z1b/iStock via Getty Images

Co-Produced with Treading Softly

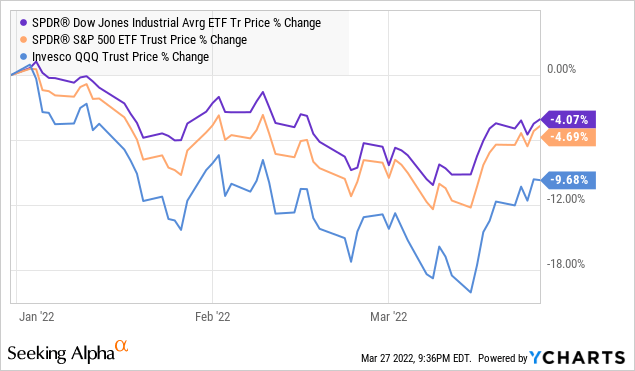

The market is a real downer this year.

It doesn’t take a “market expert” to know that returns for the broad market have been negative.

Yet in many areas of the market, we’re seeing selling for no other reason than “The price is down” or “This internet expert said it’s a bad company”. I also encourage investors to do due diligence, read, research, and discuss.

So while the market is beating down some of our Model Portfolio holdings, I’m happily buying more and more. We can see our income grow massively from the misunderstanding of others. They blindly look at 10-year charts and say “See! It’s bad!” while lacking a basic understanding of why those 10 years were rough for any particular pick. That lack of study makes me sad for them, while I am happily buying their shares.

Let’s look at two picks that as they drop, I’m buying more and more.

Pick #1: AGNC – Yield 10.8%

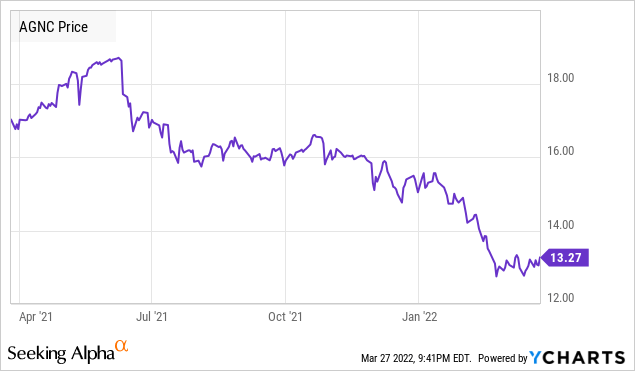

AGNC Investment (AGNC) is a stock that generates a lot of strong opinions. This is something I frequently see when the dividend yield is very high, but the price is down. No doubt about it, agency mREITs have had a really tough run when you look at the share price.

Since June of last year, AGNC is down over 30% in price, which any bear will be happy to remind you is greater than the dividend paid.

If you bought in June and are selling today, AGNC has been a terrible loss in your portfolio. There are two solutions that solve that problem. You can get a time machine and tell yourself not to buy it in June 2021. My time machine just broke, so that’s off the table. You can just not sell at today’s price, after all, why would you sell? Just because the price is low?

When investing, it is important to keep our eyes on the fundamentals. The market is fickle, prices change, sometimes rapidly. In the long run, the market’s price isn’t going to account for much of our return from AGNC. Since IPO, AGNC has paid out $44.32 in dividends. So since IPO, approximately 80% of total return came from dividends. As time goes on, that number will continue to grow. There are two ways to invest in AGNC. You can try to trade frequently trying to catch the price swings, or you can invest and hold for the dividend recognizing that most, if not all, of your return will come as dividends.

What has changed since June 2021 when the market was willing to pay a lofty $18/share for AGNC?

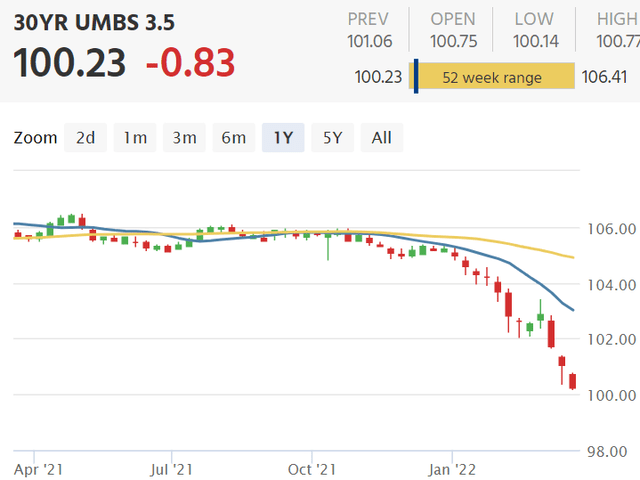

The main driver of the current share price has been a decline in book value. Agency MBS has fallen off a cliff, which accelerated significantly in February 2022.

Clearly, the market is following book value. AGNC comes out with a report that book value was $13.48/share on February 28th, and the price falls the same day. “Book value is falling!!!” “The price “always” goes down!” “AGNC is terrible!”

Good. Panic. Sell all your shares. I’ll buy them.

You see, I didn’t buy AGNC because I thought book value would go up. My thesis was never “buy this, the book value will go up and then I’ll sell”. When I bought AGNC, my goal was not to sell to someone at a higher price. AGNC’s price can fall to $5/share and sit there forever for all I care, that is the kind of thing I dream about.

Why did I buy AGNC? For the income. So, if the falling prices indicate a threat to that, then I might be concerned.

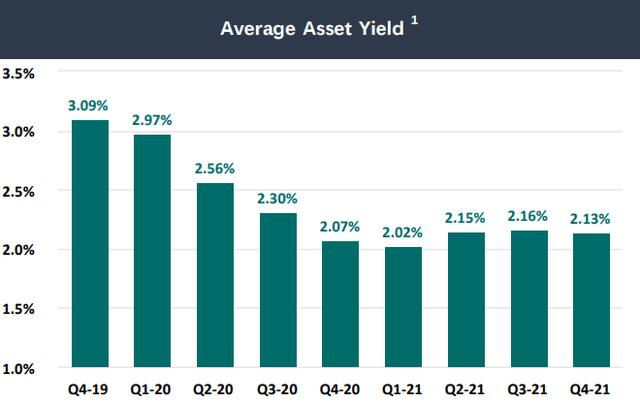

What is causing book value to decline? The spread between agency MBS and US Treasuries is getting wider. Agency MBS is getting cheaper, and is, therefore, more profitable. We’ve discussed before how AGNC makes its income. Average asset yield, minus the cost of funds = net interest spread. The higher the net interest spread, the higher AGNC’s net investment income.

What happens when MBS prices come down? The average asset yield goes up. Here is what happened to the average asset yield over the past two years, note it dropped from a little over 3% to 2.13%.

Q4 2021 Stockholder Presentation

This headwind was made up for by the Fed slashing the target rate to 0%, keeping the cost of funds minimal.

Today, 3.0% coupon MBS are trading right around par – so they are yielding 3%. In other words, AGNC’s asset yield is going to go back to being around 3%. A good 0.8% to 0.9% higher.

Of course, the cost of funds is going up too. But how much? The Fed approved a 0.25% rate hike. So AGNC’s asset yield is going up about 0.8% on new investments, and its cost of funds is going up about 0.25%.

In my crazy world, revenues climbing faster than expenses is a positive and a reason to buy a stock. Not a reason to sell it at a loss!

Here is CEO Peter Federico on the last earnings call:

Wider mortgage spreads adversely impact our book value in the short run, but benefit our business over the longer run. The net present value of our business can be thought of as the expected return on our existing portfolio, combined with the expected return on the new investments that we add over time. If an Agency MBS investor is well-positioned and enters a period of spread widening with lower leverage as we have, our business benefits in two ways. First, with respect to our existing portfolio, wider mortgage spreads can improve the flows on higher coupon specified pools through slower prepayment speeds and reduced premium amortization expense. Second, with respect to our future portfolio, wider spreads obviously improved the return on new investments. For example, a 25 basis point widening in spreads levered 8x, improves the ROE on new investments by 2.25%.

AGNC has been expecting the prices of MBS to come down and has waited patiently for it allowing its leverage to decline. As MBS paid off, it didn’t reinvest. Now, MBS prices have come down and AGNC is likely starting to back up the truck to load up at high yields. AGNC’s book value is lower, but its earnings power is much higher.

History says that spreads will probably tighten again. That will drive book value back up. I’m not in the business of predicting what book value will do next month. It might happen next month, in 3 months, maybe next year. AGNC uses a lot of leverage, so book value is volatile. It goes down, it comes back up, then it goes down again. I disagree with those who think that book value is an effective way to value the company.

What I’m concerned about is will AGNC be able to cover the current dividend? To which the answer is a definitive yes. AGNC is covering and will continue to cover it with ease for the foreseeable future.

Will AGNC raise the dividend? To which the answer is they have plenty of room to do so. AGNC already had 208% dividend coverage, and now it is able to invest at even higher spreads, generating even higher returns.

So while others are selling AGNC because the book value is down, I’m buying because the income is strong.

Pick #2: RNP – Yield 6.5%

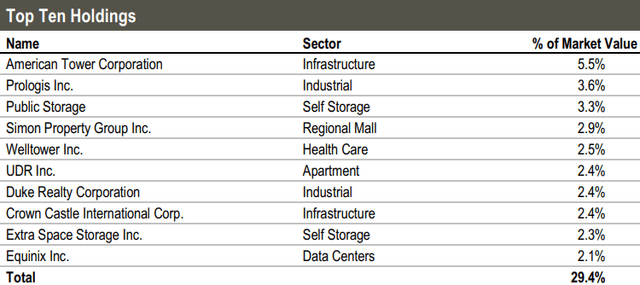

Cohen&Steers REIT & Preferred Income Fund (RNP) is a CEF with a mix of REIT common equities and preferred shares that are primarily in the banking and insurance sectors. RNP currently holds around 44% in preferred shares.

This balance provides exposure to the upside potential in REITs. RNP’s top 10 holdings are all common equities and are all “blue chip” REITs that are the highest quality REITs in their respective sectors.

Factsheet as of December 31, 2021

Inflation is driving rents higher, while interest rates remain relatively low. This is a win/win for REITs which have seen revenue rising even as interest costs decline. The next few years are going to be fantastic for REIT earnings, driving dividends and share prices higher.

The preferred portfolio for RNP provides stable income and creates less volatility compared to sister fund Cohen & Steers Quality Income Realty Fund (RQI), which has a very similar REIT portfolio but less exposure to preferred shares.

Usually, RQI trades at a higher yield, which makes sense because RQI is taking a more aggressive investment approach being 84% in common equities. However, RNP has sold off and is now trading at a 5% discount to NAV. This presents a buying opportunity where RNP is a more conservative investment and has a higher yield!

Most of the time, we choose RQI, today RNP is the better deal.

Dreamstime

Conclusion

I’m always amused when “experts” come out of the woodwork to beat down on a company simply because its share price is down and to praise a company simply because its price is up. I guess on the free internet you get what you pay for!

With my Income Method, a team of 6 experts, and a community of 5300 members, we can see past the noise and do the research, looking into the fundamentals, researching the cause of events, and not simply posting charts. This has allowed us to glean excellent income from what others simply refuse to own, refuse to study and research, and write empty articles on.

I take all this income to the bank, every monthly deposit from RNP and AGNC. It lets me pay my bills, enjoy a vacation, and even buy more shares! They’re paying for my retirement, and they can pay for yours. The more it drops, the more I buy – at even sweeter yields.

As I said above, I’m buying for income. I don’t sell because book value is temporarily depressed. I didn’t buy 10 years ago or even 5 years ago, so those old charts without deeper research mean nothing to you and me in the present. Don’t gamble your retirement on a lack of study and research. Lay a foundation of clear thinking, deep research, and hard work. You’ll be thankful you did regardless of your choices. You worked hard day after day, don’t be lazy in building the portfolio that will pay for your retirement!

Be the first to comment