Eoneren

NICE’s (NASDAQ:NICE) beat and raise of the last quarter is a testament to the company’s strong technological foundations and the product-market fit that the company has. However, the declining cash flows due to collection issues do not inspire confidence and hence we remain in a wait-and-watch mode.

Business

NICE was originally known as Neptune Intelligent Computer Engineering Ltd. The company’s focus has been to digitize and manage large volumes of unstructured data. With the increased computing power, the ever-growing volume of data and advancement in analytics (using artificial intelligence or AI), NICE has become a leading player in the contact centre and the Financial Crime and Compliance analytics solutions markets, allowing it to get positioned as a leader in the 2022 Magic Quadrant for CCaaS (or Customer Service as a Service).

The company is headquartered in Israel and has over 7,000 employees.

Segments

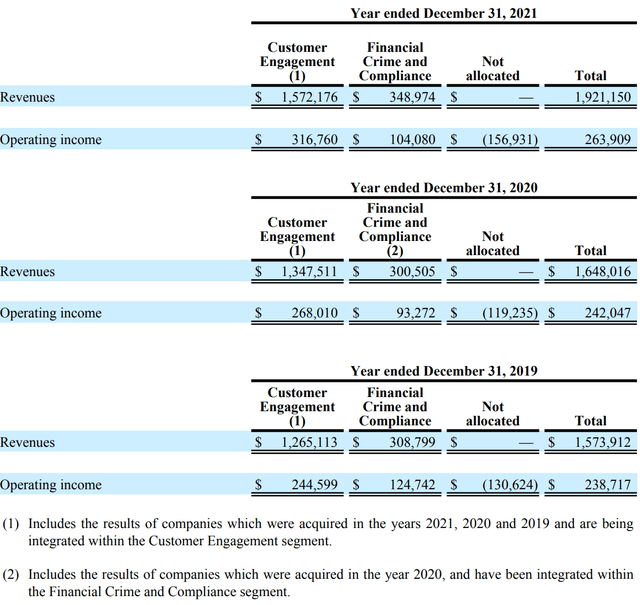

Company filings Company filings

- Customer Engagement: The company generates revenue from selling solutions to the contact centre and associated industries. The USP is the engagement and satisfaction customers experience using NICE’s products (primarily CXone) across channels. The company also offers workforce experience solutions to enhance contact centre agent productivity

- Financial Crime and Compliance: Through this division, NICE offers solutions to identify risks and help in the prevention of money laundering and fraud and help in achieving compliance in real-time.

Much of the company’s business is subscription based, which has allowed NICE to enjoy a strong margin profile in an end-market that is dominated by service providers.

The sustained application of technology and the ability to offer scalable solutions have allowed NICE to continue its growth path with the management raising its full-year guidance in Q2 2022:

- Revenue: $2.168 – 2.188 billion (13% y/y versus earlier expectation of 12% y/y growth)

- Diluted non-GAAP EPS: $7.33-7.53 (14% y/y versus earlier expectation of 10% y/y growth)

What we like

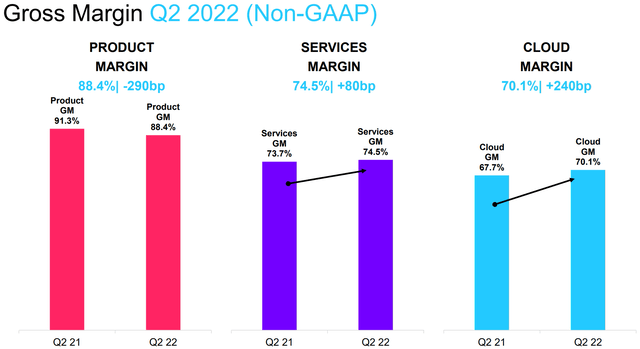

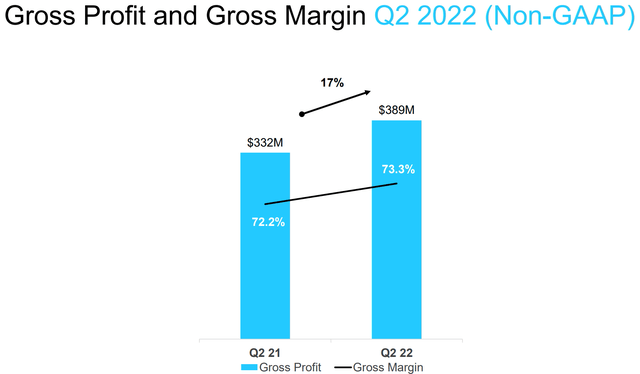

Gross margin expansion

The NICE management was quite candid to admit that the same level of gross margin improvement cannot be expected going forward, considering the amount of juice that has already been extracted.

Interesting we note the management’s confidence in sustaining this level of gross margin with potential improvements, despite inflation. The confidence stems from the growth in digital deals, incremental upsell within an expanding customer base and high retention rates.

While NICE acknowledges that the days of growth in contact centre agent volumes are long gone, the investment companies are making to engage agents has seen a rise. The idea is to have more effective agents, who can leverage digital to enhance the journeys their customers undertake. The stickiness in NICE’s product set is an outcome of the loyalty that the ecosystem can help develop in customers. A case in point is the recent win, where NICE displaced a major CCaaS vendor due to NICE’s ability to provide a comprehensive suite of offerings as opposed to spending time integrating several point solutions, which then allowed NICE to help the migrate quickly onto NICE’s systems.

Upward revision of guidance

The momentum in cloud and digital has been able to offset the weakness in EMEA. Additionally, the stickiness and upselling into a 200 logo/quarter client base have not hurt either. The cloud ARR at the end of the quarter was $1.3 billion (NICE is expected to do a little under $2.2 billion for the full year).

NICE has been winning in the market leveraging on the trend of customers unwilling to opt for point solutions, which then the customers become responsible for integrating. While the objective of the CX solutions is to cut costs, the introduction of an integration partner hurts margins. Since NICE offers an entire ecosystem of agent engagement, NICE’s systems also help alleviate labour challenges which in effect help the customer companies’ cost management.

Considering the CX market has numerous point solutions and NICE has been sustainably winning by displacing these point solutions with its platform, we think the company’s growth has two vectors – addition of logos through the displacement of incumbents and upselling in the existing customer base, both of which should allow for growth in the foreseeable future.

The EPS upside is also inspiring for the company expects to continue generating cash to be able to service debt, while buying back its shares.

What we don’t like

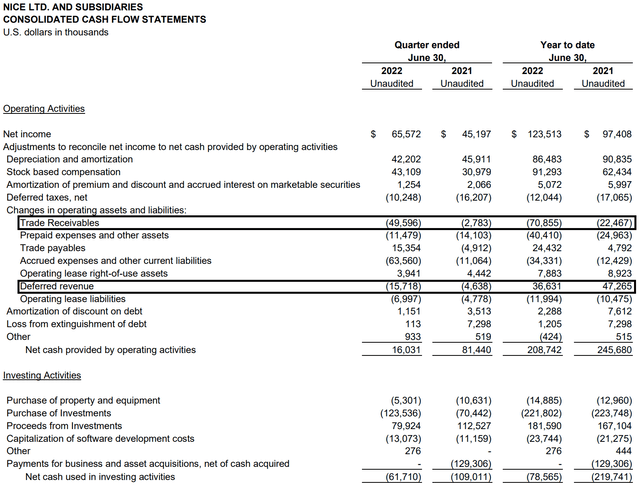

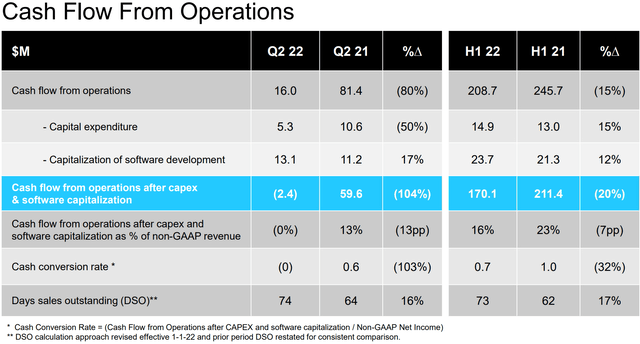

Collections seem to be lagging

While we think the recent partnership to make CXone available on Azure is a great step, NICE’s challenge with its receivables is a bit concerning.

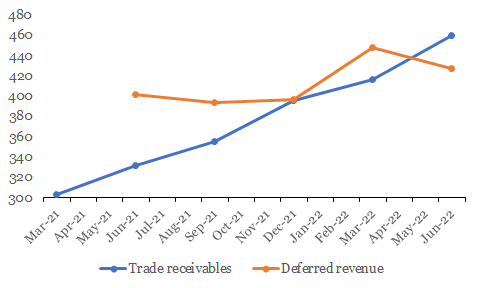

Company filings, Author analysis

From around $300 million, the trade receivables have gone up by over 50% over the last few quarters.

When you look at the cash flow – on the cash side, certainly, there are timing differences that happened from quarter to quarter. In Q1, we actually recorded a record in terms of our collection activity with a significant amount of collections coming in this quarter. Some of that had pulled into last quarter, of course. And so, there’s timing differences.

Source: Nice Ltd CEO Barak Eilam on Q2 2022 Results – Earnings Call Transcript

While the management points to the collection activity remaining robust, we find the mounting receivables with a somewhat weakening total deferred revenue to be a spot of bother. More specifically, the FCF weakness appears to be majorly stemming from these two metrics.

We also acknowledge that the blip may be temporary and in view of the large seven and eight-figure deal wins that the company has seen across sectors and by displacing competitors could lead to strong revenue over the next few quarters.

However, whether the collection efficiency returns along the same trajectory remains to be seen.

Financials and Valuation

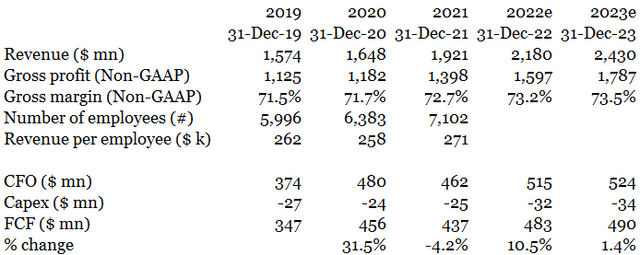

Company filings, Seeking Alpha, Author’s analysis

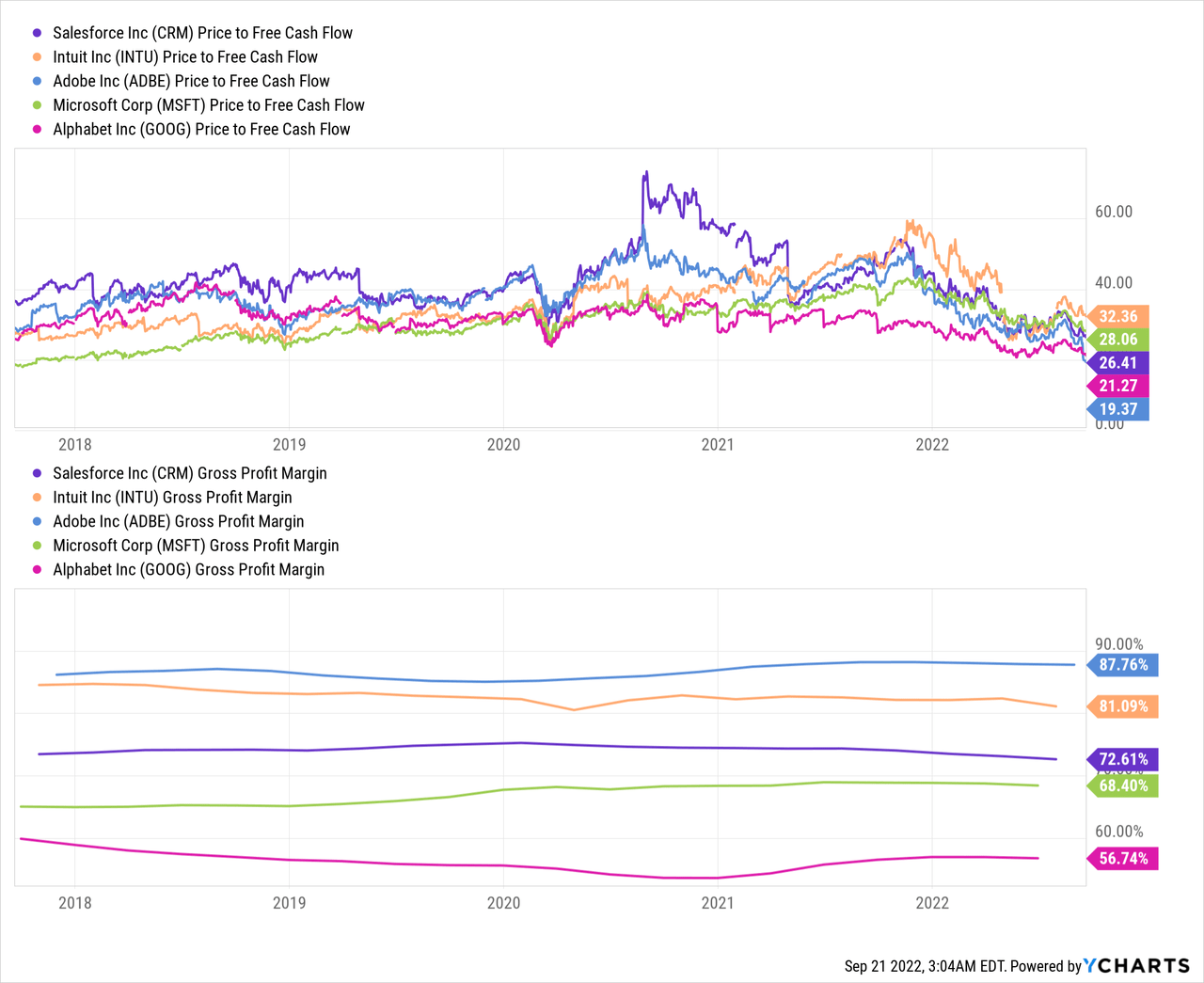

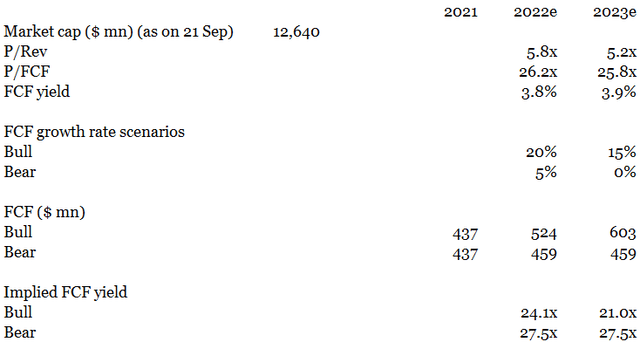

We think NICE has a solid set of financials and the company’s SaaS profile and low-teen revenue growth rate make it an ideal candidate to be valued on P/FCF.

While the market may be giving higher P/FCF multiples to competition, our contention is on the growth in NICE’s FCF due to the collection-related issues as highlighted above.

Until the company talks about a path to where it can further strengthen cashflows, we think it is difficult to buy the stock. In the same breadth, let us also make it clear that we do not think this is stock that should be shorted, given the fundamental strength in the business.

Company filings, Seeking Alpha, Author’s analysis

Per our estimates, the company trades at a forward P/FCF of 26 times, which translates into an FCF yield of a little under 4%.

We think the stock is fully valued. A more bullish scenario would be where FCFs increase, with a particular focus on improved collection efficiency. From a one-year time frame, the FCF yield will then be closer to 5% and quite attractive in our opinion.

On the downside, the continued increase in working capital needs could lead to a muted FCF growth and an FCF yield closer to 3.5% – which is an unattractive valuation considering the 10 yr US bond also yields around that number.

Risks to our thesis

- Adoption of CXone – The key growth driver for NICE has been CXone offering customers the ability to have a unified view of CX. While point solutions failing have helped NICE, any change in the competitive dynamics here could cause weakness in the company’s growth profile.

- Collection efficiency – An increase in efficiency will likely lead to a re-rating due to higher FCFs and a potentially more challenging environment could make the stock appear expensive.

- Potential acquisition target – NICE’s conversational AI technology could make for a very ‘nice’ tuck-in for the larger cloud plays. For example, CXone is now offered in Azure. IBM has been vocal that the first commercial-grade applications of AI will be in conversational workflow and Google’s cloud chief has been scouting for anything that can help expand the search engine’s footprint in the cloud. While difficult to predict the value, if the recent Adobe (ADBE) deal for Figma at 50x ARR is anything to go by, NICE could be a very sweet reward for its investors.

Conclusion

NICE is a strong play on one of AI’s early uses in conversational technology. The company has established itself as a leader and continues to grow at a steady pace. While the company deserves to trade a premium given its margin profile, we find NICE’s collection issues to be a small niggle. Hence, we would be holding onto the stock until greater clarity emerges.

Be the first to comment