andresr

Investment thesis

I believe The Trade Desk (NASDAQ:TTD) is a business with sustainable competitive advantages compared to other players in the industry. More specifically, my thesis is guided by three main factors: the company’s data advantage, switching costs and network effects. I expect the company to continue growing at high rates and to keep earning high returns on capital in the years ahead. Despite these favourable elements, I think that the company is still trading at a lofty valuation. Therefore, I assign a hold rating to the company’s shares.

Business model

TTD is an independent buy-side platform operating in the advertising industry and more specifically on the “open internet”. TTD enables advertisers to conduct more data-driven advertising campaigns across a multitude of different channels such as video, audio, display, CTV, etc. allowing them to make real-time decisions based on more granular data, new consumer insights, and global trends.

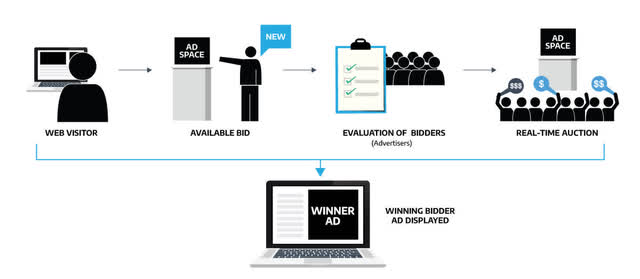

The role of Programmatic advertising

Programmatic advertising is a data–driven process of buying ad inventory electronically, starting with an auction after a user visits a website followed by the creation of the impression. This triggers an ad request sent to the server which forwards it to bidders who can review potential demand in real-time (100 ms). The total number of these auctions across the Open Internet happens 12 million times each second – not including Wall Gardens.

Along with that, with the introduction of the new platform Solimar, The Trade Desk moved from a fixed rate toward a percentage of media (POM) and a CPM (cost per mile or per 1,000 impressions) cap pricing model (less than a $5). The goal is to encourage more data usage removing barriers to the employment of data in ad campaigns.

I believe the company’s new approach gives ad buyers superior flexibility and a larger number of insights regarding first-party data that other companies cannot offer (excluding the Wall Gardens). Therefore, The Trade Desk’s clients have more insights into the value of each ad impression and also have higher ROAS (return on ad spend). This incentivises them to be far stickier and potential new clients to join TTD’s platform.

Data aggregators can collect a wider breadth of data from users through different channels allowing them to aggregate that data and integrate it with other data sources. Data aggregators are also able to monetize their data in more efficient ways and ad buyers can buy partial data instead of paying for the full database leading to significant cost reductions for TTD’s clients.

In the new data marketplace, I think each ad impression is significantly enriched for the ad buyer since the number of data applied to each impression has more than doubled. This brings a broader use of data and further incentivizes clients to invest more.

A practical example

The French company BIC recently ran a campaign on Walmart‘s (WMT) new DSP, achieving an impressive ROAS of 500%. That means for every dollar spent on ads, they received $5 in consumer purchases. The average ROAS across all market sectors is 287%, and 400% in e–commerce – far lower than the result achieved by BIC. The success achieved by leveraging The Trade Desk’s DSP platform will likely encourage other major retailers like Walmart to partner with The Trade Desk and build similar platforms. Furthermore, it enables advertisers to access Walmart’s exclusive omni-channel customer data outside their properties – allowing brands such as BIC to gain more comprehensive and granular insights into customers’ journeys and create targeted advertisements tailored to each individual user.

The Trade Desk AI engine – Koa™

At the heart of The Trade Desk’s DSP platform, there’s Koa™, an AI engine that enables advertisers to perform media planning and more data-based decisions maintaining both control and transparency for the advertiser. Also, it exploits a vast amount of data analysis from over 790 billion queries each day which is more than 100x the query volume of a global search. Here’s are some functionalities of The Trade Desk’s AI engine:

– Koa enables advertisers to navigate through audience key information and gives real-time recommendations

– It allows the company’s clients to adapt bids entered on more than ten dimensions in order to support up to three KPIs per campaign

– Koa analyses past clearing prices across first-price auction environments in order to allow the company’s clients to set optimal bid prices for each impression while reducing unnecessary spend (for this last point see Made In’s and MediaDonuts case studies)

– The AI engine leverages the company’s robust vendor marketplace and chooses the best cross-device vendor

The Trade Desk moat

The Trade Desk offers a goal-based approach that enables advertisers to personalize their campaigns across different channels enhancing the targeting and the optimization process. With Solimar, The Trade Desk’s new measurement marketplace, marketers can create specific goal performance metrics for their digital advertising campaigns on the open internet allowing them to check in real-time the progress of their campaigns while focusing on the business side and its KPIs.

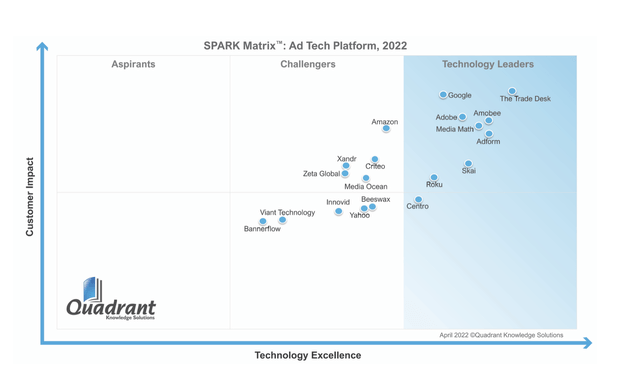

I believe that unlike from the Walled Garden companies like Google (GOOG) (GOOGL), Facebook (META), and Amazon (AMZN), The Trade Desk doesn’t own inventory and its business model doesn’t involve buying content in order to resell them to its clients. Who controls the advertising campaigns are only The Trade Desk’s clients and thanks to a vast amount of data points collected over more than a decade, advertisers are able to better manage their advertising spend and choose from several ad inventories. Moreover, The Trade Desk’s clients can customize their own advertising campaigns adding what they believe are the most suitable attributes on top of the company’s platform.

I think The Trade Desk is also well protected from smaller companies that operate DSPs and are therefore on the same side of the value chain. The company has substantial switching costs considering it enjoys an industry-leading scale with its 12 million queries per second and over 790 billion per day which makes The Trade Desk the best option for new advertisers who want to conduct their programmatic ad campaigns combining both scale and transparency. I believe the last point is also demonstrated by the over 95% retention rate that the company has managed to maintain for 8 consecutive years.

The above mentioned switching costs are also widened as the company’s application programming interfaces (APIs) give clients the flexibility to invest and develop their own features such as customised reporting tools, different campaign strategies or the deployment of new ad servers, etc. aiming at building long term relationships and increasing clients’ stickiness to the company’s several offerings. Moreover, I think the company benefits from network effects as its artificial intelligence engine will continue to leverage and enhance its execution thanks to the vast amount of data that gets collected whenever the company onboards new advertising agencies.

A customer centric platform

The Trade Desk focuses on an open and transparent platform, placing customers first. This allows them to gain more insights with accurate targeting at lower prices. Unlike Walled Gardens which links consumer information like age, gender or buying habits to their identities, The Trade Desk doesn’t cross the privacy boundary by not connecting data with client identities. To address third-party cookie issues concerning user privacy, The Trade Desk launched Unified ID 2.0 (UID 2.0).

Unified ID 2.0 employs consumers‘ anonymized email addresses, collected when they log into a website or app. An identifier is generated from the same email and constantly regenerates for better security. Consumers can set their data–sharing preferences and opt out of UID 2.0 at any time if desired. The system operates according to four core tenets:

1. Open Source: Consumers can view the entire code base of Open Source and examine how it works by visiting its “get out page.”

2. Accessible: Anyone can access UID 2.0 as long as they comply with consumer privacy and the rules set by its governing body.

3. Independently governed: UID 2.0 is not owned by The Trade Desk, but it’s an industry solution and for that reason there is an independent industry body that will keep everybody within the ecosystem accountable for any broken rule.

4. Secure and Privacy Friendly: UID 2.0 is secure through hashing, encryption and salting. Consumers have the option to control their identifier generated upon providing an email address and agreeing to be part of Unified ID. They can also revoke authorization at any time.

As The Trade Desk bolsters its customer loyalty and AI engine with more training data, I believe the number of companies partnering with them increases. A prime example is Made In‘s 2021 ad campaign using UID 2.0: they experienced a 20% reduction in average cost per acquisition and 22% growth in user conversion compared to third–party cookies, while also seeing 33% faster user conversion.

Financials and Intrinsic Value

The company compounded its revenues by 40% over the last seven years while consistently achieving net positive results, an uncommon feat for high–growth technology companies in their early stages.

In 2021, the EBIT margin was severely impacted by a $819M one–time stock option package. The first tranche of this program ($157.7M) was recorded as general and administrative expenses; the remaining will be recognized over the next three years. Without these charges, normalized EBIT would have been $282,517 (23.6% EBIT margin).

I assume that The Trade Desk will grow its revenue base by approximately 30% CAGR over the following 5 years from $1.196B in 2021 to $4.5B in 2026. Then, I consider an FCF multiple of x40 and two FCF margins for two different scenarios: 25% and 30%.

Based on a 10% discount rate and the previously mentioned data, I get the two following earning powers based on a 6-year time horizon:

| Assumptions | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Projected revenue (25% CAGR) | $1196.4 | $1495.5 | $1869.3 | $2336.7 | $2920.9 | $3651.1 | $4563.9 |

| Projected revenue (30% CAGR) | $1196.4 | $1555.3 | $2021.9 | $2628.5 | $3417 | $4442.1 | $5774.8 |

Figures are in million

| Assumptions for revenue at 25% CAGR | Estimates |

| Revenue (2027) | $4563.9 |

| FCF margin (25%) | $1140.9 |

| FCF margin (30%) | $1369.1 |

| FCF multiple | 30 |

| Intrinsic value (25% FCF margin) | $34.2 or $68.4/share |

| Intrinsic value (30% FCF margin) | $41 or $82/share |

Figures are in million excluding the multiple and intrinsic values which are in billion

| Assumptions for revenue at 30% CAGR | Estimates |

| Revenue (2027) | $5774.8 |

| FCF margin (25%) | $1443.7 |

| FCF margin (30%) | $1732.4 |

| FCF multiple | 30 |

| Intrinsic value (25% FCF margin) | $43.3 or $86.6/share |

| Intrinsic value (30% FCF margin) | $51.9 or $104/share |

Figures are in million excluding the multiple and intrinsic values which are in billion

Intrinsic values per share are calculated with an FCF multiple of 30 and then the figures are divided per the number of total shares outstanding, which as of the last quarter are 500.3 million.

Risks

Take rates oscillated between 19.7% and 21.1% from 2016 to 2019, now trending down to 20%. This decreasing trend could be a risk for The Trade Desk due to increased competition from incumbents; however, it can be mitigated by providing Koa™ with more data so their clients receive higher ROAS, better prices per impression and lower average cost per acquisition. My greatest concern is the potential financial impact of executive compensation following last year’s incentive award plan on EBIT and FCF in 2021.

Conclusion

I believe The Trade Desk is well–protected from competitors due to its competitive advantages outlined in the previous paragraphs. As it continues to improve its DSP platform and widen its moat, I anticipate that network effects and switching costs will only become more robust for this company. However, investors should exercise caution when investing in The Trade Desk as it trades at a premium earnings multiple.

Be the first to comment