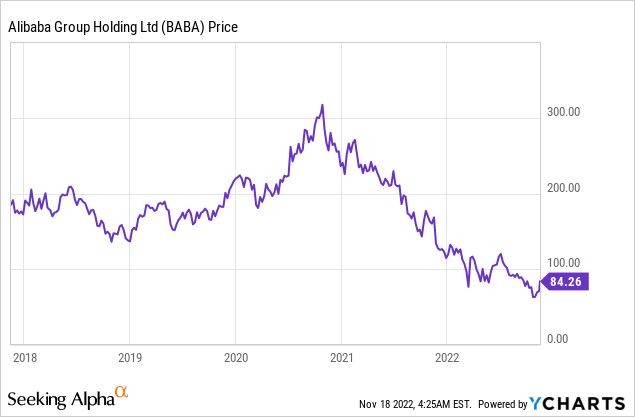

Alibaba Group Holding Limited (NYSE:BABA) is a legendary technology titan also known as the “Amazon of China.” The company is the market leader in e-commerce and is poised to benefit from the growth in China’s cloud industry. Since its IPO in 2014, its revenue has increased by 12 times, its Adjusted EBITDA by 4.5 times, and Free Cash flow by 4 times. Despite this, its share price trades at ~10% lower than its $94 IPO price in 2014, as if the past years of growth didn’t occur.

Part of this decline in share price was driven by the company’s outspoken (but brilliant) founder, Jack Ma. He previously clashed with the Chinese Communist party, which resulted in the anticipated IPO of Ant Financial being suspended and the company being slapped with a huge fine of $2.1 billion. But now that CEO Daniel Zhang has taken more of a prominent place, the company could be in a position to shake off past issues. In this post, I’m going to break down the recent earnings for the September quarter and reveal the valuation, so let’s dive in.

Sean Gallup

Mixed Second Quarter Results

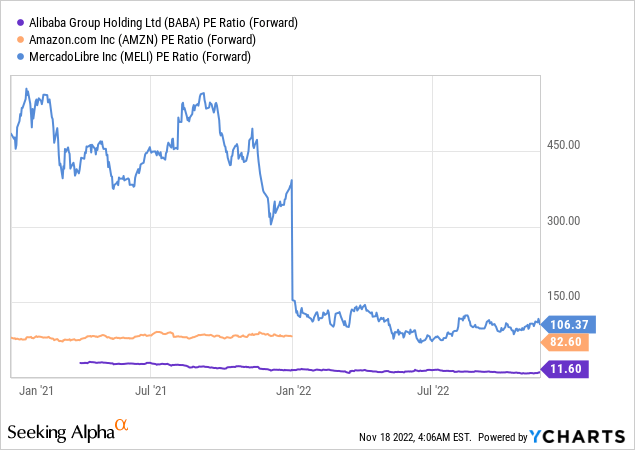

Alibaba generated mixed financial results for the September quarter of 2022, its fiscal Q2 2023. Revenue was $28.95 billion, which increased by 3% year-over-year in RMB but was down 6% year-over-year in USD, due to the strengthening of the U.S dollar. Revenue came in below analyst expectations by $665.65 million.

China’s domestic consumer market remained depressed with revenue of ~$19 billion (135.5B RMB), down 1% year-over-year. This was driven by its Taobao and Tmall, which saw a single-digit decline in Gross Merchandise Volume [GMV]. This was mainly driven by lower consumer demand in areas such as apparel and consumer electronics, as hard CV19 lockdowns occurred in parts of China. The country’s hard stance on CV19 caused logistics disruption, which resulted in poor experience for the consumer and uncertainty in the market. The good news is Alibaba reported positive growth in categories such as pet care, outdoor and wellness, as it looks as though consumers are finding comfort in these areas. “Pandemic pets” was a common trend that occurred during the pandemic of 2020, as people were socially isolated; therefore, furry friends offered some consolation.

Taobao and Tmall continue to have strong positions as the go-to market places for Chinese citizens. Over 124 million customers spent over $1,400 in the trailing 12 months, with a retention rate of 98%. To give you some perspective into the number of people this is, the entire U.S population is approximately 331 million, so this represents a staggering 37% of the U.S.

A segment of strong growth was Local Consumer Services (highlighted in red on the table above), which increases by 21% year-over-year to 13 billion RMB, or $1.8 billion USD. This segment includes Alibaba’s “To Home” and “To Destination” businesses such as Amap (similar to Google maps), Ele.me (online food delivery) and Fliggy (online travel agency). Therefore, it looks as though the Chinese resident is ordering food during hard lockdowns and planning vacations away, as the middle class grows in the country.

Logistics company Cainiao also reported solid growth, up 36% year-over-year to $1.875 billion (13,367 RMBm). The Cainiao Post business has over 170,000 locations across China from rural villages to residential communities. A high-tech and vast logistics network acts as a competitive advantage for Alibaba. A larger network offers a better customer experience (through faster delivery) and a lower cost structure.

Alibaba Cainiao Logistics Robots (Alizila)

Alibaba’s Cloud segment reported surprisingly slow growth of just 4% year-over-year, to $2.9 billion (20.757B RMB). Over in the west, the cloud segment is the fastest-growing segment of many tech giants such as Amazon [AWS], Microsoft [Azure], and even Google Cloud. Alibaba’s relatively underwhelming result looks to have been driven by a “top internet customer” which has gradually stopped using overseas cloud services for its international business. This was combined with headwinds from softer demand across China’s internet industry. A silver lining is that Alibaba Cloud reported solid growth in the financial services and telecommunications industries.

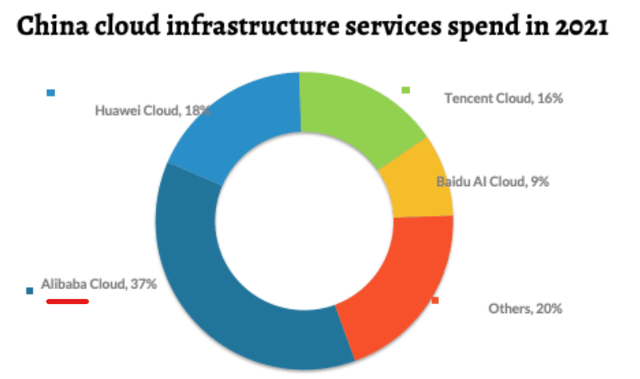

According to a McKinsey study, the Cloud industry in China was worth $32 billion in 2021 and is forecasted to nearly triple in size, to $90 billion by 2025. This is expected to be driven by the digital transformation of China’s manufacturing industry, which, despite being the largest by GDP, has historically lagged behind in Cloud adoption. Therefore, I forecast Alibaba Cloud to generate strong growth in the future, as the company is the market leader with a 37% share of cloud spending as of 2021.

Alibaba Cloud (China Internet Watch)

Expenses and Profitability

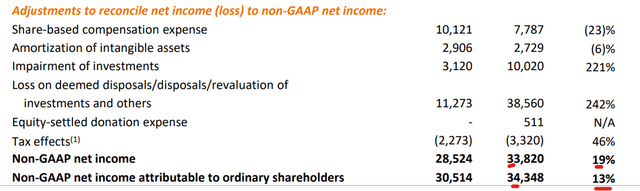

Alibaba generated adjusted earnings per share of $1.81 in Q3 2022, which beat analyst expectations by $0.16. The company generated Non-GAAP net income of $4.75 billion (33.8B RMB), which increased by a rapid 19% year-over-year.

Adjusted Income (Q2,22 report)

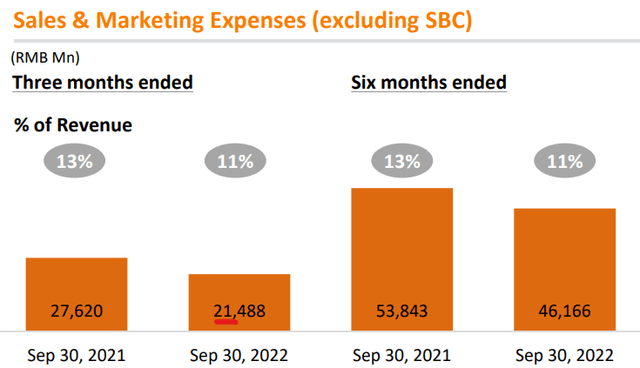

This growth in earnings was driven by improved operating efficiency across its various business segments. The company has kept its Cost of Revenue at 63% of the total. Therefore, if Alibaba starts to grow at a faster rate again, I imagine its costs will remain at a relatively similar percentage, which is a positive for profits. In the September quarter, Alibaba reduced its sales and marketing expenses to just 11% of total revenue, from 13% in the prior, which reflects positive user acquisition costs.

Sales and Marketing Expenses (Q2,22 report)

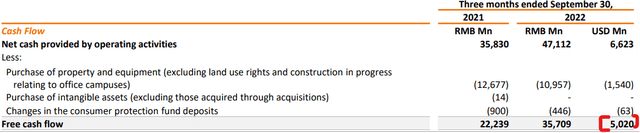

Alibaba reported free cash flow of ~$5 billion, which increased by 53% year-over-year on an RMB basis, or close to double in U.S dollars as the currency has strengthened significantly.

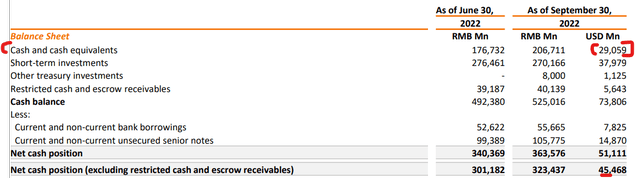

The company has a fortress balance sheet, with a $73.8 billion “cash” balance. This consists of $29 billion in cash and cash equivalents. This is in addition to $37.98 billion in short-term investments, $1.1 billion in treasury bills, and $5.6 billion in restricted cash. Its Net cash after debt is ~$45.5 billion. Therefore, Alibaba is in a strong position to weather any storm.

As of mid November, the company has used $18 billion of its $25 billion share buy back program. In addition, management showed confidence as it upsized the existing buyback program by another $15 billion.

Advanced Valuation

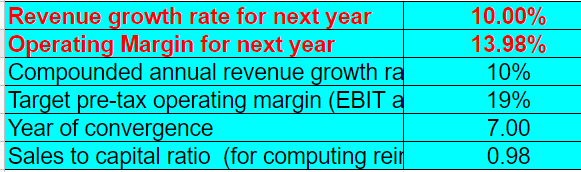

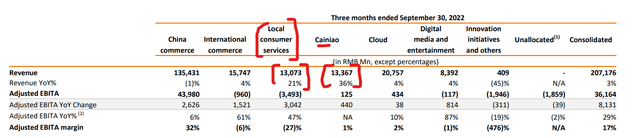

In order to value Alibaba, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 10% revenue growth for next year and 10% per year over the next 2 to 5 years. I forecast this to be driven by a rebound in local shopping demand in China and growth acceleration in the cloud.

Alibaba stock valuation 1 (created by author Ben at Motivation 2 Invest)

In order to improve the accuracy of the valuation, I have capitalized the company’s R&D expenses, which has lifted net income slightly. I forecast its operating margin to increase to 19% over the next 7 years as the cloud business accelerates, upsells from consumer demand increase, and operating leverage starts to show.

Alibaba stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $136.7 per share for Alibaba. The stock is trading at $84 per share and thus is ~39% undervalued.

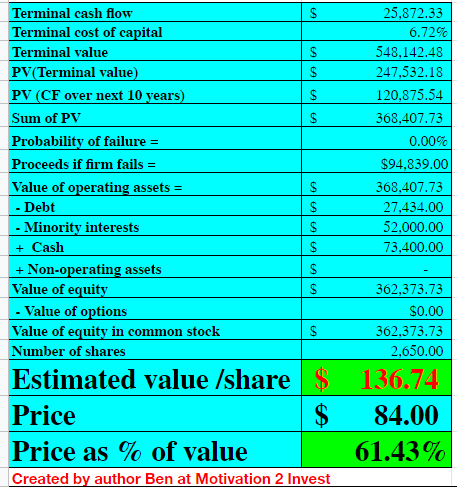

As an extra data point, Alibaba trades at a Price to Earnings ratio = 11.77 which is 51% cheaper than its 5-year average. For a rough comparison, you can see that Alibaba trades at a much lower P/E Ratio than Amazon (AMZN) and MercadoLibre (MELI), which is known as the “Amazon of Latin America.”

Risks

Chinese Government and Delisting

Alibaba has been the poster child for the Chinese communist party [CCP] to flex its muscles, as it reigns in the tech giants. The company was even slapped with a $2.1 billion fine in 2021. Then, on the other side of the world, the company is being squeezed out of the New York Stock Exchange by the SEC, which demands more accounting transparency from Chinese companies. The good news is Alibaba has had its primary listing on the Hong Kong Stock exchange approved, but any investment into China always has intense political risks.

Final Thoughts

Alibaba is a tremendous technology giant which is currently battling a series of headwinds from China’s lockdowns, recessionary headwinds, and government regulation. The good news is the business has begun to improve its profitability (on an adjusted basis) and has a strong leadership position in e-commerce and the cloud. Alibaba stock is undervalued intrinsically and thus this could be a great long-term investment. However, due to the uncertain geopolitical environment, I will label Alibaba stock as a “hold” for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment