Hispanolistic

We are surprised as how resilient Globant’s (NYSE:GLOB) growth has proven. The company delivered once more in the most recent quarter. In the third quarter Globant brought in $458.9 million in revenue, which represents 34.2% y/y growth and 6.9% on quarter-over-quarter. It is therefore not surprising that Gartner recently named Globant as the fastest-growing IT services company worldwide. To sustain this revenue growth the company continue to grow its number of employees too, Globant now has over 26,000 employees present in more than 20 countries.

The company has a huge number of projects with many different customers, but some that the company shared that we found particularly interesting were the FIFA+ streaming platform, and the LA Clippers new Intuit Dome. Globant is working with FIFA in order to supercharge the growth of the FIFA+ streaming platform. Globant was also selected as the official digital transformation partner of the Intuit Dome, which is the new home of the LA Clippers. It is expected to be one of the most technologically advanced smart venues in the world.

Q3 2022 Results

Revenues for Q3 were $458.9 million representing a 34.2% y/y growth. On a sequential basis, revenues for the third quarter increased 6.9% and Q3 revenue growth was 36.7% y/y in constant currency. Acquisitions contributed three percentage points to growth.

Adjusted gross profit increased to $179.6 million, representing a 39.1% adjusted gross margin. Adjusted operating income for the quarter amounted to $73.7 million or 16.1% of revenues. Adjusted net income totaled $54.7 million, representing an 11.9% adjusted net income margin. Adjusted diluted EPS for the quarter was $1.27, which represented solid 29.6% y/y growth.

Growth

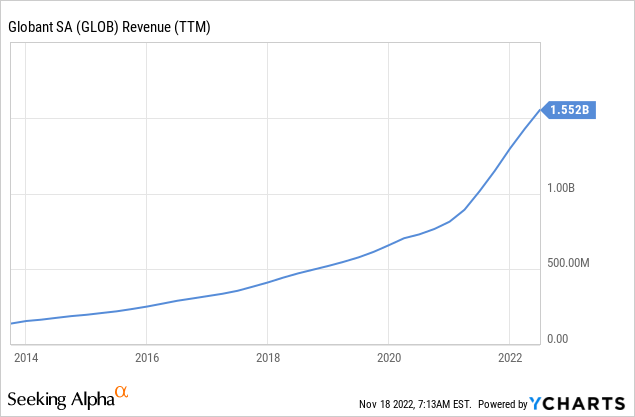

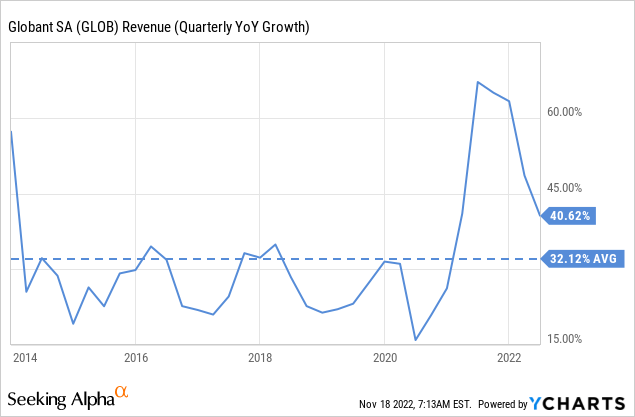

Globant has been delivering very significant revenue growth for a long time. Its 2014 to 2021 revenue growth CAGR is an impressive 30.7%. For the last twelve months the company has reached $1.7 billion in total revenue.

Growth accelerated after the pandemic, but has since moderated slightly. For Q3 growth was relatively close to the historical average.

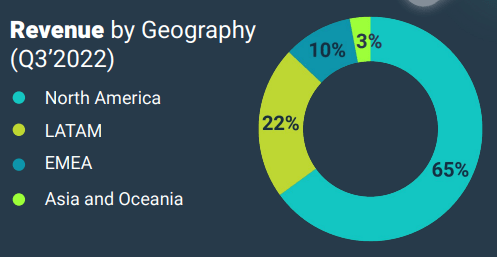

In order to keep growth going, the company is looking at international expansion opportunities. In particular it plans to increase its focus on Asia Pacific and the Middle East. As can be seen in the graph below, at present most of the revenue comes from North America and Latin America.

Globant Investor Presentation

During the most recent earnings call there was a question about this new focus on Asia Pacific and the Middle East, and this is what Co-Founder and CEO Martín Migoya had to say in that respect:

I think that Asia Pacific for us has been an area which has been absolutely underdeveloped in the past. So some time ago, we decided that, that should change, and that should be one of the main areas of expansion. So we decided to start with some acquisitions like we did today and we announced the acquisition of eWave in Australia. And also, they have operations in Singapore, in Hong Kong and other places, which will help us.

Also when we acquired GeneXus, they had an operation in Japan, and they will complement those operations that we are acquiring right now with eWave. And I believe there’s a big opportunity there when you add up all the Asia Pacific plus the Middle East countries plus some other countries in which we operate, but sometimes the market was not a take like India or some other countries over there.

So I believe that overall, when you take all those things it represents a gigantic market where needs are pretty similar to what we serve to our customers in the U.S., in Europe, in Latin America. So I think it’s a very good vector of growth for us moving forward.

Balance Sheet

Globant exited the quarter with cash, cash equivalents, and short-term investments of $369.2 million. Its $350 credit facility million is fully undrawn, and the company continues to carry a net cash position in the balance sheet. This strong balance sheet is further complemented with robust free cash flow generation. Globant generated $45.9 million in free cash flow in the quarter, representing 84.1% of its adjusted net income.

Guidance

Globant increased its full year revenue guidance to $1,778 million or 37.1% y/y growth. The guidance includes approximately two percentage points of foreign exchange headwinds, and implies Q4 2022 revenues of at least $488.5 million.

Adjusted diluted EPS guidance for the year was also increased. It is now expected to be $5.06, implying an adjusted EPS for Q4 of $1.38.

Valuation

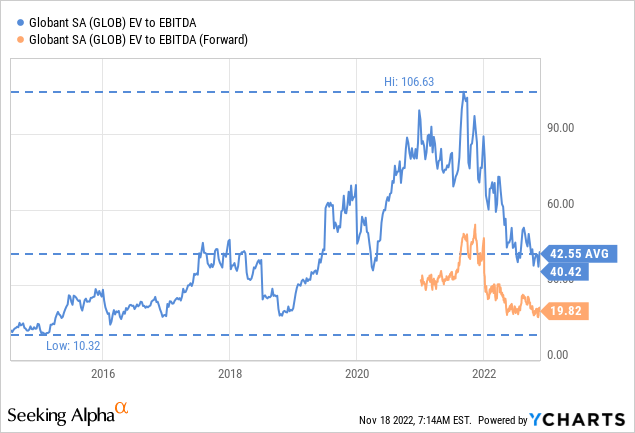

We believe the valuation is reasonable given the resilient growth the company has been delivering, even if some valuation multiples can look relatively high.

For example, EV/EBITDA at ~40x looks pricey, but based on forward estimates shares look a lot more attractive.

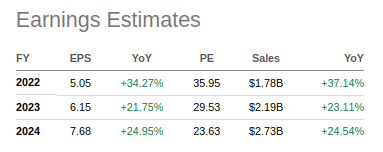

One way to look at the valuation is based on analyst estimates for the coming years. Based on average analyst estimates for fiscal year 2024, shares have a forward p/e ratio of only ~23x.

Seeking Alpha

Risks

We believe the biggest risk for Globant investors is that of a potential revenue growth deceleration. While shares appear reasonably valued when considering the strong revenue growth, the valuation would quickly appear expensive if the company fails to maintain this level of growth going forward.

As Globant becomes a larger company it will become increasingly difficult to grow revenues at 30%+. We are already seeing the company start looking at new geographies in order to be able to maintain the high growth rates a little longer.

Conclusion

Globant delivered another strong quarter, with revenue growth above 30% despite some headwinds and a weakening economy. The company has an impressive track record and so far is showing no signs of slowing down, although it is starting to increasingly look at new geographies in order to be able to maintain high revenue growth rates going. Shares look fairly valued to us at current prices, but they could quickly become expensive should the revenue growth rate decelerate in a meaningful way.

Be the first to comment