Charley Gallay

The past couple of days have been very interesting for shareholders of The Walt Disney Company (NYSE:DIS). After news broke that the company’s former longtime CEO, Bob Iger, had been recruited back to the company in the chief position, replacing Bob Chapek, effective immediately, shares of the most magical company on earth skyrocketed over 6%. Shares have since pulled back a little bit, but are still trading 4.8% above where they were prior to the news breaking of the management shuffle. At first glance, it seems as though a great deal might change and the glory days of the company might very well come back to it. I do expect some changes and those are already in the works. But for those who are of the opinion that this represents some seismic shift for the company, I believe will be disappointed.

Changes are coming

On November 21st, shares of The Walt Disney Company soared higher in response to news that Bob Iger would be coming back to the CEO position at the company and replacing then-current CEO Bob Chapek. This was a sudden development and comes only around two years after Iger left the enterprise. Previously, he had served as CEO from 2005 until February of 2020 when he stepped down with the idea of retirement in mind. Though, it is worth mentioning that he stayed on with the company as its Executive Chairman until 2021.

In response to volatile conditions at the company, Iger was lured back to The Walt Disney Company with the hopes that he could instill confidence in investors and generate significant value to get the company back on track. But this will not be an inexpensive move. At present, the current contract for Iger extends until the end of 2024. During this time, he is slated to receive a $1 million annual base salary and a long-term incentive bonus that has a target value of $25 million for each year that he sticks with the company. Though to be fair, this is lower than the $32.46 million in compensation that Chapek received in 2021 and it’s lower than the $45.90 million received by Iger as Executive Chairman that same year.

The expectation from investors is that the glory days of the company can come back. To put in context what this means, consider that during his tenure, Iger oversaw some of the largest developments in the history of the company. The company’s market capitalization skyrocketed from $48 billion to $257 billion, driven by a continued expansion of its theme parks and multiple acquisitions. These acquisitions included Pixar at a cost of $7.4 billion, Marvel Entertainment for $4 billion, and Lucasfilm for $4.1 billion. The company also purchased significant assets from 21st Century Fox for $71.3 billion. Outside of these deals, The Walt Disney Company engaged in some other interesting and innovative endeavors. Most notably they partnered up on Hulu and launched Disney+.

With a track record like this, it should come as no surprise that investors would be optimistic. And already, Iger is hard at work. Only a single day after returning to the company he sent out a memo to the DMED (Disney Media & Entertainment Distribution) side of the enterprise. In that memo, he talked about his intention of restructuring the unit in a way that will honor and respect creativity ‘as the heart and soul’ of the business. He also ousted one top executive, Kareem Daniel, the head of media and entertainment for the company and a long-term loyalist of Chapek. What this restructuring might look like is anybody’s guess. Having said that, this particular unit of the enterprise has been known for being structured to consolidate much of the spending and decision-making and removing those activities from the various subunits that comprised it. Today, these units are known as Linear Networks, Direct-to-Consumer, and Content Sales/Licensing (which really focuses on content sales and licensing activities for the Parks, Experiences, and Products, the Studio Entertainment, and the Direct-to-Consumer portions of the firm). More likely than not, we will see this segment of the company broken up into multiple segments like what we had previously. These included, amongst others, the Media Networks and Direct-to-Consumer & International segments.

Personally, I believe that returning power to the creative side of the business would be a great thing for the company in the long term. I have no doubt that the firm will add additional value to investors that way. Though my anecdote and the anecdotes of others may not mean much in the grand scheme of things, I have found some of the content put out by The Walt Disney Company over the past couple of years to be formulaic and more of a cash grab than anything.

How bad was Chapek?

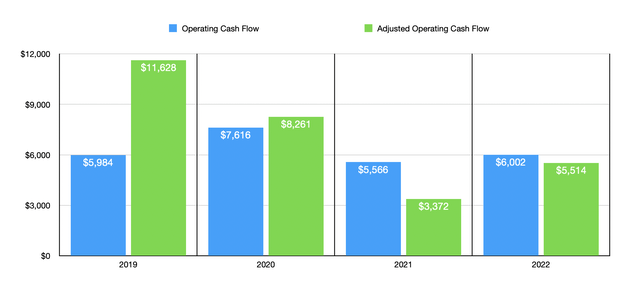

Some investors and market watchers may very well believe that this transition will have other major ramifications. Personally, I don’t think that is likely. I do think the quality and financial success of their films will improve. But beyond that, I don’t know if there is much that Iger can do that isn’t already being done rather well. Don’t get me wrong. There have been some real issues at The Walt Disney Company in recent years. In 2019, for instance, the company generated adjusted operating cash flow of $11.63 billion. Although this figure declined to $8.26 billion in 2020, the regular operating cash flow of the company did manage to rise from $5.98 billion in 2019 to $7.62 billion the next year. But then, in 2021, cash flow plunged to $5.57 billion, with the adjusted figure for this that excludes changes in working capital hitting just $3.37 billion.

At the end of the day, cash flow is what determines the value of an enterprise. And to see the picture worsen in such a manner was definitely discouraging. But we have to keep in mind that much of this was likely outside of the company’s control. A global pandemic caused it to shutter its parks, significantly curtail its theatrical aspirations, and more. If anything, I believe it’s a testament to the high quality of management from Chapek that the company partially recovered its cash flows in 2022, with operating cash flow climbing to $6 billion and adjusted operating cash flow hitting $5.51 billion.

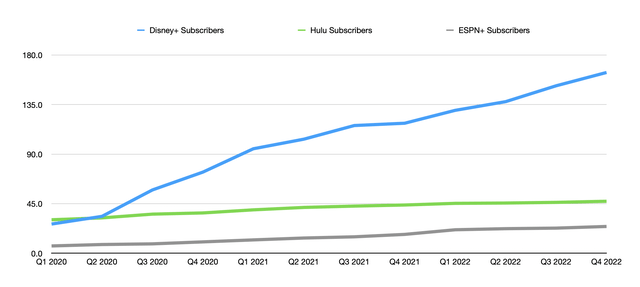

During Chapek’s tenure, the company also made some other really solid progress. Net debt for the company during the final quarter of Iger’s reign was $41.24 billion. This dropped to $36.75 billion as of the latest quarter. That’s quite impressive for a company that was dealing with a global pandemic and investing significantly in its streaming operations. We also have to give credit to Chapek for the success of the company on the streaming side. Although the seeds of streaming were planted by Iger, there is no denying that Chapek watered them and tended to them with significant care. Under his watch, The Walt Disney Company became the largest streaming company on the planet, with Disney+ expanding to 164.2 million subscribers, ESPN+ growing to 24.3 million, and Hulu hitting an all-time high of 47.2 million. When it comes to Disney+ as a whole, the expectation is for it to still grow to as large as 245 million subscribers in 2024. That’s far above what management initially forecasted when they launched the platform, with original forecasts suggesting that the platform would only have between 60 million and 90 million subscribers by the end of 2024. In just 16 months after its launch, the service surpassed the 100 million subscriber mark, blowing away what everybody thought it could achieve in such a short window of time. Moving forward, this should be a particularly large and valuable part of the firm.

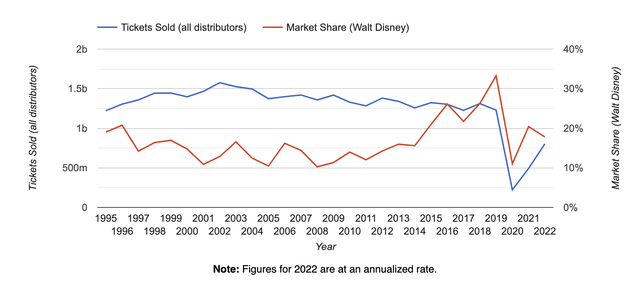

Outside of these items, it’s also worth mentioning, as I pointed out in a prior article, that the parts of the company hit hardest by the pandemic are now recovering nicely. I expect this trend to continue. As a testament to this, management has already raised prices multiple times this year for its theme parks. And when it comes to complaints over the company’s films, I would like to point out that, although I believe my own criticisms are correct, the company has still managed to keep its market share under the leadership of Chapek. This can be seen in the image below.

Takeaway

In the long run, do I believe that The Walt Disney Company is making a wise decision by bringing Iger back in with the purpose of mixing things up? For me, the answer is yes. I do think it’s wise to restructure the parts of the company already mentioned because I ultimately think that the long-term success of the firm will be determined by the quality of the content it produces. The rest of the enterprise feeds off of that. Outside of that change though, I don’t expect a great deal to transpire. Given the fact that we went through a global pandemic that significantly affected almost every major company on the planet in a negative way, I believe that Chapek did a solid job in his role. It’s hard to imagine somebody doing a better job to be honest. Given the positive impact this is likely to have on content though, I do view this as a slight net positive for shareholders moving forward. But considering I already have the company rated a ‘strong buy’ and as one of my only 8 holdings, there’s not much room for upward revision.

Be the first to comment