wildpixel

Men are never convinced of your reasons, of your sincerity, of the seriousness of your sufferings, except by your death. So long as you are alive, your case is doubtful; you have a right only to their skepticism.”― Albert Camus

We took our first look at Protara Therapeutics (NASDAQ:TARA) back in the first quarter of 2021. No one on Seeking Alpha has provided coverage on the company since. Given I get an occasional question around Protara, today we are going to circle back on this small biopharma concern. An updated analysis follows below.

Company Overview:

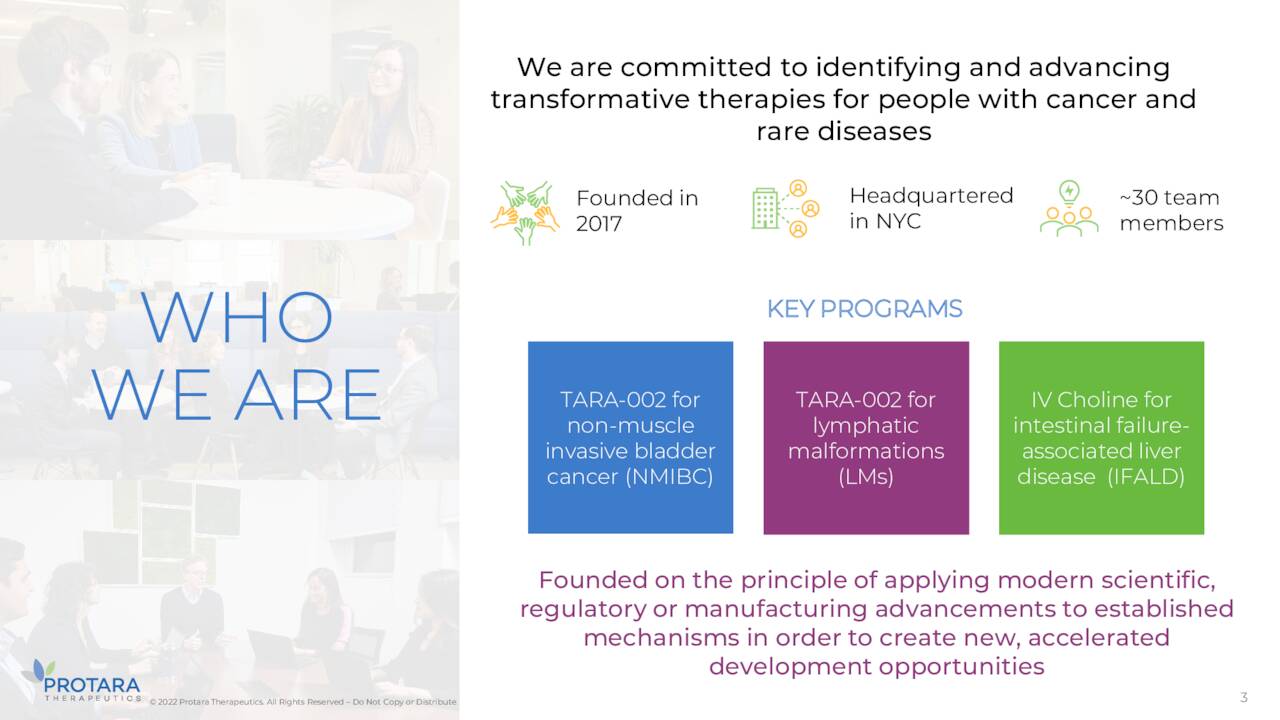

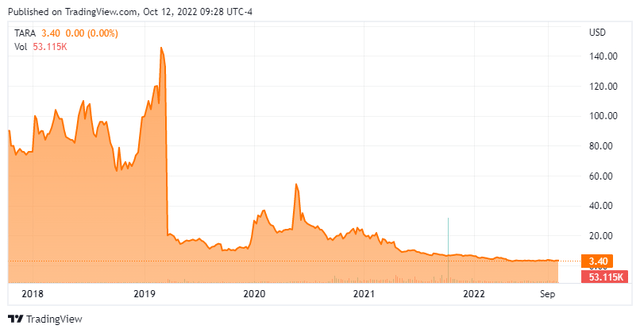

Protara Therapeutics was formed when Proteon Therapeutics merged with privately held ArTara Therapeutics in late 2019. The company is based in New York City and is focused on developing transformative therapies for the treatment of cancer and rare diseases with significant unmet needs. The stock currently trades around $3.50 a share and has an approximate market capitalization of $40 million.

March Company Presentation

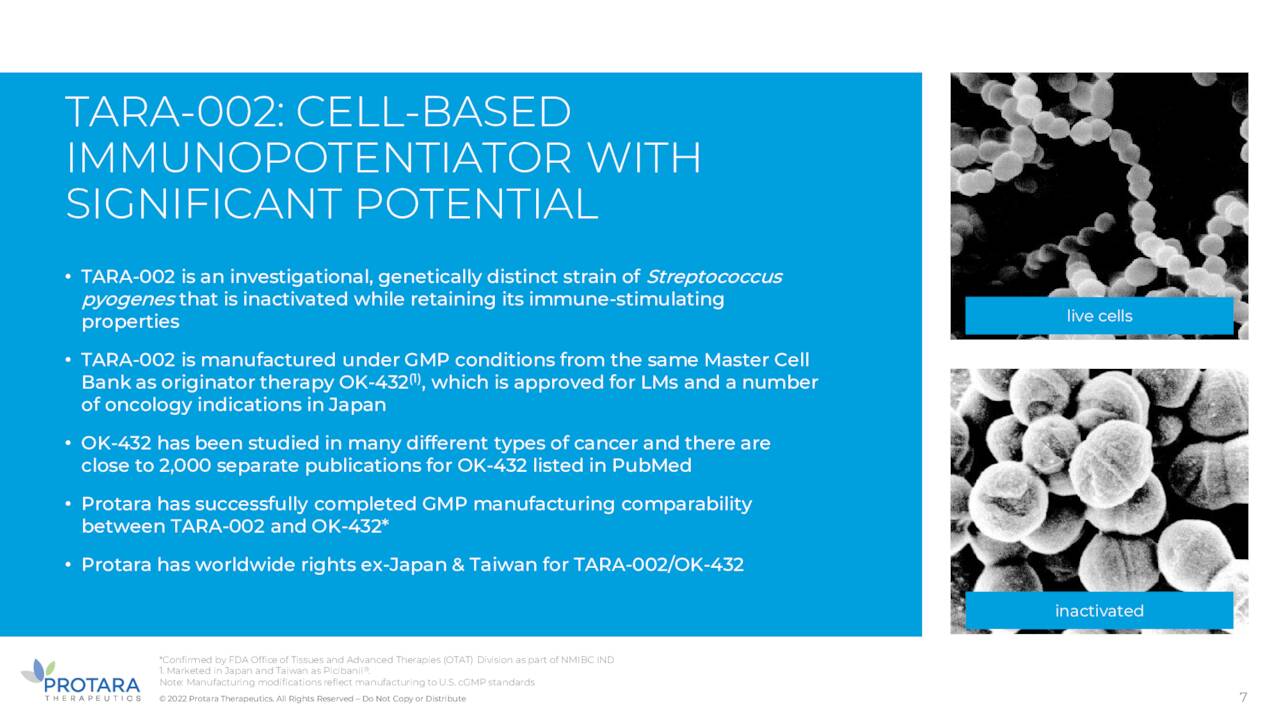

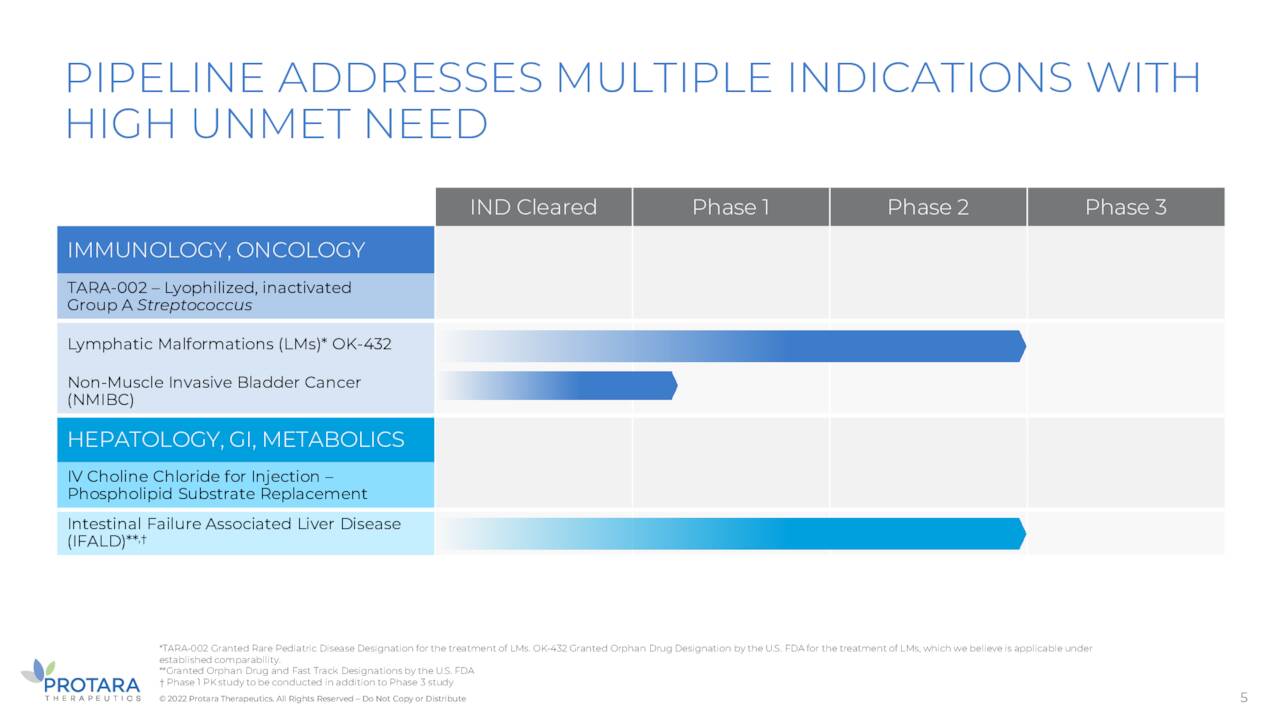

The company’s pipeline consists mainly of one key compound in development. Protara’s lead pipeline asset is TARA-002. It is in development for the treatment of lymphatic malformations [LMs] and non-muscle invasive bladder cancer (NMIBC). It has a Rare Pediatric Disease designation for LMs.

March Company Presentation

The company received preliminary guidance regarding a development path for TARA-002 in lymphatic malformations in the first quarter of this year from the FDA.

March Company Presentation

Management’s plan is to initiate a Phase 2 clinical trial in this indication, subject to alignment with FDA on the clinical trial protocol. LMs are rare, congenital malformations of lymphatic vessels resulting in the failure of these structures to connect or drain into the venous system. Most LMs are present in the head and neck region and are diagnosed in early childhood during the period of active lymphatic growth.

March Company Presentation

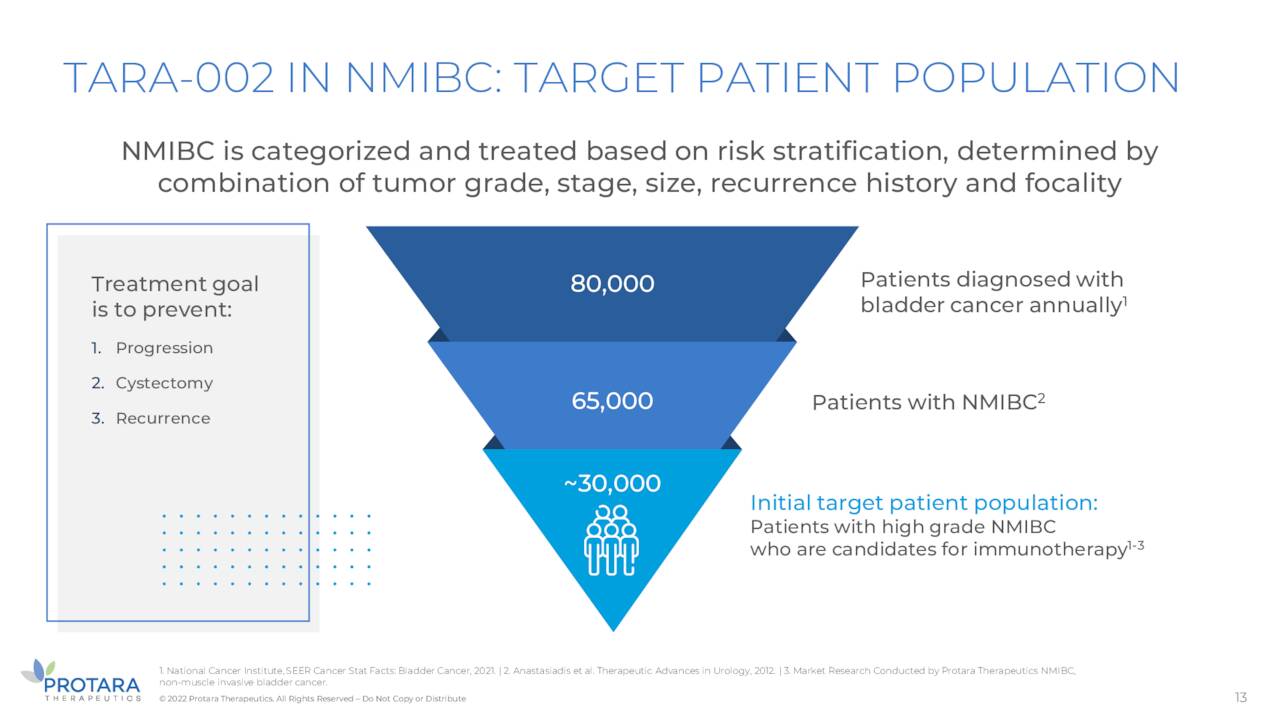

The first patient was dosed in Phase 1 trial evaluating TARA-002 to treat NMIBC in the first quarter of 2022. NMIBC represents 80% of all bladder cancer, which is the sixth most frequent time of cancer in the world. Approximately 65,000 patients are diagnosed with NMIBC in the United States each year.

March Company Presentation

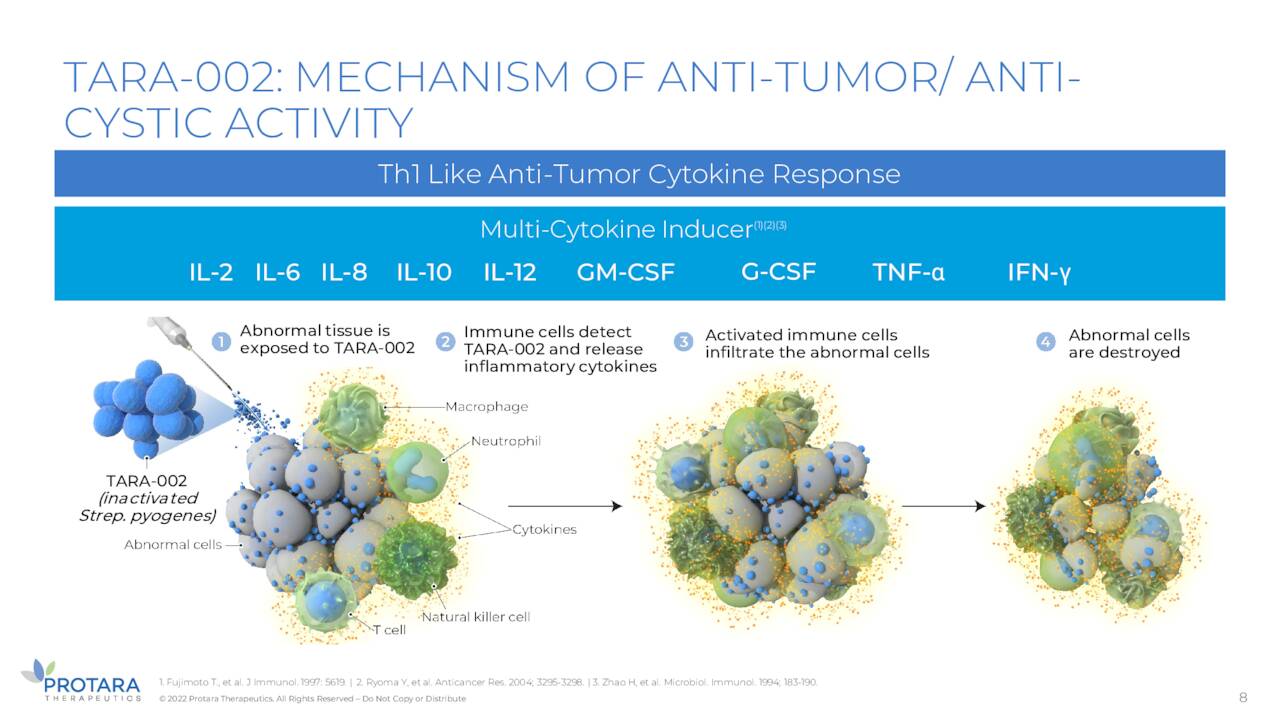

When TARA-002 is administered, it is hypothesized that innate and adaptive immune cells within the cyst or tumor are activated and produce a strong immune cascade. TARA-002 was developed from the same master cell bank of genetically distinct group A Streptococcus pyogenes as OK-432, a broad immunopotentiator marketed as Picibanil® in Japan and Taiwan.

March Company Presentation

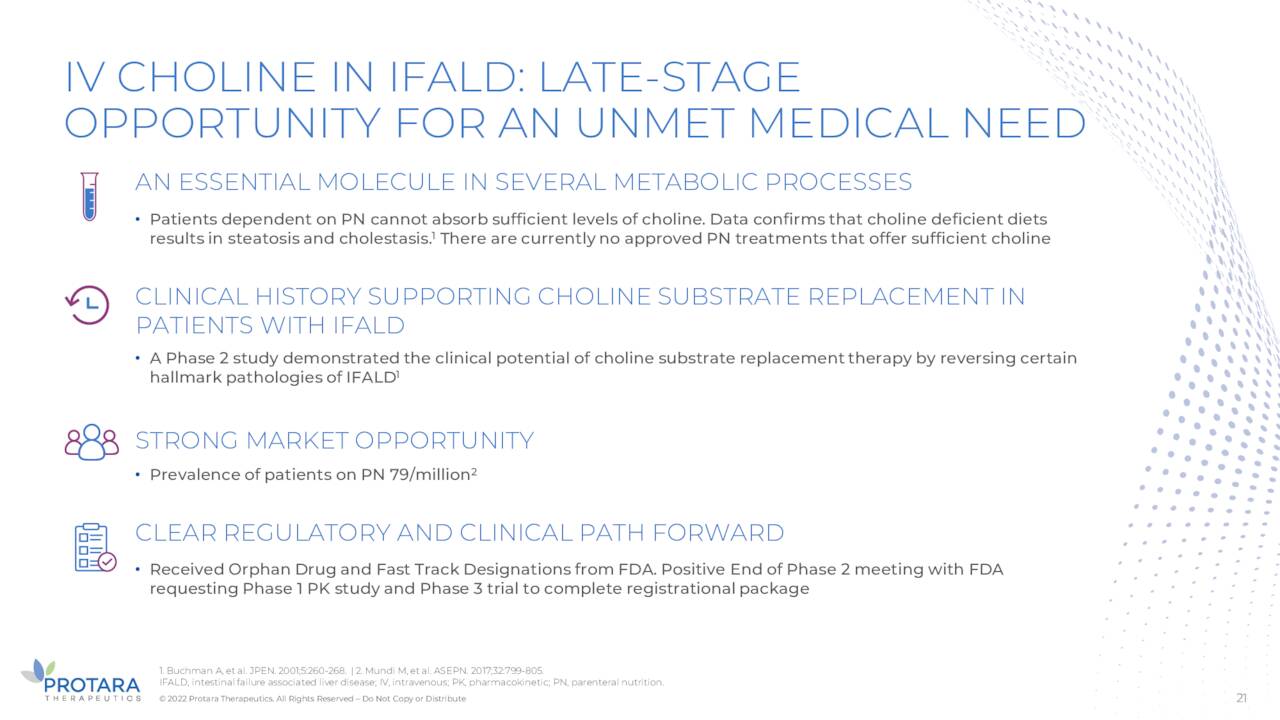

The company is also doing a prospective study to enhance its understanding of the incidence of Intestinal Failure Associated Liver Disease or IFALD in patients dependent on parenteral nutrition that remains ongoing. The company did get a key patent for this potential IV Choline Chloride program in April of this year. This candidate is an investigational, intravenous (IV) phospholipid substrate replacement therapy. There doesn’t seem to be much movement in this program since we last looked at Protara in February of 2021.

March Company Presentation

Analyst Commentary & Balance Sheet:

The company gets sparse commentary on Wall Street. In 2022, Oppenheimer ($32 price target), H.C. Wainwright ($23 price target) and Ladenberg Thalmann ($32 price target) have maintained Buy ratings on the stock. These are the only analyst firms I can find that have chimed in around Protara so far this year.

Approximately two percent of the outstanding float in the shares are currently held short. At the end of the second quarter, the company had nearly $100 million of cash and marketable securities on its balance sheet against no long term debt. Management has guided that this cash balance is sufficient to fund all planned activities until mid-2024. The company had a net loss of $8.5 million in 2Q2022.

Several insiders have been small buyers of the shares throughout 2022, accumulating just over $400,000 worth of new shares in aggregate so far this year. There have been no insider sales of equity in 2022.

Verdict:

Ordinarily buying a few shares in a small biotech concern with pipeline assets and whose net cash dwarves its market capitalization would be a relatively easy decision. Unfortunately, research is not so straight forward with Protara. The last earnings call transcript came out in early May. Its website also seems flagged by my browser due to safety concerns and is unreachable.

This makes getting a good idea on where the company is with its pipeline development very difficult. It is no wonder no other author on Seeking Alpha has published anything focused on Protara Therapeutics since our last article on it more than a year and a half ago.

We ended that piece stating we were awaiting ‘greater clarity on the company’s pipeline progress‘. Nearly 20 months later, that remains our conclusion around Protara Therapeutics.

A giraffe doesn’t waste time quarrelling with rabbits over what the top of a tree looks like.”― Matshona Dhliwayo

Be the first to comment