DNY59

Like it or not, when the talk these days gets around to the stock market, the bottom line still comes down to what the Federal Reserve is going to do.

Read the write ups on the action in the stock market this week, or, last week, and you get a suggestion that the performance of financial institutions was behind the increase in the stock market this week, or, that the better-than expected third-quarter GDP growth indicated that the economy was doing better than many expected.

But, right after these reasons are given, the attention is then directed to the Federal Reserve.

The Federal Reserve is having a meeting of its Federal Open Market Committee, the policy making group of the Fed, on November 1 and 2.

Almost everyone expects that the FOMC will raise its policy rate of interest by 75 basis points, bringing the effective Federal Funds rate up to 3.83 percent.

The big debate right now?

What will the Federal Reserve do at the December meeting of the FOMC.

People had been expecting another 75-basis point increase in the rate, but, the word got around this past week that the Fed may only be going to raise its policy rate by only 50 basis points.

This would mean that after five consecutive 75-basis point increases, the Fed would be backing off of such a strong move every meeting.

As this word spreads through the investment community, quite a group of “investors” are talking about a “pivot” in Federal Reserve monetary policy.

A move like this, to many investors, is seen an adjustment like this is “major.”

There is no proof of this. There are no specifics about such a “pivot.”

As far as I can read the market, the investor judgment is a judgment on Fed Chairman Jerome Powell.

Chairman Powell led the Federal Reserve through the spread of the Covid-19 pandemic, the subsequent economic recession, the supply chain problems, and other disrupted sectors or markets.

But, Mr. Powell always led in a way where the Fed erred on the side of monetary ease.

This is one reason why so many people believe that the Fed’s plans for stopping inflation do not remove near enough of the liquidity that Mr. Powell and the Fed pumped into the economy in 2020 and 2021.

But, this attitude has led to the feeling that Mr. Powell will lead the Fed to err on the side of monetary ease as the Fed works to “tighten up” the monetary strings.

That is, for whatever reason, Mr. Powell wanted to make sure that the economy didn’t accidentally “fall apart” because he was not pumping enough liquidity into the banking system as he attempted to prevent a financial collapse and led the economy back to recovery.

On this side of the curve, Mr. Powell is concerned that he might take too much liquidity out of the banking system, making it subject to an accidental shock that would send the financial system and the economy on a downward path leading to a financial collapse.

That is, Mr. Powell wants to avoid being responsible for a real economic disaster. He knows he is treading in that territory, and doesn’t want to be the one who is ultimately identified with the bad news.

Bottom-line, I think that many analysts and investors sense this fear in Chairman Powell.

And, so these analysts and investors are, in the present situation, looking for the time when Mr. Powell will “pivot.” They are looking for the time when he says, “enough is enough.”

But, any such “early” decision leaves the Fed and the economy short of stopping the relatively rapid inflation that now exists in the United States.

And, if the inflationary bug spreads, the U.S. is faced with importing the double-digit inflation now being experienced in England, Europe, and many other areas in the world.

So, what have we achieved this year.

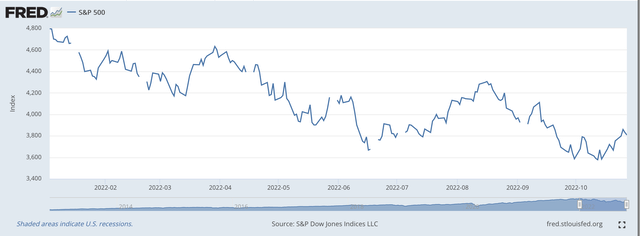

The Standard & Poor’s 500 Stock Index is as good of a representative as any measure.

On January 3, 2022, the S&P 500 closed at a historical high of 4,796.56.

Standard & Poor’s 500 STock Index (Federal Reserve)

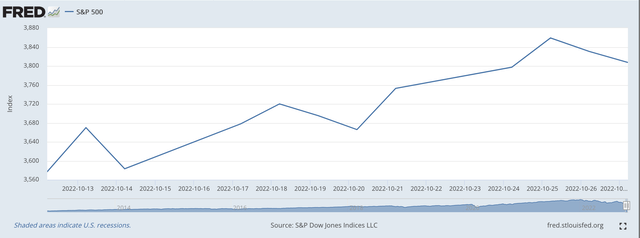

On October 12, the S&P 500 closed at a low for the time since the high at 3,577.03.

This represented a decline of 25.4 percent keeping the index in “Bear country.”

Since then the index has picked up a bit and has risen since October 12, to the Friday high it reached on October 28, of 3,901.06, a 9.1 percent rise since the low on October 12.

Standard & Poor’s 500 Stock Index (Federal Reserve)

Note that the chart does not include the 94-point rise the index made on Friday, October 28.

So, the stock market is providing quite a bit of volatility in the short run.

And, one can look at the performance of the index going back to January 3, 2022, and see just how volatile the market has been this year.

But, the takeaway from all this volatility is that very little of this volatility can be attributed to “real” economic factors.

The volatility has come as the investment community reflects on the actions of Mr. Powell and the other Federal Reserve leaders and sways between feelings that Mr. Powell will “pivot” and ease up on the monetary brakes, or they will not “pivot” and will ‘stick to their guns’ and keep the foot on the brake.

This behavior seems to me to be driving the stock market this year.

The Federal Reserve raised its policy rate of interest on March 16 and also began to reduce the size of its securities portfolio at the same time.

My reporting has indicated that the Fed has continued on since then, raising its policy rate of interest and further decreasing the size of its securities portfolio, and has provided no actions to suggest it was “backing off” from its monetary tightening.

Yet, the market has been quite volatile. Analysts and investors continue to believe that the Fed is going to “pivot.”

This is what is driving the stock market these days. All the other “stuff” is just white noise.

Be the first to comment