Mongkol Onnuan

The final week of September 2022 saw the S&P 500 continue the swoon that began on Tuesday, 13 September 2022. Measured from its closing value of 4,110.41 on Monday, 12 September 2022, the index has dropped by 524.79 points to end 2022-Q3 at 3,585.62. That level is now 25.2% below the S&P 500’s all-time peak of 4,796.56 recorded on 3 January 2022.

Which is to say that it has only taken 14 trading days from when the August 2022 inflation report was released for the S&P 500 to rack up the equivalent of 43% of its total loss to date during 2022.

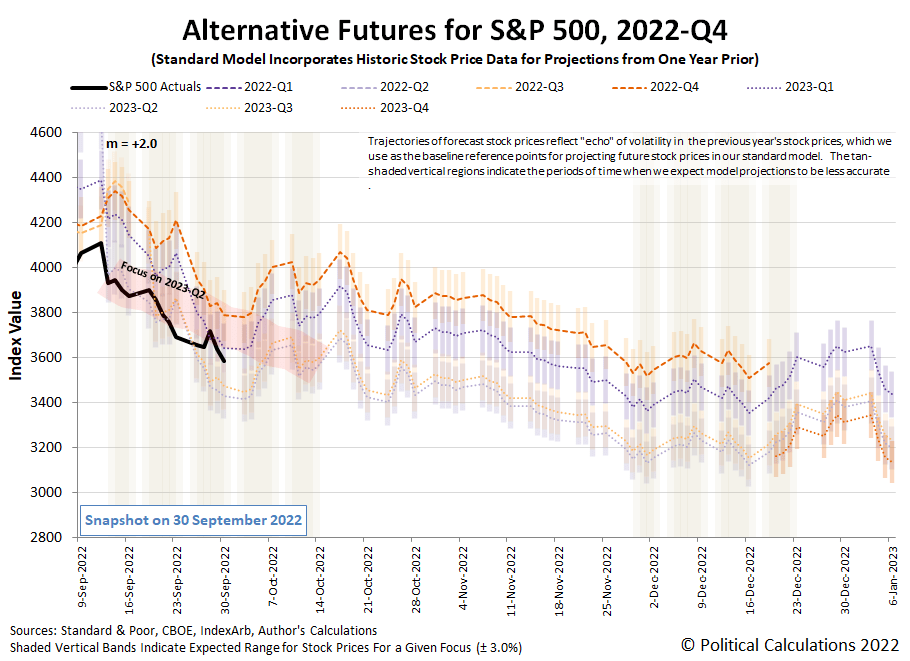

We’ve rolled the S&P 500 alternative futures chart forward to show 2022-Q4. In doing so, we’ve also included enough of September 2022 (2022-Q3) to show the aftermath of the regime change that took hold in the market after 12 September 2022.

In the previous edition of the S&P 500 chaos series, we were concerned the actual trajectory of the index was following the projected trajectory for investors focusing on 2023-Q2 too closely. That’s because we’re also in a period where the dividend futures-based model‘s projections of the potential futures for the index are being impacted by the echoes of the past volatility of stock prices. Since the model uses historic stock prices as the base reference points for its projections of the future, that echo effect means the model should be less accurate at this time.

This week’s update confirms looks more like we would expect. We’ve added a redzone forecast showing where we would expect the actual trajectory of the S&P 500 to be outside that noise. We’re showing the redzone forecast range as the typical plus-or-minus three percent we would expect in a typical market environment. Using it as a reference, we find the actual trajectory of index is tracking within a couple of percentage points below it.

The redzone forecast range represents what we would call the signal, it’s where we would expect the index to be under ordinary conditions for investors. The gap between the actual trajectory and the redzone forecast range is what we would call noise. This difference represents the effects of speculation caused in part by the higher level of volatility unleashed in the new market regime.

We think investors are setting stock prices more negatively in the new market regime because of their developing expectations for how high the Federal Reserve will ultimately set interest rates. They are expected to peak in 2023-Q2, which is why that distant future quarter has become the primary focus for investors.

That’s supported by the context provided by the market-moving headlines of the week that was. Here are the headlines we followed during the final trading week of September 2022.

Monday, 26 September 2022

- Signs and portents for the U.S. economy:

- Fed minions claim they can avoid ‘deep pain’, see recession ahead from aggressive actions, say they’re going along with their central bank friends:

- Bigger trouble developing in Japan, Eurozone:

- BOJ minions want yen to fall in orderly fashion:

- Bank of Canada minion wants more rate hikes:

- Bank of Mexico expected to hike rates:

- ECB minions thinking inflation, Eurozone economy will get worse:

- Wall Street ends lower, Dow confirms bear market

Tuesday, 27 September 2022

- Signs and portents for the U.S. economy:

- Fed minions attempt to call the top for rate hikes, blame housing for inflation, say they’re just going along with their global central bank friends on going into recession:

- Bigger trouble developing in China, Eurozone:

- BOJ minions conducting special ops to keep never-ending stimulus alive:

- ECB minions notice Eurozone inflation is higher than they expected:

- S&P 500 ends near two-year low as bear market deepens

Wednesday, 28 September 2022

- Signs and portents for the U.S. economy:

- Fed minions starting to call the top for rate hikes, want to overhaul how they regulate bankers, want to slow down pace of rate hikes:

- Bigger stimulus developing in China:

- Bank of England minions forced to abandon rate hikes as recession forces hand:

- ECB minions getting excited to deliver bigger rate hike in November:

- Wall Street bounces off lows as UK steps in to calm bonds

Thursday, 29 September 2022

- Signs and portents for the U.S. economy:

- Fed minions say all’s well for U.S. economy:

- Bigger trouble developing in China, Eurozone:

- Bigger stimulus, currency rescue developing in China:

- ECB minions thinking mostly about hiking rates, want debtor EU countries to suffer:

- Wall Street ends down sharply; investors fret over economy

Friday, 30 September 2022

- Signs and portents for the U.S. economy:

- Fed minion says screw any sign of a slowing economy, crank up rates MOAR!

- Bigger trouble developing in China, Japan:

- Bigger stimulus developing in China:

- BOJ minions to price the cost of currency bailout, Japanese government to boost stimulus:

- ECB minions under pressure from double-digit Eurozone inflation:

- Wall St posts third straight quarterly loss as inflation weighs, recession looms

The CME Group’s FedWatch Tool still projects a three-quarter point rate hike in early November followed by a half-point rate hike in December (2022-Q4). In 2023, investors anticipate a quarter-point rate hike in March (2023-Q1), setting to top for the Federal Funds Rate’s target range at 4.75-5.00%. After that peak, the FedWatch tool indicates the Fed will be forced to swing into reverse, with a quarter-point rate cut projected as early as May 2023 (2023-Q2).

The Atlanta Fed’s GDPNow tool‘s projection for real GDP growth in the just-ended calendar quarter of 2022-Q3 rocketed up from +0.3% to +2.4% based on new data pointing to higher consumer spending and more private investment. The Bureau of Economic Analysis will provide its first official estimate of real GDP growth in 2022-Q3 at the end of October 2022.

Looking backward, the BEA’s annual GDP revision confirmed the U.S. economy experienced a technical recession in the first two quarters of 2022 with two consecutive quarters of negative real growth.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment