Fahroni

I have been looking at my investments over the last month and I have to make some decisions. I have a large position that is starting to get closer to my estimation of fair value, and I plan to start selling it off piece by piece. I have a couple reasons for this, from funding my Roth IRA for the year to building up some cash for when I move this spring. The position is large enough to do both and leave some dry powder left over which I plan to put to good use. Some of the dry powder will end up in shares of NewLake Capital Partners (OTCQX:NLCP).

Investment Thesis

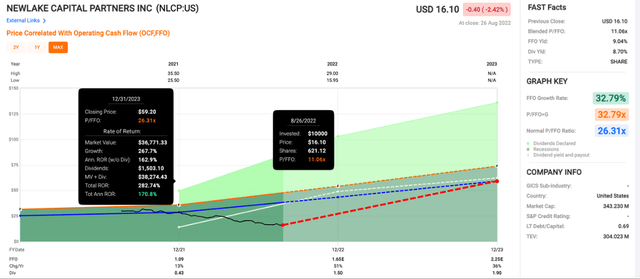

NewLake Capital Partners is a small cap REIT focused on cannabis cultivation properties across the US. They target limited license jurisdictions to limit their risk and have double digit cap rates with 2-3% rent escalators across their portfolio. Shares are down over 40% YTD as the selloff in cannabis REITs has been worse than broader markets. This has opened up an opportunity, as shares are now sitting at 11.1x price/FFO. I think we will see multiple expansion, and a 15x multiple would be conservative given NLCP’s rock solid balance sheet and FFO/share growth expectations. Shares now have a forward yield 8.7%, and it could be even higher if the pattern of quarterly dividend hikes continues. I was buying in the mid-20s, and I plan to buy a lot more as I sell off one of my larger positions to raise some cash.

Overview

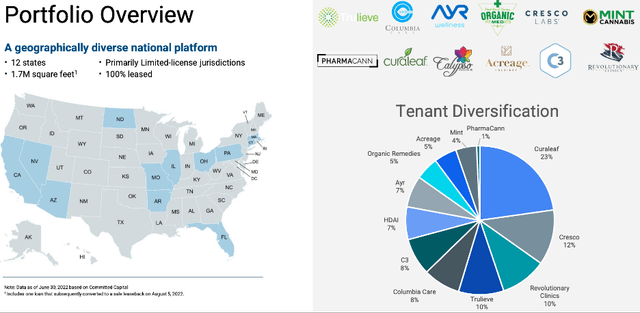

For those of you that might not be familiar with NLCP, I will lead off with a brief summary. The REIT owns properties (primarily cannabis cultivation facilities) across the US. They have made it a focus to target limited license jurisdictions, which management believes should help them weather any difficulties with tenants. Their tenant list is made up some of the largest public companies, like Curaleaf (OTCPK:CURLF), Cresco Labs (OTCQX:CRLBF), Trulieve (OTCQX:TCNNF), as well as several private companies. Due to the limited capital available to the cannabis industry, they can get double digit cap rates with rent escalators at 2-3%, which should lead to impressive FFO/share growth.

While the tenant concentration might be a red flag for some, it is bound to happen with the size of the larger players in the industry, especially when you consider NLCP only currently has 31 properties. I’m not too worried about it, and the tenant concentration has come down since last year, a pattern I expect to continue. There have also been several developments of note in Q2 worth mentioning.

C-Suite Shakeup & Credit Revolver

Over the last couple months there have been several changes to NLCP’s front office. This includes the promotion of President Anthony Coniglio to CEO. It seems to me like this was part of the succession plan. He was on Seeking Alpha’s CEO Interviews series after the IPO, which I would recommend watching if you are interested in investing in NLCP. Despite it being from December, most of what they discussed is valid today. They also brought in Lisa Meyer as CFO, replacing the previous CFO who recently retired. I’m not too worried about the executive suite turnover because it looks like it has been planned for at least a couple years.

One of the other major developments in Q2 was the addition of a credit revolver. The original agreement was for $30M, but in July they bumped it up to $90M adding to their dry powder. The rate is set at 5.75% and is fixed for three years. After that, the rate is floating. I expect they will continue to tap debt markets as needed for capital because the balance sheet is still rock solid and it wouldn’t make much sense to issue equity, especially with shares at current levels.

Earnings Call

I typically skim earnings calls, especially for the companies that are among my larger positions. While most of it confirms what I already knew from reading quarterly reports, investor presentations, and articles, I did see something that I found interesting in the most recent earnings call.

I would note that approximately 90% of our capital is invested in properties where the operator is vertically integrated in the state. We always consider price compression in our underwriting and we utilize quarterly property level financial information we received to vigilantly observe financial performance at our properties, allowing us to identify emerging financial pressures.

This approach reminds me of another net lease REIT that I own, STORE Capital (STOR). They also get property level financials which gives them more insight into how each property is performing and how it integrates into the larger business. This brings me to the balance sheet, which is rock solid.

The Balance Sheet

Despite NLCP’s small cap status, the balance sheet is a solid as it gets. They have the real estate portfolio, plus $49.6M in cash and $35M in loans receivable at the end of Q2. The cash balance has been decreasing as they have continued to acquire new properties, and despite the $90M revolver, they have plenty of capacity to add debt to fuel new acquisitions. While the FFO multiple makes it obvious to me that NLCP is undervalued, the balance sheet just reinforces that for me.

Valuation

While finding undervalued stocks and REITs hasn’t been easy over the last couple years, the cannabis REIT sector has gotten more attractive as the selloff has been nonstop since the beginning of the year. NLCP is no exception is down 44% YTD. NLCP is currently sitting at a price/FFO of just 11.1x, which is way too cheap in my opinion. While the average multiple isn’t that helpful since NLCP has even been public for a year, I think we will see multiple expansion sooner or later.

I think a 20x multiple would make sense with NLCP’s balance sheet and projected growth, and you could even argue for more multiple expansion than that. Even if we only see multiple expansion to 15x, we are looking at double digit returns for several years to come. The other reason that NLCP looks undervalued to me is the large dividend yield, which has only gotten larger as the selloff in shares has continued.

The Dividend

Just like the other relatively new cannabis REITs, NLCP doesn’t have a long track record of dividend raises. It has, however, raised the dividend each quarter since the IPO. It was raised from $0.31 to $0.33, and more recently to $0.35. I’m not counting on continued dividend raises, but as a shareholder, I would love to see it. The forward yield is now sitting at 8.7% if they just maintain the dividend. With their cap rates and expected growth, I think the long-term future is very bright and I’m expecting dividend raises to continue for several years, even if doesn’t come every quarter.

Conclusion

NLCP is wildly mispriced in my opinion. While there has been some shuffling in the C-suite, the rock-solid balance sheet and portfolio approach has me very bullish on the long-term future of the company. They recently added $90M with the revolver at attractive interest rates and should be able to tap debt markets in the future as necessary. The company has targeted limited license jurisdictions which should limit risk, and the cap rates and escalators should lead to attractive long-term returns.

One of the other pieces that should lead to attractive returns is the dirt-cheap valuation at 11.1x price/FFO. I think we will see multiple expansion, anywhere from 15-20x price/FFO as the company continues to post solid results and likely dividend raises. With a huge 8.7% yield, NLCP is set to deliver double digit returns as the company continues to grow its real estate portfolio. I have been long since shortly after the IPO, and I plan to add more shares in the next couple months because I think the risk/reward is heavily skewed to the upside with NLCP.

Be the first to comment