Justin Sullivan

Tesla (NASDAQ:TSLA) is an interesting growth story and one for the ages. After staring bankruptcy straight in the eyes several times, according to CEO Elon Musk, they ended up as one of the biggest success stories in early market penetration and scaling up capacity around the globe in record time.

Just like other once-startups in an emerging new industry, however, there are always issues with how to value a company like Tesla. And going one step forward – what influence does the presence of a revolutionary mind like that of Elon Musk have on the stocks share price and subsequent valuation.

While the company is the only current all-electric vehicle manufacturer with the capacity to meet the demand around the globe, I still believe that there is significant premium to the company’s valuation due to its association with Mr. Musk and that if you take him out of the equation – while the company will still do remarkably well and continue to grow, their valuation may be excessive.

Let’s dissect what I mean by excessive and the implications of such.

Tesla’s Advantage Is Clear

While the company is facing increasing competitive pressures from nearly all automobile manufacturers around the globe, they still remain the only company which currently has the capacity to manufacture and deliver hundreds of thousands of all-electric vehicles. While there are some exceptions to this with Chinese-based companies, I’ll discuss that later.

This means that when a company like Hertz (HTZ) wants to cut their maintenance and fuel consumption surcharges and puts in an order for 100,000 all-electric cars – they really only have one option if they want them delivered within a year or two. And that’s exactly what they did.

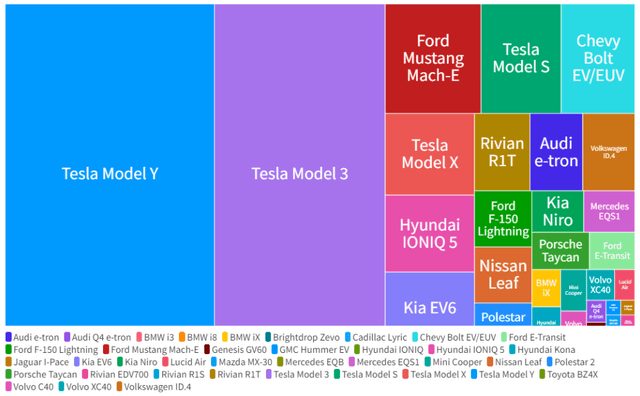

US EV Sales – 2022 YTD (Electrek US EV Sales Tracker)

Even while other companies like Ford (F), General Motors (GM), Toyota Motor (TM) have ramped up production of their all-electric and plug-in hybrid vehicles, they still remain well behind in their capacity for delivery.

Furthermore, even though most other companies are catching up on this as time goes by, Tesla still has built-in technological advantages like automated driving capabilities, vehicle control technologies, supercharging stations and others. These aren’t only just for tech geeks who want to make an investment in the company’s current lead in the race for autonomous driving, the vehicle mileage and performance is on the top of consumers’ minds as they think of which all-electric vehicle they want to purchase.

Tesla’s Growth Is Astonishing

It’s not just that the company has an advantage in their ability to deliver more than their competitors – it’s that they’re actually increasing deliveries almost every quarter, on average, and they’re expected to maintain this growth for quite some time.

They’re doing this by opening manufacturing plants outside of the United States in fast growing markets in the Asia-Pacific region and the European Union and the United Kingdom. While the full capacity of their Shanghai and Germany plants were slightly hindered by the COVID-19 pandemic closures, they’re on tap to make record deliveries once more this year.

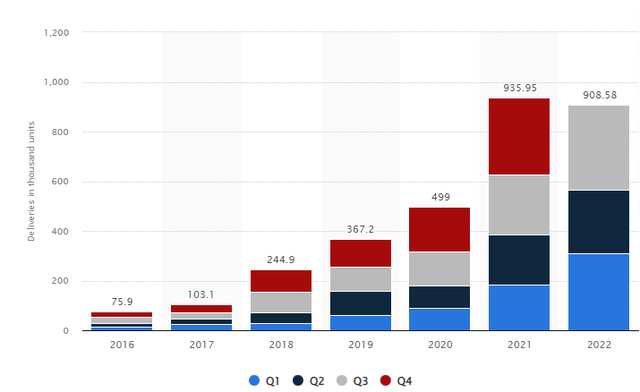

Tesla Vehicle Sales by Quarter (Statista – Sales Visualization)

As we can see, the company has made nearly as many deliveries of their new all-electric vehicles, mostly the Model 3 and Model Y, in the first 3 quarters of this year as they did in the entirety of last year and are set to deliver well over one million vehicles in 2022.

While they’re growing these figures with new plants, other companies are struggling to increase capacity and convert existing manufacturing facilities in the United States to manufacture their own versions of all-electric vehicles.

That’s why I believe Tesla’s growth story is far from over, and we can see that in the company’s current projections for the coming years.

Future Growth Is Strong, But…

While the company is projected to deliver almost 2 million vehicles in 2023, there are some negative factors which stand in the way of future growth for the company, even if they seem to be minor in the grand scheme of things.

Firstly, there’s increased competition. While this may not mean much for Tesla in the near term, it certainly will mean a lot in the longer term. There are hundreds of new all-electric and plug-in hybrid models hitting the streets (pun intended) in the coming years and while that may not do much for a few years, it’s bound to cut into their market share.

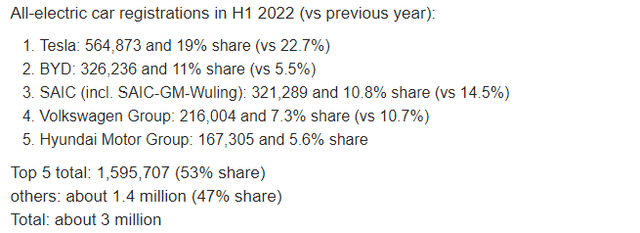

In fact, that’s already been happening. While their cars are not sold in the United States or in major markets (in significant numbers, in any case) outside of the People’s Republic of China, BYD (OTCPK:BYDDF) has seen their market share double in the global all-electric vehicle sales and now stand at 11% while Tesla has decreased to about 19% in the latest report of YTD figures in 2022.

H1 2022 EV Sales by Company (InsideEVs EV Sales)

Even with these global sales and market share figures, the company is still projected to do very well, as you can see by the company’s current projections for sales and earnings.

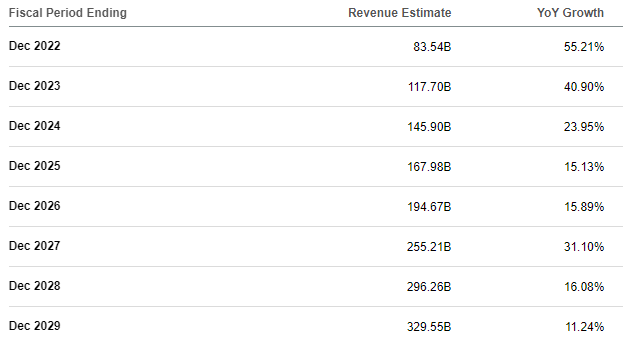

Tesla Sales Growth Projections (Seeking Alpha)

But there’s still this issue.

The Elon Musk Problem

I know, I know, I bore you with details about the company before getting to the issue at hand. But context here is very important.

The company does have things it can do, which don’t require some magical solution by the contrarian-thinking Elon Musk – things like lowering their prices to outmaneuver other companies introducing high-end (ish) all-electric vehicles and things of that nature. But there’s still an issue.

The issue is Elon Musk. While most of the world was struggling with updating the technology in regular automobiles, he was 10 steps ahead with battery technology advancements, technological advancements, EV range increases, charging station expansions and many other things.

This forward-thinking vision is exactly what made Tesla the hype (rightfully so, not in a bad way) which it is today and I don’t believe the company will be where it is today without him. But for how long is he going to stay?

Twitter Is Hardly The Only Issue

As we’ve seen with Jack Dorsey when he operated both Square (SQ) and Twitter (TWTR), it’s nearly impossible to run multiple companies at once and do a great job at all of them, even if you’re Elon Musk.

While Mr. Musk runs Tesla’s as its chief-product-officer, as he dubs himself, he also runs SpaceX (SPACE), The Boring Company, SolarCity (part of Tesla) and other AI (artificial intelligence) companies and he now picked up Twitter.

While he did sell a significant portion of his Tesla stock to do so, diluting his ownership, it’s the hands-off approach I think is coming to Tesla which can hurt valuation. Not only is there a board which can hold this work ethic accountable for the time spent elsewhere, it’s about where he spends most of his time.

During the company’s near-bankruptcy times a few years back, Elon Musk notoriously slept on the factory floor to make sure production headwinds were dealt with and it was undoubtedly one of the reasons employees, officers and other mangers managed to get the job done and get vehicles out for delivery.

Can Elon Must continue to do that now?

Eventually He Has To Make A Choice

Right now, I believe that Tesla is no longer a priority for Mr. Musk, and that the following companies will take precedent:

1 – Twitter: With Elon Musk’s personal crusade and fortune tied into this acquisition, it’s hardly a stretch to think that he’ll need to spend a lot of time building the company into something which can potentially be profitable. Since 2021, a lot of the folks who he presumably wants to bring back to Twitter (I won’t mention names since I don’t want the article to turn political, but unless you’ve been living in a cave for the past 3 years – you know who I mean) have found other platforms and have since gravitated away.

Especially since he plans to fire 75% of the company’s employees, he’ll need to have a hands-on approach if he wants to steer this mega tech company to a place where it can generate meaningful growth or profits in the years to come.

2 – SpaceX: With the world of space exploration just beginning, and the company’s recent advancements in rocket technologies, the company has been experiencing increased demand and this too requires a hands on approach to work with the engineers to solve the seemingly endless headwinds they face trying to colonize other planets, set up the Starlink network and more.

This means, I believe, that outside of the near full-time job of running Twitter, that Mr. Musk will be spending a near full-time job equivalent of time at SpaceX in order to make these futuristic technologies and products work.

3 – The Boring Company & Neuralink: While these companies have not been as high profile as Mr. Musk’s other ones, recent news that the company is battling deadlines and postponing show-and-tell events further eludes or confirms that the companies are facing some difficulties taking off.

Since Mr. Musk has been actively taking part in these companies and their issues, it’s apparent to me that he’s going to continue to spend time with these companies, which will further take time away from Tesla.

So What’s The Problem Exactly?

The problem is the company’s valuation.

As we’ve seen with sales, growth is projected to slow over the next decade since competitive pressures are mounting and that’s true for net income as well, especially if the company will need to lower prices in order to compete.

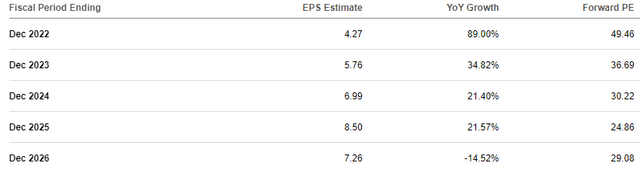

Earnings Per Share Multiples – Comparison

Tesla is currently trading at 30x to 50x forward earnings per share projections while they’re expected to report slowing growth and a decline by 2027 due to certain estimates that tax credits end and various other factors coming in.

EPS Projections & FWD P/E Ratio (Seeking Alpha)

While these may not seem excessive, companies like Ford with a projected 25% increase in EPS this year are trading at around 7x forward earnings. Toyota Motors with a longer term EPS growth projection of 5-6% are trading at around 9x forward earnings.

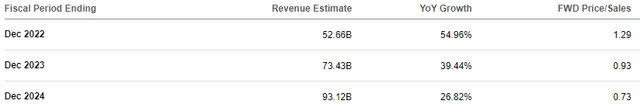

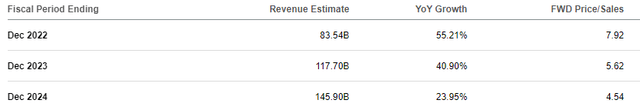

Sales Multiples – Comparison

If we want to look at sales as an indication, things get even more interesting. Comparing Tesla’s sales growth to that of BYD’s, the company’s closest competitor by unit sales volume, there’s a stark difference in valuation.

BYD Sales Growth / Multiples (Seeking Alpha)

TSLA Sales Growth / Multiples (Seeking Alpha)

The difference here is quite astonishing. With nearly identical growth, Tesla is trading at 4.5x to 8x sales multiples while BYD is trading at 0.7x to 1.3x.

This is due in part to the enthusiasm and trust around Elon Musk’s ability to solve issues and come up with product improvements, as his title so suggests. Without him at the helm, I have no doubt that the company can succeed, but can they do so at a valuation 3-4 times as high as other companies with somewhat similar growth projection? I’m just not sure.

Conclusion, If There Is One

Is Tesla a good company which currently has a near monopoly on US all-electric vehicle sales with ramping up production in the Asia-Pacific and European Union and United Kingdom regions? Absolutely yes.

Will they continue to grow their long-term sales at low to mid double digits over the next decade? Most likely.

But with increasing competitive pressures from existing companies, near-certain Model 3 and Model Y pricing cuts and a sluggish sales prospect in China due to increasing competitive pressures from geopolitical forces, the company is going to need the ingenuity of the person who made them what they are today.

As Mr. Musk continued to take on more and more impossible projects, I don’t believe that dedication is sustainable for Tesla and I believe that the company will see him having a more and more hands-off approach as he focused on the other monumental tasks ahead with Twitter, SpaceX, The Boring Company and Neuralink.

This doesn’t mean that the company’s growth is in question – but it does mean that if we treat Tesla as a generic company growing at the pace they are, they may be valued quite significantly lower than they are right now. This also means that, historically, during period where the market underperforms, like during recessions or market slowdowns, these types of companies tend to underperform the broader market.

While the company’s growth is not in question, their valuation is. And as a result, I believe that their fair value lies lower than their current valuation. So while I do believe in their future, I’m avoiding the stock altogether.

Be the first to comment