JoeLena

The Shyft Group (NASDAQ:SHYF) continues to report impressive backlog increases, and the most recent guidance given by management is beneficial. In my view, the recent innovations delivered by SHYF are generating a lot of product demand. Investments in research and development and feedback collections from clients may enhance future revenue growth. Even considering risks from inflation and the supply chain, I believe that the fair valuation is significantly higher than the current price mark.

The Shyft Group: Beneficial Expectations From Financial Analysts And Optimistic Guidance From Management

The Shyft Group deals with specialty vehicle manufacturing and assembly for the commercial vehicle industry. Apart from repair and maintenance services, The Shyft Group offers different types of walk-in vans and truck bodies that are necessary for e-commerce and utility trade.

Annual Report

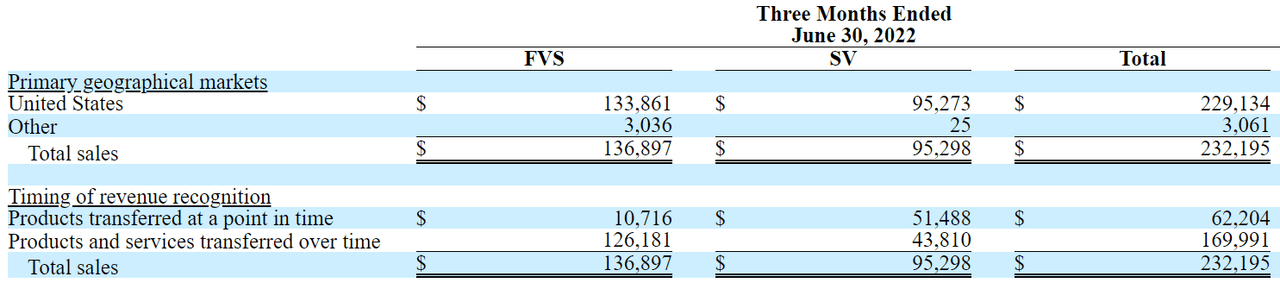

Revenue in the United States from fleet vehicles and services is significant as compared to revenue from outside the United States. In my opinion, there is significant potential from the internationalization of SHYF’s products.

10-Q

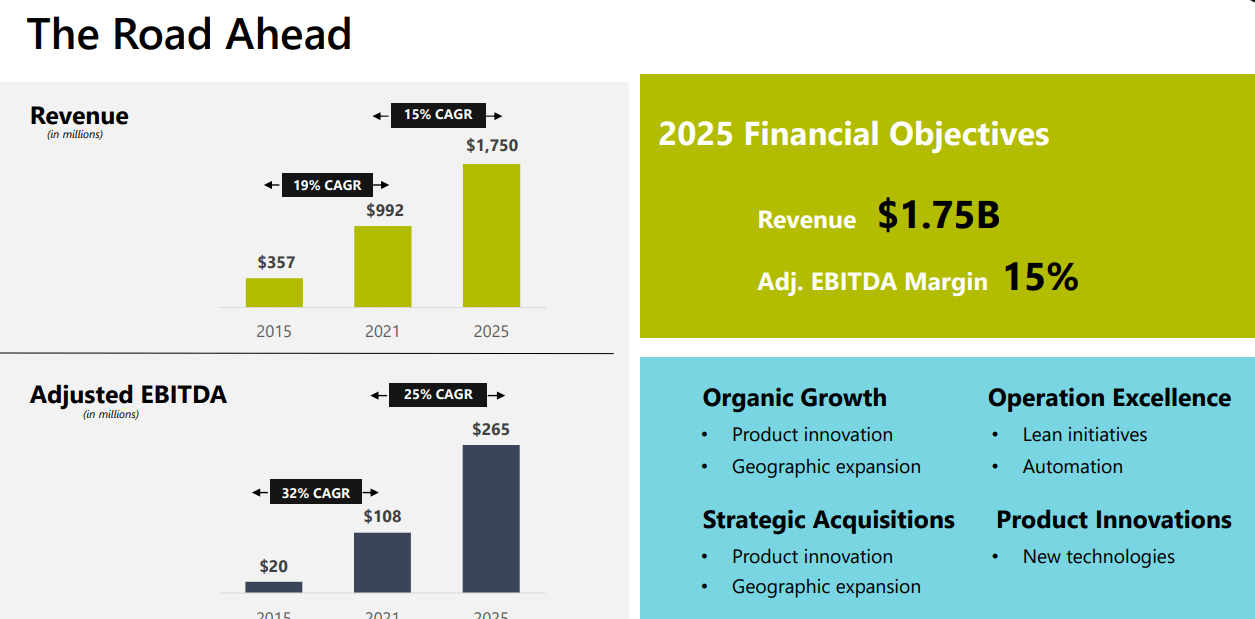

There is another great reason to review the company’s business model. The company’s financial objectives for the next three years are quite impressive. Product innovations, strategic acquisitions, and organic growth, among other initiatives, are expected to enhance revenue growth. The company is expecting double-digit sales growth and double-digit EBITDA margin in 2025.

Presentation

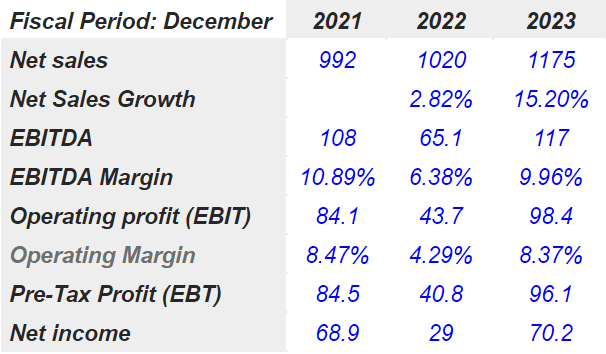

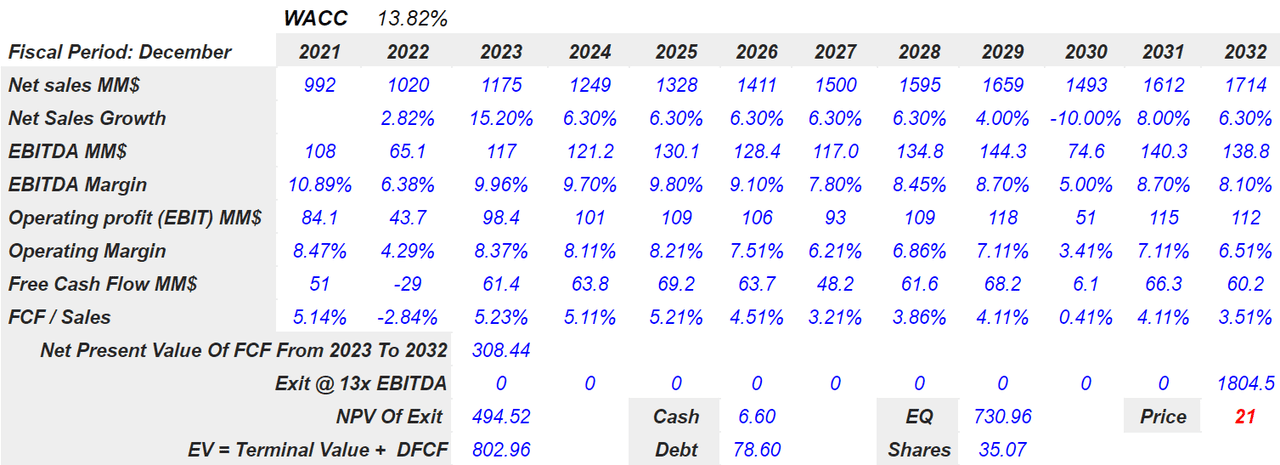

Financial analysts expect SHYF to deliver 15.2% sales growth in 2023 and 9.96% EBITDA margin. I think that the expectations are quite beneficial. Keep in mind that the 2023 pre-tax profit is also expected to increase to $96 million, with net income being $70 million. If the final numbers are as expected, in my opinion, the demand for the stock will likely increase from 2023.

marketscreener.com

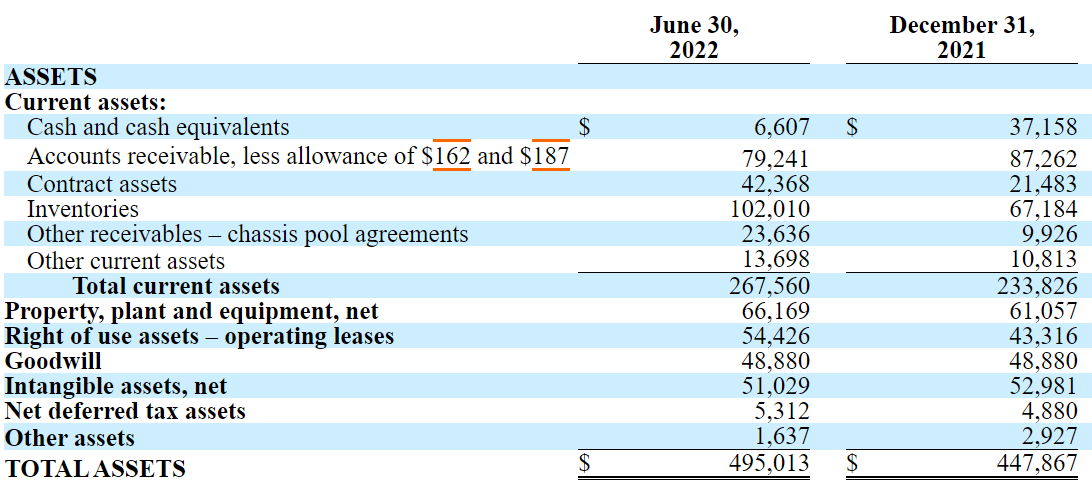

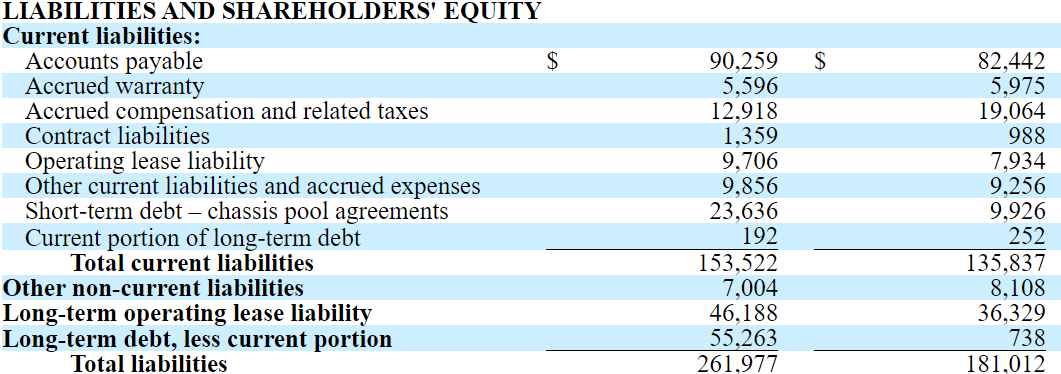

Balance Sheet

As of June 30, 2022, SHYF included $6 million in cash, $102 million in inventories in its annual report, and $79 million in accounts receivables. With an asset/liability ratio close to 2x, I believe that the current balance sheet stands in good shape.

10-Q

The total amount of debt includes $55 million in long-term debt and $23 million in short-term debt. I expect forward EBITDA to be larger than $101 million, so I am not really worried about the company’s total amount of leverage. In my view, SHYF would most likely receive more debt if necessary.

10-Q

Base Case Scenario: R&D, Innovation, And Backlog Increase Could Imply A Valuation Of $21 Per Share

SHYF receives feedback from customers through trade shows and motorhome rallies. Recently, the company identified new innovations, which may shake the market in the coming years, and may fuel demand for SHYF’s products. Let’s also note that research and development expenditure increased by more than 99% in 2021 as compared to that in 2020 as explained below:

Recent innovations to our motorhome chassis include: Custom tuned suspensions, independent front suspension, and passive steer tag axle that greatly improve ride, handling and maneuverability. Source: Annual Report

Recent innovations implemented by our Solution Experts include innovative and cost saving solutions for the specialty service segment, utility industry, food and beverage delivery, and mobile retail industry, such as safe loading equipment, keyless entry and cargo access systems, backup camera systems, and refrigeration solutions. Source: Annual Report

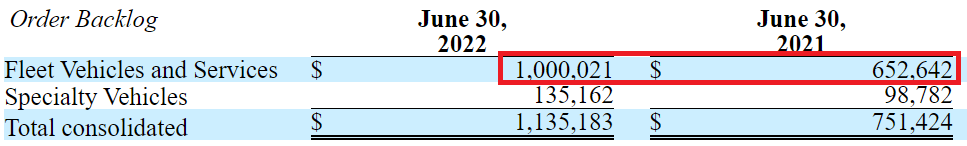

The recent increase in order backlog is really showing that there is significant demand for the company’s fleet vehicle and services. If the order backlog continues to increase as in the past, revenue growth and free cash flow will likely follow.

10-Q

Under this case scenario, I assumed a discount close to 13% like other investment analysts. I also used sales growth close to 6.3%, which is the expected growth for the automotive motor market.

Automotive Motor Market will be Thriving at a CAGR of 6.55% Between 2020 and 2027- Report by Market Research Future. Source: Automotive Motor Market will be Thriving at a CAGR of 6.55%

I also included growing EBITDA margin from 6% to around 8.7% and an FCF/sales margin between 5.2% and 0.41%. The sum of future free cash flow with a discount of 13% implies a total valuation of $308 million. For the terminal value, with an exit of 13x, the net present value of the exit would be $494 million. The sum of both the exit and the discount of free cash flow stands at $802.9 million, and the fair stock price would be close to $21-$22.

Author’s DCF Model

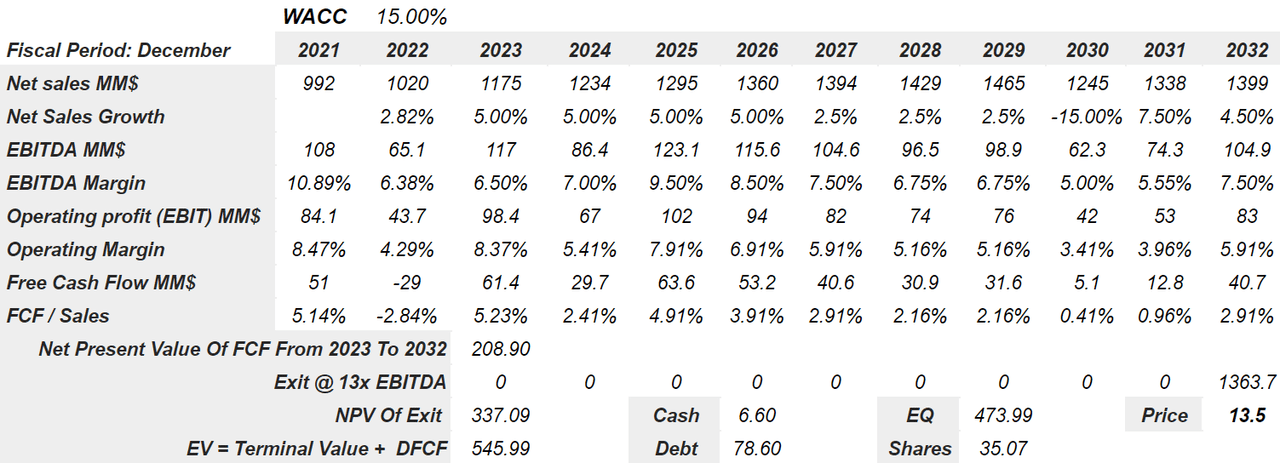

Lack Of Innovation, Inflation, Salary Increases, And Supply Chain Risks Could Push The Fair Price Down To $13.5 Per Share

In the worst case scenario, it could happen that the new innovations proposed by management are not welcomed by clients. Products may be unnecessary, useless, or not that attractive. As a result, I believe that SHYF’s brand would be affected. Revenue expectations could decline significantly.

Under tragic circumstances, the price of manufacturing components and labor costs could increase in the coming years, which would decrease future FCF margin. Even considering the negotiation skills of management, if suppliers suffer inflation, SHYF may suffer it too in one way or another. The company may also suffer production increases, which may lower future sales expectations.

Our results of operations may be significantly affected by the availability and pricing of manufacturing components and labor, changes in labor rates and practices, and increases in tariffs or similar restrictions on materials we import. Source: Annual Report

SHYF could also suffer from supply chain risks coming from political events or disasters affecting international logistics. If the company has to pay more to send products or to receive components, future free cash flow would also decline. In the worst case scenario, I believe that a decline in the stock price could occur.

Disruption of this supply base due to international political events, natural disasters, or other factors could affect our ability to obtain component parts at acceptable prices, or at all, and have a negative impact on our sales, results of operations and financial position. Source: Annual Report

Under my worst conditions, I assumed 5% sales growth, a declining EBITDA margin, and 2030 EBITDA margin of 5%. The operating margin would also decline from 8% in 2023 to around 3.41% in 2030. Finally, the free cash flow would stand at around $60 million and $30 million, and the sum discounted at 15% would be $208 million.

Author’s DCF Model

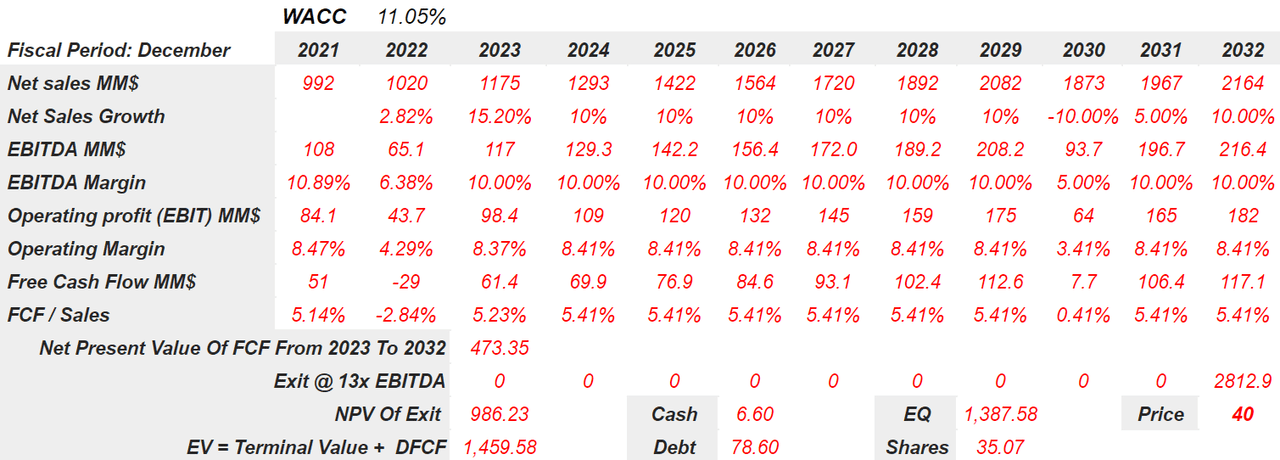

More Negotiations With Suppliers And Certain Internationalization Could Mean A Fair Price Of $40 Per Share

With a solid balance sheet, SHYF will most likely be able to acquire other companies in order to grow. New acquisitions could bring new capabilities, increase the company’s target markets, or increase market share. Finally, let’s note that M&A is among the options that management currently sees:

As part of our growth strategy, we have pursued and expect we will continue to selectively pursue acquisitions. Source: Annual Report

I also believe that an eventual increase in the number of suppliers could be very beneficial for SHYF. According to management, certain components are acquired from a few suppliers, which means that their price may be a bit expensive. If management finds new suppliers, and starts new negotiations, in my view, prices would be lower. As a result, in the future, I would expect much better EBITDA margins:

Most chassis and specialty vehicle commodity components are readily available from a variety of sources. However, a few proprietary or specialty components are produced by a small group of suppliers. Source: Annual Report

Finally, in my view, SHYF would benefit quite a bit from the internationalization of the business model. As of today, the amount of sales executed outside the United States was not that significant, which is a pity. With know-how acquired in the U.S., I believe that the company could be successful elsewhere:

In 2021, 2020, and 2019, we derived 1.2%, 1.4%, and 2.8% of our revenue from sales to, or related to, end customers outside the United States. Source: Annual Report

My assumptions in this case include sales growth of 10% from 2024 to 2029, an EBITDA margin around 10%, and operating margin of 8.41%. With an assumption of FCF/Sales of 5.41%, 2031 FCF would stand at $106.4 million, and the sum of future FCF would be around $473.1 million. If we also use an EV/EBITDA of 13x, the implied valuation would be $40 per share.

Author’s DCF Model

My Takeaway

SHYF reported an impressive backlog increase, and the guidance given for the next three years includes double-digit EBITDA margin and significant revenue growth. Besides, the annual report shows that a lot of new innovations were included in the new models, which may explain why demand is increasing that much. In my view, if SHYF continues to invest in research and development, and perhaps executes new acquisitions, the fair price could stand at approximately $40 per share. In any case, I believe that the current stock price, even considering all the supply chain risks and inflationary pressures, does seem a bit cheap.

Be the first to comment