krblokhin

It’s been a little over 5 months since I wrote my bullish article on Bed Bath & Beyond (NASDAQ:BBBY), and in that time, the shares are down about 68% (!) against a loss of about 12.75% for the S&P 500. The trade initially worked out very well, driven largely by rumours of a sale but from the end of March to the present, the shares have absolutely cratered. In my article, I acknowledged that the firm is very troubled, but I was intrigued by the insider buying that was then happening. In fact, it was the only bright spot I could find, and I bought in spite of that. I think my experience here offers investors an interesting cautionary tale: insider buying alone isn’t a sufficiently powerful reason to buy. Insiders know a business better than the rest of us, but they aren’t omniscient. I think this is relevant to people who are buying based on recent insider transactions.

Thankfully, I only bought a few hundred shares, but I’m also short puts that were at the time deep out of the money, but are now deep in the money, so it’s time to think about this investment again. I’ll comment on the most recent financial history here, and will also look at the stock as a thing distinct from the underlying business. Of course, I’ll also write about the puts because I think there are lessons to be had here.

Here comes my ubiquitous “thesis statement.” It’s here where I offer you the highlights of my thinking in a (hopefully) succinct nutshell so you won’t have to wade through 2,300+words of “Doyle mojo.” I think the financial performance here has deteriorated precipitously and rapidly. The capital structure in particular has gotten far worse in only three short months, with long term debt up dramatically, and cash down dramatically. In my view, the financial performance here has gone from “bad” to “appallingly bad” in a very short period of time. When I wrote my previous missive, I knew that the company was performing badly, but I took a small position because of the insider buying. My experience with this investment has caused me to think more deeply about insider buys. The number of failed startups demonstrates that just because someone knows the most about a given business doesn’t mean they’re right. This experience has shown me that we need some sort of confirmation that the people who are buying are making the right decision. We also need to look at what percentage of their wealth they’re putting on the line. If they’re only committing a tiny fraction of their own wealth, why should we not do the same, or simply avoid the stock?

Another lesson involves my short put strategy. I’ll be buying back the puts I wrote earlier at a loss. I wouldn’t be me, though, if I didn’t try to spin my trade in as positive a light as possible. Although I’ve lost about $4 per contract here, that performance has been far less bad than the $10 per share loss on my few hundred stocks that I bought at the same time. Given the life I’ve lived “less bad” is sometimes a win. Even in this very troubled circumstance, short puts were a superior, risk adjusted choice. Also, you may wonder if this episode makes me nervous about the idea of selling deep out of the money puts in future. Far from it, as this is the exception that proves (or “proofs” if you like to be archaic). Not to get too philosophical with a Seeking Alpha audience, but the existence of this exception offers further proof for the rule that selling deep out of the money puts offers a lower risk trade. I don’t even need to get too fancy with my rhetorical footwork here either. I did badly on my short puts, but I did very, very badly on my long stock position.

Financial Snapshot

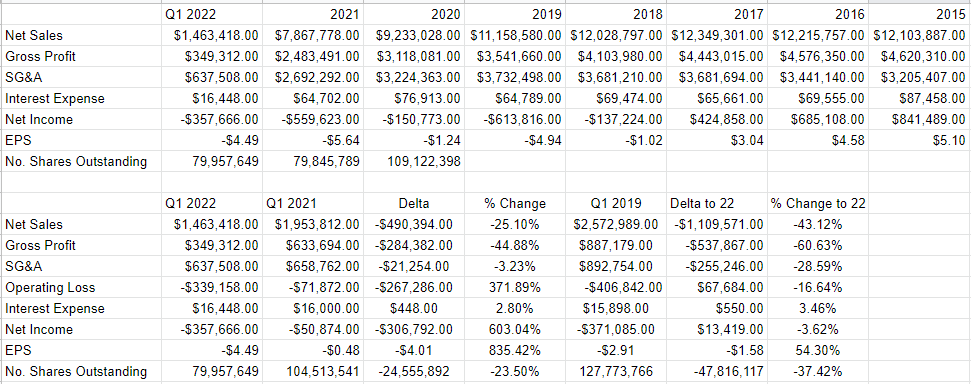

The most recent financial results have been shockingly bad in my view. I’ll start with the bad news and finish with the very bad news. Sales and net income both deteriorated dramatically in the quarter relative to the same period a year ago. Specifically, sales were about 25% lower than they were in Q1 2021, and net income jumped from a loss of $50.8 million to $358 million. So revenue was down by a quarter, and net loss was over six times worse. I looked back in time, and found that 2021 wasn’t anomalously good, making comparisons to it particularly harsh. For instance, net income during the first quarter of 2022 was fully 43% lower than it was in 2019. In fairness, net income in 2022 was better by about $13.4 million, but that’s the consequence of the fact that in 2019, the company took impairment losses of ~$401 million. My regulars know that I’m not a fan of “adding back” non-cash losses like this, but we have to admit that in the absence of these writedowns, we would clearly see that performance in 2022 has been uniquely bad.

When we turn our gaze to the capital structure, things get noticeably worse in my view. Specifically, long term debt has grown by a net $197.3 million, or 16.7% over the year. At the same time, cash on hand has cratered, down just under $1 billion or 90% from the year ago period. Most of this deterioration happened during the first three months of the year. Although merchandise inventory is only about 2% higher than it was at the end of the year, it’s fully 12.5% higher than it was at the end of Q1 2021. Merchandise inventory sat at about $1.76 billion at the end of the quarter. Given the growing risk of recession, this obviously raises the spectre of an upcoming write-down.

In my previous missive on this name, I characterised Bed Bath and Beyond as “troubled.” I’ve modified my views somewhat. I would now characterise it as “very troubled.” That said, even the most troubled company can represent reasonable value at the right price. At this point, Bed Bath & Beyond may be what the great Ben Graham referred to as a “cigar butt.” I’ll take a puff of it at the right price.

Bed Bath & Beyond Financials (Bed Bath & Beyond investor relations)

The Stock

My experience with this stock demonstrates the truism that “what the market giveth, the market taketh awayeth.” For that reason, I’m more “gun shy” than usual when it comes to buying this stock. I need to remind readers that we’re seeking “risk-adjusted” returns, not simply returns. This is because the price returns we’ve generated from following the momentum of the crowd can be taken from us relatively quickly.

Anyway, my regulars also know that I consider the stock and the business to be very different things. If you’re new here, and you haven’t heard me drone on about this to the point of tedium, let me tell you now: I consider the stock and the business to be very different things. Specifically, every business buys a number of inputs like inventory for instance, performs value-adding activities to those like displaying them in an attractive venue, for instance, and sells the results. Hopefully, this results in a profit. Eventually. Anyway, in the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets tossed around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. Additionally, the stock can move around because “stocks” as a class move in and out of favor. Thus, there’s often a very strong disconnect between the price of the stock and what’s going on at the business. We all believe this, otherwise, we wouldn’t be on this platform. All of this can be frustrating, but also potentially profitable. We can make money if we spot the difference in expectations about the company embedded in the current price, and subsequent reality. So, if the market carries the stock of a company with poor results aloft because of “market up”, that discrepancy creates a potential profitable trade.

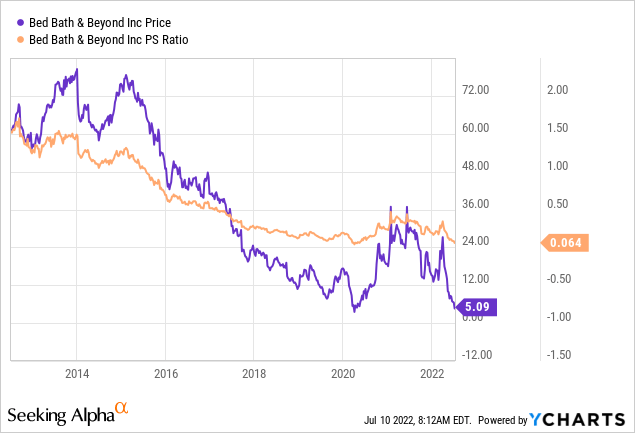

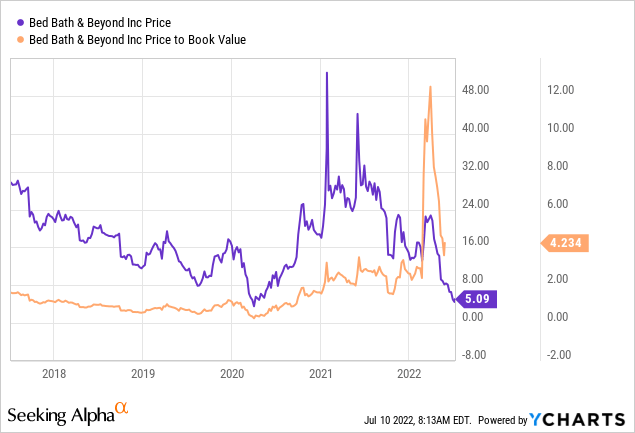

I should also point out that it’s typically the case that the lower the price paid for a given stock, the greater or “less bad” the investor’s returns over time. This idea shouldn’t need any explanation or elaboration. I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In my previous piece on this name, the market was paying about $.20 for $1 of sales, and the shares were trading at a price to book of ~2.9 times. Fast forward a relatively short period of time, and the market is now paying about 6 ½ cents for a dollar of this company’s sales per the following:

At the same time, the price to book ratio has risen dramatically as book value has evaporated.

Given the above, I can’t recommend adding at current prices. Although I think there’s generally a disconnect between stock and business, I am compelled to suggest that people avoid this name until there’s some sign of a turnaround. I was seduced earlier by the strong insider buying and won’t make that mistake again. That brings me on to my next topic.

Insider Buying Activity

As I stated above, the market seems to have gotten excited about the fact that there have been three insider buys recently. In particular, recently Sue Gove, Harriet Edelman, and Jeff Kirwan bought 50,000, 10,000, and 10,000 shares, respectively. They paid between $4.61 and $4.90 per share for these purchases. I like to see such trades, obviously, because I like being on the same side of the table as people who know this business better than anyone else. At the same time, though, this experience has taught me that insider buys are not a sufficient precondition to take a position in a stock. There must be other identifiable positives, because there’s a risk that such activity is simply a means to goose the stock price higher.

It might also be interesting to start gauging the strength of the insider buy signal by comparing the size of the transaction to the insider’s net worth if such data is available. For instance, Sue Gove’s net worth is estimated to be around $13.75 million. That puts her recent $230,000 purchase of these shares in context. I realise that $230,000 is a great deal of money for everyone, but it’s greater for some of us than for others. Anyway, I’ll be impressed by such insider maneuvers when these transactions compound other positive news.

Options Update

In my previous missive, I suggested selling what were then deep out of the money puts. Specifically, I recommended selling the January 2023 puts with a strike of $10. I sold 7 of these and earned a $2 premium for each. They are currently priced at $6.05-6.15, so this trade is what the young people refer to as a “spicy meatball.” Although these $4.15 per contract that I’ve lost is painful, it’s nowhere near as painful as the $10.88 per share I’ve lost on the stock I bought. This will serve as yet another reminder that short options are lower risk. “Lower risk” does not mean “no risk”, though. Thus, I think caution is warranted, and I think we would be wise to resist temptation at this point. For instance, the at the money January 2023 puts are currently bid at $1.95. This represents about a 40% yield on cash for six months of time. In my view, this great return is a mirage, and is the economic equivalent of picking up hundred dollar bills in front of a steamroller. Although the short-term rush is great, it’ll lead to a bad outcome. I’d remind investors that we’re not looking for superior returns. We’re looking for superior “risk adjusted” returns. Although 40% in six months sounds great, selling these puts may lead to greater losses.

For my part, I’ll take my lumps and will close out my short put position at a loss. This is significant because it’s the first time that I’ve bought back puts at a loss. I very frequently write deep out of the money puts and the trade has always worked out well. Whenever I’ve been exercised in the past, things have eventually worked out well enough. I fear that that won’t happen in this case, though, so I’m taking my punishment and getting out. I hope to live and learn.

Conclusion

This trade has worked out badly for me, and I’ll be cutting my losses. I was impressed by insider transactions previously, and I demonstrated a misguided faith that when people who know this business best put their own capital to work, that must be a good sign. To borrow a song title from the great Gershwin “it ain’t necessarily so.” I think in future it would be better to put these insider buys in context, as they’re not all created equal. What percentage of their net worth is the buyer putting on the line? Is there evidence that they are correct in their assessment? The number of business failures every year indicate that even people who know most about a given enterprise can be wrong. If we don’t have any evidence that confirms the buy is wise, it’s probably a bad idea to follow along. This trade has been a painful lesson for me, and I’m hoping the “tuition” I’ve paid for this teaches me, and offers all of you a cautionary tale which you can learn from.

Be the first to comment