Prostock-Studio/iStock via Getty Images

Investment Thesis

The Trade Desk (NASDAQ:TTD) has not seen analysts downward revising their EPS estimates for Q4 and early 2023. Even though EPS estimates for its peers have already moved lower.

TTD has been relatively immune to the bear market that has seen countless names fall substantially more than 50% from their highs.

With this in mind, I don’t believe that paying more than 40x EBITDA for TTD makes sense.

Bear Market Rallies

We are likely in the middle of a bear market. Along the way, there are going to be periods where stocks get oversold only to pull back and trap bulls.

Stocks rarely move in a straight line, either up or down. There are vicissitudes along the way that trick investors that don’t fully buy into the overarching narrative.

The bear market rallies happen when stocks have moved too quickly into negative territory. For example, back in the 2000s, the Nasdaq (QQQ) had 7 bear market rallies that saw stocks jump 50%, even though the long-term trend was lower over a period of years.

Those rallies are meant to erode investors’ capital. Only when investors are sufficiently burnt to stop throwing good capital after bad, can the market stabilize.

Looking Ahead, It’s Going To Get Tough

Moving on, I argue that Q4 is going to be tough for TTD, despite political spending percolating into its business.

More importantly, as we look out to early 2023, there are a lot more questions than answers. Investors are going to navigate a period of substantial uncertainty.

And even though TTD could well come out the other side with significant market share gains, I don’t believe that today’s investors will benefit. And I’ll get to why momentarily, before that, let’s address near-term earnings expectations.

TTD Earnings Expectations Need To Come Down

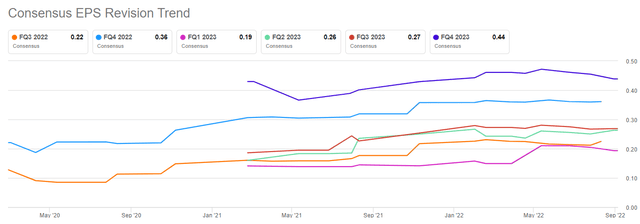

In the graphic below we can see several straight lines for TTD earnings expectations.

TTD analysts’ consensus earnings

What this tells you is that earnings have not come down.

In fact, what you can clearly see is that Q4 and Q1 2023 EPS estimates, light blue and lilac respectively, have actually come up slightly in the past several months.

Consequently, I argue that the Street is widely off the mark here. Look no further than every other ad tech and advertising company in the public market.

The market is the best leading indicator that you need to know that everything is not fine in the advertising sector. Concurrently, I think analysts are stuck with their unreasonable expectations!

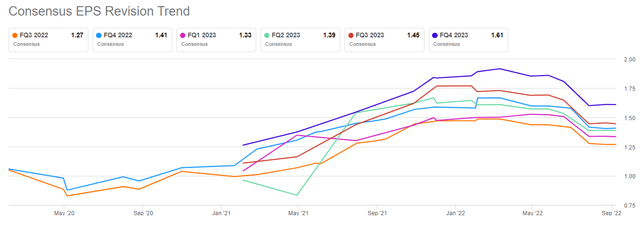

Consider a more widely followed name, such as Alphabet (GOOGL)(GOOG).

GOOG analysts’ consensus earnings

And one may make the case that Alphabet is a more widely followed name, so there’s a bigger cohort of analysts, which ultimately leads to better insights into EPS forecasts. And I would retort, precisely!

Analysts are being too flat-footed to figure out that TTD isn’t going to thrive in the coming quarters in my opinion, as much as analysts expect.

Essentially, I believe that TTD is likely to deliver to investors a large negative surprise in its upcoming Q3 quarterly earnings season.

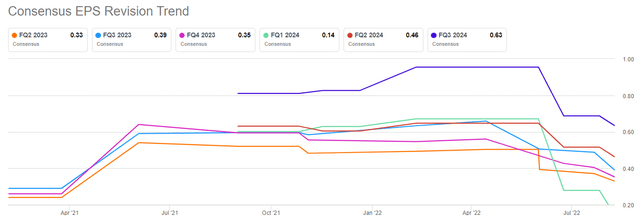

Here’s another point of reference, consider Digital Turbine (APPS).

APPS analysts’ consensus earnings

And we can make the argument that Digital Turbine is no match for TTD. Perhaps it could be true that Digital Turbine’s analysts are too bearish on its prospects.

But the fact that there’s been no adjustment at all on TTD’s EPS quarterly estimates, doesn’t this strike one as odd?

As I look around I see countless advertising businesses referencing a lengthened sales cycle, as well as a slowing economy, and the impact of higher interest rates. But no adjustment for TTD? Seriously?

Bull Case Too Far Stretched

The reason why TTD has remained so resilient is that its EBITDA is so strong. Indeed, in a time where countless other businesses are only marginally EBITDA profitable, TTD stands tall.

In fact, Q2 2022 saw its EBITDA margin report at 37%, down 500 basis points y/y, but still incredibly high, as I’m confident you’ll agree.

By my estimates, I believe that TTD will see around $640 million in 2022. My previous article breaks out my inputs and assumptions around this figure.

Nevertheless, this leaves TTD priced at 44x this year’s EBITDA. This is too high a multiple for a business that has yet to see the investment community significantly downwards revising its EPS estimates.

The Bottom Line

The market has this habit of lulling investors into inactivity. Investors often believe that doing nothing is the right course of action, simply because until now, it has been the right course of action. But doing something is an action. It’s underwriting the investment thesis.

I show you how the rest of TTD’s advertising peers have already seen their EPS estimates rollover. And until that happens, there’s too much risk left in The Trade Desk’s valuation. It doesn’t make sense to pay more than 40x EBITDA for a company with such looming risks bubbling under the surface.

Be the first to comment