piranka

Growing and gaining share

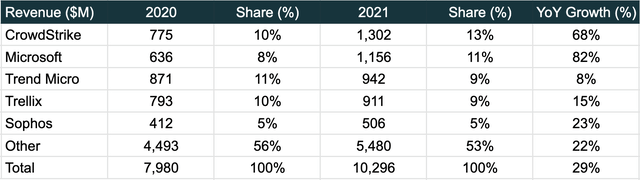

CrowdStrike (NASDAQ:CRWD) has been an exceptional growth story, while most companies within the software sector have been struggling with slowing growth under the current macro backdrop. The company is a leading cloud-native provider of corporate endpoint security and has been gaining a meaningful market share in the industry. According to IDC, CrowdStrike’s share increased from 10% to 13% in 2021, while revenue growth outpaced most industry peers at 68%.

The corporate endpoint market had a total value of just over $10 billion 2021 and is likely to grow at a double-digit CAGR over the next several years thanks to a highly concerning threat environment amplified by the Russia-Ukraine crisis and China’s potential invasion of Taiwan in 2022. From a macro perspective, there has never been a better time to be in the cybersecurity business as companies and governments look to upgrade their mousetraps.

A better mousetrap

Without a question, CrowdStrike is the company that’s built a better mousetrap. The signature Falcon platform offers a complete set of solutions including EDR (endpoint detection and response), XDR (extended detection and response), identity protection, threat intelligence, file monitoring, vulnerability management, and many more.

Before we move on, let’s first understand some of the industry lingos. An “endpoint” is essentially any digital device that connects to the Internet and is thus vulnerable to a cyber attack. For example, your work laptop is considered an “endpoint”. EDR protects the endpoint, or the device that you’re using at work. XDR is a more comprehensive solution that integrates protection across endpoints (devices), cloud workload, server, email, etc. Both solutions are similar in detecting and reacting to threats and are set to displace a plethora of legacy solutions that no longer meet corporate needs in today’s cybersecurity landscape.

Recent performance and outlook

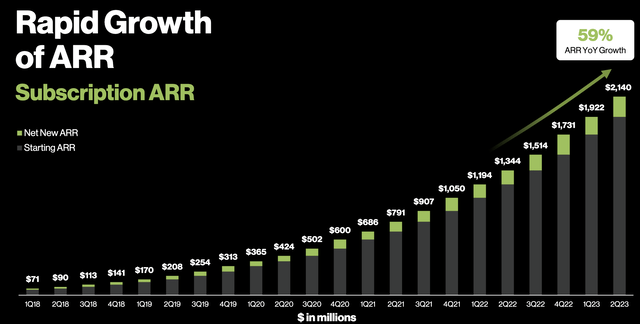

CrowdStrike reported a strong 2Q22 that almost puts the company in its own league. Revenue of $535 million and adj. EPS of $0.36 both came in above Street estimates of $516 million and $0.28, while total ARR grew 59% YoY to break above the $2 billion mark. Emerging products (Discover, Spotlight, Identify Protection, Humio) delivered a record ARR of $219 million, up 129% YoY.

CRWD 2Q22 Investor Presentation

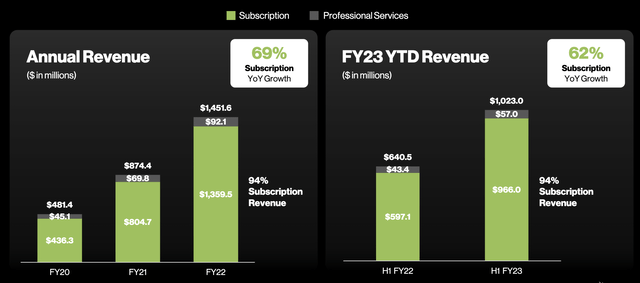

The majority of top-line growth was driven by a strong 60% subscription revenue growth as customers embraced more solutions. Customers with +5/+6/+7 modules represented 59%/36%/20% of total customers, indicating a YoY growth of 70%/84%/105%. Subscription gross margin of 79% in 1H22 also held up well vs. 79% in 2021 and 2020.

CRWD 2Q22 Investor Presentation

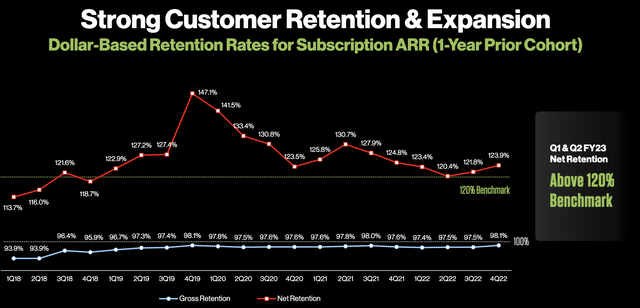

Customers are not only staying with CrowdStrike but spending more. The net retention rates (NRR) for 1Q22 and 2Q22 were above 120%, which continued to remain very strong as the company has long maintained a >120% NRR. Given only 20% of total customers are subscribed to 7+ modules, this should help maintain a strong NRR going forward.

CRWD 2Q22 Investor Presentation

All told, it was another solid quarter characterized by record ARR, strong subscription margin and free cash flows. For 3Q22, management guided revenue of $572 million at the mid point which was above $569 million consensus.

Fal.Con

CrowdStrike just recently had an Investor Briefing at the annual Fal.Con conference with the following key takeaways:

- XDR will be integrated into CrowdStrike’s EDR module (Falcon Insight). Previously, customers had to separately purchase the XDR module.

- Will acquire Reposify, an EASM (external attack surface management) provider that helps companies identify corporate assets that may be exposed to risks of being attacked.

- Humio will become Falcon LogScale with a new fully-managed service.

- Announced Cloud Infrastructure Entitlements Manager (CIEM), an identity product for cloud customers.

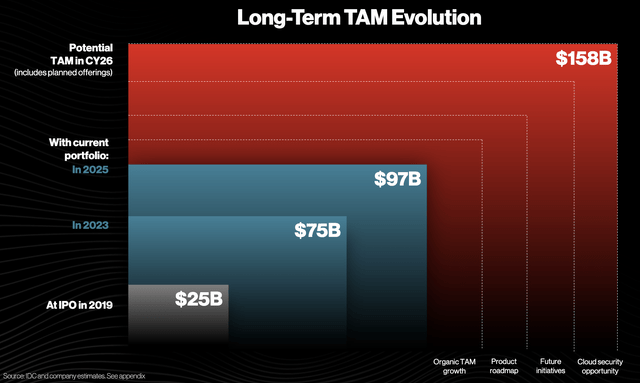

- Management sees a $97 billion TAM for current product portfolio by 2025 and a $158 billion long-term TAM (vs. $126 billion previous estimate).

- More importantly, big deals are still happening despite a light early summer, per Barclays’ notes from the partner panel (see below).

CRWD Investor Briefing Barclays

Valuation

CrowdStrike is no doubt a secular growth story supported by strong industry tailwinds. The company is projected to grow its revenue by 54% to $2.23 billion in 2022 and 37% to $3 billion in 2023. That said, with a market cap of $39 billion, valuation is very demanding at almost 13x C2023 revenue.

What this tells me is that (1) the company’s growth potential is quite well understood and (2) markets may have adequately reflected the resiliency of the business in this bear market. Since the stock is almost priced for perfection, future sales and guidance will have to again surprise Street estimates to the upside to justify for another round of positive re-rating. Conversely, results going forward will have to meet expectations just to keep the stock price from falling.

Of course, risks to the upside include renewed geopolitical risks and another blockbuster cybersecurity attack at a major company (eg. Apple (AAPL)) that again increases the world’s urgency to invest in endpoint security. For a structural grower like CrowdStrike, I’d most definitely avoid shorting the stock.

That said, readers of my articles know that I pay close attention to the valuation side of the story, no matter how good the business looks. From I’m seeing, the risks currently outweigh the rewards.

Final thoughts

Yes, CrowdStrike is an incredible growth machine against a very difficult macro backdrop, and investors will give the company a pass on the bottom line (currently negative due to heavy stock-based compensation expense, though becoming less negative) as long as the top-line continues to deliver 30%+ growth. However, the growth trajectory is also well understood and prices have sufficiently captured that. In short, sit back, relax, and wait for a better buying opportunity.

Be the first to comment