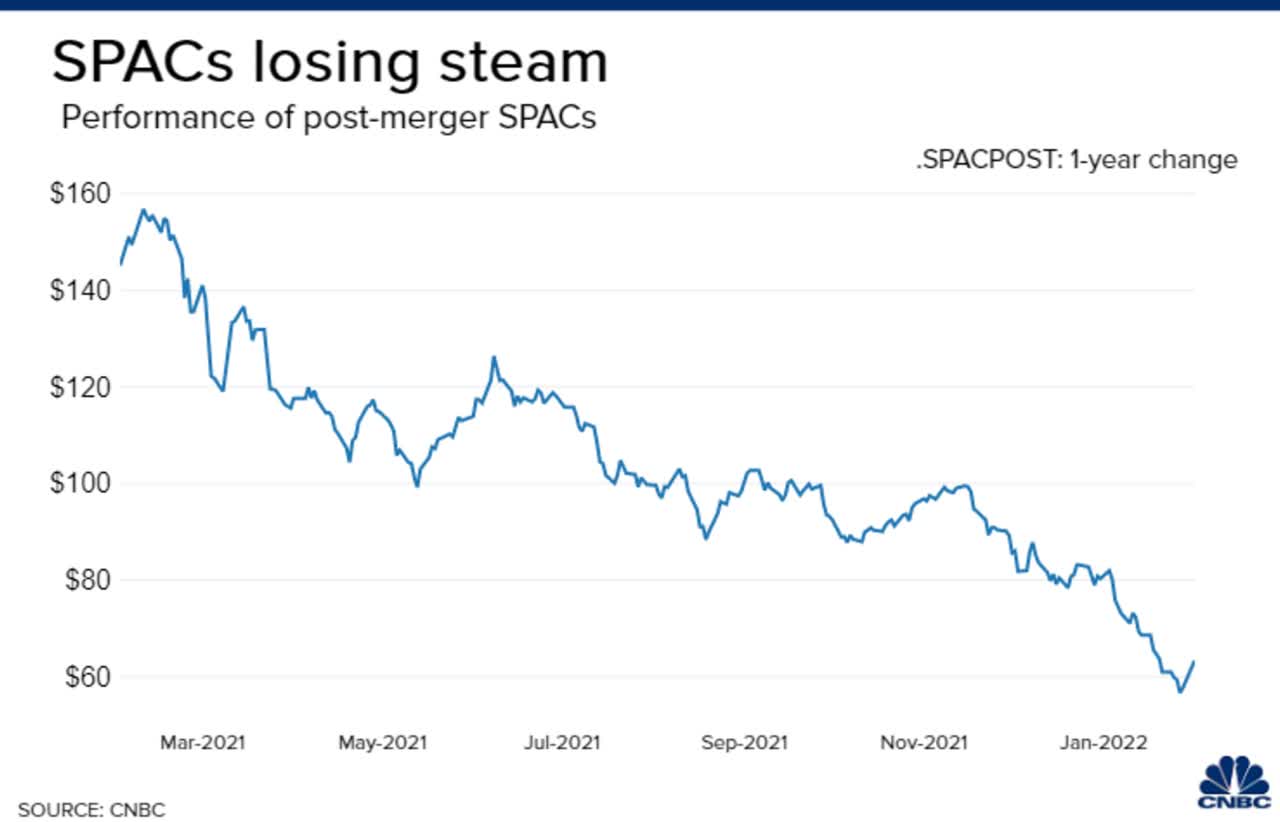

One of the greatest pockets of excess built up with easy money is the special purpose acquisition company market (SPACs). Those companies that went public through blank-check deals have been some of the worst performers in 2022. The SPAC Post Deal Index shown below was down 23% in January alone. This is a bubble that has already burst, but I don’t see it coming back anytime soon. There are 600 SPACs still looking for private companies they can take public, but that window is closing, as there is usually a time frame associated with the capital raised.

cnbc.com

This gradual valuation adjustment for a higher interest-rate environment should continue, as the price-to-earnings multiple for the S&P 500 has only fallen 9% so far this year. I expect it will continue to decline through a combination of stable to modestly lower index values (P) and higher earnings (E), until it approaches a forward multiple that’s consistent with where the rate of inflation stabilizes. My best estimate is that it will be approximately 17-times with an inflation rate of 3%.

edwardjones.com

Yet that does not mean investors should evade the stock market. Instead, they should be more surgical in their security selection by avoiding the pockets of excessive valuations that are being expunged. Many of the most enticing investment themes out there today may look cheap, having lost 50% of their value, but they can lose more and are not likely to return to previous price levels in the year(s) ahead given the headwinds of inflation and interest rates.

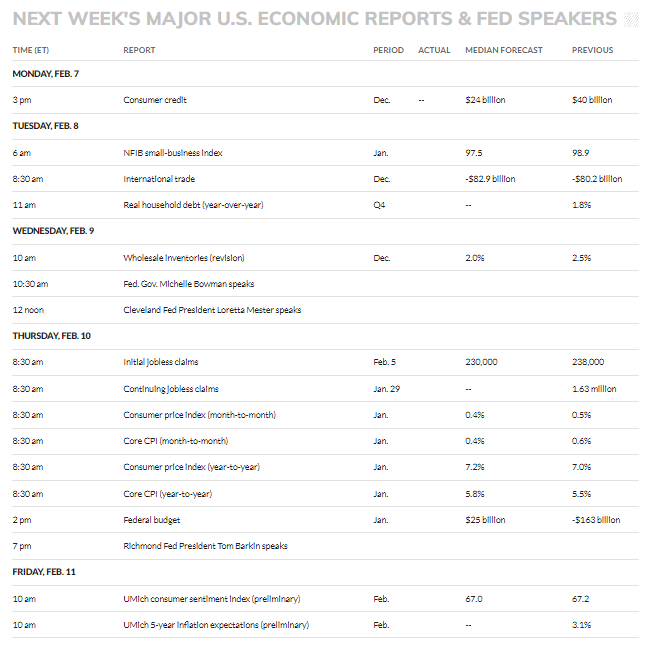

Economic Data

This week’s focus will be on the Thursday’s Consumer Price Index report. The consensus expectation is to see prices rising 7.2% year-over-year in January, which would be up from 7% in December.

marketwatch.com

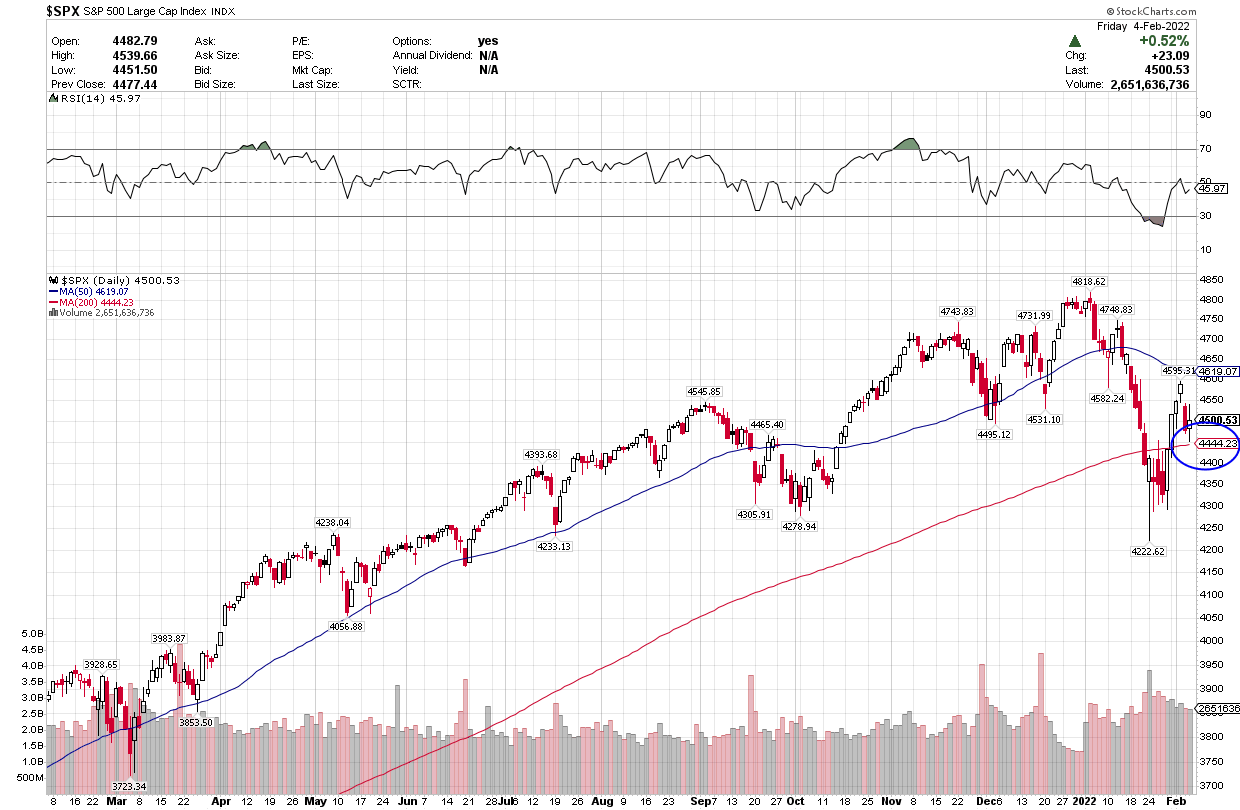

Technical Picture

With the correction behind us (fingers crossed) we had the first successful test of the 200-day moving average last week for the S&P 500 at 4,444. The next challenge will be to climb above the 50-day moving average at 4,620. In the near term, everything depends on Thursday’s inflation report.

stockcharts.com

This gives you some perspective on where long-term interest rates stand. We just broke above last year’s high of 1.76% on the 10-year Treasury yield and are approaching 2%. It was not until we hit 3.25% in October 2018 that stocks came under significant selling pressure.

stockcharts.com

Be the first to comment