The Most Effective Way To Work When Dealing With Securities Markets

Wavebreakmedia/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s Not Going To Zero. Really It Isn’t.

As everyone knows the whole market is going to zero, fast, or if not zero then maybe 3000 on the S&P and 10000 on the Nasdaq or whatever. The just desserts of an economy over-fattened by Fed helicopter money with a workforce that would rather buy-pumpkin-spice-latte-pay-later-when-mom-lends-me-the-money than get down to a hard day’s work from dawn to dusk. The decadence of the end of empire. America the Great is Finished. Finished, I tell you!

This garbage is all over FinTwit right now and in truth it’s not worth reading. The market will go up or it will go down but it has nothing to do with whether Chad makes his Klarna payment or not. It has to do with the institutional dynamic of moving money around in order to generate gains whether the weather be good or whether the weather be bad. And no more so than around key dates such as quarterly options expiry and FOMC prints.

Let’s Talk About SPY

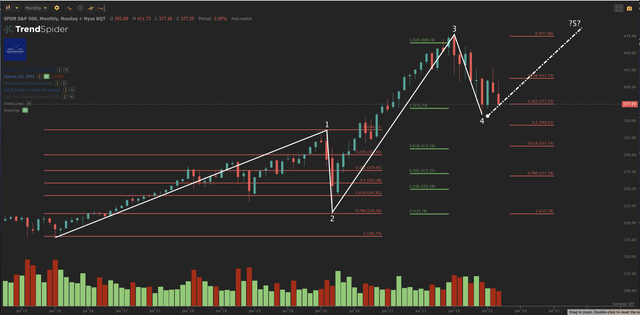

OK folks, let’s just take a step back and zoom out on NYSEARCA:SPY. Using absolutely standard technical analysis pattern-recognition tools (we like the Elliott Wave / Fibonacci method, but, other methods also are available) we can say that in the larger degree, SPY has been carving out a 5-wave up cycle since its 2015 lows. Like this (you can open a full page version of this chart here).

SPY Chart I (TrendSpider, Cestrian Analysis)

Wave 1 moves up from the 2015 lows to the 2019 high, adding around $158/share on the way up.

Wave 2 moves from the pre-Covid high to the crisis low, in a Yikes Cat type move as befits a Wave 2, troughs at the 0.786 retrace for a $122/share correction.

Then Wave 3, adding $283/share to peak a little above the 1.618 extension of Wave 1 (the share price movement in W1 multiplied by 1.618 and placed at the Wave 2 low), right at the end of 2021.

And along comes the will-it-ever-end Wave 4 selloff of 2022 which despite the apparent unrelented selling – just ask anyone on FinTwit, they’ll tell you! – troughed in June at between the 0.5 and 0.618 retrace of that big Wave 3 high.

So now the standard Elliott Wave pattern tells us that SPY can make a new high in a final Wave 5 up, peaking sometime in 2023 most likely. A minimum target of $480 or better, enough to just peak above that Wave 3 high.

Yes, we’re saying SPY can climb to never-before-conquered levels despite inflation and recession and 75bps and labor market and blah. Why? Because SPY has traded so well to this standard pattern for so long that we believe it more likely than not that it sees the pattern through to the end.

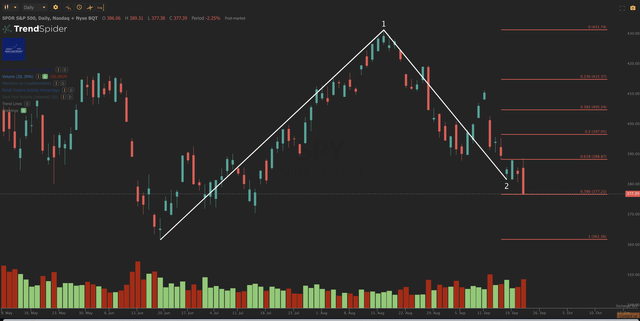

But don’t take our word for it. Let’s zoom in. As you know, if SPY has commenced its climb up from the June lows towards its final resting place in the sky, it ought to be showing wave progress in the smaller degree too.

And is it ever. Today’s close was actually funny, so perfectly did the ETF kiss the 0.618 retrace of Wave 3 on the way up then the 0.786 retrace on the way down. But even after this dump the stock remains perfectly positioned to move up. This is the Wave 1 and Wave 2 in the smaller degree up off of the June lows. That is one picture-perfect Wave 2 low right there. We shall see what happens but to us that’s thus far confirming evidence that SPY will be moving up. You can open a full page version of this chart here.

SPY Chart II (TrendSpider, Cestrian Analysis)

What The Fed Is Going On Then?

Today was a very strange day if you look closely. The index ETFs SPY and QQQ both did exactly the same thing – the two charts above are in essence carbon copies whether you look at the QQQ or the SPY. Up then down, to close down, at a level suggesting that the next big move is up. But still bright red on the day.

Whereas ostensibly more scary stocks like Cloudflare (NET), Palantir (PLTR), DataDog (DDOG) and so on – were … up? Huh?

We may be able to shed some light on this. Now, we hate to come over all FinTwit once more and be shouting about manipulation and so forth. Because that’s just naive. In the Great Online Game of traded securities, the game is in fact that all the other players are trying to take all your money off of you. That is Rule 1. The basic rule. The constitution upon which all other rules are founded. And further, while we don’t doubt that there are some bad apples in the virtual Big Apple that’s rather quaintly still referred to as The Street, most times Big Money is just doing its job which is, being good at taking money off of Chad and not letting Chad take money off of it, or at least not for very long.

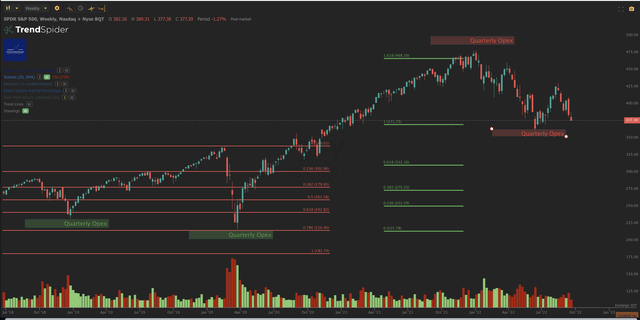

You see in the index ETFs there’s a hugely powerful force at work – not Jerome Powell, not Redditors, but the options market. The capital sloshing around in options way exceeds the capital in equities, and as a result it’s to some degree true that options are the primary security class, equities the derivatives. As a simple illustration, here you can see how the major reversal points in SPY in recent years have coincided with major options expiry dates. Full page version of this chart here.

S&P Chart III (TrendSpider, Cestrian Analysis)

Options markets love FOMC days because the emotion – the volatility – is running high. And you have a wall of capital in SPY and QQQ puts and calls sat driving the ETF stocks around all day. It’s no surprise on that basis that the closing price – the place where the option probability surface collapses to a singularity – hit a key technical level in both the SPY and the QQQ with such precision. Now, if you want to go deeper into the options-are-primary, stocks-are-derivatives rabbit hole – and it’s a doozy – we suggest you take a look at our friends over at SpotGamma who are expert on the topic. For us, we’ll just observe that the wall of option money pushing the ETFs around is not in place at scary high-beta names such as NET or PLTR and so on. So the market reaction today may look like genuine fear, but it isn’t. Because if it was widespread genuine fear, all these high beta names would be getting dumped. And they’re not.

So we say: SPY is setting up in a smaller degree 1,2 for a smaller degree 3 which will represent a material push up toward that new all time high. We think the next big move for SPY is, up, and we think the June low was the low for the Wave 4 just passed. You’ll know soon enough if we’re right or wrong. If right, SPY won’t spend long at the $377 zip code but will instead move up and out; if wrong, SPY will plunge down through that $377 level to continue the larger-degree Wave 4 down. This will happen soon, either way.

For now we remain bullish on SPY and assign an Accumulate rating to the name.

Cestrian Capital Research, Inc – 21 September 2022.

Be the first to comment