robas

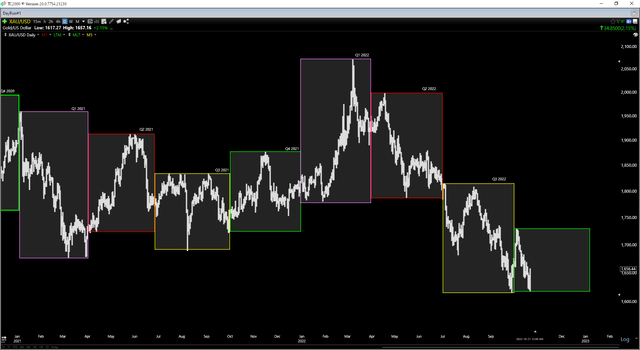

It’s been a rough year thus far for the Gold Juniors Index (GDXJ), with the ETF’s 2,000-basis point outperformance in April relative to the Nasdaq-100 (QQQ) completely erased as of last week. Few gold producers have been spared by the violent third leg down in this cyclical bear market, and one name hit especially hard has been Eldorado Gold (NYSE:EGO). In fact, the stock has found itself down over 60% from its Q3 2020 highs, partially attributed to margin compression due to inflationary pressures.

While the margin compression is certainly not ideal, this is hardly a company-specific issue, and the company is now much closer to fixing this issue. This is because it is potentially only months away from approving the start of construction at its high-margin Skouries Project. Meanwhile, Lamaque continues to see resource growth, suggesting a much longer mine life than initially envisioned at this Tier-1 jurisdiction asset. So, with EGO trading at a significant discount to net asset value, further weakness should present a buying opportunity.

Eldorado Gold Operations (Company Presentation)

Q3 Results

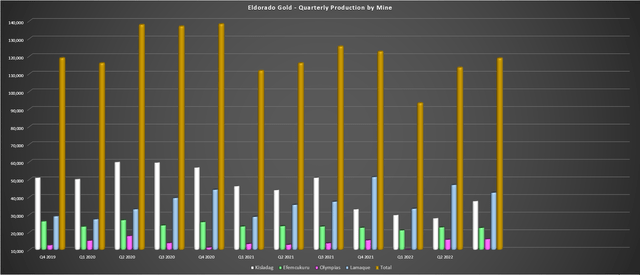

Eldorado Gold released its preliminary Q3 results earlier this month, reporting quarterly production of ~118,500 ounces, a 6% decline from the year-ago period. This was related to a softer quarter at Kisladag this year, which was up against difficult year-over-year comps (better-than-planned production in Q3 2021) and slightly lower than planned production at Lamaque due to throughput. The result is that Eldorado continues to track towards the low end of its FY2022 guidance range (460,000 to 490,000 ounces of gold), with 325,500 ounces produced year-to-date and ~134,500 ounces needed to meet the low end of guidance.

Eldorado Gold – Quarterly Production (Company Filings, Author’s Chart)

While this might seem like a significant feat to meet in its next quarter, it’s worth noting that the company saw its strongest quarter from Lamaque in 2020 and 2022, setting the asset up for a strong finish to the year. Meanwhile, Kisladag has seen a sharp increase in production from its trough in Q2 2022, with the HPGR performing according to plan and larger conveyors set to be installed in Q4, which will provide further improvements from a material handling standpoint. The higher production from these two assets should allow Eldorado to meet the low end of its production guidance, with the slight miss vs. the mid-point impacted by severe weather, resulting in power outages and COVID-19-related absenteeism in Q1 at its smallest Olympias operation.

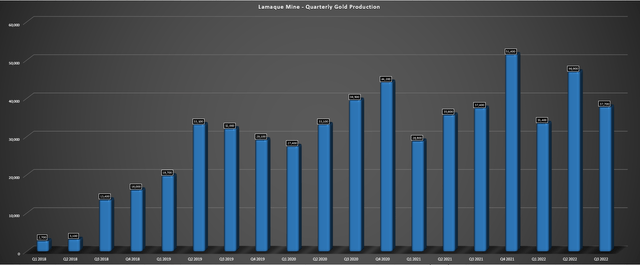

Lamaque – Quarterly Gold Production (Company Filings, Author’s Chart)

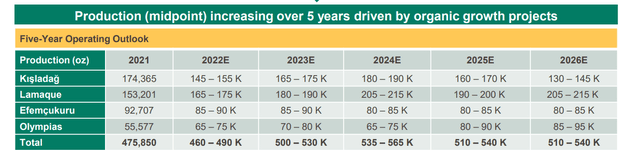

While it’s easy to be negative about the expected miss vs. the production guidance mid-point, Eldorado is hardly a 2022 story, and it’s not a 2023 story, either. Instead, this is a 2025 story with production steadily improving from ~460,000 ounces in FY2022 to ~550,000 ounces in FY2024, with continued production growth at Lamaque and a steady increase in production at Kisladag. This should lead to a dip in unit costs from FY2022 levels (~$1,200/oz) and work to optimize Olympias, which is ongoing, with the company noting that the mine continues to ramp up productivity.

More important to the forward outlook, we could see Eldorado’s Skouries Project come online in 2025 if approved by year-end, while attributable production will increase from the company’s equity interest in G Mining (OTC:GMINF), which is currently building the Tocantinzinho Project in Brazil. Based on the first five-year average production profile at this asset of ~196,000 ounces, this would potentially push Eldorado’s attributable production profile north of 620,000 ounces depending on the timing of the Skouries restart in 2025.

Five-Year Outlook (Company Presentation)

Recent Developments

Unfortunately, while the future is quite bright, Eldorado has seen significant margin compression in the meantime relative to 2020 levels. This has been impacted by inflationary pressures felt sector-wide, cost increases with the VAT import charge on Olympias concentrate shipments to China, and significant increases in electricity prices related to the Russia-Ukraine War. Based on an estimated average realized gold price of $1,790/oz in FY2022 and estimated all-in-sustaining costs [AISC] of $1,200/oz, we could see Eldorado’s AISC margins dip to $590/oz this year, down from $862/oz in FY2020, undoubtedly putting pressure on the stock.

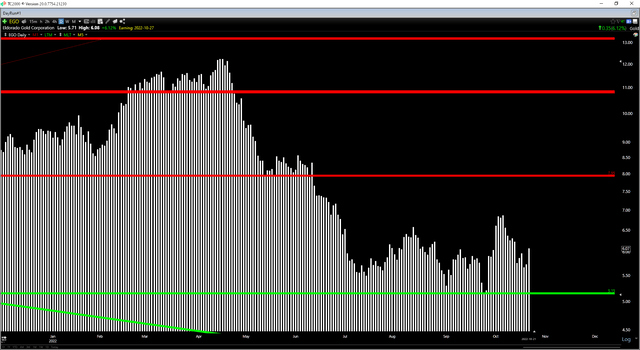

Gold Futures Price (TC2000.com)

However, unlike most producers, Eldorado has a path to significant margin expansion with one of the lowest-cost projects globally in the wings that’s already part way through its construction (placed on care and maintenance in 2017, awaiting an updated AIA with the Greek Government). This is a huge differentiator vs. Eldorado’s peer group and suggests while the current margin compression isn’t ideal, it’s not a reason to avoid the stock. In fact, one could argue that the current weakness that’s related to lower cash flow generation ($1.35 FY2022 estimates vs. $2.43 in FY2020) is an opportunity to pick up the stock as margins are making a trough, assuming the gold price holds the $1,600/oz level.

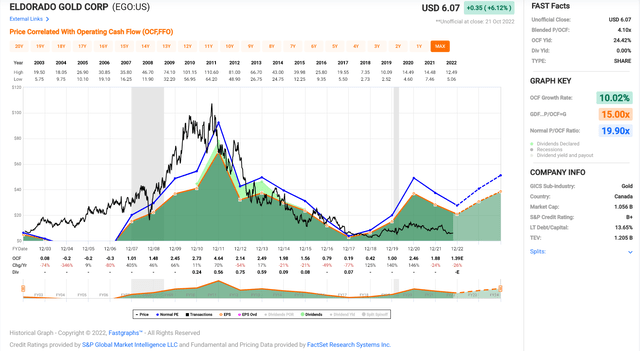

Skouries Construction Progress (Company Presentation) Eldorado Gold – Historical Cash Flow Per Share (FASTGraphs.com)

Finally, it’s worth noting that even though we’ve seen a significant decrease in cash flow per share in the period, Eldorado’s NPV (5%) at Lamaque has increased considerably, up from estimates of $550 million in FY2020 to $1.05 billion at a $1,650/oz gold price assumption (Upper Triangle, Lower Triangle & Ormaque). So, while it’s understandable that the stock has remained under pressure due to the sharp decline in cash flow generation, its consolidated NPV (5%) has soared as this high-grade project continues to add ounces. Judging by the large land package and continued exploration success, Ormaque isn’t done growing. Let’s dig into the valuation:

Valuation

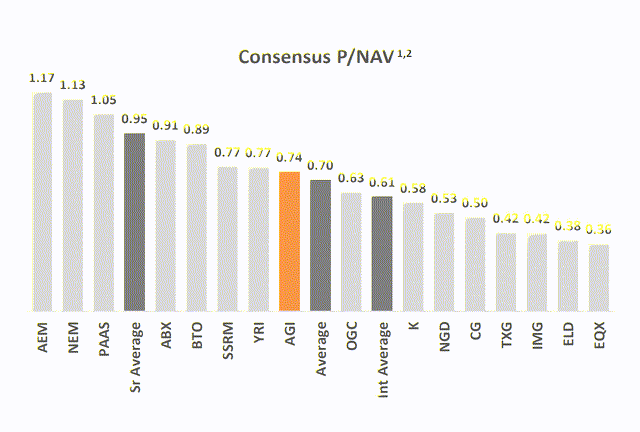

Based on ~184 million shares and a share price of US$6.10, Eldorado sits at a market cap of ~$1.12 billion, which is below that of the NPV (5%) of its two main assets combined (Kisladag, Lamaque). This compares very favorably to an estimated net asset value of $3.02 billion, with Eldorado trading at just 0.37x P/NAV, a valuation that is typically reserved for gold developers, not producers. Of course, some of this discount is justified with just one of its operations in a top-10 ranked jurisdiction (Lamaque) and others in less favorable jurisdictions (Turkey, Greece). In addition, a massive chunk of this NPV (5%) is at a project that’s yet to be approved.

Eldorado P/NAV Multiple vs. Peers (Alamos Gold Presentation)

Still, Eldorado continues to make progress at Skouries, signing a mandate letter with Greek banks for a credit committee-approved $680 million project finance facility for the project. The company also noted at its Denver Presentation that it’s continuing discussions with the European Bank for Reconstruction and Development [EBRD]. Eldorado noted that it would be open to having them as a potential partner. Regardless of how the project is financed (Eldorado goes it alone or partners), I would expect this to lead to a re-rating for the stock from its current depressed multiple, which is in line with some single-asset or extremely high-cost producers.

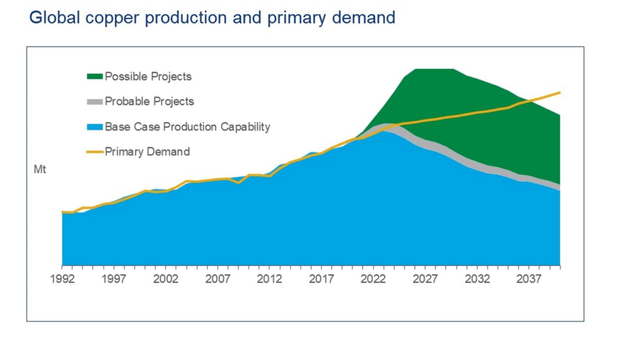

For those unfamiliar, Skouries is truly a transformative operation for Eldorado with the potential for a 140,000-ounce production profile at sub $100/oz all-in sustaining costs. Compared with the company’s estimated FY2022 profile of ~460,000 ounces at $1,215/oz, this would be a major improvement, helping to pull consolidated costs below the $925/oz mark. It’s also worth noting that these costs could improve dramatically if copper is above $4.25/lb, which is certainly possible post-2025, given the favorable supply/demand picture. So, while a discount to its peer group might make sense, I don’t see this persisting for long if Skouries is approved.

Copper Supply/Demand Outlook (Wood Mackenzie)

Technical Picture

Moving to the technical picture, Eldorado has a new support level at $5.15 and no strong resistance until $7.95, leaving it trading in the lower portion of its expected short-term trading range. Generally, I prefer a minimum 5.0 to 1.0 reward/risk ratio to justify entering new positions, and the current reward/risk ratio is 1.95 to 1.0 from a share price of US$6.10. So, while the stock is clearly undervalued, it would need to dip below US$5.60 to enter a low-risk technical buy zone. This doesn’t mean that the stock has to pull back this far, but this is the ideal buy zone where the technicals and fundamentals would tip strongly in favor of the bulls.

Summary

Eldorado Gold has had a mediocre year, impacted by a very difficult Q1 operationally, inflationary pressures, and continued weakness in the gold price. However, while it’s easy to be negative on the stock due to the margin compression this year, the real story for the stock should come together post-2024 once Skouries nears completion (assuming it’s approved promptly). So, for patient investors that are looking for gold producers on the sale rack and those that don’t mind some exposure to Greece/Turkey, I would view any pullbacks below $5.60 as buying opportunities.

Be the first to comment