Lux Blue

Introduction

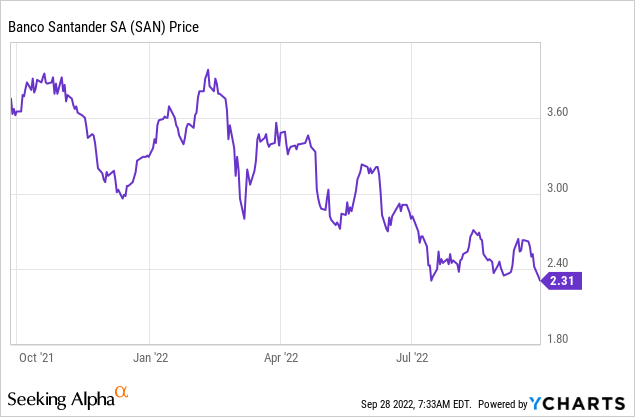

Nine months after my previous article on Banco Santander (NYSE:SAN) wherein I discussed the bank’s new dividend policy, the share price is trading approximately 25% lower. Of course, the entire European banking sector has been hit hard by the concerns surrounding the European (and world) economy and although interest rates are increasing (which should result in expanding interest margins and higher net interest income results), the markets are worried about the financial institutions’ ability to cope with a rapidly changing reality. I will refer to the bank’s Euro listing.

Earnings remain strong, despite some headwinds

Credit losses are part of the game for every bank in this world, and the business model is focused on making sure the net interest income and fee-related income are able to offset all expenses.

Higher interest rates are generally good news for a bank as it traditionally results in an expanding net interest margin and a net interest income. We already see the start of this phenomenon in Santander’s quarterly results, and that has clearly helped the bank to mitigate the impact of increasing operating expenses and higher loan loss provisions.

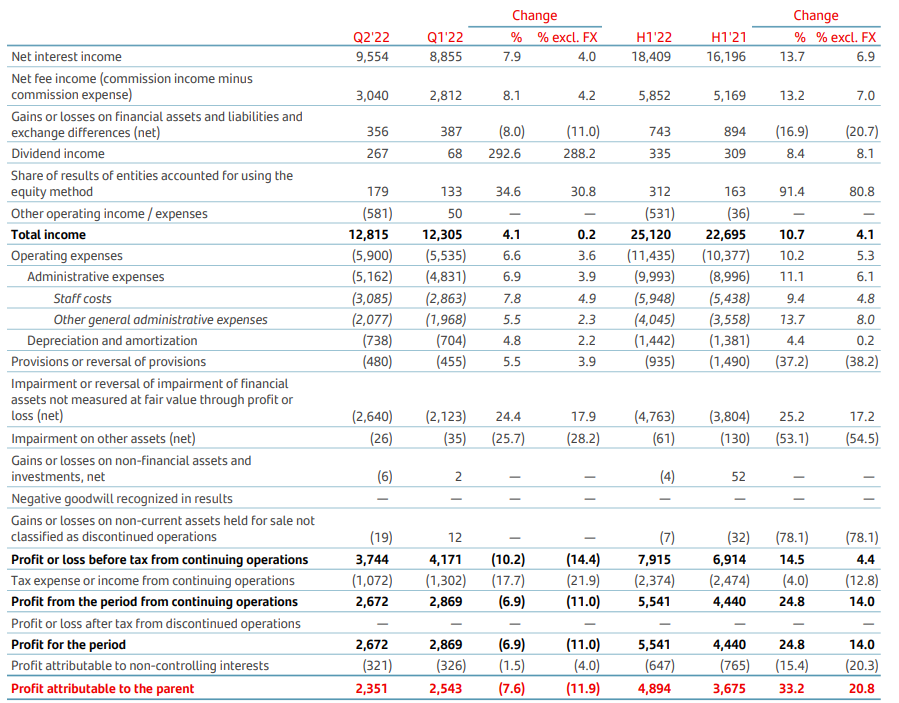

In the second quarter of 2022, Santander’s net interest income increased by a very impressive 8% compared to the first quarter as the net interest income came in just shy of 10B EUR, a level I hope the company will reach any quarter now. On top of that, the net fee income and dividend income also increased and the only reason why the total revenue came in at just 12.8B EUR (which is an increase of just 4.1%) is the 581M EUR in “other operating expenses.” Excluding this element, the total revenue would have come in approximately 8% higher at just over 13.3B EUR.

Banco Santander Investor Relations

The other operating income is related to a lower leasing income (about 240M EUR lower than in the same period last year) while the bank also had to record higher contributions to the Single Resolution Fund while the total amount also includes additional provisions related to the Polish banking fund. On top of that, the total amount also includes the elements related to the inflationary environment in Argentina.

As you can see in the income statement above, Santander also saw its operating expenses increase and on top of that, the bank reported a 24.4% increase in the impairment of financial assets (read: Loan loss provisions) on a QoQ basis. That pushed the pre-tax income lower by about 10.2% to 3.74B EUR. The entire decrease is caused by the higher loan loss provisions (which increased by in excess of 500M EUR in absolute numbers) and the higher “other operating expenses.”

Given these elements, seeing a net income of approximately 2.67B EUR, of which, 2.35B EUR is attributable to the common shareholders of Santander isn’t bad at all. The EPS based on these results comes in at 0.131 EUR per share, so on an annualized basis, the multinational bank will still generate north of 0.50 EUR per share in earnings.

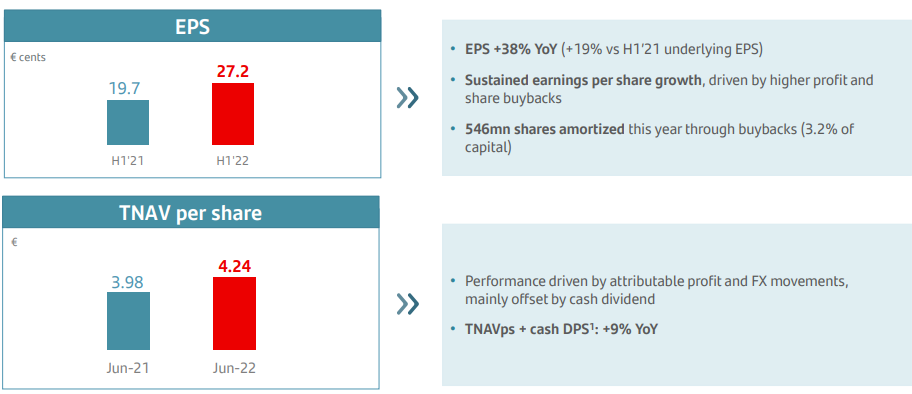

On top of that, several of the special elements like the contribution to the Single Resolution Fund are “seasonal” and generally don’t reoccur every single quarter. That helps to explain why the H1 EPS already was 0.272 EUR per share despite recording almost 1B EUR in additional loan loss provisions. Given the strong performance in the first semester and the increasing interest rates, it shouldn’t be too difficult for Banco Santander to generate an EPS of at least 0.50 EUR per share (which implies a 15% profit decrease in the second semester) as a bearish scenario while 0.55-0.58 EUR appears to be a more reasonable target for this year.

Banco Santander Investor Relations

Investment thesis

Thanks to the new dividend policy, Santander is hoarding a substantial portion of its earnings on its balance sheet, and this helps to boost the book value per share. As of the end of June, the tangible book value per share was 4.24 EUR, an increase from the 4.12 EUR per share as of the end of 2021 and an even more impressive increase from the 3.98 EUR per share registered at the end of Q2 in 2021.

The fully-loaded CET1 ratio decreased just slightly (but is still higher than a year ago) and as the bank is generating about 26 base points per quarter, Santander seems to have its capital position fully under control.

I recently went long again, and although it currently still is a relatively small position in my portfolio, I may be looking to further increase my exposure to Banco Santander as it’s trading at less than 0.6 times tangible book value and less than 5 times earnings.

Be the first to comment