VioletaStoimenova

Ribbon Communications Inc. (NASDAQ:RBBN), which offers digital solutions, is working to obtain operating efficiencies and cross-selling opportunities from recent acquisitions. In my view, Ribbon will likely experience sales growth thanks to new 5G networks. Even considering risks from new regulations and client concentration, future free cash flow indicates that the company is undervalued. Keep in mind that I obtained a fair valuation of $4 using a simplistic discounted cash flow model.

Ribbon: Geographically Diversified And Operating In An Innovative Industry

In the last decade, the way we communicate has changed radically, and this has reached the spheres of personal life and public life. The business world is no exception to this digital revolution. Some companies have been and are pioneers in the development of technologies for network innovation and data storage. Same is the case of Ribbon Communication, founded in 2017 as a result of the merger of Genband and Sonus Networks, currently based in Plano, Texas.

Ribbon offers services related to digital solutions for companies, preparing personalized design and development plans for each business need. This is mainly the internal fiber optic network to achieve almost immediate speed in data transfer as well as the creation and management of a storage cloud for the particular use of each corporation. In addition, Ribbon facilitates the administration and maintenance of these facilities, and offers other types of solutions such as highly complex software, analysis and perspectives based on data collection, cyber security plans, and protection of information.

Ribbon reports 3,000 people globally, of which 41% are hired in Asia and 29% in EMEA, surpassing 27% in the United States. I believe that the company’s business model is geographically diversified. Ribbon also details that currently 23% of its employees are women, highlighting the effort made in recent years in the area of diversity, equity, and inclusion.

Positive FCF Margin And Beneficial FCF Margin Expectations From Other Analysts

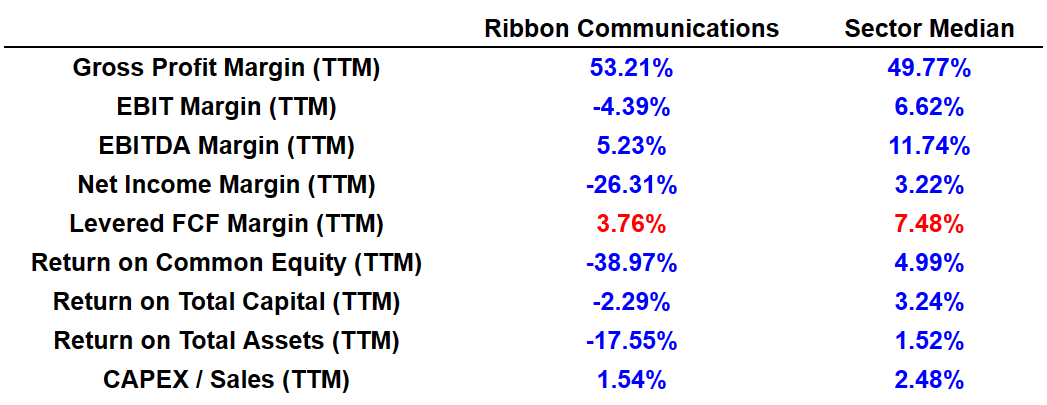

Ribbon reports a massive gross profit margin of 53.21%, with an EBIT margin of -4.39% and EBITDA margin of 5.23%. It is quite beneficial that the levered FCF margin stands at close to 3.76%. According to Seeking Alpha, the numbers reported by other peers indicate that the FCF margin and the EBITDA margin could grow even higher. Note that the sector median figures include FCF margin of 7.4% and EBITDA margin close to 11%.

Source: SA

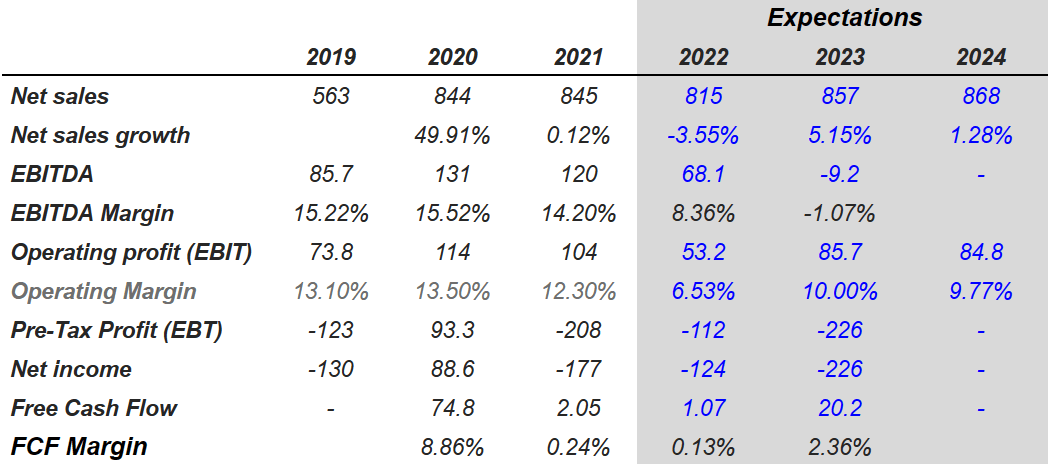

Estimates from other analysts are beneficial. 2024 net sales would stand at $868 million with net sales growth of 1.28%, in addition to 2022 EBITDA margin of 8%. The net income expected for the year 2023 is not positive, but the free cash flow figures remain close to 2% in 2023 and 0.1% in 2022.

Source: Marketscreener.com

Balance Sheet

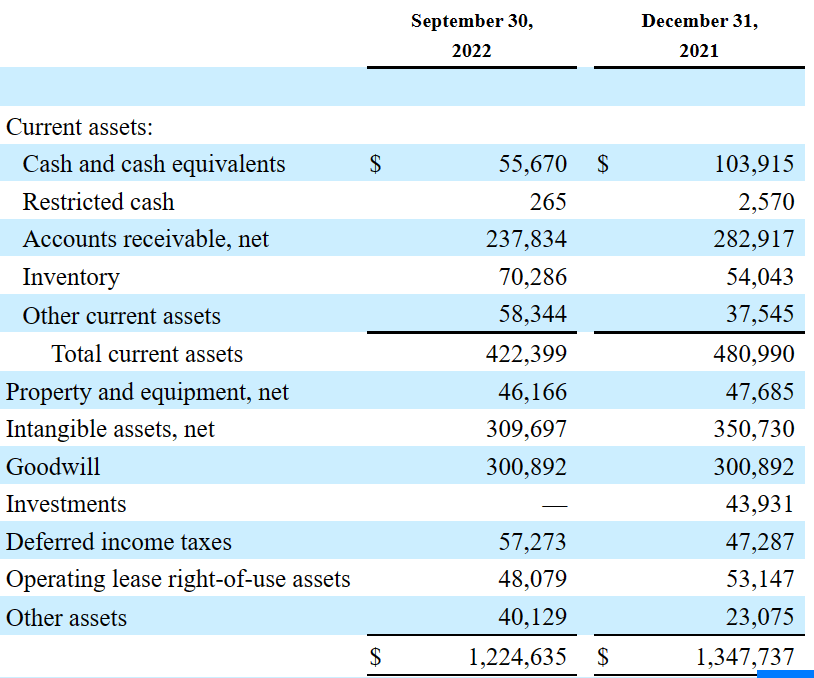

As of September 30, 2022, Ribbon reported cash of $55.670 million, accounts receivable of $237.834 million, and total current assets of $422.399 million. Total current assets are significantly higher than the total amount of current liabilities. Liquidity does not seem to be a problem here.

Ribbon is an active player in the M&A markets. Keep in mind that intangible assets stood at $309 million with goodwill worth $300 million. The most recent acquisitions are ECI Telecom Group Ltd. and Anova Data, Inc. I appreciate that Ribbon knows how to acquire and integrate acquisition targets. I would be expecting further inorganic growth in the near future.

Source: 10-Q

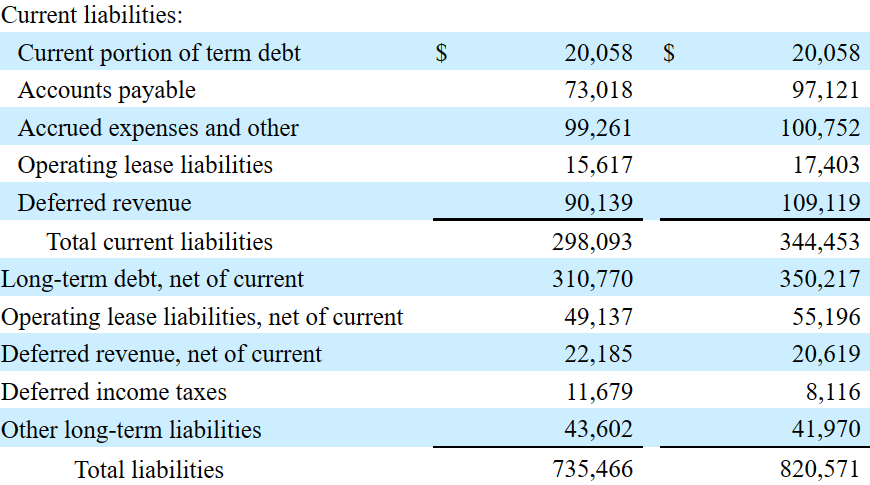

The list of liabilities includes accounts payable worth $73 million, in addition to accrued expenses worth $99.261 million and deferred revenue of $90.139 million. Total current liabilities stand at $298 million, and with operating lease liabilities worth $310 million, total liabilities are equal to $735.466 million.

Source: 10-Q

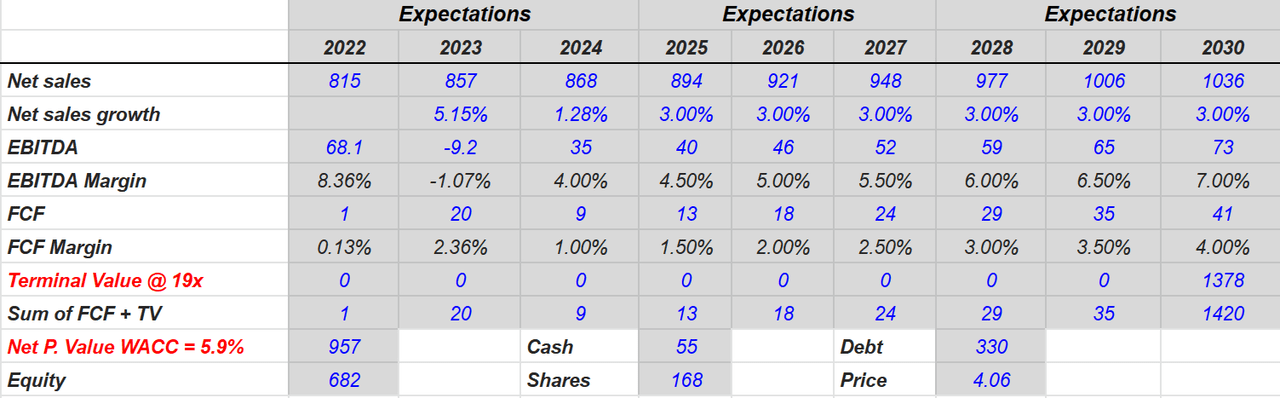

Base Case Scenario: Successful Integration Of ECI, Cross-Selling, And 5G Could Bring A Fair Price Of $4.06 Per Share

Under successful circumstances I assumed that the integration of ECI would work out. In my view, operational efficiencies, integration of corporate functions inside Ribbon, and addition of new team members would likely bring free cash flow margin growth.

A key step of the strategy includes continuing to successfully drive the integration of ECI and Ribbon to achieve best-in-class operational efficiencies. We have made significant progress and largely completed this integration in 2021, including a revamped internal organization aligned along a business unit model with regional sales teams and integrated corporate functions, as well as the addition of new experienced members to our leadership team. Source: 10-k

Under this case scenario, I also assumed that management will successfully sell new products obtained in acquisitions to existing list of corporate customers. As a result, revenue growth would most likely trend north.

We are laser-focused on marketing and selling our combined post-acquisition broad portfolio to our global deployed base of service provider and enterprise customers to expand our presence and share of the larger IP and Optical networking and transport market and cross-sell the complete portfolio. Source: 10-k

Finally, I assumed that Ribbon would obtain significant advantages by offering the deployment of 5G networks. In my view, backhaul and long-haul transport and networking solutions, IoT, and AI could bring significant revenue growth to Ribbon.

We believe 5G is a multi-year opportunity as global service providers roll out the new capital-intensive technology and build out the needed network infrastructure over the next decade. We want to be at the forefront of preparing our customers for the deployment of 5G on two major fronts: providing for metro, backhaul and long-haul transport and networking solutions in service provider networks, industrial verticals, and critical infrastructure; and supporting their needs as new applications, including IoT and AI, become a reality with 5G. Source: 10-k

Under my base case scenario, I assumed 2030 net sales of $1.036 billion and a growth of 3%. 2030 EBITDA would stay at $73 million with an EBITDA margin of 7%, FCF of $41 million, and FCF margin of 4%. If we use a discount of 5.9%, the equity valuation would be $682 million, and the fair price would be $4.06 per share.

Source: Author’s DCF Model

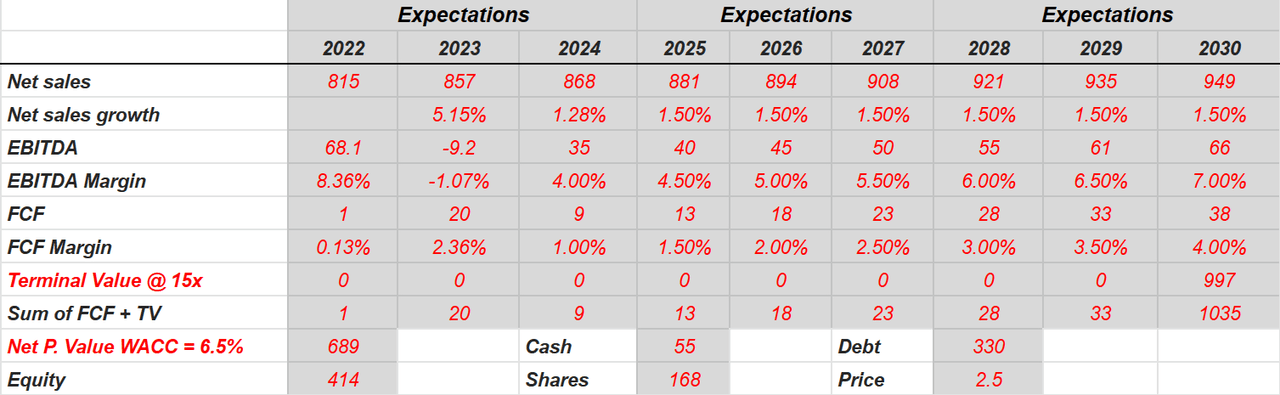

Under certain Risk Factors, I Believe That The Fair Price Could Stand At $2.5 Per Share

One of Ribbon’s most important clients is Verizon (VZ), which represented 16% of the profit during the year 2021. According to the company’s own statements, 34% of the profits for that year were generated through five of its largest clients. This is considered a great risk factor in possible future development although it is evidence of the success of Ribbon’s contracting and bidding strategy.

In the same way, Ribbon’s exposure to the financial credit situations of its contracting companies and their participation in high-risk fragile markets, together with the alignment between the plans of both companies in question, are marked as factors of risk in the annual report.

On top of these, we could add the risks in international operations, the risks of intellectual property and cybersecurity, and the risks in relation to government regulations in each region. An example of this is the delicate war situation between Russia and Ukraine in addition to the variations in the exchange rate at the global level not only because of access to certain materials and resources, but also because of the difficulties that can be generated at the time of transfers as well as the increase in the price of oil for international movements.

In relation to intellectual property and cyber security, Ribbon does not depend solely on its own protection, but also on the protection and effectiveness of third parties. This is clear when we understand that Ribbon provides software services to a large number of companies with huge connection networks. In the same sense, access to certain licenses from supplier companies can generate drastic complications.

It is also good to understand that the telecommunications industry, through digital transformation, has transferred a large part of its profits to the reception and analysis of customer data. Although the regulatory laws in the United States have not had the same development as in Europe, there are always chances of the elaboration of a new law that endangers the operation of the business in that area. Ribbon also points out that failing to comply with the FCPA in the USA or the UKBA in the United Kingdom, both control programs on corporate corruption, can mean a great risk to its growth and development.

During the year 2022, Ribbon has developed a plan to restructure its operation, investing $20 million for this purpose, of which $6 million were allocated to its employee base, and $14 million were allocated to the consolidation of its facilities. Although the company expects great results from this restructuring, its success or failure also means a risk in its future development plans.

Under this case scenario, I used 2030 net sales of $949 million, with a net sales increase of 1.50%, and an EBITDA margin of 7%. I also expect a free cash flow of $38 million with a FCF margin of 4%. Finally, with an EV/EBITDA of 15x and a WACC of 6.5%, the implied equity valuation would be $414.5 million, and the fair price would be $2.5 per share.

Source: Author’s DCF Model

Takeaway

Ribbon could obtain significant operating efficiencies from recent acquisitions. Management may obtain a lot of revenue growth thanks to cross-selling new products acquired to existing clients. I am also optimistic about the new 5G networks, which may bring new clients from various industries. In my view, future free cash flow would justify a valuation close to $4.06 per share. I also see risks from new regulations, restructuring failures, or client concentration. However, even considering the risks, the company appears undervalued.

Be the first to comment