Jean-Luc Ichard

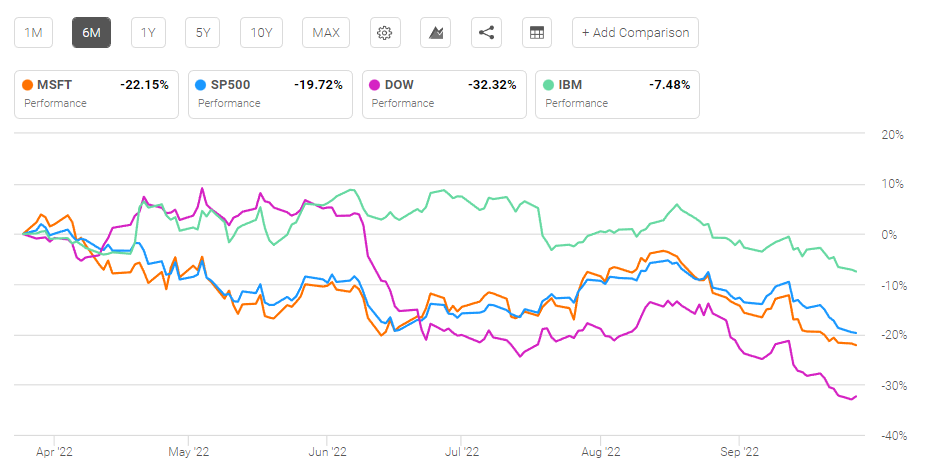

Microsoft (NASDAQ:MSFT) is a high-flying stock that is now under the falling knife category. Technical analysis of the Dow Jones Index indicates its MACD is still below zero. The persisting bearish emotion of the stock market convinced me that MSFT’s price will continue to dip. The high-valuation factor grade of MSFT is D-. MSFT will likely perform worse than IBM (IBM). IBM’s 6-month decline is only -7.48%, much better than MSFT’s -22.15%.

Seeking Alpha Premium

The YTD performance of MSFT is -29.71%. This is another gross underperformance against IBM’s -8.92%. Based on its EMA, MACD, and Stochastic indicators, MSFT will continue to decline. The fast stochastic of MSFT is 8.23. The trade signal is it is Oversold Buried – near term bearish alert. Best to wait for a cheaper buy-in window.

StockTA.com

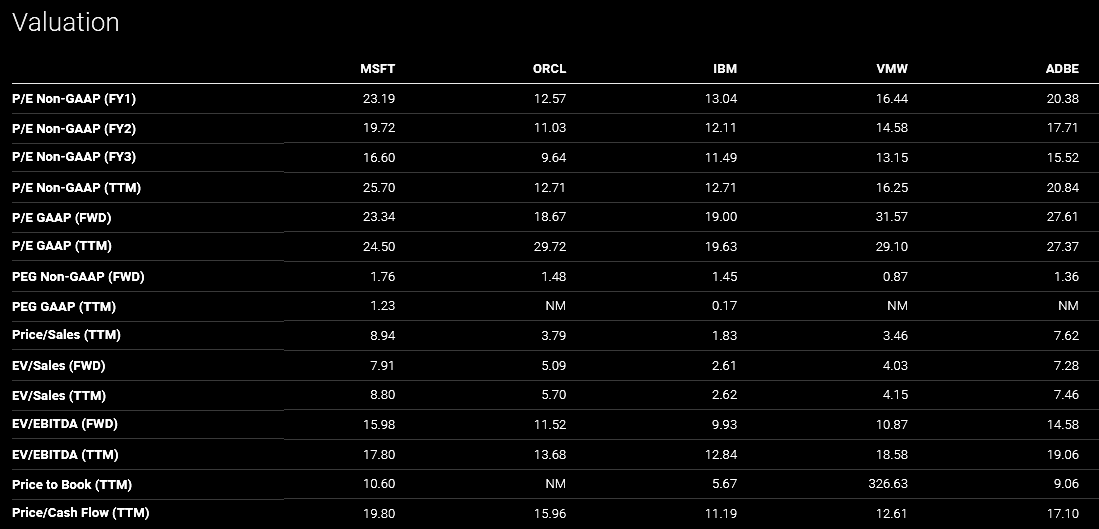

Still High Valuation

In spite of the almost 30% YTD dip, MSFT remains a pricey investment. Compared to its mega-cap software peers, Microsoft’s stock is more expensive to own. This relative overvaluation is best exemplified by MSFT’s TTM Price/Sales valuation of 8.94x. This is significantly greater than IBM’s P/S ratio of 1.83x. and Oracle’s (ORCL) 3.79x

Seeking Alpha Premium

More Competition Is A Headwind

The relatively high P/S valuation of MSFT makes it a tempting target to short sellers. It is a blessing that Microsoft touts more than $104 billion in cash to intimidate shorts. The decline of MSFT is due to profit-takers, bearish investors, and skeptics. Investors are perhaps realizing that MSFT’s 5-year revenue CAGR is less than 16%. MSFT therefore is clearly not a high-growth stock.

Azure remains a far second to AWS in cloud infrastructure market share. Microsoft 365 has fierce competition from cheaper or even free alternatives. The massive success (48.08% market share) of Microsoft 365 has inspired Canva to launch its own online office suite.

Microsoft’s revenue CAGR could fall below 12% if more companies imitate Canva’s move to challenge Microsoft 365. Canva became a $40 billion unicorn because of its affordable templates-based graphic design business. Adobe’s (ADBE) Creative Cloud suite of software has less customers because budget-conscious businesses/individual can subscribe to Canva Pro for their graphic content projects. The Canva Office Suite will take customers away from the $9.99/month Microsoft 365. The freemium made-in-China $29.99/year WPS Office is another headwind for Microsoft 365. So is the $24/year German-made SoftMaker Office Universal NX.

As per Microsoft’s FY 2022 report, the productivity and business processes earned $63.4 billion. It is alarming that Google (GOOGL) Workplace now enjoys 59.41% market share in U.S. organization adoption. Microsoft 365’s market share is 40.35%.

On the global stage, Google Workplace has 48% and Microsoft 365 has 46%. Losing to Google Workplace contributes to the big decline in MSFT’s stock price.

Important Tailwind From .NET

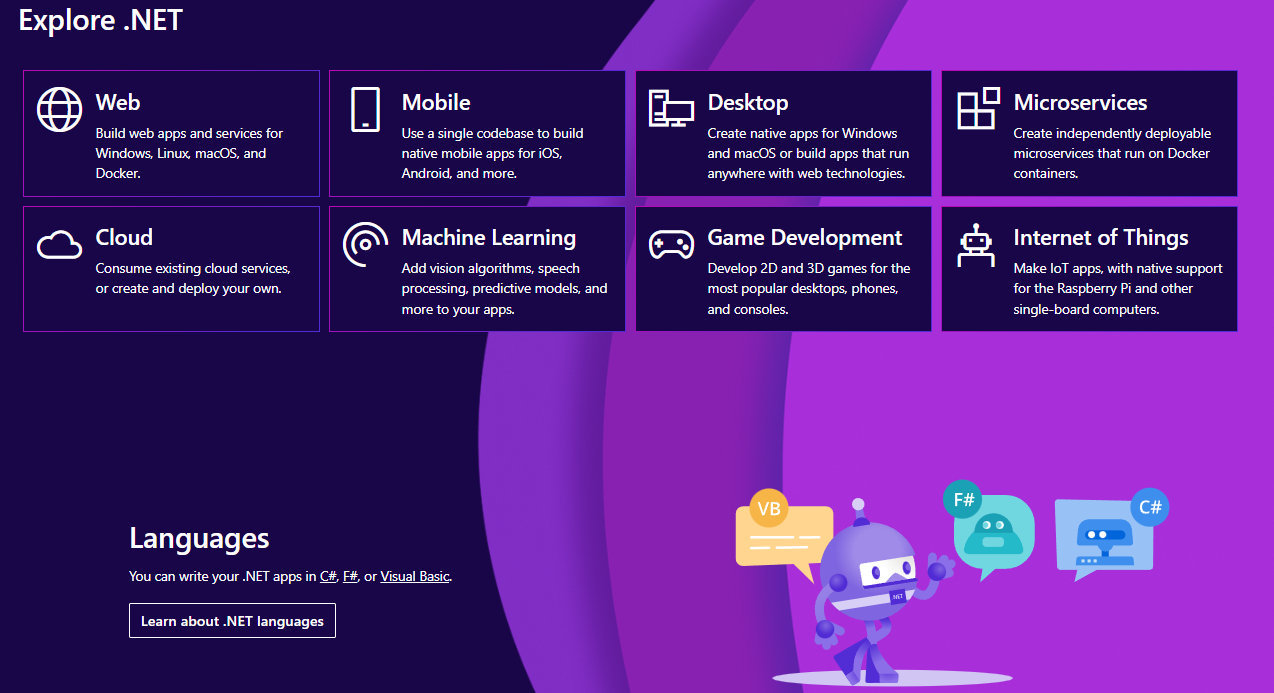

Microsoft’s growth potential is not limited to Microsoft 365. Investors should evaluate the rarely discussed contribution of the 20-year-old.NET ecosystem. The .NET business is more important than Microsoft Ads. Microsoft is never going to make it big in digital display ads because its Bing Search still has less than 9% market share in usage. Microsoft Edge’s browser market share is 10.84%.

Microsoft is also marketing cost-savings if developers host their .NET apps on Azure. Anything that helps sustain Microsoft’s $30.4 billion/year Azure business is worth discussing here at Seeking Alpha. Microsoft also offers its Visual Studio Enterprise IDE for $250/month so people can develop .NET and ASP.net apps.

The .NET ecosystem is Microsoft’s growth driver inside the $389 billion (2020 estimate) custom software development industry. This niche market is set to become a $650.13 billion business by 2025. Building .NET apps for any device is possible through Microsoft-made programming languages C#, F#, and VB (Visual Basic). The screenshot above is emphasizing .NET MAUI and Blazor. Both software development frameworks are C#-centric. Microsoft has officially stopped development of VB.net.

Microsoft

Microsoft bought Xamarin in 2016 and it came up with Xamarin.Forms to extend the .NET platform for cross-platform app development. The new version of Xamarin.Forms is .NET MAUI (Multi-platform App UI). It seeks to unify the different technologies of Xamarin, Mono, and .NET CORE.

MSFT is a buy because it is helping .NET and C# developers create apps more coherently. The average U.S. annual salary for .NET or C# developers in the U.S. is $100k. These high-income developers can easily afford to pay the $250/month Visual Studio Enterprise just so they can build .NET MAUI apps.

Blazor is Microsoft’s popular ASP.NET framework to build client web apps using HTML, CSS, and C#. Blazor is Microsoft’s effort to diminish the popularity of JavaScript frameworks for websites and mobile apps. Many developers hate JavaScript for several reasons. Microsoft made C#-centric Blazor as an alternative to create web, PWA (Progressive Web Apps), and WebAssembly applications.

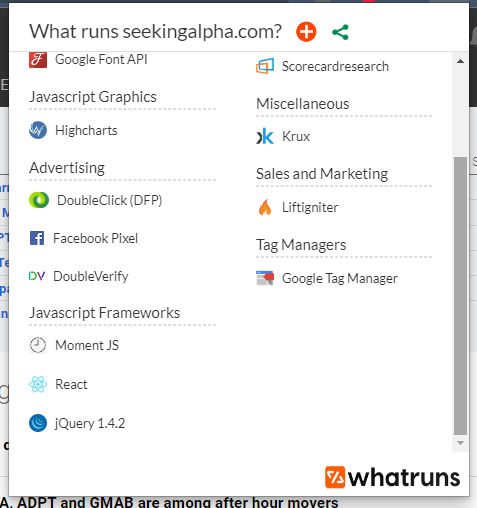

Of course, developers will have to pay $250/month for Visual Studio Enterprise to develop Blazor apps. Blazor might inspire profitable websites like Seekingalpha.com to stop using JavaScript for frontend/backend purposes.

Motek Moyen

C# is faster and therefore better than JavaScript. Microsoft was not so happy with the very old JavaScript. It created TypeScript in 2012. TypeScript developers in the U.S. now tout average salary of $130k/year. JavaScript developers’ average is $126,75k. The $45/month Visual Studio Standard IDE can be used to build TypeScript and JavaScript apps.

MSFT is a buy because Microsoft is monetizing .NET MAUI and Blazor even though there’s the free Uno Platform. Uno is the development framework that can do the jobs of .NET MAUI and Blazor. The Uno Platform is so good that Microsoft used it to revamp its Windows Community Toolkit Labs.

Microsoft is a good investment because people/companies still pay $99.99/year for Microsoft 365. They ignore the free LibreOffice and the cheaper $29.99/year WPS Office.

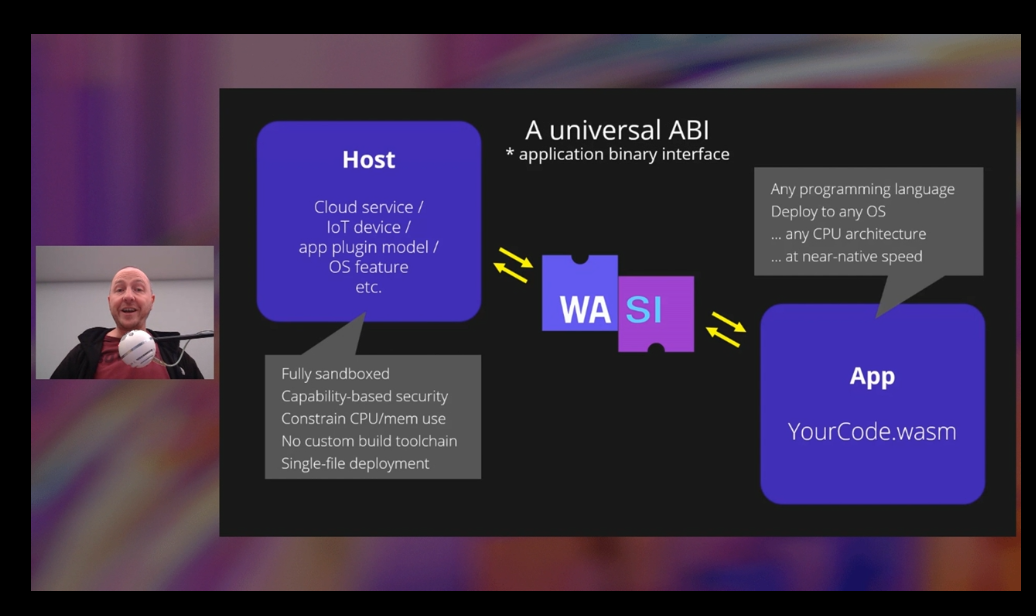

WebAssembly Gambit

Microsoft makes money by helping developers build .NET and C# apps through premium Visual Studio IDE and Azure subscription fees. It might be safer for Microsoft to stop its efforts on WASI (WebAssembly System Interface). WASI is an attempt to bring WebAssembly apps beyond the browser.

Azure’s topline is not going to benefit from Microsoft’s experimental but not yet committed effort to bring .NET app to WASI compliance. Microsoft’s WASI SDK iwill fix Blazor’s unsuitability for WASI apps. Blazor uses JavaScript interop to handle DOM and browser API calls. WASI does not use JavaScript.

Microsoft.com

WASI means it will be possible to create truly autonomous C# and .NET apps on any device without Azure hosting and JavaScript dependencies. WASI will sacrifice future Azure revenue just to attract more paying developers to use Visual Studio Standard or Enterprise.

It is tempting to pay $45/month or $250/month for an IDE that helps developers build cross-platform, web/WebAssembly, and no-JavaScript WASI apps.

It is now possible to use the experimental WASI SDK to build .NET 7 and ASP.NET Core apps. Microsoft should let it remain experimental.

Focus More On No-Code

WASI is not the optimal long-term strategy. Attracting more C# developers is the better option. Microsoft must attract more kids and adults to the well-paying C# developer population. Giving away free educational Visual Studio Standard to K-12 institutions is highly recommended. Adding C# to the coding option of Microsoft’s MakeCode visual programming learning platform should inspire more kids to study C#. To date, MakeCode only let block-based programmers use JavaScript or Python to learn hands-on coding.

Microsoft can afford to pay $68.7 billion to acquire Activision Blizzard (ATVI). It should be willing to spend a few millions to build a no-code C# version of the WebAssembly game engine GDevelop. GDevelop uses JavaScript for its game logic.

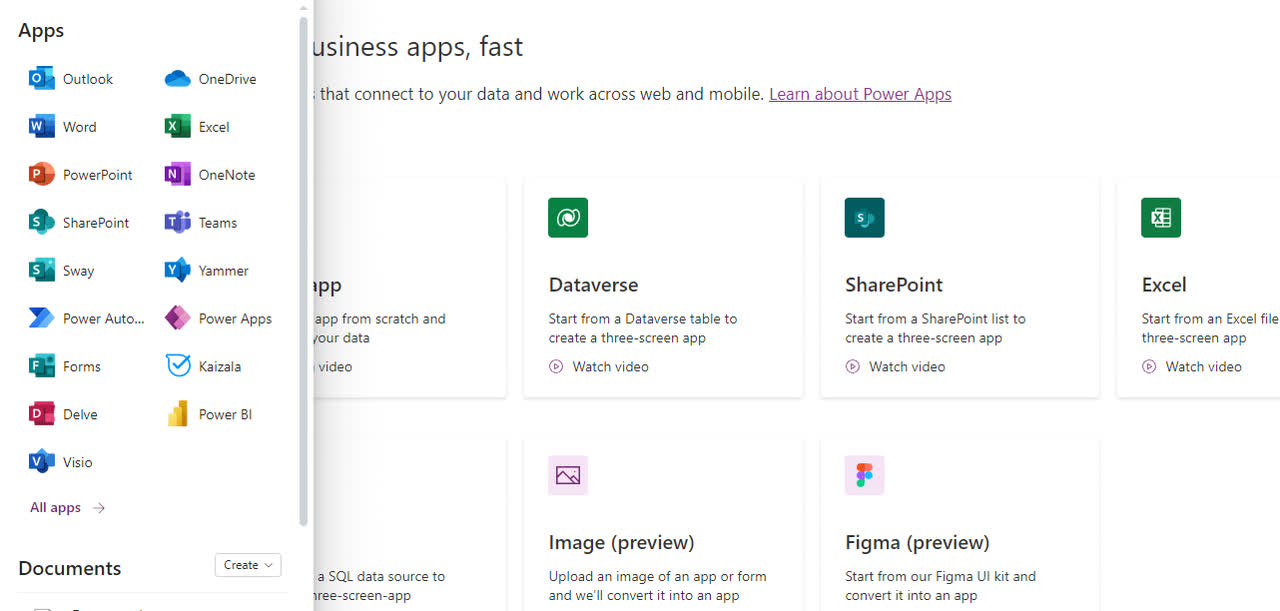

I still use my $99.99/year Microsoft 365 account. Microsoft is kind enough to bundle free no-code PowerApps and Power Automate with it. This is the brilliant tactic that keeps Microsoft 365 attractive. Microsoft wants Word, Excel, and PowerPoint loyalists to start becoming no-code app developers. Microsoft can then entice them with affordable Azure hosting for their no-code apps.

The new integration of Figma with PowerApps means the UI/UX layout tasks are now a cakewalk. Corporations will save money by letting its lowly paid clerks and receptionists do no-code app development. Why hire a $100k/year C# developer when you can have the $36,000/year clerk learn PowerApps and PowerAutomate.

Motek Moyen

Instead of the experimental WASI, it is better for Microsoft to develop and sell an HTML+CSS+C#+ASP.NET version of my favorite $250 Decsoft App Builder. Decsoft’s product uses HTML+CSS+JavaScript+Apache Cordova.

Final Thoughts

MSFT is trending south for the near-term. Be patient and you could purchase it at much lower price levels. Going forward, slower growth is expected for Microsoft 365. Google Workspace is leading the fierce competition in the $71.03 billion office productivity software. The 86.2% market share of Gmail in webmail opens has trained many people to use the free legacy versions of Google Docs, Google Sheets, and Google Slides.

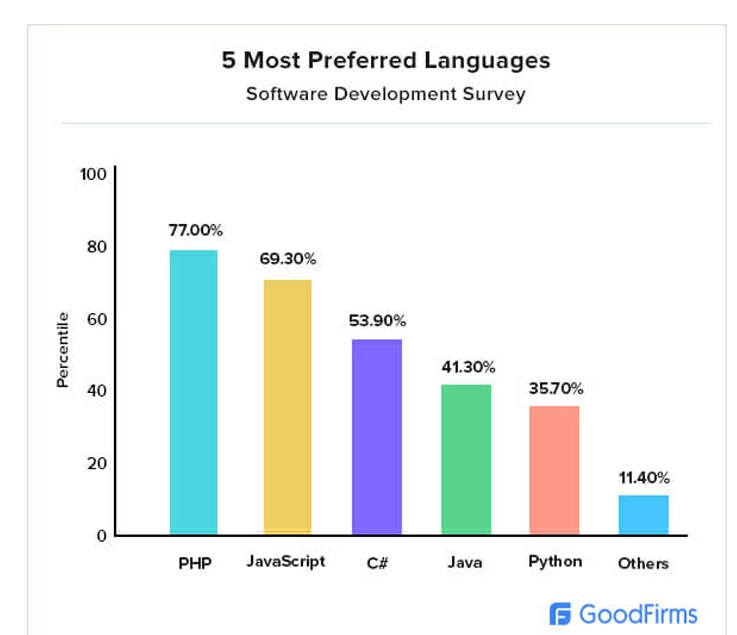

The .NET software development ecosystem could offset slower growth of the productivity/business processes segment. Software developers will remain loyal to .NET and C#. Invest in Microsoft because C# is the third-most used software development language.

Goodfirms.com

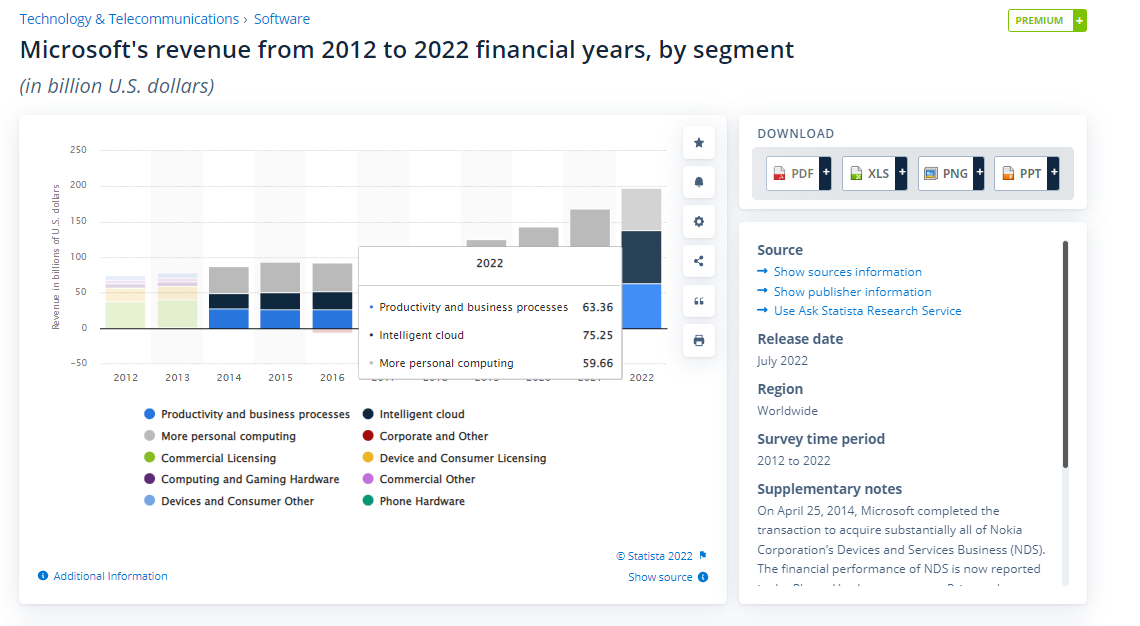

Going forward, .NET MAUI and Blazor might help C# overtake JavaScript. These C# loyalists can help sustain the $63.36 billion/year productivity & business processes and the $75.25 billion/year intelligent cloud segments.

Statista.com Premium

The 29% cheaper valuation ratios of MSFT are not affecting its very robust cash position. It can easily purchase the nventive, the maker of the C#-centric Uno platform. The estimated annual revenue of nventive is only $9.03 million. Microsoft has more than $104 billion in cash and its net operating cash flow is $89 billion.

Purchase nventive and then make Uno Platform freemium like Visual Studio IDE. Give a free-but-limited Uno Community version and charge $19.99/month for premium. Aside from being free, Uno Platform is popular because of its Figma UI integration.

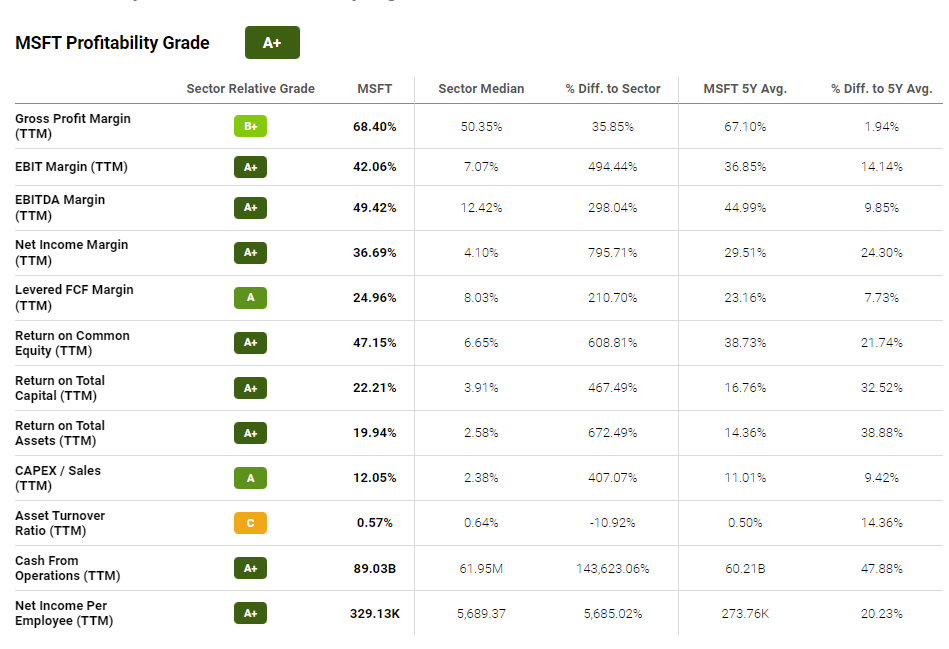

The no-code Power Platform, Blazor, .NET MAUI, and the C#/.NET custom software app development ecosystem are helping Microsoft maintain its high-profitability. Despite its falling knife status, Seeking Alpha’s quantitative AI still gives MSFT a profitability factor grade of A+.

Seeking Alpha Premium

MSFT could end 2022 with a YTD of -35% and I will still rate it as a buy. Lower valuation perception from investors is not a dealbreaker. The key point here is that MSFT’s TTM net income margin is 36.69%, notably higher than its 5-year average of 29.51%. MSFT is becoming profitable and yet investors are dumping it.

Be the first to comment