z1b

We are likely headed into a recession…

Interest rates are rising rapidly…

Inflation is out of control…

The pandemic is still lingering around…

The war in Ukraine is causing significant uncertainty…

The market is collapsing…

Increasingly, many people are selling…

And yet, we think that the time to buy real estate investment trust (“REITs”) is right now.

These are not just empty words, as we are aggressively accumulating larger positions at the moment.

Why are we so bullish even as so many are turning bearish?

The answer is actually quite simple.

The best opportunities emerge during times of uncertainty when there is blood on the street, and that’s the case today.

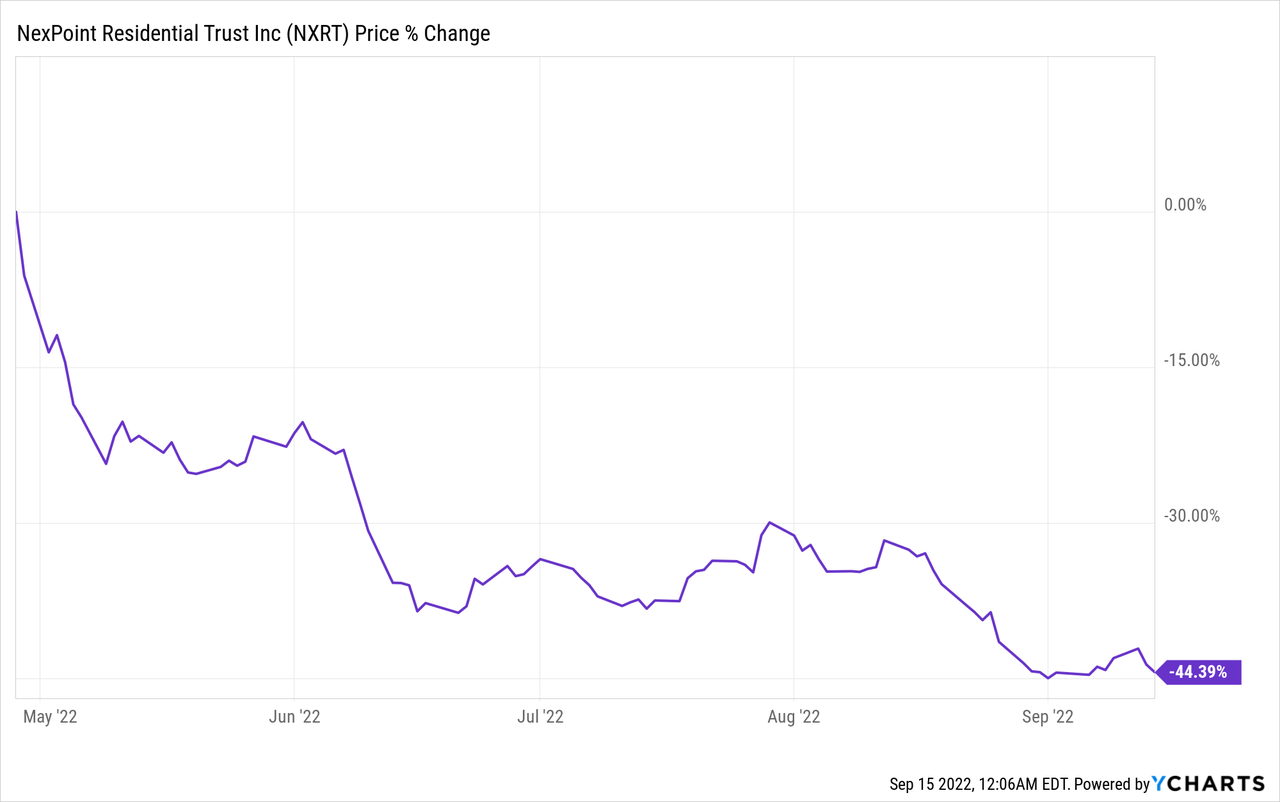

REIT market averages (VNQ) have dropped by 20%, and many individual names are down by as much as 30, 40, 50 or even 60%! A good example is NexPoint Residential Trust (NXRT), an apartment REIT that saw its share price nearly cut in a half over the past months:

As a result, valuations are now historically low, with some REITs trading at their lowest valuations ever, or close to it.

We don’t deny that there is near-term uncertainty ahead and some REITs will inevitably suffer from a recession, rising rates, and other lingering issues.

But what most investors appear to forget is that these are just short-term issues that have little to no impact on the long-term prospects of these REITs.

Most investors have no patience and cannot see past the next few quarters, and they are selling because of that. But their lack of patience can be your opportunity if you can keep an eye on the bigger picture.

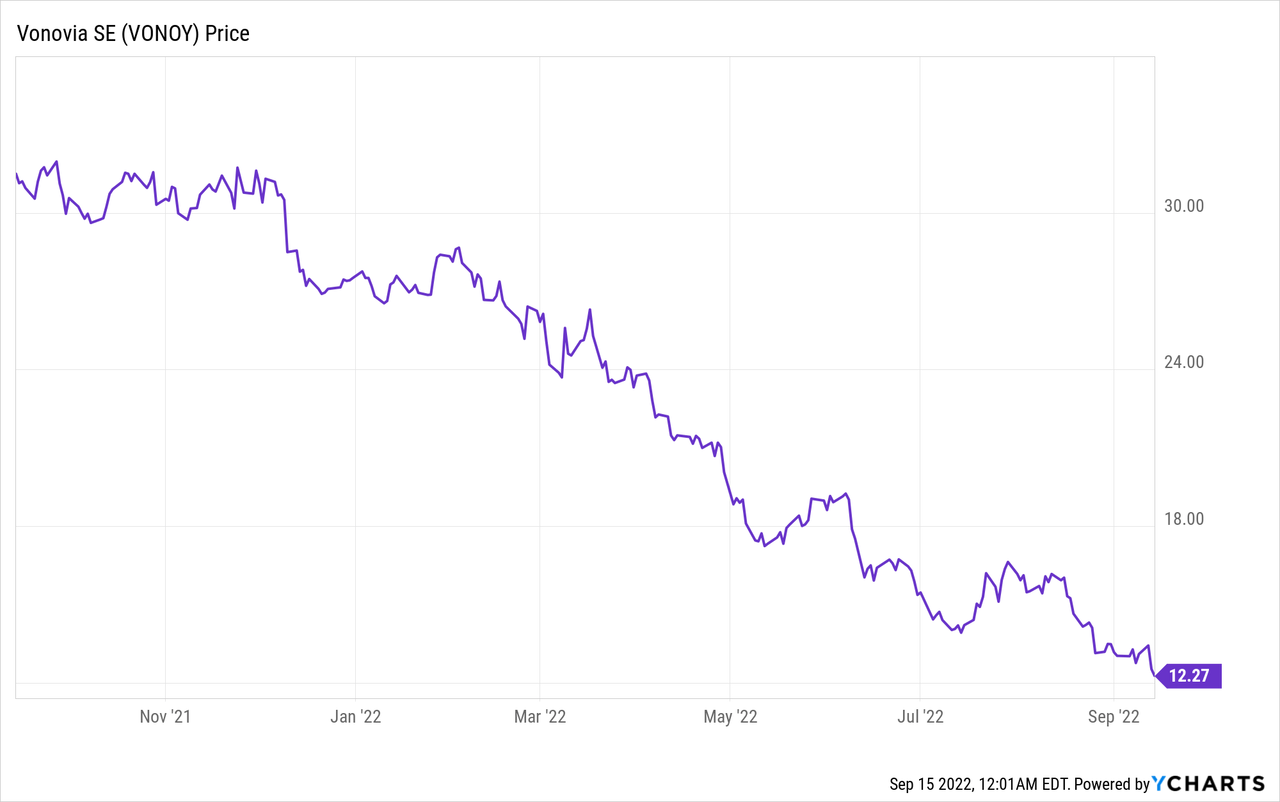

Take the example of Vonovia SE (VNA/OTCPK:VONOY), the leading apartment landlord in Germany. Today, it is priced at a huge 60% discount to its net asset value, which is truly unprecedented. The company has never traded at such a low valuation in its entire history. On average, it has actually traded at a small premium to NAV, which makes sense given that it’s a blue-chip company with great management, a strong track record, an investment-grade rated balance sheet, etc.

Europe will suffer a recession and the energy crisis could impact Vonovia’s results in the near term. We think that the impact will be very modest (see our full thesis here), but even if the impact was significant, should the company really be repriced at a 60% discount due to 1-2 years of poor results?

Of course not!

The long-term value of the real estate is unchanged. It is absolutely necessary to the survival and prosperity of the German society and cannot be replaced with anything else.

Its NAV per share is €65 and this represents a valuation of €2,500 per square meter for its portfolio of apartment communities. Today, if you wanted to build a new community, it would cost you closer to €4,000 per square meter. So even the NAV represents a huge discount to its replacement cost, and you get a massive discount on top of that since the shares currently trade at €27.

So once again, does it make sense for Vonovia to trade at a 60% discount to NAV due to a short-term crisis? Of course not. Unless it is life-threatening to Vonovia, the discount makes no sense whatsoever. It is simply the result of a market that’s overly focused on short-term results and forgetting about the bigger picture.

It provides an opportunity for more sophisticated, long-term-oriented investors to buy high-quality real estate at a steep discount to long-term value. You earn a ~10% cash flow yield while you wait for over 100% upside as it returns to its NAV. Believe it or not, its cash flow is actually rising. Vonovia grew its funds from operations (“FFO”) per share by 5.5% in the first half of the year and reaffirmed its full-year guidance.

Vonovia

And Vonovia is just one example among many others. You have similar apartment REITs in the US that are also trading at large discounts to NAV. AvalonBay (AVB), Camden (CPT), and BSR REIT (OTCPK:BSRTF) are all good examples. Their discount to NAV is not quite as large, but it is also around 25%, which essentially means that you get high-quality real estate at 75 cents on the dollar. You then get the diversification, liquidity, and professional management for free on top of that.

BSR REIT

If you are willing to step into other real estate sectors, the discounts are often even greater.

This is why Blackstone (BX) has been buying REITs left and right. Typically, it prefers to buy private real estate, but since REITs trade at large discounts, it has shifted its focus to them in order to acquire real estate at a discount.

Here’s what they said in their most recent conference call:

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.”

They have bought $30 billion worth of REITs in 2022 and expect to buy a lot more of them if they continue to trade at low valuations.

They understand the opportunity because they are opportunistic, long-term-oriented real estate investors. They don’t worry about the next 2 quarters. Instead, they focus on the next 10 years and know that good real estate bought at a discount has always been a great investment in the long run.

Bottom Line

You want to be greedy when others are fearful, and if you read comment sections of REIT articles, you will see that people are quite fearful right now.

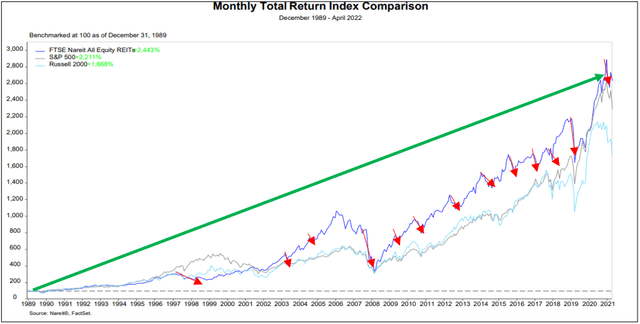

They appear convinced that there is only one way for REITs, and it is down. Yet, in reality, REITs are already priced at historically low valuations, and while it is impossible to predict how the market will perform in the short run, we know that eventually, REITs will recover because they always do.

REITs have gone through countless crises, and each time investors panic sell and then regret it later:

This time shouldn’t be different and therefore, the time to buy is now. We cannot predict tomorrow, but we know that those who have the courage and patience will be richly rewarded in the long run. It is not a coincidence that Blackstone is accumulating REITs right now.

Be the first to comment