MF3d

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Forget That It’s Called Tesla, Just Look At The Numbers And The Chart – Then Decide

A blessing and a curse has accompanied Tesla stock since knowledge of the name migrated beyond the tonier parts of Atherton and into the wider American investor community. And that blessing, that curse, is hoopla. Never a dull moment it seems. New products announced way before they can be manufactured at any kind of scale, new features announced before the underlying technology is viable, Twitter feuds, a feud with Twitter, it’s exhausting.

Fortunately help is at hand. Want to get to grips with owning Tesla stock and working out whether that is a good idea for your capital or not? Just ignore all the hyperbole. Ignore all the Musk sideshows and ignore all the Musk fanbois and Musk haters. Because none of it matters. What matters is the same as matters for all stocks. In no particular order, one, the fundamental financial performance of the underlying company and, two, the emotive chart performance of the stock.

Let’s first turn to Tesla’s fundamental financial performance.

TSLA Financials – Key Metrics

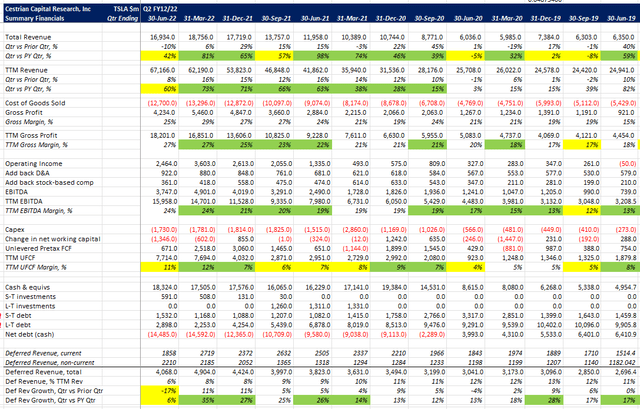

Here are the numbers up to and including its Q2 report.

TSLA Financials (TSLA SEC Filings, YCharts.com, Cestrian Analysis)

Growth slowed in Q2 due to some combination of China Covid lockdowns, component supply shortages, and no doubt a modest demand hiatus influenced by inflation and recession fears in the US. In Q3 we want to see the company evidence no worsening of growth, but for now, those are the numbers. So you have a business with $67bn of revenue growing that revenue base in the 60-70% pa. range, whilst achieving a low double-digit unlevered pretax free cashflow margin. That is a rare achievement indeed. That it is achieved by a company with a heavy manufacturing base is still more remarkable. The balance sheet is a fortress, with $14.5bn net cash keeping the wolf from the door.

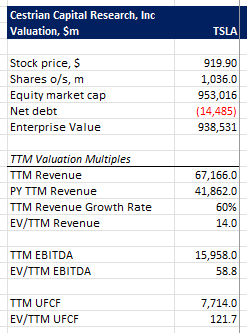

Tesla Valuation

The market is asking you to pay 14x TTM revenue, 59x TTM EBITDA or 123x TTM unlevered pretax FCF for Tesla. It’s hard to argue that on pure financial fundamentals that’s a bargain. It’s not. If it’s free cashflow yield you are looking for, look elsewhere. But if it’s a valuation that is threshold acceptable as support for the technical opportunity the chart affords you? Different story.

TSLA Valuation (YCharts.com, Cestrian Analysis)

Tesla Stock Chart

This is where things get really interesting from our perspective. Specifically because the company inspires such visceral reactions is what makes it an attractive stock. Whether you like to play it long or short, what you can count on with TSLA is volatility. Speaking for ourselves – both our professional ratings and our staff personal account holdings – we prefer to play TSLA long though we have dabbled with the occasional short position. Yes, it’s true. You can in fact be emotion-neutral with TSLA if you don a lead helmet, ignore all opinions, switch off Twitter, and just deal with the facts and the chart in front of you.

Let’s take a look at the chart in the larger degree.

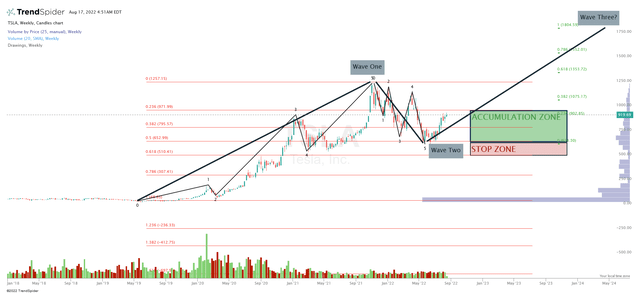

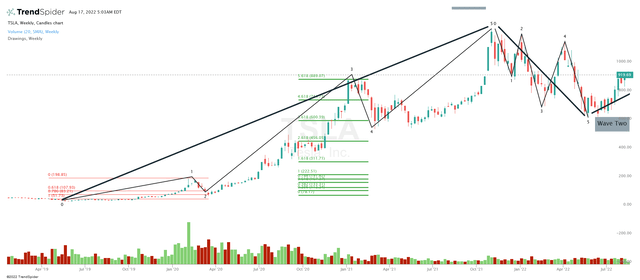

TSLA Chart (TrendSpider, Cestrian Analysis)

You can open a full-page version of this chart, here.

Here’s how we see the TSLA chart and its prospects.

From the 2019 lows, the stock puts in a 5-wave up sequence that peaks with the other growth names, and indeed the market at large, in late 2021. This 5-wave sequence tracked rather well to key Fibonacci levels. Let’s zoom in for a moment just to show that. (Full page version of this chart, here).

TSLA Chart II (TrendSpider)

The Wave 1 up retreats into a Wave 2 down troughing at the 0.786 retrace; textbook Wave 2. Then the Wave 3 – whilst a huge version thereof – peaks at precisely the 5.618 extension of the Wave 1. And so on. Now, the reason to show this is because it is evidence of the highly emotive nature of TSLA stock. Stocks don’t move up to 5.618 extensions because the underlying company is growing quickly. They move up that far because they inspire all kinds of emotions to run high. And if a stock has generated that much investor emotion in the recent past, there’s a good chance it does so in the near future, in our view. Which means we think that TSLA can trade well to Fibonacci levels going forward too.

Pros Of Buying Tesla Stock

The pros of buying Tesla stock are in our view:

1 – the stock trades unrestrained by fundamentals, unconstrained by the news, and instead moves purely with sentiment. This means that the level-headed investor or trader can take advantage of the crowd – and also,

2 – whilst it is true that other EVs are also available, Tesla’s brand advantage and penchant for viral marketing means that the underlying fundamentals of the company do remain strong. That may change in the future; it may be that in the end Ford or GM swallow the beast as they did niche manufacturers a century back; but for now, Tesla remains the one to beat in EVs, and EVs remain the segment with the most consumer pull and government push.

Let’s take a look at the pro case. Back to the charts in order to do so.

That 5-wave up sequence forms a larger-degree Wave One in our first chart above. Wave One starts in 2019 at around $45 (adjusted for the stock splits that have taken place since that time) and peaks late in 2021 at around $1,240. The larger-degree Wave Two that follows has bottomed out at a relatively shallow 0.5 retracement of that Wave One up. At first blush one could be forgiven for expecting a further drop – after all stock after stock has already put in 0.618 or 0.786 retracements of similar moves up. But that’s rather the point. To our eye it looks like the 2022 bottom may well be in, because so many big-name stocks have bottomed out at those deep retracement levels. And we take that as evidence that maybe, maybe – TSLA has bottomed too.

If that’s the case, and we’re now in a larger-degree Wave Three up, then as a function of that nuts Wave One, technically – which is to say emotionally – we may reasonably expect the stock to run up from here to at least the top of the Wave 1 high, and more likely to the 100% extension of that Wave One. That means a bull target of $1,245 (minimum, if we’re right) and a crazy ol’ bullrider target of $1,805 (that’s the 100% extension). We don’t need to talk about the fact that most likely a Wave Three terminates at the 1.618 extension of Wave One, because that would suggest a meth-addled crack-snorting bull target of $2,534, and, honestly? We don’t have the time to handle all the comments if we slapped a $2,534 stock price target on the name. But, between us? The stock is perfectly capable of achieving that target, and the only reason to disbelieve the potential is if you have yet to free your mind, and you still think that stock prices are driven primarily by fundamentals or by the news. (If you want to apply some reverse neurolinguistic programming to that mental block, take a look at a post of ours from March this year, here.)

Cons Of Buying Tesla Stock

Well, this one is easy. Here’s a bunch of reasons to not buy Tesla stock.

1 – The valuation. 122x unlevered pretax free cashflow. Give your grandparents a quick call and ask them whether they think you should buy a stock valued at 122x cashflow. (It will be a quick call).

2 – The hoopla. If you can’t ignore the hoopla, if you are compelled to watch the Elon Musk show play out live on every media forum near you, well, that’s exhausting, because if you’re watching it then you can’t help but wonder whether the latest move will undermine your investment in Tesla stock or not.

The Latest (Twitter)

Is that good for TSLA stock? Bad for TSLA stock? Will it make no difference? You already spent too much time thinking about it. You see the problem with hoopla.

3 – The competition. It’s not like Ford and VW and everyone gave up. They are behind, but spending like crazy and nobody likes a show-off, so, assume they have Tesla well in their sights.

4 – The share sales by Elon Musk. Whatever the logic, they don’t build investor confidence.

The bear opinion on Tesla is mainly emotional and we that is all best ignored. If you want to read a well-reasoned bear take on the name, read this Seeking Alpha article. The author vomited all over our last bull piece on Tesla and then wrote this, which is good work. We don’t agree with the conclusions – but it’s good work. Take a look.

Is Tesla Stock Worth Investing In?

In our long-run investment work we adopt the Wyckoff Cycle model. We aim to slowly accumulate a position in a stock when it is beaten down, stop buying once a certain price is reached, sit back in anticipation of the markup cycle then lifting the stock, and then distributing once a high is reached. We can’t claim to do this perfectly of course, but it has worked pretty well for us through the recent Covid lows, 2020-2021 markup period and then into the 2021 highs. We sold a bunch of high beta names as their 5-wave cycles topped late last year, both in our Growth Investor Pro service and in staff personal accounts. Right now we have been through a period of ‘accumulate’ ratings in many high beta names and we seem to be moving into a markup period. Tesla has yet to move up and out of our accumulation price zone. If you go back to that first chart above, we think a viable way to invest in Tesla without taking on undue risk is:

Accumulate – meaning build up slowly over time – a position in that green ‘Accumulation Zone’ box – let’s call it between $624-$902 (yes those numbers are odd boundaries to pick – they represent the Fibonacci levels that define the zone for us). If the stock does move up then you can either just wait for a Wave Three to play out and sell as it nears those targets, and/or set a trailing stop on the way up. If the stock flames out, we believe that stops set in the region below say $610 (that’s a little below the recent lows) are protective without being likely to get executed on a whim. The stock remains inside our Accumulation zone so we rate the stock at, er, Accumulate.

We have invested in the stock in staff personal accounts; we rate the stock at Accumulate on a professional basis; and we think the risk-reward balance is good if you take an approach similar to the above. So for us? Yes, Tesla is worth investing in. But then we don’t watch the hoopla and we wear lead helmets to work every day. You’ll make the right decision for you, as always.

Cestrian Capital Research, Inc – 17 August 2022.

Be the first to comment