JHVEPhoto

As you no doubt are aware, the 2022 bear-market has been characterized by a large-scale rotation out of highly-valued growth stocks into value stocks, with dividend paying companies leading the way. If you think this trend is likely to persist over the short- to mid-term (or even longer), or if you just want to add a strong income producing investment to your portfolio, you may want to consider allocating some capital to the First Trust Morningstar Dividend Leaders ETF (NYSEARCA:FDL). This ETF tracks the Morningstar Dividend Leaders Index – a portfolio of the 100 highest yielding stocks that have a consistent history of paying dividends and which, in the opinion of the index managers, have the ability to sustain their dividends going forward. That said, the index does not consider ESG criteria.

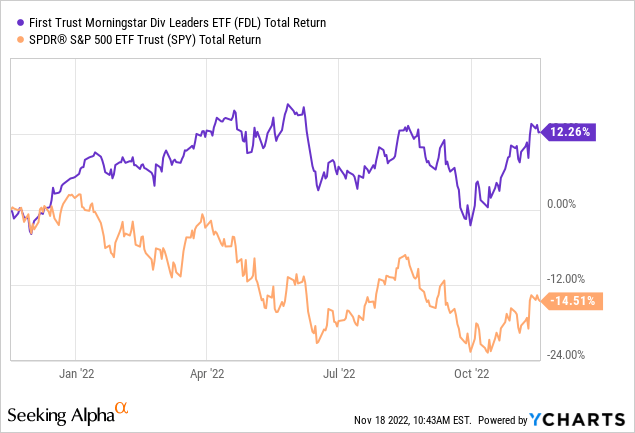

The FDL ETF has a TTM yield of 3.72%, an expense ratio of 0.45%, and has significantly outperformed the broad S&P500 over the past year (by 26.7%):

Investment Thesis

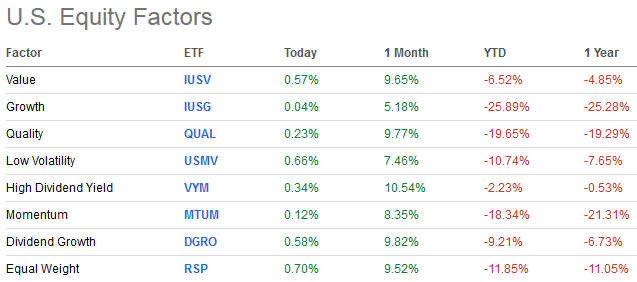

As mentioned earlier, the 2022 bear-market reset has caused a strong rotation out of growth and toward value – specifically, toward dividend paying companies. Indeed, as the graphic below taken from the Seeking Alpha homepage shows, the Value, High Dividend Yield, and Dividend Growth equity factors have been leaders over the past year:

Seeking Alpha

By stock picking within the dividend leaders category, the FDL ETF has performed even better over the past year than the related indexes in the above graphic indicates. That being the case, let’s take a closer look at the FDL ETF to see if it might be a good addition for the investor looking for some income and to build and maintain a well-diversified portfolio for the long-term.

Top-10 Holdings

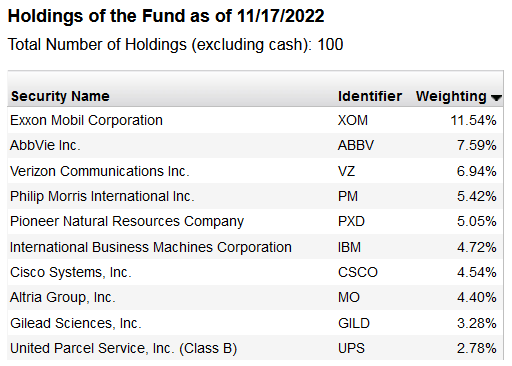

The top-10 holdings in the FDL ETF are shown below and can be found on the First Trust FDL ETF homepage. The top-10 holdings equate to what I consider to be a relatively concentrated 56.3% of the entire 100 company portfolio:

First Trust

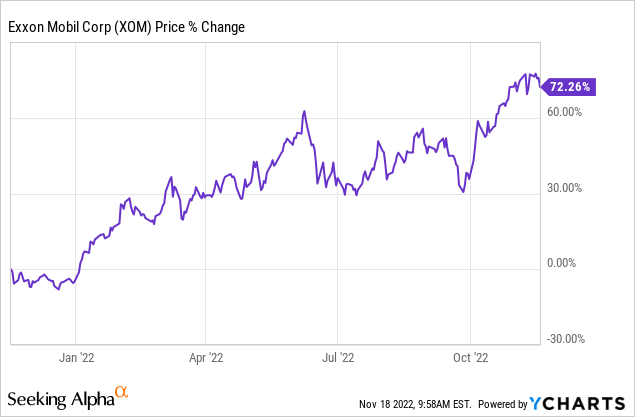

The #1 holding with an 11.5% weight is Exxon (XOM). That being the case, this fund might not be the best choice for investors that already hold a full-position in Exxon and are looking to keep a well-diversified portfolio.

As you know, Exxon has been generating record free-cash-flow this year as a result of the high oil & gas price environment combined with a big reduction in cap-ex spending that is largely due to the influence of the three new board members from Engine #1 and their goal to increase shareholder after the “lost decade” when XOM’s total returns were actually negative. See How Tiny Engine #1 Was Able To Turn Exxon Around. As a result of that over-spending, XOM’s balance sheet was ill-prepared for the global pandemic and had to take on a ton of debt during the crisis. The market punished the shares. But the new-found cap-ex discipline has led to the resurgence of the stock: Exxon, which currently yields 3.22%, is up 72.3% over the past year and has been an out-sized contributor to the strong returns delivered by the FDL ETF over the past year:

Pharmaceuticals company AbbVie (ABBV) is the #2 holding with a 7.6% weight. ABBV currently yields 3.89% and is up 31.5% over the past 12-months. For Q3, AbbVie beat on the bottom line by $0.10/share and raised the dividend by 5%.

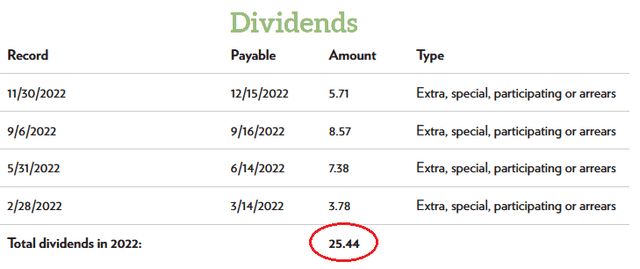

Another energy company, Pioneer Natural Resources (PXD), holds the #5 spot with a 5.05% weight. As I reported in a previous Seeking Alpha article in April (see PXD Could Pay $20/share In Dividends This Year), the company has delivered excellent dividend income for investors this year, and actually beat my annual estimate by a whopping $5.44/share:

Pioneer Natural Resources

Given the current price of $248, that equates to a TTM yield of 10.3% for PXD.

Tech stalwart Cisco Systems (CSCO) is the #7 holding with a 4.5% weight. CSCO released Q1 FY23 earnings on Wednesday and beat on both the top- and bottom lines. The company raised guidance and the stock has popped higher:

CSCO yields 3.26% and pays a $1.52/share annual dividend.

The top-10 holdings are rounded out by UPS (UPS) with a 2.8% weight. UPS has struggled over the past year (down 14.5%) due to strong competition and the general macro-environment in retail-delivery. The stock pays a $6.08/share annual dividend and that is good enough for a 3.45% yield. In Q3, UPS delivered non-GAAP earnings of $2.99/share (a $0.14 beat), but revenue of $24.2 billion (+4.2% yoy) came in light. The company plans to buyback $3 billion worth of shares this year.

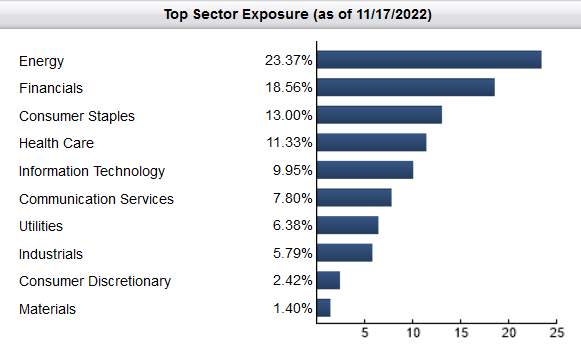

Overall, the portfolio is significantly over-weight in the energy, financials, consumer staples, and health care sectors:

First Trust

That being the case, this is a relatively defensively oriented portfolio, but with significant oil & gas commodity price exposure.

Performance

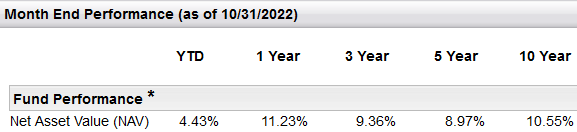

First Trust, for some reason, reports long-term NAV performance, which is odd considering the ETF is dividend oriented. That is, one would think they would report average annualized total returns):

First Trust

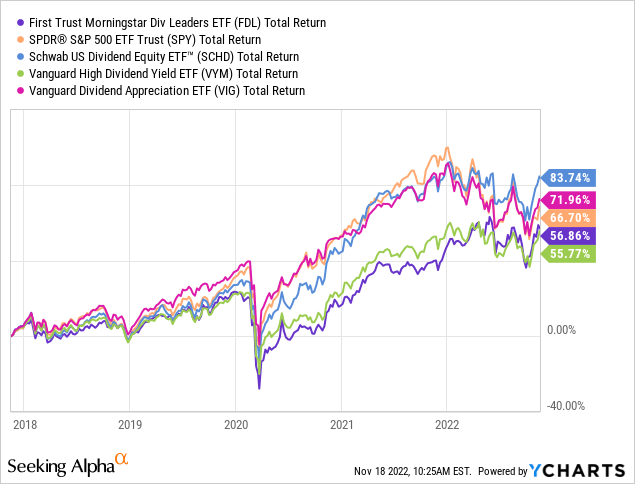

So I will. The graph below compares the 5-year total returns of the FDL ETF relative to the broad S&P500 – as represented by the (SPY) ETF – along with FDL’s industry peers such as the Schwab Dividend Equity ETF (SCHD), the Vanguard High Dividend Yield ETF (VYM), and the Vanguard Dividend Appreciation ETF (VIG):

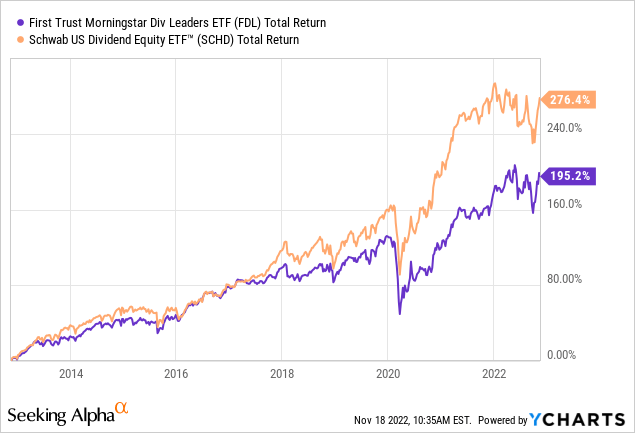

As can be seen in the graphic, the SCHD ETF beats the FDL ETF by a wide margin (~17%). SCHD currently yields 3.24% and has an expense ratio of only 0.06%, a whopping 39 basis points below that charged by the First Trust FDL ETF.

Risks

The FDL ETF is not immune to the macro-environment risks facing the entire market: high inflation, higher interest rates, the still on-going supply-chain challenges and factory shut-downs related to the global pandemic, and the impact of Putin’s horrific war-on-Ukraine that has arguably broken the global energy and food supply chains and could result in further global economic contraction and, perhaps, even a severe recession next year.

In addition, the FDL fund’s over-weight in energy leaves it particularly exposed to a downdraft in oil & gas prices.

On the flip-side, the relatively high-yield of the fund (roughly double that of the 1.65% yield of the S&P500) provides some downside protection.

Summary & Conclusion

The idea behind the FDL ETF is a good one: invest in highly-rated dividend companies as screened by the generally well-respected analysts at Morningstar. However, as is somewhat typical with First Trust, the 0.45% expense ratio is overly expensive for what it delivers: it under-performs the much cheaper SCHD ETF (which has an expense fee of only 0.06%) by a wide margin while providing similar income. That being the case, and while I do expect FDL to out-perform the S&P500 over the next twelve months, I would SELL the FDL ETF and move the proceeds into the better performing and significantly lower-cost SCHD ETF.

I’ll end with a chart comparing the total returns of the FDL ETF to the SCHD ETF over the past 10-years:

Be the first to comment