fotokostic/iStock via Getty Images

Fertilizers have been coming into the spotlight recently due to the tensions in Ukraine. In this article, I will give an outlook on fertilizer pricing based on new trends and correlations.

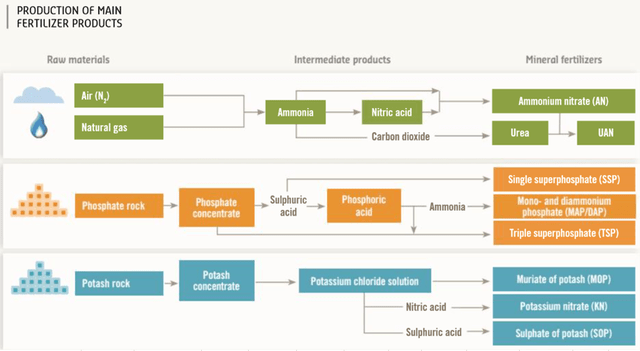

Before going into the details, it is important to know that fertilizers consist of 3 key nutrients: nitrogen (N), phosphate (P) and potash (K). The production process of each of these 3 types of fertilizer is given in the figure below.

Nitrogen is taken from the air and converted into ammonia using the Haber-Bosch process. It is then further refined into urea. Important to know is that this process involves the consumption of natural gas. This is why nitrogen fertilizer is mainly produced in countries with cheap energy, like Norway and the Middle East. Phosphate is mined from phosphate rock in open pit operations around the world. Most of the production of phosphates are coming from countries like China, Morocco, U.S. and Brazil. The last fertilizer is potash, which is mined from underground brine operations. Most of the potash production is coming from Canada and the other part is coming from Russia and Belarus.

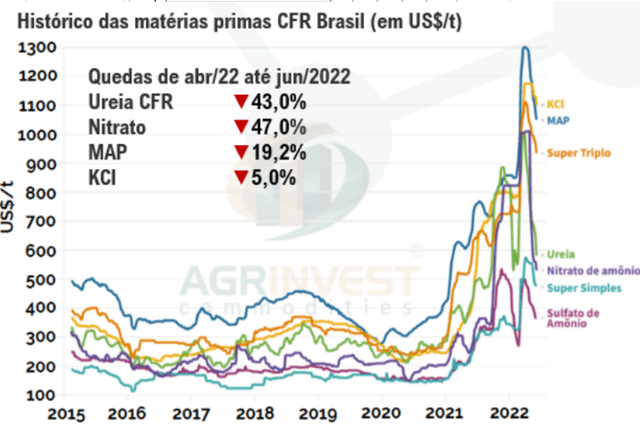

To predict fertilizer prices, it is important to know that all 3 types of fertilizers are correlated to each other even though they are produced in different ways (see chart below from Agrinvest).

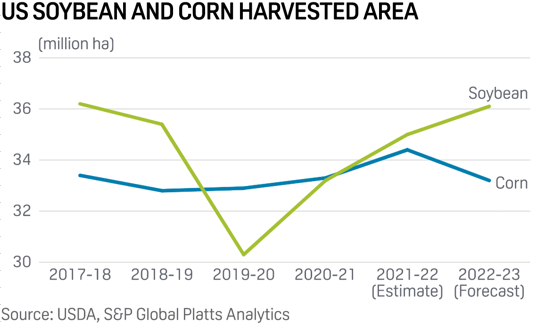

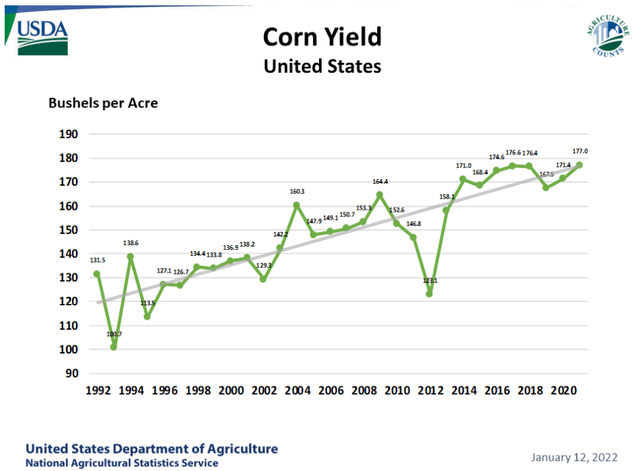

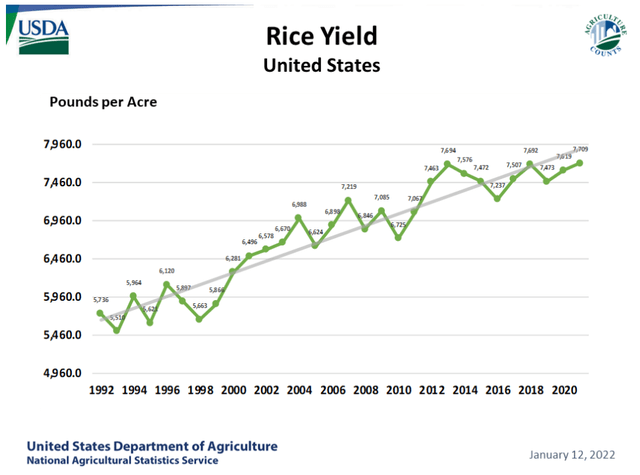

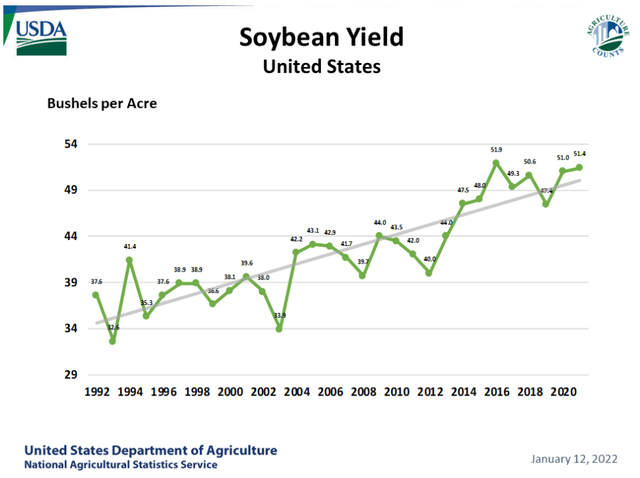

The reason for this correlation is that when one of these fertilizer types rises/falls, it will alter the behaviour of farmers in producing crops. For example, when nitrogen fertilizer rises too much, farmers will switch from producing corn (which is nitrogen intensive) to producing soybeans (which don’t require nitrogen). The chart below from the USDA shows how farmers switched to soybean production due to high nitrogen fertilizer prices.

USDA, S&P Global Platts Analytics

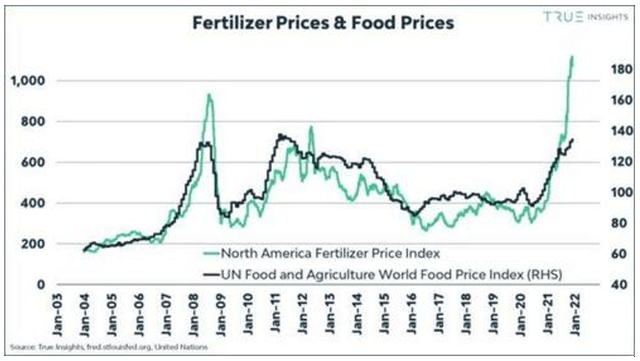

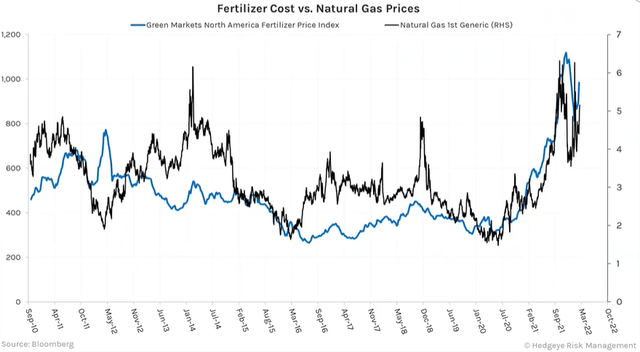

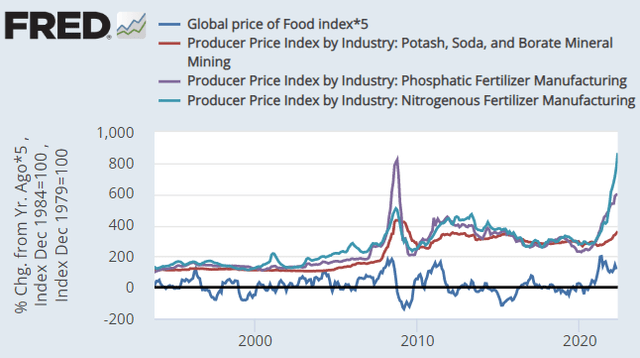

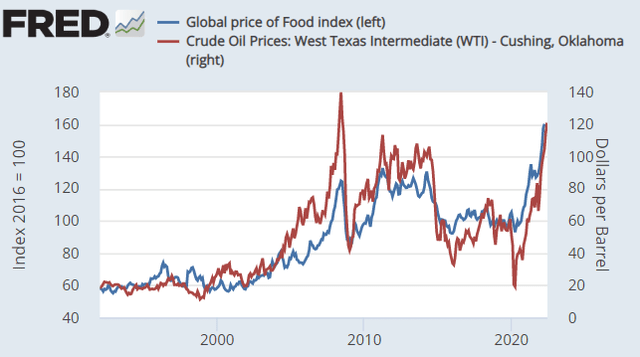

Now let’s move on to the key drivers of fertilizers. I believe fertilizers are heavily correlated to 2 things: food and energy. These correlations are shown in the charts below. If one is able to forecast the outlook for food and energy, he will know the outlook for fertilizers.

True Insights Hedgeye Risk Management

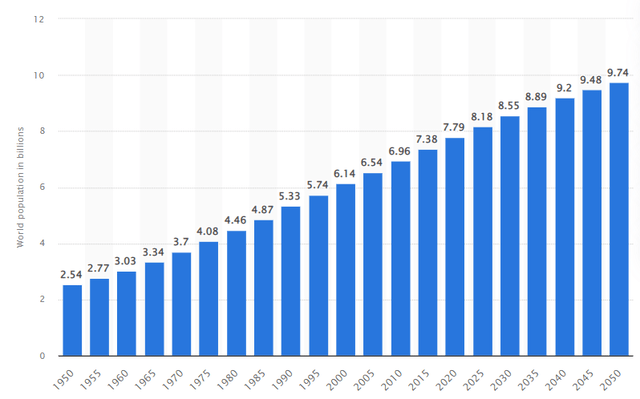

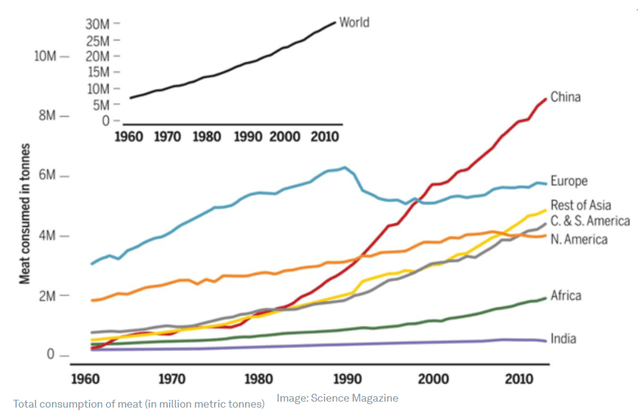

Let’s start with food first. I always like to look at any commodity from a demand and supply perspective. Food demand comes from a growing population, which is clearly in an uptrend. The world is also eating increasing amounts of meat, which requires a lot of animal feed.

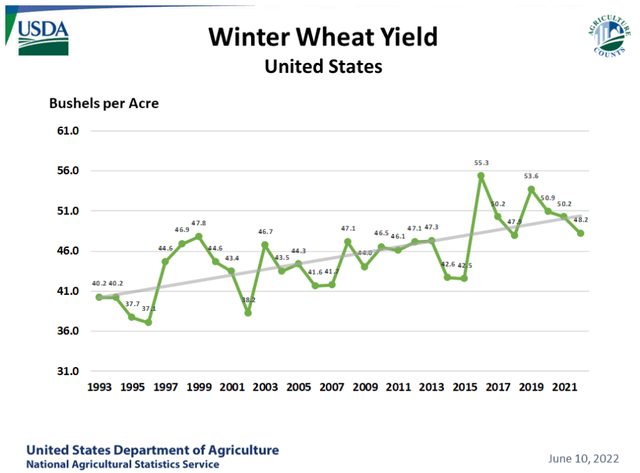

Food supply on the other hand is hitting its limits as crop yields are starting to stagnate after a huge run-up led by the third agricultural revolution of genetic engineering. Increasing drought and the solar minimum will also reduce crop yields.

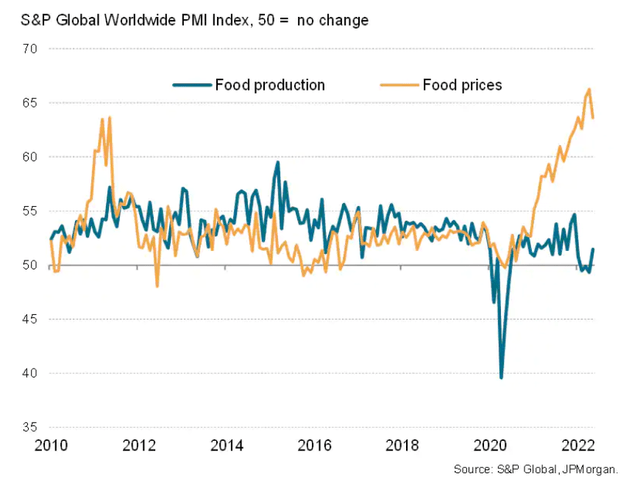

Food production has not kept pace with the rise in the price of food, so I expect food prices to stay elevated for some time.

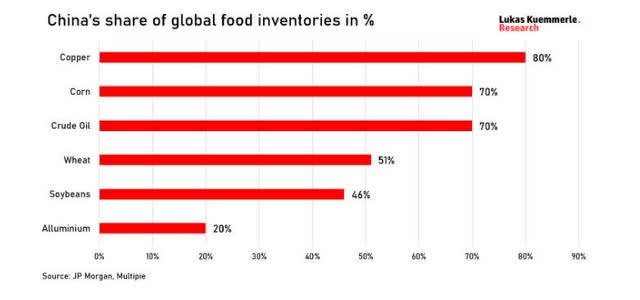

China is actively preparing for food shortages as they have stored almost 60% of global food inventory.

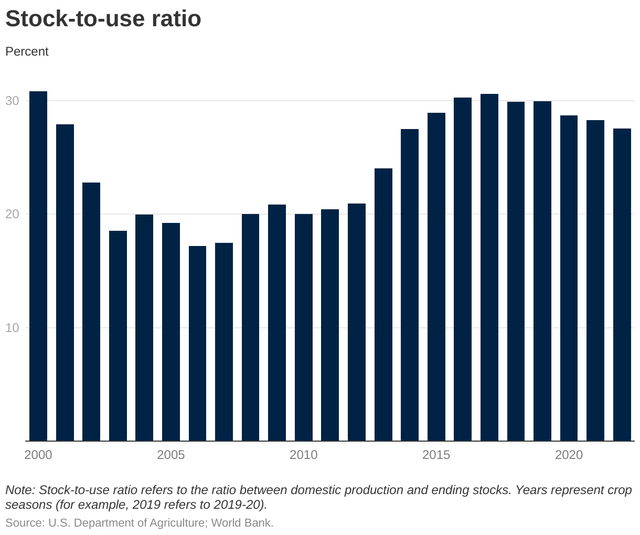

A key indicator for food prices is the stock to use ratio, which is starting to decline (see chart below from the World Bank).

In conclusion, food prices will keep on rising due to favourable demand and supply economics and will support fertilizer prices as shown on the chart below.

Next up, let’s discuss energy. Food and energy are heavily intertwined because it takes energy to produce food. Farmers use propane and diesel trucks on their farms. Fertilizers need natural gas as raw material, and transportation also requires energy.

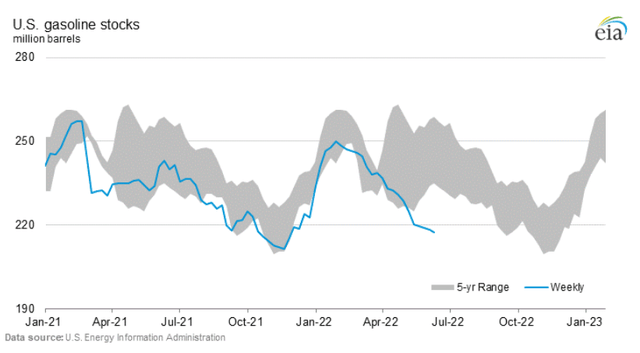

On the demand side, we don’t see a lot of demand destruction yet, even though energy prices are high. On the supply side we see very low inventory levels for oil, gasoline and natural gas which will support higher energy prices.

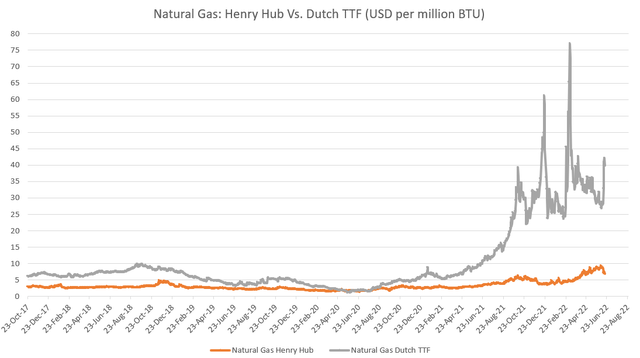

European natural gas prices have shot up in the past year due to supply disruptions and are likely to push up U.S. Henry Hub natural gas prices due to this arbitrage spread (see chart below).

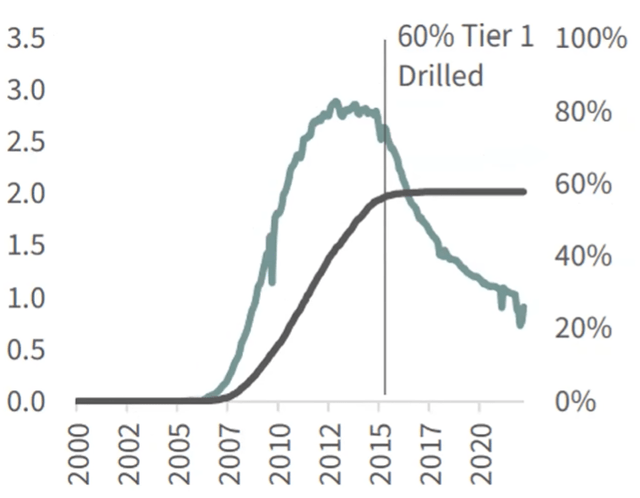

Moreover, a fundamental shift has taken place in the U.S. natural gas sector. According to Goehring & Rozencwajg, shale gas production is close to peaking. The reason being that over 50% of those shale gas reserves have already been produced. The chart below shows the production from the Fayetteville shale field. Production starts declining when 60% of the field has been drilled.

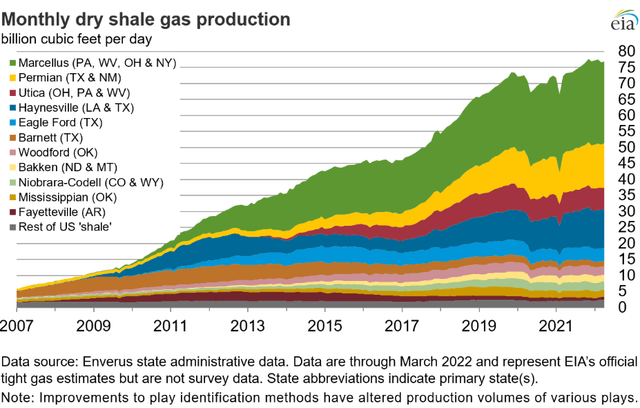

The following chart from the EIA shows that shale gas production is topping out.

In conclusion, energy prices are likely to go higher due to favourable demand and supply economics and will support higher fertilizer prices in the coming years.

On a final note, I believe the world is in need for another agricultural revolution for a sustainable path forward. The first agricultural revolution involved the transition from hunting to agriculture and settlement. The second agricultural revolution introduced equipment to increase farming yields. The third agricultural revolution was based on the invention of genetic engineering of crops. The fourth agricultural revolution has just started and involves the application of microbes in fertilizers and the soil to increase crop yields, nitrogen fixation, phosphate solubility, potash solubility, drought resistance, pest resistance, salinity stress resistance, chlorophyll production, carbon uptake and glyphosate reduction. Many companies are transitioning into this space, one of which is Verde Agritech (OTCQB:AMHPF). Interested investors can read my article on Verde Agritech to learn more about the company.

Be the first to comment