PM Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on October 22nd, 2022.

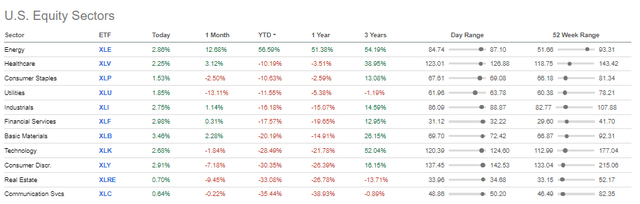

Today we would have been talking about our STAG Industrial (NYSE:STAG) puts we had sold being assigned. We had originally sold puts on STAG on September 14th, 2022, at a $30 strike. However, the market remained soft, and STAG shares fell. It wasn’t just STAG, but the whole market and especially the REIT market, has been under significant pressure this year. On a YTD basis, the real estate sector is the second worst-performing sector.

Sector Performance YTD (Seeking Alpha)

Instead of taking assignment, we chose to roll out the trade to December. We kept the $30 strike price, but rolling it out provided more premium collection to reduce the breakeven and pushed the trade out further. The likelihood of taking assignment still remains high. At the time of the trade, Fidelity’s probability calculator put it at a ~68% chance shares would still be below $30.

Overall, I was hesitant to roll out the position because I eventually want to pick up more shares in this REIT while it is beaten down this badly. However, given the trajectory of interest rates due to inflation remaining elevated, I think we will have at least several more months. We could even have longer, depending on how inflation readings come in.

That means I don’t think there is necessarily any need to rush into the market. Only time will tell if that is ultimately the case. As with any investment, any decision we make has a chance of not working out as intended. I’m also dripping STAG with its monthly dividend too. So every month, I’m adding a little bit more anyway. These puts I sold were just a way to collect some premium and speed up the process of accumulating shares.

For those that might not be familiar with STAG, here’s a description from their own website.

STAG Industrial, Inc. (STAG) is a real estate investment trust focused on the acquisition and operation of industrial properties throughout the United States. By targeting this type of property, STAG has developed an investment strategy that helps investors find a powerful balance of income plus growth.

What’s Up With REITs Anyway?

Inflation is generally seen as a positive for REITs because their properties will generally increase in value. Inflation can make it more expensive for more buildings to enter the market as material costs rise. That can then lead to a lack of more buildings going up than otherwise, making the existing properties more valuable. It can leave out the competition; therefore, rents on these existing buildings can rise if there is nowhere else to go. This is just a way simplified general idea behind the benefits of inflation.

However, in this case, it would seem that the pace of interest rate increases and just the general lack of visibility of when they’ll stabilize are causing issues. REITs love issuing equity, then issuing debt, selling buildings and then buying more to grow. REITs are required to pay out a large majority of their taxable income. Again, way oversimplifying the idea here, but it’s the general concept.

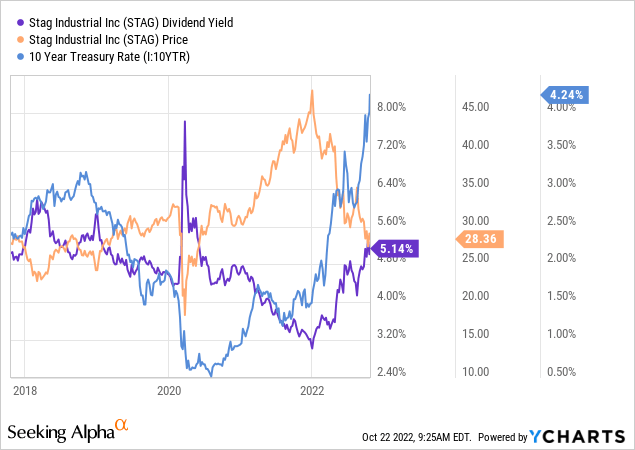

With higher interest rates, this process gets a bit disrupted. The debt being issued now needs to yield more to be competitive with risk-free rates. Additionally, the equity prices also come down, so they yield more too. REITs compete as income investments with bonds. It isn’t just a coincidence that the 10 Year Treasury Rate is rapidly climbing, and so is STAG’s yield; it is the cause, at least partially. STAG peaked entering 2022; as soon as the 10-year began to rise, STAG began to fall.

Ycharts

Economic uncertainty is also certainly playing a role, which becomes cloudy by, once again, rapid interest rate increases. The Fed doesn’t know what it’ll break until it does. We already had a derivative that goes by the acronym “LDI” show up in England due to tightening.

Of course, REITs also can offer future appreciation potential and dividend increases. That’s not something one will experience in a Treasury security. That being said, issuing more equity generally becomes less attractive since it’s done at lower prices.

Once the Fed breaks something, we are likely to be in at least a mild recession, which can cause more uncertainty for demand for REIT properties. That includes STAG, an industrial REIT. All of this slows down the potential growth of REIT earnings.

STAG’s Earnings Outlook

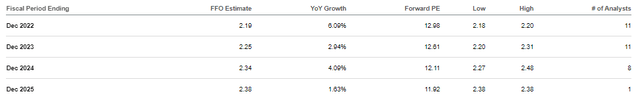

STAG’s earnings are coming up soon too. Analysts believe that STAG can still grow its FFO over the coming years.

STAG FFO Outlook (Seeking Alpha)

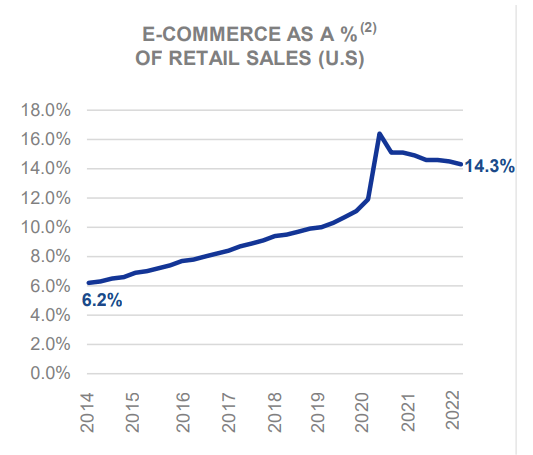

One thing that, more specifically, has caused issues for STAG is Amazon (AMZN). This is STAG’s top tenant, and they reported having too much warehouse space earlier this year. Which is precisely what STAG is trying to lease them. This came about as going through the COVID pandemic had shown a massive spike in online sales. While some of this was a permanent shift by consumers, it wasn’t entirely, and sales came down for AMZN.

Here’s a look at E-Commerce sales as a percentage of retail sales in the U.S. We can clearly see the spike in 2020, then the gradual trend lower. Before this spike, e-commerce sales had been steadily taking over retail sales.

E-Commerce % of Retail Sales (STAG Investor Presentation)

E-commerce continues to grow, so there will still be demand. At this point, though, the market share of e-commerce seems to have been mostly flat to a slight decline from the spike. This was caused by total retail sales rising across the board. Ultimately, it should mean that any excess supply in warehouses should or have been soaked up.

Despite the expectation for continued growth in FFO/AFFO, the shares of STAG were pressured below their historical trading range. An interesting turn from when they were trading at a significant premium when growth expectations were overly optimistic.

STAG P/AFFO Valuation Estimate Range (Portfolio Insight)

Dividend

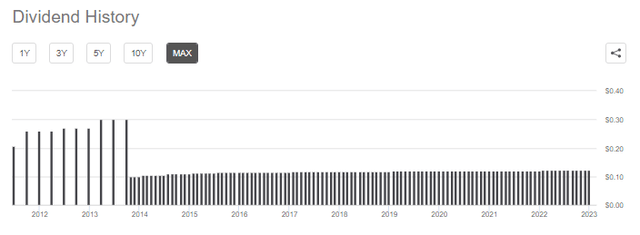

I know it wouldn’t seem like it, but STAG has been growing its monthly dividend to shareholders since 2011. You’d have to squint to see growth in the chart for the last several years, but it’s there.

STAG Dividend History (Seeking Alpha)

The latest monthly payout is $0.1217, but if you want to get more technical, it is $0.121667. Over the last five years, the CAGR of the dividend was 0.81%. It is certainly frustrating for many investors, especially when earnings growth was attractive for STAG. One of the issues is they really ramped up their payout in the early years.

The growth going forward should be better, at least according to the CFO when he made this remark in the Q1 2022 earnings call.

So, our first quarter payout ratio is 80%. We communicated a couple of years ago that we wanted to bring that payout ratio to the 80% level. We would like to be there for this year.

We will continue to evaluate it, but we are getting close to the point where we think that we can begin growing the dividend distribution in line with our CAD per share growth. It may not be this year, but we are getting close to the moderation level that we had communicated.

The CAD grew 16.6% in the latest quarter.

Produced Cash Available for Distribution of $87.2 million for the second quarter of 2022, an increase of 16.6% compared to the second quarter of 2021 of $74.8 million.

Although shares outstanding also grew. Meaning that, unfortunately, we wouldn’t see anything like 16.6% dividend growth. Weighted average common shares outstanding went from 159,736,000 to 179,049,000. The CAD per share would have gone from around $0.468 to $0.487, an increase of around 4.06%.

Premium Collection Beats Out Dividend

Going back to selling the puts, we collected a net gain of $1.46 between the original premium collected and then the net credit we gained for rolling. We rolled it out to the December 16th expiration. If we don’t roll again, this would be 93 days. That puts it right around a quarter. With the latest dividend of $0.1217, would mean we would collect around $0.3651. This means we have collected enough premium that would be roughly 4x the dividend paid out during this time. Which also played a factor in my decision to just roll the position too.

The potential annualized return, in this case, comes to 19.10%. That would be if we could collect another $1.46 every 93 days.

Conclusion

STAG is an attractive REIT that has been growing and is expected to continue to do so. The market share of e-commerce might be slowing more recently, but there has been growth nonetheless. It also remains attractively valued. Being pushed down by both interest rates and recession fears. These headwinds likely won’t last forever, and that’s why I think it’s an attractive long-term income play. While I’m long the shares, I want to get longer, and I’m hoping to do this by selling cash-secured puts.

Be the first to comment