Printing money vaeenma/iStock via Getty Images

Isn’t this repurchase program nothing but “financial engineering”?

Apparently, some investors don’t believe Naspers’ (OTCPK:NPSNY) and Prosus’ (OTCPK:PROSY) share repurchases will be accretive. They would prefer keeping all those undervalued Tencent (OTCPK:TCEHY) shares, instead of cashing them in to do “financial engineering”.

Yet it is important to understand the math behind the strategy, since it can also tell us where it will likely stop – which is a detail management hasn’t clarified yet.

Here is the math: Imagine you and nine business partners own a company and each of you owns one of ten shares outstanding. In total, the Equity is worth $427, but 75% of the value of your business consists of 10 shares of Tencent, worth $320 in total. Now five of your partners desperately need cash and want to sell out for 60% of fair value, i.e. for $128 in total (value of entire business $427 * 0.6 = trading value $256 * share to buy back 50% = $128). So your company sells 4 shares of Tencent to buy back their stock. As a result, the remaining 5 shareholders own 6 shares of Tencent, hence 20% more on a per share basis compared to the previous situation. Thanks to the transaction, NAV per share has gone up from $43 to $60.

This reflects the situation at Prosus, which trades at a 40% discount and 75% of its NAV consists of Tencent stock. Clearly, the robust discount helps. If it was less, at some point the remaining shareholders would not gain exposure to Tencent following the buybacks, but own less Tencent stock on a per share basis. (Buybacks would still be accretive to NAV, but only thanks to increasing exposure to the other 25% of assets – which the market seems to be far less certain and positive about.)

To keep things simple, let’s keep the above example and imagine the discount shrinks to 80%:

At this point, the entire business is worth still $427, but it trades for $342 (80% of $427). So the selling shareholders get $171 and the remaining five need to sell 5.3 shares of Tencent to fund the buyback. Hence, following the transaction they own slightly less than one share of Tencent on a per share basis.

This is why we should expect the buybacks to stop once the NAV discount will shrink to around 20%. (At least as long as Tencent represents 75% of NAV. If it will be more, repurchases will increase exposure to Tencent on a per share basis even if done at a lower discount, and vice versa.)

You can track the NAV discount precisely on the Prosus and Naspers IR websites.

Why the discount (or the share price) will grow the most at Naspers

The game unfolds like this: Tencent buys back its own stock, thus removing some of the oversupply coming from Prosus which buys back its own stock using the proceeds, while Naspers sells some of its Prosus stock to fund its own repurchases. This is probably what management had in mind when they said the cross holding structure would absolutely “simplify” things… (And this is what I had in mind when I called it “a clown car in a gold mine”.)

Anyway, this is what we have to deal with. At least management finally woke up and adopted the only rational solution to the problem which had been proposed early on by yours truly in the article I just linked to.

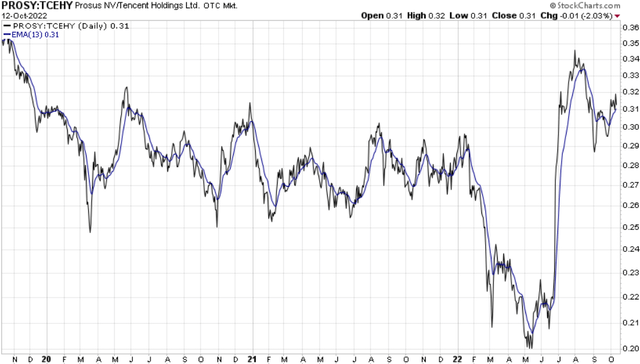

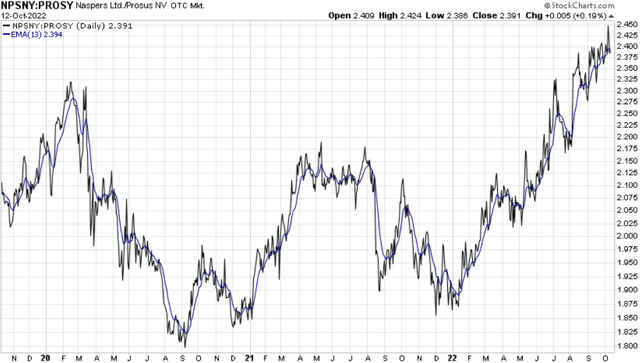

Since the buyback program has been announced, Prosus has outperformed Tencent by a large margin, while Naspers has greatly outperformed both Tencent and Prosus:

PROSY/TCEHY ratio (Stockcharts) NPSNY/PROSY ratio (Stockcharts)

As I had complained in the article mentioned above, the exchange ratio of 2.27 Prosus shares for each Naspers share used in 2021 to establish the cross holding structure was very unfair and I expected better times to switch between the two. – So has this time arrived now, since the ratio is around 2.4?

Well, the repurchase program has changed some dynamics and one of its most interesting consequences is that, over time, it should actually increase the NAV discount at Naspers – if the market does not correct the valuation. And this is what is apparently happening: The stock market understands that Naspers will benefit the most from the buybacks and steadily increases the Naspers/Prosus ratio.

Here’s how this works and how long it will work:

The repurchases started at the end of June. Since then, Prosus has bought back 4% of shares outstanding, spending about $3.6B or $36m per day. To keep its ownership steady at around 42%, Naspers needs to sell 42% of Prosus’ repurchases and will use the proceeds to repurchase its own stock. Hence, Naspers should buy back about $15m of its own shares per day. For the sake of simplicity, I will ignore repurchases by Tencent, which are relatively small compared to the size of the company and, while certainly accretive to its intrinsic value, don’t really move the needle.

So, here is how much value would be generated by these repurchases, unless market prices change:

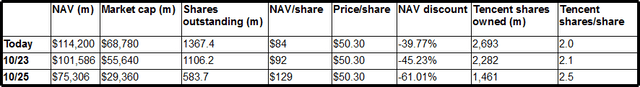

Value creation at Prosus (Own projections)

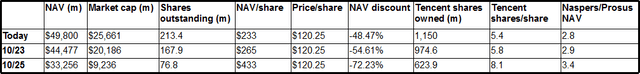

And here is Naspers:

Value creation at Naspers (Own projections)

(In these calculations I also assumed that the valuation of all other assets owned by Naspers and Prosus besides Tencent remains steady throughout the period.)

We can see that, thanks to the buybacks, Naspers’ NAV per share gets a huge boost. Buybacks are also accretive for Prosus, albeit at a slower pace. Naspers’ NAV per share grows 86% over three years, while Prosus’ increases by 54%. This is why the Naspers/Prosus ratio has increased lately, i.e. Naspers has outperformed Prosus. It is not only because Naspers has the greater NAV discount – but also because this discount is certain to increase even more if the share price doesn’t move up.

We can also see that after three years Prosus shareholders would own 25% more Tencent stock per share compared to today. However, this ratio increases far more at Naspers, whose shareholders boost their Tencent holdings per share by a whopping 51%.

Should you switch to Prosus?

I guess the question has already been answered: Prosus should outperform Tencent as long as the NAV discount is higher than 20%, and Naspers should outperform Prosus as long as its NAV discount is higher than Prosus’. There is no perfect Naspers/Prosus ratio which can inform your decision to switch: Thanks to the buyback program, it has become a moving target and will likely grow as long as repurchases continue.

How is this investment not like printing money?

Actually it is as sure a thing as printing money! The only caveat is that it still depends on the financial success of the currency we are printing, i.e. Tencent. If Tencent continues to fall, neither Prosus nor Naspers will be great investments, although they clearly represent a hedged bet on the Chinese giant. If Tencent goes down, you will probably lose less by investing in Naspers, if it recovers, you should probably make even more by owning the stock indirectly through the South African holding company.

Be the first to comment