Morsa Images/DigitalVision via Getty Images

O is for Optimism

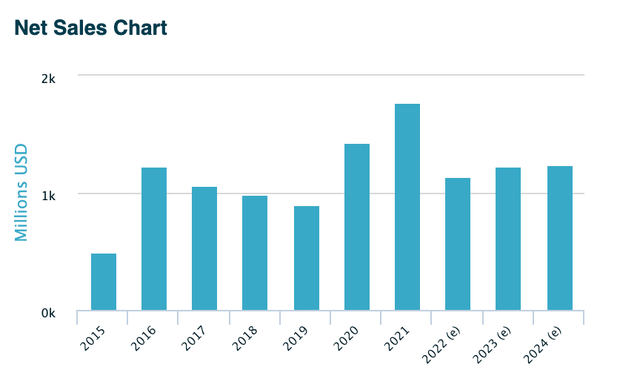

OPKO Health, Inc. (NASDAQ:OPK) is in the diagnostics and pharmaceutical business internationally. The stock has disappointed us for a long time. The share price stumbled and tumbled every year from 2015. Then it almost hit $18. Over the last 12 months, the stock price roamed between $2.79 and $5.25. It is down nearly 16% in that time.

Nevertheless, there is a lingering sense of optimism about OPK. We have bought and sold and followed the stock for years. The Chief Executive and Chairman, Dr. Phillip Frost, ponies up his own money buying shares in big lots. He sets the tone, speaking enthusiastically about the swarm of aspirational projects. The result is exploding revenue growth. OPKO has healthy free cash flow and manageable debt. Yet, the company remains unprofitable.

The consensus among Wall Street analysts is the stock deserves a bullish rating. Four out of five Seeking Alpha authors have concluded it is worthy of a buy or strong buy over the past 18 months. One analyst is forecasting earnings will jump +55%.

Hold for the Headwinds

We think revenue will slip in 2022 from the 2021 record year. COVID-19 testing numbers are dropping. Governments and insurers want lower prices for pharmaceuticals. Earnings per share will be -$0.04 in Q1 ’22 in contrast to +$0.05 EPS for the same quarter last year. The next financial report is due on May 9, 2022.

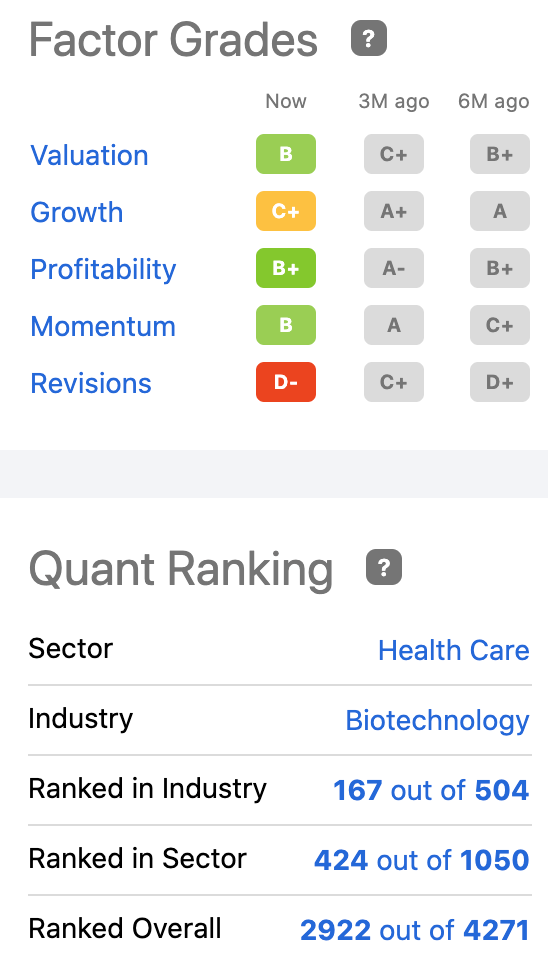

SA’s Quant Rating is a secure hold and SA concludes the current price is a fair valuation. Though we tend to the bullish side, we are more comfortable with the hold for several reasons. The stock has been and we believe will continue to be a high-risk investment.

Sales (www.infrontanalytics.com/fe-EN/34120NU/OPKO-Health-Inc-/Beta)

Shares are down 57% over the last five years. They occasionally spike over $5 on tidbits of good news. Any sizzle is usually over the rollicking purchases of shares by Dr. Frost. The price popped in March from $3.12 to $3.74 on news Dr. Frost bought another 350K shares. He owns an estimated 228M, giving him about 29% ownership.

Earlier, in January ’22, shares topped $5 on several pieces of news: OPKO announced the sale of its GeneDx subsidiary. Countries approved their drug for pediatric hormone deficiency. The FDA, however, issued a Complete Response Letter rejecting the company’s approval to market the drug in the US at this time. Shares plummeted almost 21%.

Shares rose 5% shortly afterward. On that day, OPKO’s RAYALDEE launched sales in Germany, and the company announced Dr. Frost had bought another 150K shares.

In the pharmaceutical sector, OPK is in Phase 2 studying the effectiveness of RAYALDEE to “mitigate the severity of upper respiratory tract infections and speed up recovery from COVID-19.” But getting RAYALDEE into the US market is a long way off. Some European countries approved it for treating certain conditions of chronic kidney disease.

The company’s BioReference Laboratories offer a full gamut of testing and related services. They served 11M patients last year in specialty markets including oncology, urology, women’s health, maternal-fetal medicine, genetics, and COVID-19 testing.

We do not expect OPKO to keep up the pace in 2020 and 2021. Revenue from COVID-19 testing in 2022 will be less. The federal government budget for free test kits failed to pass. Don’t expect the uninsured and underinsured to pay $125 to $400 for COVID-19 tests. Cruise lines are increasingly requiring passengers to obtain pre-cruise tests at their own expense. Correctional facilities’ budgets are strained and a target for state budget cutbacks.

Factor Grades Quant Rating (seekingalpha.com/symbol/OPK)

OPK faces other headwinds. There is not much coverage in the media about OPK. Articles average about three per week. Half are now bullish and half bearish on the stock. While Dr. Frost continues accumulating shares, hedge funds are selling. Funds decreased their holdings by about 624K shares last quarter. OPK does not pay a dividend. Short interest now stands at +10.5%.

The stock has a levered Beta of just under 1, so it is a tad less volatile than the market. The shares drifted down to $1.69 before COVID-19 testing gave them a big lift.

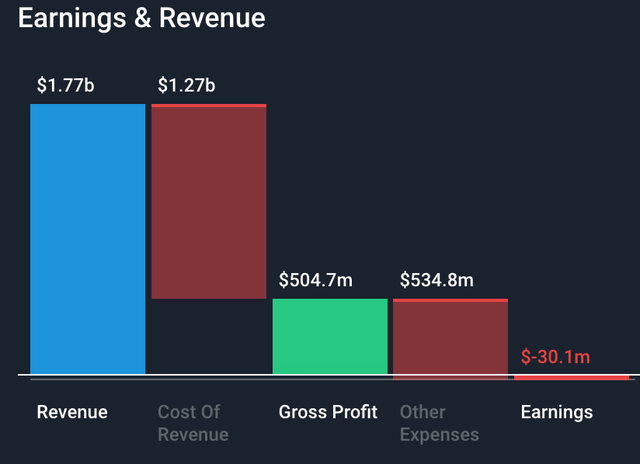

2021 was a record year for revenue. It came in over $1.7B. Japan and the EU approved the sale of OPKO’s pediatric hormone therapy. Canada and Australia also approved it for sale. BioReference closed the year with a record $1.6B in revenue. The news should have driven shares higher, but their price moved down from $4.74 into the mid-$3.

Pharmaceutical revenue increased ~15% in Q4 ’21. The increase was offset by a decrease in diagnostics from $457.9M to $362.8M for the same quarter YOY. OPK is currently net unprofitable. We see a revenue decrease in 2022 of about 4%. Earnings will not likely be positive either over the next three years. Other biotech companies expect on average a 13% growth in 2022 revenue.

Earnings & Revenue (simplywall.st/stocks/us/pharmaceuticals-biotech/nasdaq-opk/opko-health#ownership)

Assets total 2xs liabilities at the end of 2021. Debt is not an immediate worry, but worth noting. Debt closing 2021 was $204.85M. Equity totaled $1.685B. Debt during years of cheap money rose, but equity decreased. The debt-to-equity ratio increased from 4.5% to 12.2% over five years. In the future, we are going to see higher interest rates on borrowed money and tighter money. This might be problematic to all unprofitable companies.

Cash is Life

The subsidiary sale is said to generate $150M in cash plus other income. The company holds $134.7M in cash and equivalents. OPKO has $265.6M in receivables and $97M in inventory. Its $283M short-term and $370M in long-term liabilities are covered. Free cash flow leaves OPKO with a cash runway for the next three years. The market cap was $3.13B in January 2022 but now stands at $2.4B.

Bullish analysts set the average target price at $6 over the next 12 months. That represents a 67% increase from the current price. One analyst sets it at near $7. Another has a fair value at $10.46 per share. Optimism. OPK’s price-to-book ratio is 1.4x while the average for the biotech industry is 2x.

Takeaway

Dr. Frost and his management team have been able to build an impressive company. Its products benefit humanity. At the same time, the products and marketing built a stellar revenue base. At some point, we hope it will report strong net earnings and enrich investors.

86-year-old Dr. Frost is the founder, mover, and shaker at OPKO, he should live and be well. He owns almost 30% of the shares; the Vice-Chair owns 4.8%. Both are in their 15th year with OPKO. Management is in place for a long time and is extremely knowledgeable about the industry. But we don’t see any organic growth, in particular, to spark the share price. There is a possibility lurking that other biotech firms might have an interest in parts of OPKO or the whole shebang.

Dr. Frost must see it. The billionaire has been a rock star in the healthcare field since the Viagra days. It will take more than his smile and enthusiasm to keep up with the optimistic price targets, though. It might be time to consider another way to resolve investor frustration and fatigue.

Be the first to comment