blackdovfx

Are you having a tough time finding a winning stock in 2022? It seems all areas of the market have come under attack by the bears. High-duration software stocks, in particular, are under pressure. One name, though, went through a very positive corporate combination almost a year ago that is still paying figurative dividends for its investors today. But is the stock now too richly valued?

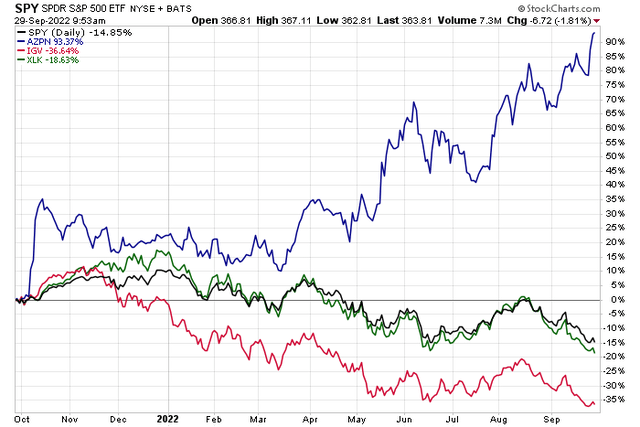

S&P 500, Tech, Software Down, Aspen Technology Up

According to Bank of America Global Research, Aspen Technology (NASDAQ:AZPN) came into existence in 1981 after an R&D initiative in MIT labs was commercialized. The company was incorporated in 1981 and reincorporated in 1998. AZPN has 3,700 employees and operates in 41 countries. Fidelity notes that the firm provides enterprise asset performance management, asset performance monitoring, and asset optimization solutions worldwide. The company’s solutions address complex environments where it is critical to optimize the asset design, operation, and maintenance lifecycle.

In October 2021, industry stalwart Emerson (EMR) partnered with Aspen Technology for its industrial software offering. The deal helped bring about value for both firms, but Aspen Technology shares have surged in a year fraught with volatility and downward price action. BofA sees the corporate transaction as a major catalyst for revenue growth, margin expansion, and diversification.

The Massachusetts-based $12.5 billion market cap Software industry company within the Information Technology sector does not have positive GAAP earnings over the past 12 months and does not pay a dividend, according to The Wall Street Journal.

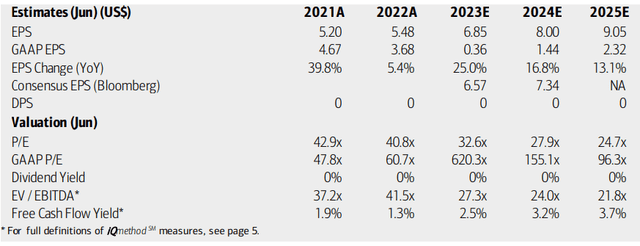

On earnings and valuation, BofA sees operating per-share profits rising sharply this year and through 2024. GAAP earnings are currently negative over the past 12 months, but the more conservative profit accounting figure also turns sharply higher in the proceeding years. Still, AZPN’s operating P/E is quite high and there’s no yield. All the while, its EV/EBITDA multiple is very stretched with low free cash flow.

AZPN Earnings, Valuation, And Free Cash Flow Forecasts

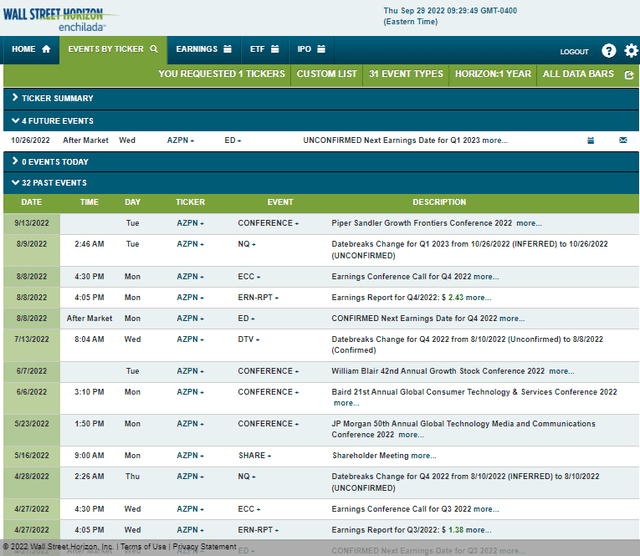

Aspen Technology’s corporate event calendar is light until its Q1 2023 unconfirmed earnings date of October 26 after market close, according to Wall Street Horizon. The company recently appeared at the Piper Sandler growth Frontiers Conference earlier in September.

Corporate Event Calendar

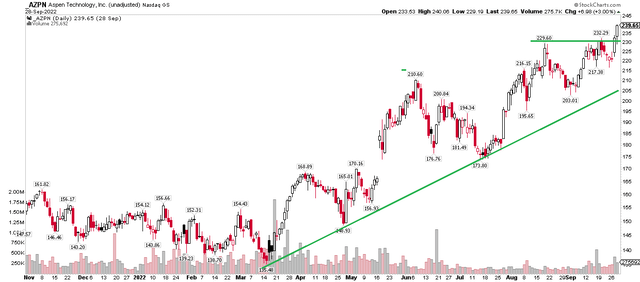

The Technical Take

Price action has been tremendous this year. It has been a long time since I have seen such a strong uptrend considering the ongoing global bear market. Nonprofitable tech/software has been particularly hit hard, but that has not negatively affected shares of AZPN it appears.

I see a near-term breakout in the stock while there is a broader uptrend to support a bullish thesis. My concern, though, is that if there is more market volatility, then the bears might come after high-fliers like Aspen Technology as a source of funds. Being long here with a stop under the $203 September low is the prudent move but watch out for a market washout bringing about sellers in AZPN.

Aspen Technology Shares Power Higher Within A Broader Uptrend

The Bottom Line

The price-action on AZPN is very bullish, but its valuation is expensive right now and free cash flow is not all that strong. Those are important characteristics in today’s market. Nevertheless, I respect the price action so am hesitant to call it a sell for fundamental investors. I think a hold rating on Aspen Technology makes sense now. Technical traders can be long here with a stop under $200.

Be the first to comment