cemagraphics

The speed with which economic conditions have changed over the past two and a half years has made positioning critical for investors. An economic slowdown now appears assured, whether this is mild or a deeper recession will determine sector performance going forward. Growth stocks have done relatively well in recent weeks as investor attention has shifted from inflation to recession, but as Snap’s (SNAP) earnings have shown, companies that are sensitive to economic conditions remain at risk.

Business and Market Cycles

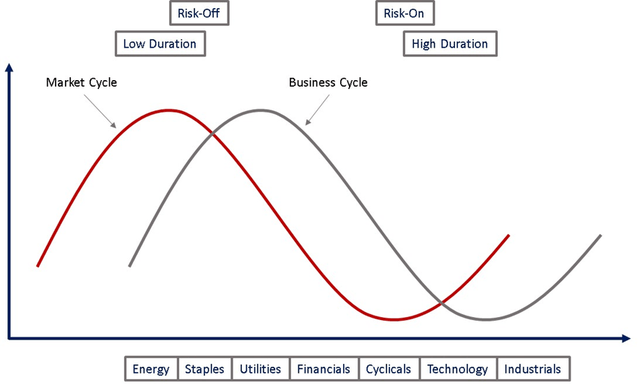

Financial markets and the economy are often cyclical, leading to variation in performance between sectors over time. While a general framework can guide positioning, not all cycles are the same, meaning the underlying cause of an economic boom and bust must be understood in order to determine positioning across sectors.

Figure 1: Example Market and Business Cycle with Potential Sector and Factor Positioning (Created by author)

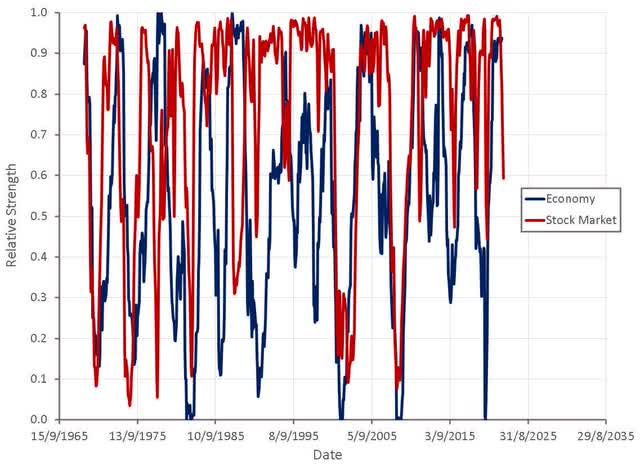

The stock market generally leads economic indicators like unemployment and GDP growth. This is likely the case at the moment as many stocks are already down significantly, and a range of leading economic indicators (housing, manufacturing, sentiment) are showing weakness. Corporate profits are yet to be significantly impacted, but it is likely that in the coming months, growth and profitably expectations will be lowered. This, along with labor market weakness, will likely be required before markets begin to bottom.

Figure 2: Relative Strength of US Economy and Stock Market (Created by author using data from The Federal Reserve)

Given that the current cycle has been driven by a combination of low-interest rates and massive fiscal stimulus, an extended period of weakness in sectors that benefited from excessive consumer spending is likely. Inflation driven by supply shocks may also limit the extent to which central banks can support weakening economies.

Sector Performance

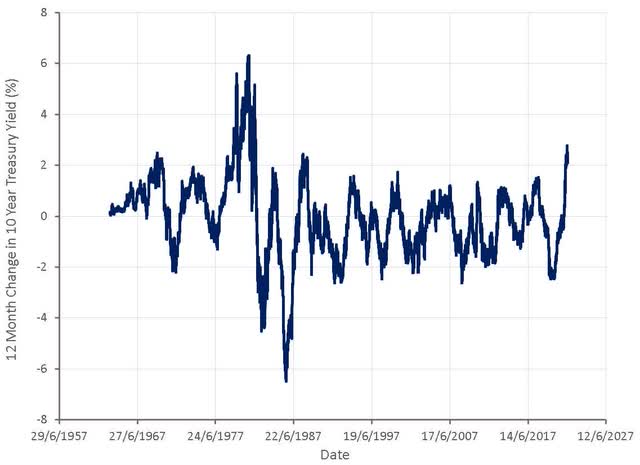

Each industry has its own range of value drivers, which causes relative performance between sectors to vary through the business cycle. The current cycle is unusual because a business cycle, which typically takes around 8 years, has been compressed into a 2-year period. As a result of this, and the speed with which interest rates are moving, the performance of some sectors may differ from what is expected. For example, financials are performing poorly when they typically would have been expected to do well. It also appears that commodity businesses will only enjoy a short window of favorable conditions. Tech stocks may also begin to outperform relatively early in the bear market due to the extent to which inflationary fears have negatively impacted them.

Figure 3: 12 Month Change in 10-Year Treasury Yield (Created by author using data from The Federal Reserve)

More defensive sectors have performed relatively well in recent months, as have sectors that are less impacted by rising interest rates. This will probably change in the coming months, though, as expectations of lower long-term rates lead investors to seek greater exposure to high-duration stocks. With corporate profits set to decline, investors are also likely to avoid exposure to more cyclical sectors.

- Energy: likely to continue performing poorly as expectations of a recession increase

- Staples: may continue to perform relatively well due to defensive nature

- Cyclicals: likely to continue performing poorly as expectations of a recession increase

- Technology: deteriorating economic conditions will be weighed against expectations of lower interest rates. Businesses with relatively low exposure to economic conditions should do well

Factor Performance

Stocks can also be thought of in terms of their exposure to risk factors, rather than just their sector or industry. More defensive stocks are likely to do well towards the end of a bull market as investors look forward to a potential deterioration in economic conditions and seek to reduce risk exposure. Conversely, near the end of a bear market, investors seek exposure to more cyclical stocks that are likely to do well as economic conditions rebound. In an environment where rates are rising, low-duration stocks are likely to perform better as their valuations are less impacted by higher rates. Conversely, high-duration stocks are likely to do well when rates are falling as their valuations are positively impacted.

Large-cap stocks have performed relatively well this year. Large-cap stocks generally outperform during bear markets, which may be due to investors viewing larger stocks as safer. Small-cap stocks appear attractively valued relative to large-cap stocks, but it is not clear when sentiment will shift.

Value stocks have outperformed growth stocks in recent months. Value stocks tend to outperform during bear markets, and the last 12 months have seen one of the most extreme periods of outperformance in the past few decades. This is likely due in part to a large initial discrepancy in valuations between growth and value stocks, and the speed with which interest rates have increased. It is probable that once fears of higher rates recede, growth stocks outperform significantly.

Profitable stocks have outperformed unprofitable stocks in 2022. More profitable stocks often have a lower duration and are better positioned to manage a downturn. As a result, profitable stocks should outperform during market downturns. A distinction should be made between businesses that are unprofitable because they have poor unit economics and businesses that are unprofitable only because they are small and/or growing rapidly. Many businesses with attractive economics have been indiscriminately sold off, and these present a large opportunity.

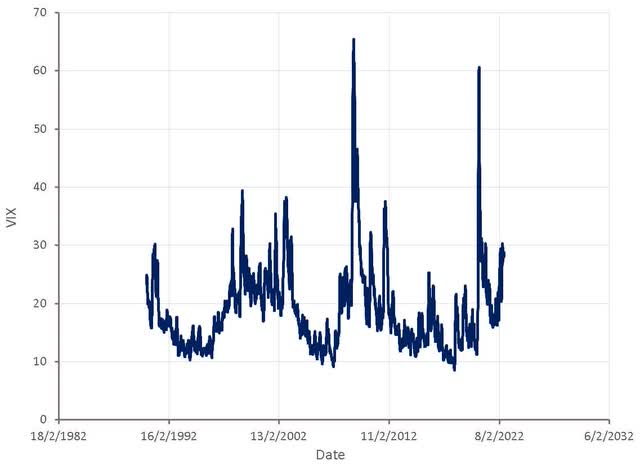

Volatility

Many investors are expecting the VIX index to spike significantly before equity markets bottom. While this is possible, it is not necessary. Large spikes in the VIX index are generally associated with panic, like the global financial crisis or the COVID pandemic. In a normal downturn, there is no reason for this level of panic, and markets may bottom without VIX moving substantially higher.

Figure 8: VIX Index (Created by author using data from The Federal Reserve)

Conclusion

Financial markets are already declining, and a recession appears imminent. Markets are unlikely to stabilize until central banks ease monetary policy and leading economic indicators bottom. Longer duration bonds may do well if expectations of a recession increase. High-duration stocks that are not exposed to economic conditions (i.e., biotech) could outperform going forward if long-term rates move lower. Commodities and cyclicals are likely to underperform going forward as economic conditions weaken and their profitability is negatively impacted.

Be the first to comment