The coronavirus has certainly put us in uncharted waters. But does the coronavirus justify the 30% market decline from the February 14 peak (doesn’t that seem like a long time ago?) through March 16. I argue in this post that it does not, and that you should consider some economically sensitive stocks, including my personal favorites, the private mortgage insurers.

The sell-off was partly to clear out some silliness…

Investors have had a crush the past few years with start-up “growth” companies that are bleeding red ink. My personal favorite is online furniture retailer Wayfair. Two years ago, Wayfair was trading at $90 per share and was supposed to lose about $2 per share in 2019, in my view pretty sad performance for a company that was then 16 years old. It turned out that Wayfair ended up losing over $8 per share last year, and now is supposed to lose more than $10 a share this year and next year. Yet less than two months ago the stock was at $110.

The bear market took care of that silliness, along with other beloved money losers:

Source: Yahoo Finance

…But mostly it reflects “investor PTSD”.

I think this bear market is a classic case of “investor PTSD”. What do I mean? I assume that investors maintain a rough range of possible outcomes for companies’ earnings performance. When reality comes in well out of that range, it is quite traumatic. You Baby Boomers may remember the fear of inflation that persisted for many years after the inflation bubble of the late ‘70s/early ‘80s was tamed. And investors still retain a fear of airlines and housing stocks after the disasters that befell those industries during the ‘00s. On the flip side, Amazon’s astounding success created an irrational desire for industry disruptor growth stories. See above.

The social and economic shock of coronavirus is similar. Way outside of the range of possible outcomes we could have imagined three months ago. So we’ve got our own PTSD. Fair enough. Me too in many ways.

The coronavirus PTSD clearly implies a major, long-lived recession. The MGIC example.

A near-term recession is obviously in the cards. Q2 GDP will be ugly, and probably Q3. But the market sell-off implies more than that. I’ll explain why I say that by with a summary analysis of MGIC (MTG), one of my investment darlings. For those of you not familiar with the company, it insures mortgage investors (almost exclusively Fannie Mae and Freddie Mac) against mortgage defaults by borrowers who put down less than a 20% downpayment. (If you have more interest in MGIC, see this and this article.)

We can analyze the value of MGIC by breaking it into three assets:

- Net cash. As an insurer, MGIC earns cash premiums which it invests to prepare for possible future claims payments. At the end of 2019, MGIC had $5.1 billion of net cash.

- Insurance in force. Mortgage insurance policies outstanding, which has an average life of about four years. At year-end ’19 it held $222 billion of mortgage insurance policies.

- New business. MGIC wrote $63 billion of new policies last year.

MGIC’s stock is currently trading at $8.72 on March 16. What does that imply for the value of its three assets?

- $13.50 per share in cash. Yes, you read that right. At the end of 2019 its $5.1 billion of investments less debt was $13.50 per share. Nearly all is in fixed income, mostly high-rated corporate bonds with a healthy slug of government and muni debt. This portfolio is clearly worth a bit more than $5.1 billion today considering the Treasury rally.

- ($4.90) per share in insurance in force value? This is MGIC’s stock price less the cash value. MGIC earned somewhat more than $1 a share on its insurance portfolio last year. Its current stock price implies greater than a $1 per share loss this year and for the next few years.

- $0 per share for new business? My best guess is that MGIC’s new business written very conservatively adds about $0.75 per share in shareholder value each year.

MGIC’s assumed insurance portfolio losses requires a multi-year recession.

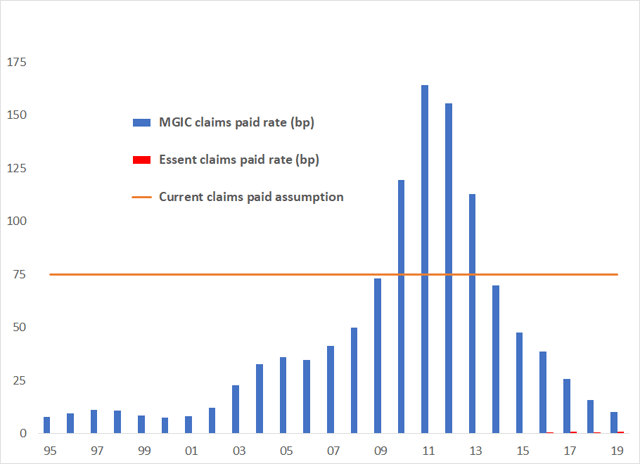

MGIC’s primary variable to determine the value of its insurance in force is claims paid. Check out this chart:

Sources:Company reports

A valuation model I created (available for $399 or a bottle of Purell) says that MGIC’s insurance portfolio must sustain annual claims payments equal to 65 bp a year to create ($4.90) of value. Yes, that level was exceeded during the housing crisis. But losses were only 10 bp during the ’01 recession, as they were for MGIC last year. But MGIC’s payments include losses remaining from the subprime era. As a comparison, I added the claims rate for peer Essent, which started up after the subprime bubble. Hard to see their losses in the chart above? That’s because they are 1 bp. Only a multi-year serious recession could cause 75 bp of losses.

What are the odds of that multi-year recession? Pretty slim, in my view.

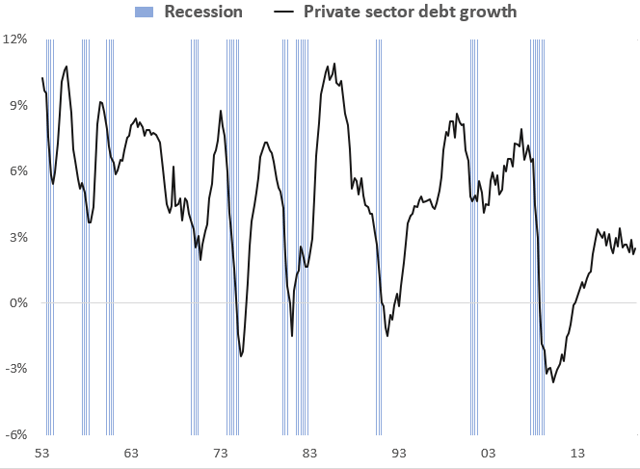

What causes recessions? Most answers to this question by so-called experts are erroneous and irrelevant tripe. One chart explains it pretty well:

Sources: Federal Reserve, National Bureau of Economic Research

The chart shows that recessions since WWll (and probably always) have been functions of credit cycles. Those supposedly buttoned-down sober bankers act more like drunken sailors. They over-lend for some period, and lo and behold, loan defaults start to rise. Shocked, the bankers restrict credit access and a recession ensues.

But take another look at the chart above, in particular private sector det growth over the past ten years. No evidence of drunken sailor behavior. Bankers joined AA, or its regulatory equivalent Dodd-Frank. No over-lending greatly reduces the odds of the credit restrictions that cause recessions.

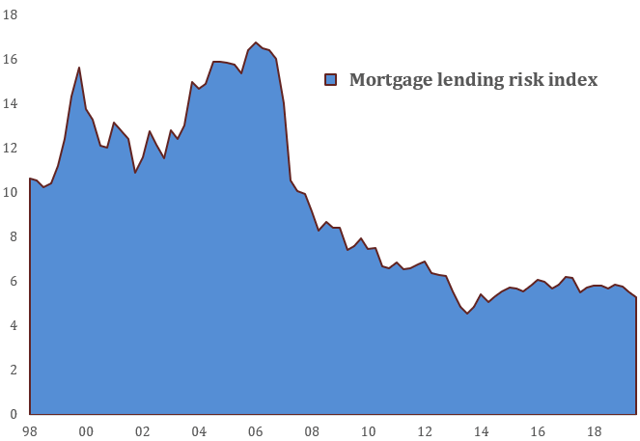

Here is one more piece of evidence about lender sobriety, the evidence that makes me such a fan of MGIC. This chart tracks mortgage lending standards:

Source: The Urban Institute

Mortgage lenders got increasingly lax from 1998 through 2007. But since then, they have been as nervous as new parents driving Volvos. As a result, generating the 65 bp of claims payments required to justify MGIC’s current stock price requires assuming a recession exceeding the Great Recession.

Summing up.

- The shock of the steps necessary to limit coronavirus has created investor PTSD, which has effectively priced in a serious, long-lasting recession.

- The credit conditions normally required to set off a recession don’t exist, so unless the coronavirus economic restrictions persist for several years a major multi-year recession is unlikely.

- I therefore recommend buying economically sensitive stocks that have priced in that severe recession. In the investment world I am familiar with, that means mortgage insurers MGIC and its peers Radian (RDN), Essent (ESNT) and National Mortgage (NMIH). Plus auto lender and consumer bank Ally Financial (ALLY).

Disclosure: I am/we are long MTG NMIH RDN ESNT ALLY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment