fredmantel/iStock via Getty Images

Reading International, Inc. (NASDAQ:RDI) runs a cinema business and it also owns a substantial amount of real estate that is located in the United States, Australia and New Zealand. The cinema business was deeply impacted by the pandemic, but it is coming back strong and appears poised to produce operating profits once again. The real estate holdings this company owns include some landmark properties the sum total of which (along with the cinema business) appear to provide a sum of the parts value (SOTP) that greatly exceeds the current share price.

The Cinema Business:

The pandemic had a huge impact on the cinema business, but that has all changed and after a couple years of watching Netflix (NFLX) at home, many people are happy to go out to the movies again. For the first time since pre-pandemic times, movie studios have really helped the cinema business in 2022, by releasing a full calendar of blockbuster type films. Movies like “Top Gun Maverick”, and “Jurassic World Dominion” have been big hits, and many more potential hits are scheduled for the rest of 2022. The great news for the cinema keeps coming—”Minions: The Rise of Gru” was recently released and it generated more than $108 million in ticket sales, during its domestic opening weekend.

More releases for 2022 include: “Thor: Love and Thunder”, “Bullet Train” “Black Panther: Wakanda Forever”, “Black Adam” and many more. Towards the end of 2022, Disney (DIS) is also planning to release “Avatar: The Way of Water”. This has major potential since the first Avatar movie is the highest grossing film of all time. A recent CNBC article summarizes the resurgent cinema business by stating:

“This summer is generally meeting, if not exceeding, expectations to that end with a robust release schedule that isn’t depending on just one film,” said Shawn Robbins, chief analyst at BoxOffice.com. “There’s something for everyone in theaters right now, and high comfort levels are coinciding to produce the latest progression of moviegoing’s rebound. Theaters are back and thriving.”

General Overview:

For the past few months, the market action has been ugly, and according to CNBC, this has been the worst first half of the year for stocks since 1970. Clearly, this negativity has pushed many stocks to very undervalued levels and this appears to be the case with Reading International. In fact, it seems that investors are asleep at the wheel in terms of recognizing the net asset value of this hidden gem of a stock. The cinema business is once again doing very well and this should begin to show up in the upcoming financial results. In addition, this company recently leased out a significant amount of commercial space which is also going to boost cash flows. There appears to be no major analyst coverage of this stock and investors have not yet come to the realization that this company is about to report strong cash flow that has not been seen since before the pandemic. This is significant because before the pandemic, this stock was regularly trading around $16 per share.

Upcoming Financial Results Could Drive This Stock Higher:

For the second quarter of 2022, Reading International reported a huge jump in revenues which came in at $64.5 million. This nearly doubled the revenues of $36 million for Q2 of 2021. The company reported a loss of $1.6 million for Q2 of 2022, however, if you exclude a one-time $1.5 million impairment charge during this quarter, the results were essentially break-even. This shows that Reading International could be poised to report positive earnings in an upcoming quarter, especially since it has recently signed new lease agreements that will boost cash flow and profitability. After a couple years of losses due to the pandemic, a return to positive earnings per share could help push the stock back up to the pre-pandemic levels it held of around $16 per share. Revenues and profits appear to be headed back to pre-pandemic levels, so it makes sense that the share price of about $16+ can also come back into play. These recent financial results show that Reading International is potentially on the cusp of reporting positive earnings which could drive the stock much higher.

The Chart:

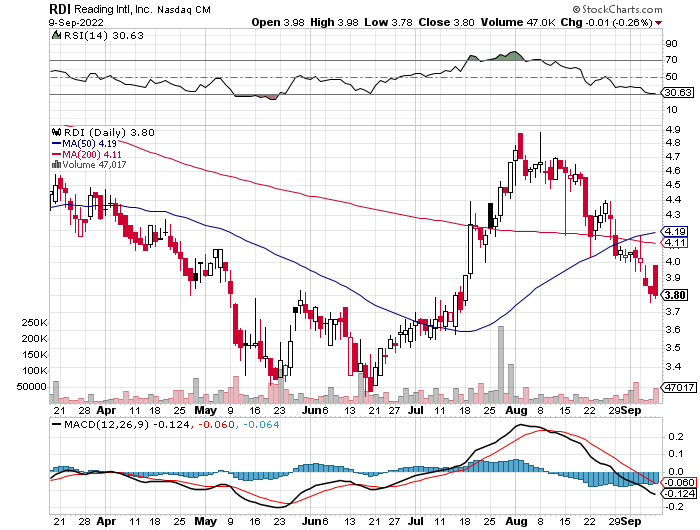

As the chart below shows, shares of Reading International put in a bullish double bottom (during May and June). The lows this stock hit in May and June coincide with the recent lows for the stock market in general. This stock is now trading just below the 50-day moving average which is $4.19, and it is also just below the 200-day moving average which is around $4.11 per share. In early August, when the market rallied, the shares went up to nearly $5, but this is still way too low when considering the sum-of-the-parts value, which we will get into next. The potential for a recession seems to be a big concern for the stock market in general and it seems to be putting pressure on all stocks, but the movie business is considered to be recession-resistant. That is another reason why the recent pullback in this stock is an ideal time to buy this deeply undervalued stock.

Reading International, Inc.

Sum-Of-The-Parts Valuation Suggests This Stock Is Deeply Undervalued:

The company has stated book value for its real estate assets that total nearly $250 million. However, as is often the case with commercial real estate that was bought many years ago, the value stated on the balance sheet does not reflect current fair market value due to depreciation write offs, as well as any appreciation that the property has experienced over the years. Here are some actual examples pertaining to this company specifically: During the pandemic, Reading International sold some properties which showed that the values carried on the books were significantly below current fair market value. In June 2021, the company sold property in Australia for $69.6 million, which was carried on their books at a value of $30.2 million. This resulted in a gain of $38.7 million (more than double the value on the balance sheet). In March, 2021, the company sold property in New Zealand that produced even bigger gains. Reading International sold two industrial properties for $56.1 million, which represented a massive $41 million gain on the (only) $13.6 million value it held on the balance sheet. These examples show that the real estate values shown on the balance sheet are significantly below actual market values. These examples suggest that the nearly $250 million valuation for real estate on the balance sheet could easily be worth at least double that amount, or around $500 million. However, a more detailed reviewed is ideal and as you can see with the breakdown provided below, the sum-of-the-parts value indicates significant upside potential:

In terms of the sum-of-the-parts valuation for Reading International, here are some numbers that suggest $18 to $24 per share could be fair value. The non-cinema real estate assets range between $400m to $500m. Based on rent estimates (PETCO recently signed a lease for 30k SF at 44 Union Square) and cap rates of about 6%, I believe the 44 Union Square and Cinema 123 properties have a combined value of $200 million. Then there is Courtenay Central (in New Zealand), which is a 100k square foot shopping center with an additional land parcel as well as several cash flow generating office buildings and shopping centers (Newmarket Village, Cannon Park, The Belmont Common), in the Reading International portfolio which could have an estimated market value of $200 to $300 million. We put a value of $200m to $300m on the cinema business. This is based on the company generating around $40 to $45 million in EBITDA on the cinema business in 2023, which seems reasonable, based on around $48 million it generated in 2019 and $55 million in EBITDA it generated in 2019. As of 6/30/22, after considering cash and cash equivalents of about $51.2 million, the net debt is around $170 million. Based on roughly 22 million shares outstanding, these numbers support a sum-of-the parts value of $18 to $24 per share. It is worth noting that the multiple previous buyout offers which ranged between $18.50 to $19.28 per share also appear to support this sum-of-the parts valuation as well.

Paul Franke (a Seeking Alpha contributor), recently wrote about Reading International in an article, in which he states this stock is undervalued and puts a potential value of up to around $14.21 per share. Mr. Franke also points out that the wide spread in value between the voting shares (RDIB) which trade for about $18, and the non-voting shares is not warranted. He believes that Reading International shares are a play on the real estate values as well as “the massive difference in share class pricing being closed in the future…” I think Mr. Franke’s valuation of $14.21 per share is very conservative when considering that Reading International shares regularly traded for $16 before the pandemic and that the company had multiple buyout offers at higher levels. But even Mr. Franke’s $14.21 per share valuation offers major upside from current levels.

High Profile Investors:

This list of high profile investors that have taken interest in this stock includes Chris DeMuth Jr., (he wrote a bullish article on this stock in the past), and Andrew Shapiro (President of Lawndale Capital and RDI shareholder), Mario Gabelli whose firm called RDI a best idea for 2018, and billionaire Mark Cuban who also owns shares in Reading International. This is a remarkable list of investors, especially for such a small company.

A History Of Buyout Offers:

Before the pandemic, this company received multiple buyout offers including a deal for $18.50 per share in 2016, and another offer for about $19.28 per share in 2019. (The 2016 offer was initially $17 per share and was then raised to $18.50). The offer was made by a consortium which included TPG (Texas Pacific Group), a very well-known investment firm. Based on the business results at those times, these offers were considered to be too low. And based on the fact that this company has had multiple suitors in the past, it would not be surprising to see another buyout offer, especially as the cinema business is well into a major turnaround. I think that this time, the Board of Directors would be far more likely to accept a buyout offer in the $18 to $19 range, if/when it emerges again.

Potential Downside Risks:

There are a number of potential factors which could challenge my bullish thesis on this stock. I feel that another major pandemic, and bad decisions from management are probably the most significant potential downside risks. With smaller companies, management plays a huge role in the ultimate results. Since this company has operations outside of the U.S., there is some foreign exchange currency risk, but it appears very limited in terms of the big picture. Reading International has over $51 million in cash on the balance sheet, so liquidity and balance sheet risk are not issues. Of course, the stock market could continue to drift lower and that could weigh on all stocks as well. One thing we don’t really need to worry about is the risk of a recession which seems to be what everyone is doing now, because the movie business has historically done very well in downturns and considered to be recession-resistant which is backed by historical statistics according to this article. The reason this business does well in recessions is because during downturns, people are looking to escape and dream more than ever and a movie ticket is just about the least expensive way to take a break from reality. Reading International management also addressed the recession resistance nature of this industry, in the latest Q2 earnings call transcript by stating:

On a final note, for decades, our industry has argued that movie theaters are recession-proof. Going to the movies was always and continues to be a reasonably priced form of entertainment for your family and friends. I think this most recent period bears out that old adage again. Over the last few months, despite some price increases, audiences have returned in record numbers to see top-notch entertainment like Top Gun, Minions, Sonic and Doctor Strange.

Summary:

It is rare to find the unique combination of circumstances whereby a stock is deeply undervalued based on hard assets such as prime commercial real estate, and at the same time also seeing a strong improvement in revenue growth which at Reading International is being driven by a big turnaround in the cinema business as well as new lease signings. At some point, something far closer to fair value will be reached in terms of share price for this stock. The catalyst for this is most likely to be another buyout offer, or it could happen when investors and analysts see the strong cash flows and profits reported from the cinema division in the coming quarters.

Be the first to comment