courtneyk

Investment Thesis

The Trade Desk (NASDAQ:TTD) is the largest demand side platform, serving as a critical intermediary for advertisers looking to optimize their ad spending. Through The Trade Desk, advertisers have access to the world’s most premium inventories and rich data insights.

The company released its 3Q22 result and my verdict is that it once again proves itself to be an extremely resilient company as brands and advertisers are shifting more ad dollars to the platform. This combined with operating margin expansion due to strong operating leverage shows that it should continue to reinvest into the business to grab market share. The only change, though, is how I view its operating profit and Free Cash Flow since my previous article. Do continue reading on as I touch on the investors’ general concern over stock-based compensation.

Strong Revenue Growth

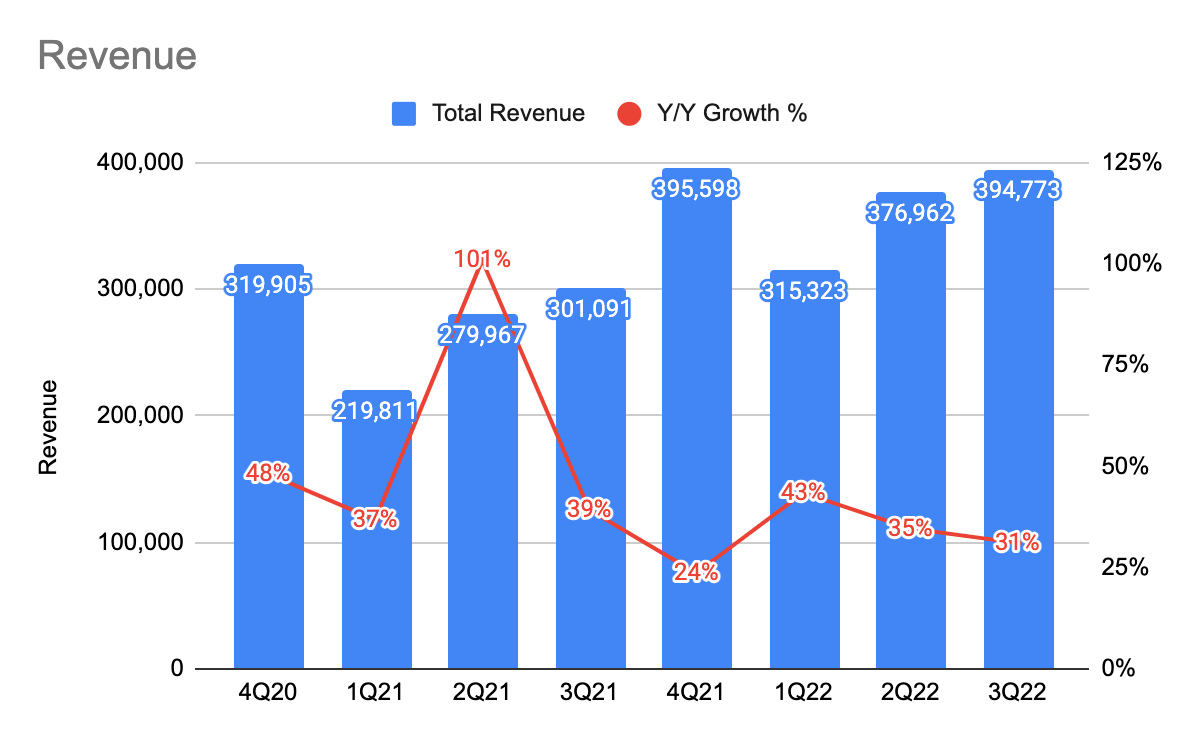

TTD 10-Q

The company is approaching a seasonally stronger half (i.e., 3Q22 & 4Q22) as its revenue grew 31% Y/Y. This is an impressive growth considering that many ad-tech companies such as Digital Turbine’s (APPS) app growth platform are exhibiting single-digit growth rates. This is a result of landing more multi-year agreements with the world’s largest brands, and an increasing shift of advertising dollars onto its platform, particularly on its rapid growth of CTV.

Strong Operating Leverage Led To Increased Operating Margin

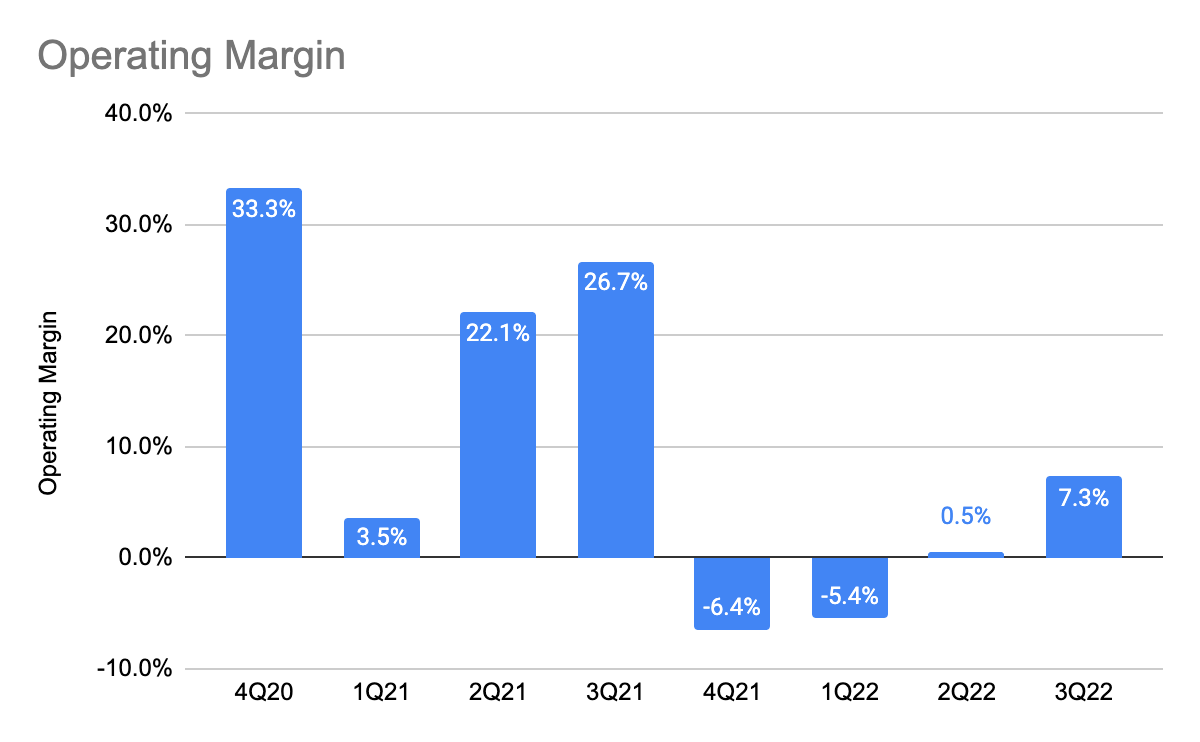

TTD 10-Q

The Trade Desk demonstrated strong operating leverage, as its 64% Y/Y operating profit growth doubled that of revenue growth. This led to an increased operating margin of 7.3% from 0.5% in the last quarter. This combination of strong revenue growth, operating leverage, and favorable competitive positioning among peers strongly support that it should continue to reinvest heavily into the platform to land more market share.

Concern Over Stock-Based Compensation

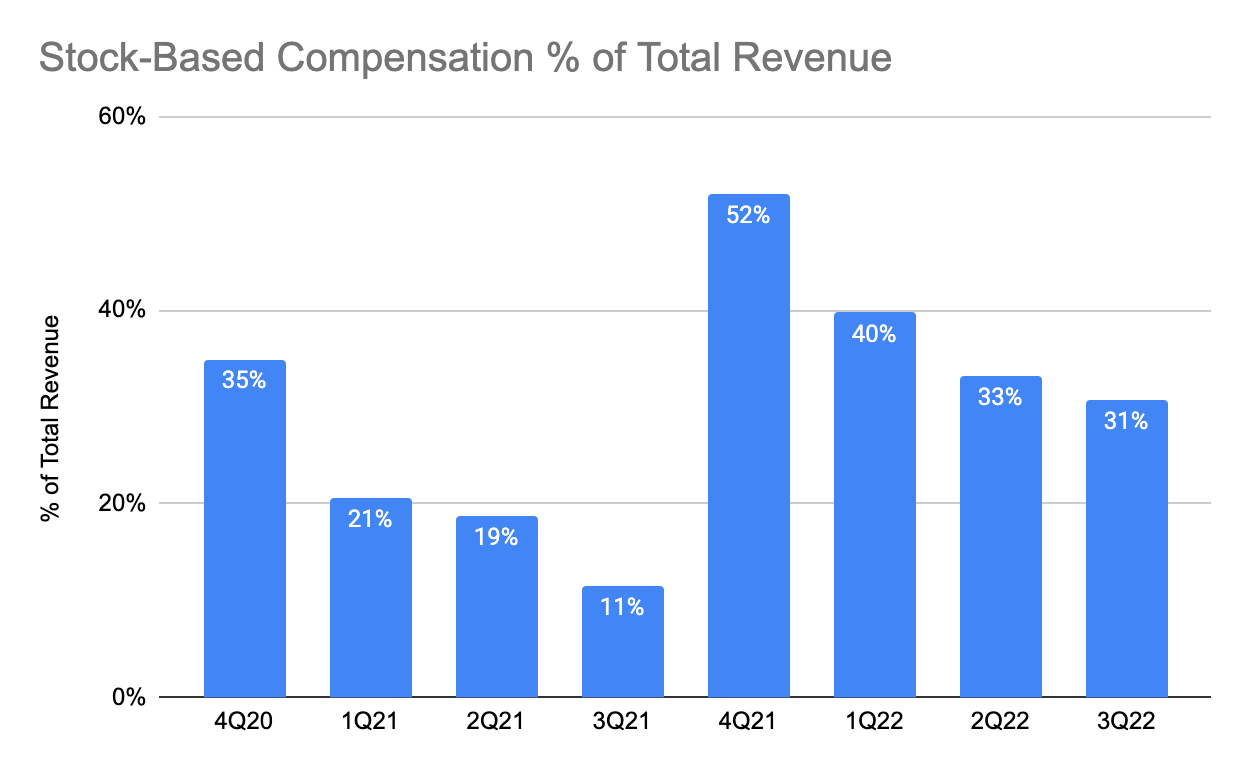

TTD 10-Q

For investors who are wondering about the massive decline in operating margin from a year ago, this is a result of the high stock-based compensation (“SBC”) expenses incurred as a result of the CEO’s compensation. However, as management has indicated, this is likely a one-off expense, it should and has been declining in the past few quarters.

Recall that in my previous article, I attempted to find out the normalized operating margin of the company by adding back the SBC expenses. However, according to Aswath Damodaran, SBC expense is an in-kind expense – equities that companies pay and retain their employees, and excluding this is assuming that they can give away equity without bearing any consequences for value per share. Therefore, SBC should not be added back to compute the Free Cash Flow (“FCF”).

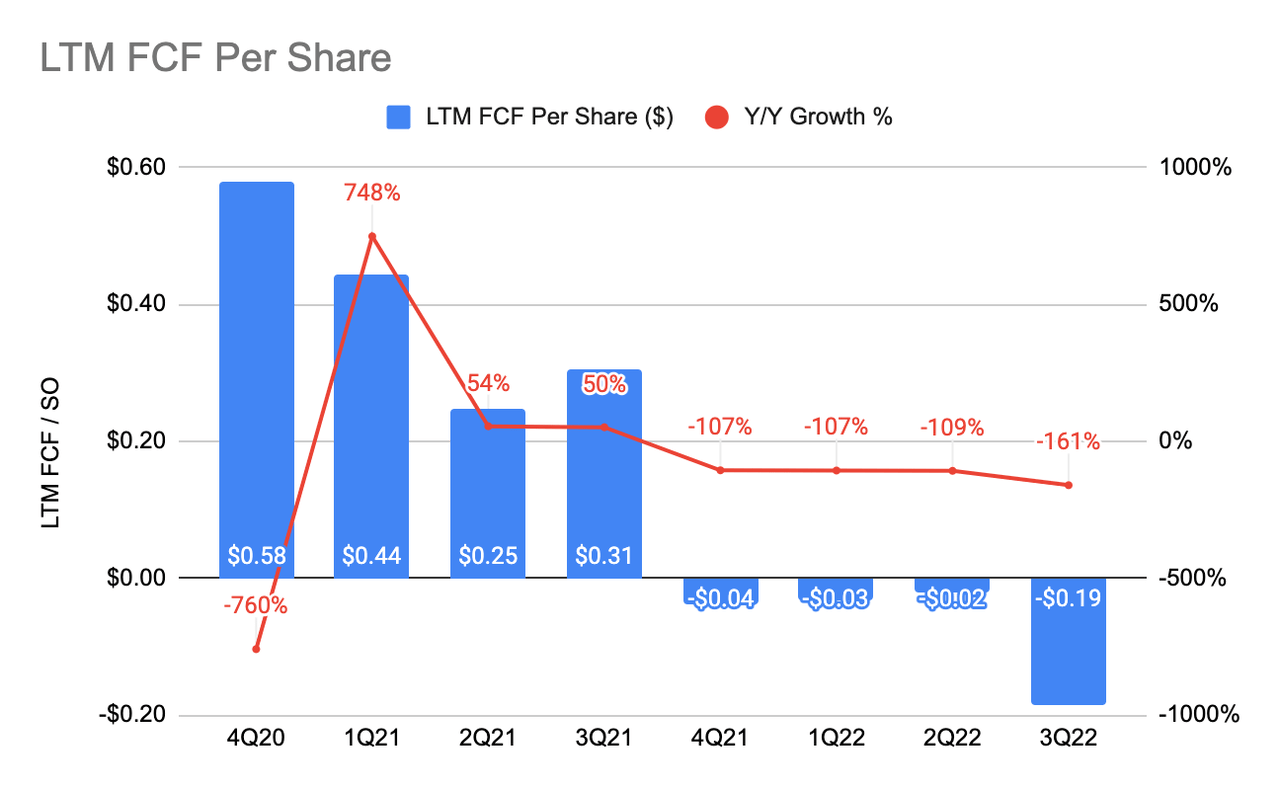

Declining LTM FCF Per Share And FCF margin: Not Creating Shareholder Value On A Per-Share Basis

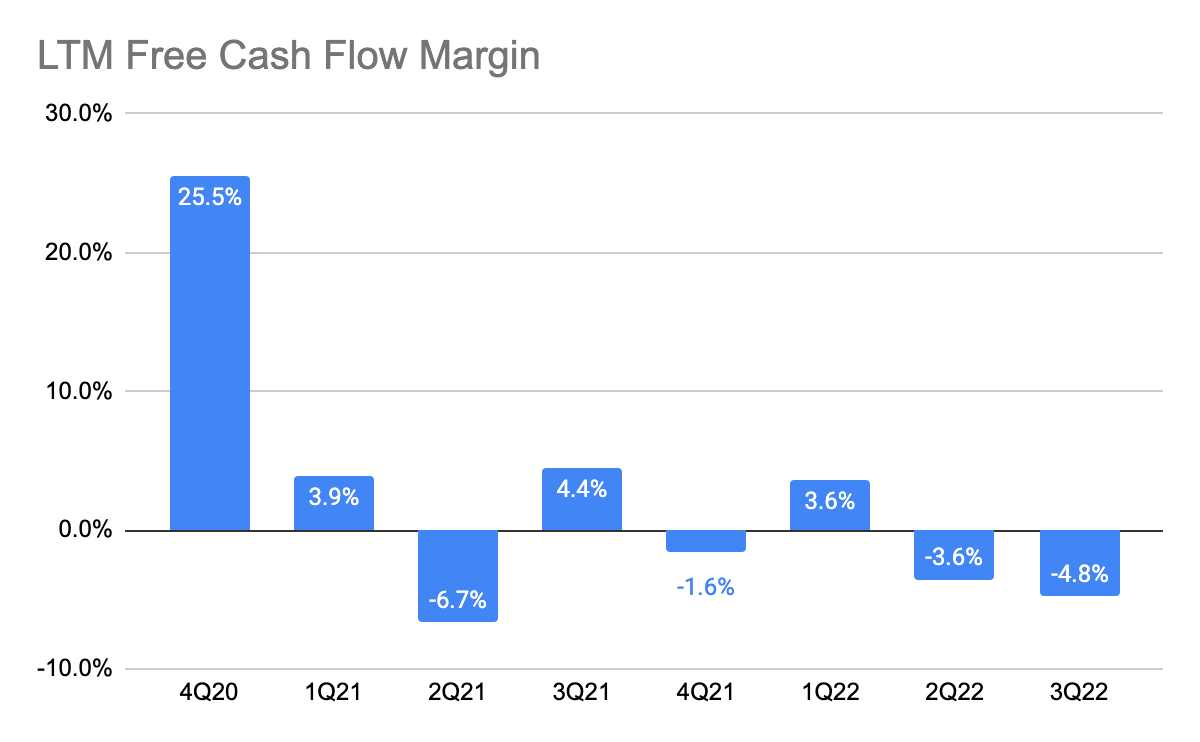

TTD 10-Q

TTD 10-Q

Hence, the only change from previously is that I net out the SBC from FCF, and this gave me FCF for the company. Here, we see that the LTM FCF per share has been declining massively, suggesting that the company is not generating shareholders’ value on a per-share basis. Although, as mentioned earlier, management did indicate that SBC is likely to tune down over time.

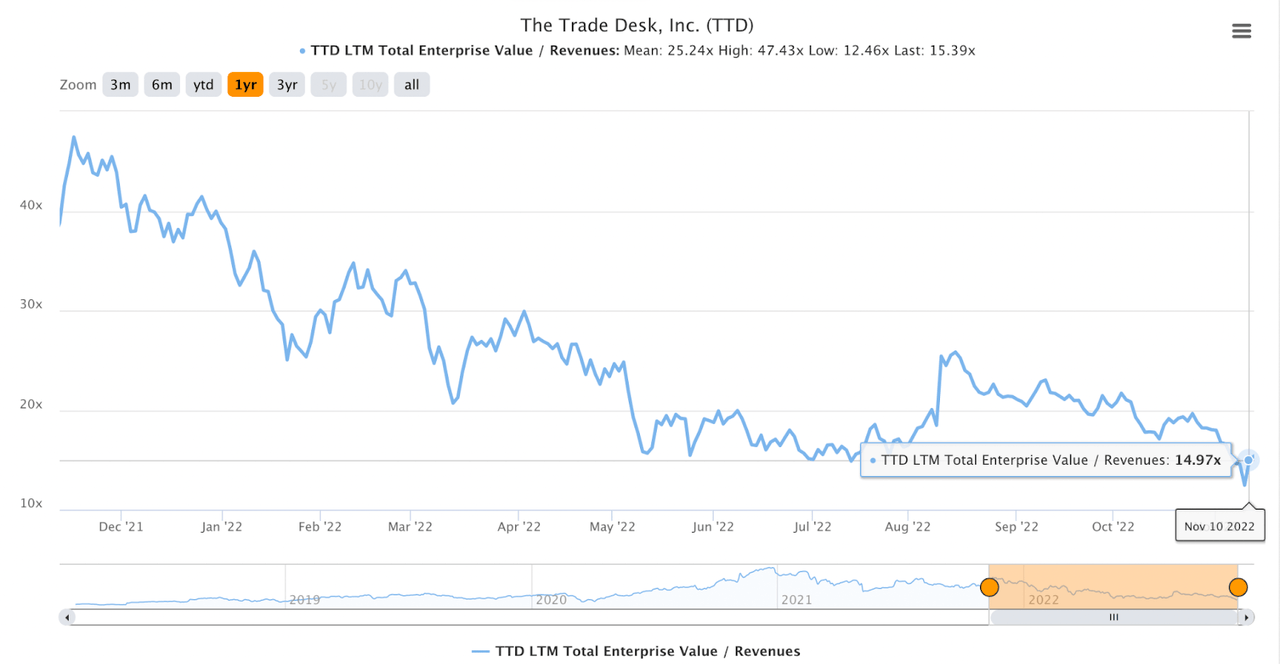

Unappealing Valuation

TIKR

Despite the great execution, I continue to maintain my stance that I am uncomfortable with the company’s high valuation. All the more so given its low FCF margin, I personally find it hard to justify the high multiple it is trading at.

Conclusion

The Trade Desk continues to establish itself as a leading ad-tech platform as they continue to win more ad dollars from the world’s largest brands and advertisers. This resiliency and strong operating leverage, which also resulted in operating margin expansion, during the quarter show that it should continue to reinvest heavily to land more market share. And as mentioned, SBC should not be added to the computation of operating profit and FCF, and what this means is that TTD is not generating shareholders’ value on a per-share basis. However, management does anticipate SBC expenses to tune down over time, which was shown in the past few quarters.

What are your thoughts on the quarter? Let me know in the comment section below!

Be the first to comment