NONFARM PAYROLLS DATA SMASHES FORECAST, MARKET REACTION MUTED AMID LOW LIQUIDITY

- US Nonfarm Payrolls for March showed 916K jobs added and unemployment steady at 6%

- S&P 500 Index futures are reacting positively to the stronger-than-expected NFP report

- EUR/USD price action is rather muted due to low liquidity caused by Good Friday holiday

For those of us still on the desk today during Good Friday holiday, the release of monthly nonfarm payrolls just crossed market wires. The NFP report for March came in much better-than-expected as the headline figure showed 916,000 job gains. This compares to the consensus forecast looking for an increase of 647,000 according to the DailyFX Economic Calendar. The US unemployment rate held steady at 6%, though average hourly earnings did tick lower from 5.2% to 4.2%. The NFP report noted that 280,000 jobs were added in the leisure and hospitality segment as pandemic-related restrictions ease and covid vaccines are administered. Labor force participation was little changed at 61.5%.

Recommended by Rich Dvorak

Trading Forex News: The Strategy

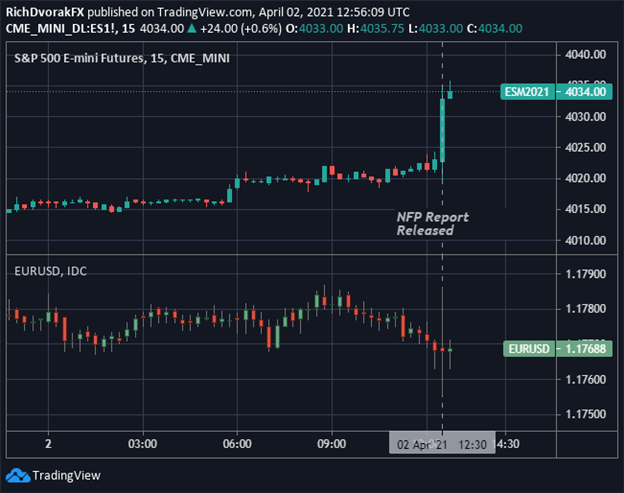

S&P 500 INDEX FUTURES PRICE CHART WITH EUR/USD OVERLAID: 15-MINUTE TIME FRAME (02 APRIL 2021 INTRADAY)

Chart by @RichDvorakFX created using TradingView

S&P 500 Index futures spiked higher in immediate reaction to the nonfarm payrolls data release. EUR/USD price action saw a bit of volatility as well, but it seems as though US Dollar strength will prevail as the major currency pair oscillates lower. It is worth noting that market reactions to the latest NFP report have been largely muted due to a lack of liquidity with most of the world on holiday for Good Friday. That said, the solid NFP report looks to underscore the relative outperformance of the American economy, which looks to be supportive of the S&P 500 and US Dollar over the weekend and into next week once liquidity returns.

| Change in | Longs | Shorts | OI |

| Daily | -17% | 9% | -1% |

| Weekly | -29% | 17% | -4% |

— Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight

Be the first to comment