mphillips007/iStock via Getty Images

This article examines the current state of the US Dollar and looks at the negative factors that could lead to its depreciation in Forex markets. This writer has favoured the view that the Dollar is destined to depreciate. Readers can refer to an earlier article. What was considered before is still the case. So far, the US Dollar has not appreciably weakened even though logic would suggest that it should. To be clear, it is not the case that this writer “wants” the US Dollar to crash and cause a global financial crisis. It is rather the case that the US Dollar has so far resisted depreciation and has maintained its dominant status in Forex markets. The demand for dollars has not collapsed due to the commercial demand for dollars and the large amounts of US Dollar-denominated debt. Most recently, the Fed has contributed to dollar strength by raising interest rates. We shall see, however, that there are developments that suggest the fall of the US Dollar as the dominant global currency is imminent. It is worthwhile examining the developing geopolitical situation in connection with domestic financial policy. Investors should keep in mind all the various factors involved. A Black Swan event could trigger sudden Dollar depreciation as opposed to a gradual loss of strength. Investors should be prepared for either scenario. The fact is that the US currency is the basis for American prosperity, but the current direction of Administrative policy is putting the value of the greenback at risk.

Fed Debt

A lot of information is available from the US Debt Clock (U.S. National Debt Clock: Real Time). The federal debt is now over $30.6 trillion. Federal spending is over $6 trillion with a budget deficit of $1.6 trillion. The US federal debt to GDP ratio is 130% while servicing the debt costs $440 billion annually. The budget deficit will be financed by making more debt (negative financing).

Remember the Micawber Principle:

“Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery” ― Charles Dickens, David Copperfield

The federal Administration in Washington, D.C. does not seem interested in balancing the budget and not at all willing even to consider reducing debt. The situation risks getting out of control because the Fed is busy raising interest rates. This will mean that the Treasury will be issuing debt with higher interest rates, and that will mean that servicing the federal debt will become more onerous. It looks like the pace of monetization of the federal debt is going to accelerate. The US cannot go on increasing its federal debt ad infinitum. It is not sustainable.

Trade Deficit

The US trade deficit is $1.2 trillion with $390 billion going to China. It is indeed remarkable that the US Dollar has maintained its value in Forex markets with such a huge trade deficit.

Inflation

Inflation can be calculated in different ways. The current CPI is reckoned at 9% but would be double that if calculated the way it was 40 years ago. The BLS is expert in manipulating inflation figures. Food and gasoline prices have increased substantially, much more than 9%. In fact, gasoline prices have practically doubled recently. The result is that consumers will be spending less on other goods. Low earners will note the negative effect of higher prices and feel even poorer. Investors will also be poorer as their holdings will have less buying power unless their nominal value increases at the same rate as inflation. It is needless to point out that holding bonds with extremely low yield is a certain way to become poorer in an inflationary environment.

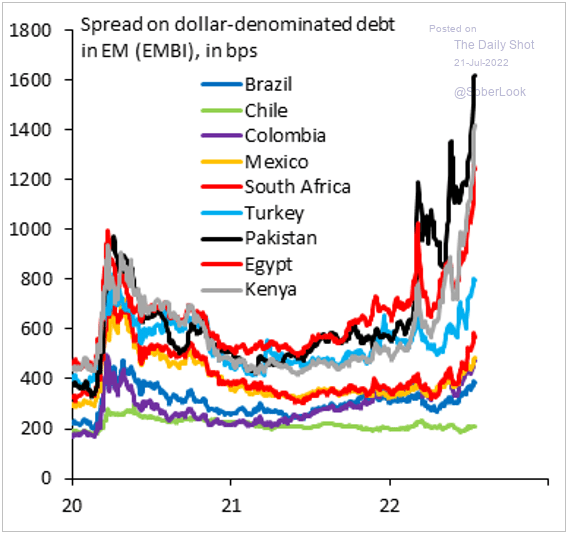

The effects of dollar inflation will be felt not only by Americans. All those persons and entities with US Dollar-denominated debt will find that servicing the debt is much more expensive if the US Dollar maintains its value in Forex markets. In order to service the debt, US dollars have to be bought with local currency. If the local currency weakens against the dollar, then servicing the debt becomes problematic. The case of Sri Lanka shows what happens when an economy tries to implement green policies. Defaulting on debt is serious and has negative consequences. If debt default becomes widespread, this could have an effect on the value of the US Dollar. There are many countries that risk defaulting. The chart below indicates some countries at risk.

States at Risk of Default (Robin Brooks)

The Fed At It Again

The Fed recently rose interest rates by 0.75%. The stock market reacted with a rally, which shows that markets react in strange ways to news, whether it is good or bad. Rising interest rates generally favour bonds and not stocks. It remains to be seen how long the rally will last.

One effect, however, that is going to last for at least a short while is that the US Dollar strengthens as foreign investors see higher yields for US paper and therefore invest in Treasuries. Even the ECB has had to go along with raising rates as the Euro had fallen and was at par with the US Dollar. This explains why the dollar index went higher. One could also note that the EU was hurting itself by imposing sanctions on Russia, which meant cutting down on energy supplies from Russia. It is likely that there is going to be a severe recession in the EU, which already has much higher inflation than before.

A corollary of a stronger dollar is that American companies will find it more difficult to compete internationally. It is to be expected that American corporations will continue off-shoring production facilities to take advantage of the favourable exchange rate with the Dollar buying a lot more local currency abroad. At the same time, the US will probably continue importing huge quantities of goods manufactured abroad because of the strength of the US Dollar.

It, therefore, seems to be rather complicated when it comes to evaluating the situation of the greenback. On the one hand, there are negative factors that would induce one to conclude that dollar depreciation is going to take place. On the other hand, the Fed raises interest rates, the Dollar strengthens, and the EU risks lapsing into recession. It thus seems that the US Dollar is going to maintain its dominant position in the $6 trillion daily Forex markets.

BRICS

There are other factors that should be considered. China has developed a CBDC (Central Bank Digital Currency) and has increased its amount of trade with Russia. The BRICS countries are working on a currency system that will be an alternative to the current US Dollar-dominated global financial system. One reason why there is interest in avoiding the US Dollar is that the US has used its currency and dominant financial strength as a weapon to coerce other countries to conform to what the US deems correct behaviour.

What this means for investors is that there is opposition to the US Dollar that is mounting, and this could result in dollar depreciation. One thing that investors should watch out for is how Saudi Arabia accepts payment for its oil. The petrol dollar system is based on the Saudis demanding US dollars for payment. If the Saudis start accepting payment for oil in other currencies, that will signal a new era in global economics. China, Iran, Russia, and Venezuela will be key players in this game with North Korea on the sidelines.

The Bottom Line

There are several factors that influence the value of the US Dollar in Forex markets. On the one hand, it is possible to argue that the greenback is going to depreciate considerably due to negative factors, while on the other hand, it is difficult to imagine a fall of the Dollar, given its present dominant position. The war in Ukraine may be a turning point because of the US effort to ruin the Russian economy. An alternative to a Dollar-dominated system has become a necessity for Russia, and this is going to have repercussions on the value of the US currency. An objective consideration of future prospects for the Dollar leads one to the conclusion that the present situation is likely to change. When and how Dollar depreciation is going to come is not known now, but it is coming.

Be the first to comment