nemke/E+ via Getty Images

Co-produced with “Hidden Opportunities”

Whether you’re new to investing or have been in the market for decades, times like this may make you feel like you are lost at sea. Wall Street analyst ratings and opinions can be conflicting and can change quickly. Having clear expectations from your investments is key to avoiding making irrational decisions based on the news.

The Single Best Investment – Lowell Miller

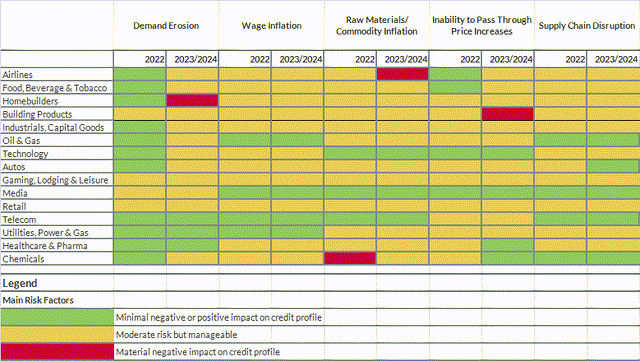

Although no one can accurately predict what will happen next, staying invested in profitable businesses that maintain a competitive advantage in their domain is the best approach to navigating turbulent times. Today’s market is worried about rising prices, demand erosion, and a Fed-induced recession. Let us look at this Fitch industry report that rated several market sectors against such economic perils.

U.S. Corporates – Main Risk Factors Considered in Forecasts 2022-2024

Industries, where the new competition takes years of investment to make a dent, have been rated to outperform during economic hurricanes. Telecom and Utility companies in the U.S. are a few such wide-moat industries with inelastic demand and strong pricing power. The best part is that these are some of the most dividend-friendly sectors of the market. As income investors, we should enrich our portfolios with such investments, mainly when they are trading at attractive valuations. Let us review our telecom and utility picks without further ado.

Pick #1: UTG, Yield 7.1%

The utility sector includes water, electricity, waste collection, oil and gas, and the internet. These companies provide services that form the backbone of modern society and tend to see relatively stable earnings regardless of the economic climate. These companies have a massive network of assets that have taken years and cost billions of dollars to deploy, maintain, and operate. Moreover, several regulatory approvals must be obtained before a company can serve as a utility provider in a region.

The profit margins for these companies are protected through regulations. Public policy guarantees the companies a monetary return on their investments while allowing them to fix prices for consumers. So when costs go up, these companies can raise prices to the customers, protect their profitability and maintain their dividends to shareholders. They make ideal investments for boosting your returns or reducing losses in a recession.

Reaves Utility Income (UTG) is a closed-end fund (‘CEF’) managed by Reaves Asset Management. Founded in 2004, UTG is built to produce competitive risk-adjusted returns and generate income in all market cycles. The CEF has delivered on its founding principles by paying a constant distribution while growing its NAV (Net Asset Value) for over 18 years.

UTG has 44 holdings, and U.S.-based utility companies represent 80% of the portfolio. Looking at the names below, it is evident that UTG’s top positions are robust names with limited concerns about declining revenues in the event of a recession.

UTG Fund Update July 2022

UTG’s $0.19/share monthly dividend calculates to a healthy 7.1% annualized yield. This CEF trades at par with NAV today, making it a bargain at current prices.

Utilities are ideal bond proxies, and their shareholder return is pre-established by regulators. They can weather inflation pressures better than most industries and effectively pass rising costs to the consumer without experiencing demand destruction. This predictability in the financials and the dividend-friendly aspect of these companies makes UTG a low-risk investment for sustainable income generation.

Pick #2: AT&T, Yield 6.6%

In this era of cloud computing and the Internet of Things (‘IoT’), internet connectivity is entering the category of “essential utility.” Unlike electricity, gas, sewage, trash, and water companies, there are only a handful of telecom and internet service providers in the U.S. Specifically, the big three telecom companies in the U.S. have ~80% market share in the U.S.

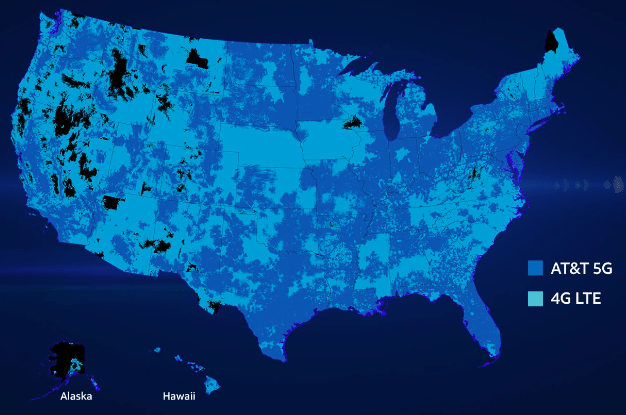

AT&T (T) has the largest fiber network in the U.S., reaching 39.3 million Americans in 21 states. Additionally, the company’s 5G network covers over 18,000 cities and towns in the country, placing them 2nd in overall availability according to RootMetrics.

AT&T website

Several parts of rural America still lack access to basic internet connectivity due to vast geography and relatively low population density. The Federal Government continues to prioritize the expansion of broadband connectivity through its $65 billion allocation in the infrastructure bill. Such government programs subsidize and incentivize Fiber buildout, and T is using the opportunity to expand its asset moat. They have recently partnered with Corning (GLW) to establish a fiber-optic cable manufacturing facility in Arizona to meet the soaring domestic demand. We continue to see a growing moat for T as these investments expand their domestic network.

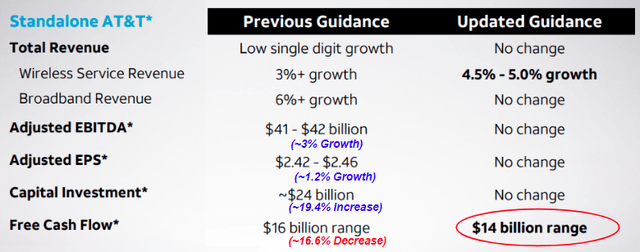

Below is the straw that broke the camel’s back in this bear market. T’s updated guidance shows higher growth in the Wireless Service Revenue (50-65% higher than the original guidance). But Wall Street only wants to focus on the $2 billion reduction in Free Cash Flow (‘FCF’).

AT&T July 2022 Investor Presentation

Investors must note that T originally projected to hit 70 million 5G users by the end of the year. However, the company has accelerated the rollout and has already achieved the target by Q2. T now projects hitting 100 million users by the end of the year, a whopping 43% increase from initial projections. In addition to inflation pressures such as higher than expected technology and network costs, higher advertising costs, and higher wholesale costs, the accelerated rollout came at an additional $1 billion expense. These have resulted in reduced FCF guidance for 2022.

The faster rollout means more of the costly Capex is in the rear-view mirror. It is also important to note that T spends $2 billion on quarterly dividend payments. Therefore, the guided $14 billion FCF still provides 175% coverage to the $8 billion annual dividend payment, indicating its safety amid recession fears. Thanks to a fearful market, T is the cheapest U.S. telecom stock, trading at a forward PE of 6.7x.

It is just a matter of time before Capex for 5G translates into sustained FCF and growing dividends for the years ahead. High-speed internet and wireless connectivity are the lifeblood of a growing economy. Operators are shutting down 2G, and 3G connectivity across the country, the rising number of 5G compatible devices at more affordable price points, and growing cloud adoption in corporate America are mid-term catalysts for T to print money with its wide-moat assets. A 6.6% yield to stay calm through the market fears.

Shutterstock

Conclusion

There is no shortage of information about the financial markets. We are drowning in information, and it is easy to get emotional and make irrational decisions. If you don’t believe that an investment will rise (in the short term), negative sentiment will prompt you to sell. The right long-term investment becomes more attractive to you as it declines.

Throughout your investing career, there are several questions you must repeatedly ask yourself to stay grounded in reality:

- Why are you investing in this stock (or security)?

- Do you have realistic goals with your investments?

- Do you try to hit a home run on every swing?

- Do you put all your eggs in one basket because some investment guru tweeted about its awesomeness?

The common sense method of investing involves a “simple to implement strategy” that is effective in virtually all market conditions. Investing with common sense also involves setting reasonable, achievable goals, never trying to hit home runs, and adequately spreading your risks. If you fall prey to the plethora of wisdom imparted by the news or to the gimmicks of the meme stock frenzy, you are no longer employing common sense in your decision-making and are bound to make costly mistakes.

As income investors, our objectives are built around ensuring a steady inflow of dividends. We adequately diversify to protect the income stream from economic shocks and buy more (or reinvest dividends) when the stock prices decline. As long as our dividend payments come in, we are less pressured to make irritation decisions based on market sentiment. Telecom and utility companies have strong inflation-resistant pricing power and will continue to perform well during recessions. Today, we discuss two picks with yields of up to 7.1% from boring but resilient sectors for your financial well-being through all those apocalyptic projections on the news.

Be the first to comment