Lemon_tm

Investment Thesis

SentinelOne (NYSE:S) delivered a tough earnings result last night. Not only were its revenue growth rates guided lower, but its underlying path to free cash flow breakeven has been pushed back into the next fiscal year.

At a time when investors are demanding a clear strategy towards near-term profitable growth, SentinelOne delivered to investors precisely the opposite of this.

I make the case that investors should not seek to buy this dip.

Why SentinelOne? What’s the Story?

The problem, though, is that it’s one thing to rapidly grow your business when you don’t need to be concerned about the underlying profitability of the business. But it’s quite another to pivot the company’s culture from “growth at any cost,” to thinking about the long-term viability of the business.

This quote is from my work a few weeks ago on SentinelOne. In fact, as I look through SA, in the past year, I’m the only person that holds a sell rating on this stock.

SentinelOne is a cybersecurity company that specializes in endpoint protection. The problem for SentinelOne is that right now, enterprises are going through a period of IT software digestion.

This means that, during the pandemic years, IT budgets massively increased and companies were aggressively being sold to and adopting all kinds of best of breeds cybersecurity products.

However, the theme that has been taking place in the past few months is one of vendor consolation. I’ve already reported on this to Deep Value Returns members and you can also see this expressed in yesterday’s free CrowdStrike (CRWD) analysis.

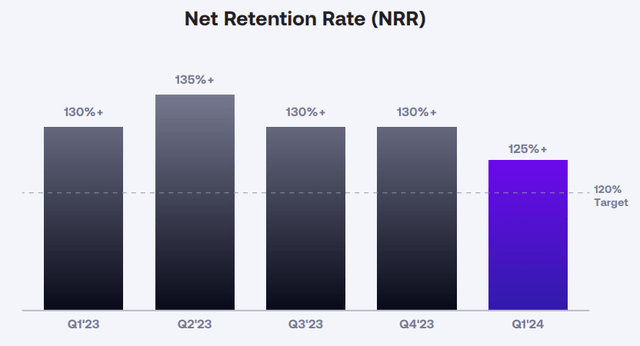

In essence, the problem for SentinelOne is not that the business is not in demand. It is experiencing healthy demand, but the problem can be best depicted below.

What you see above is that SentinelOne’s ease of upselling and cross to its customers is seeing some customer resistance. And when investors’ expectations are just so high, any unexpected pushback and slowdown in net retention rates has a significant impact on SentinelOne’s revenue growth rates, the topic that we’ll now turn to.

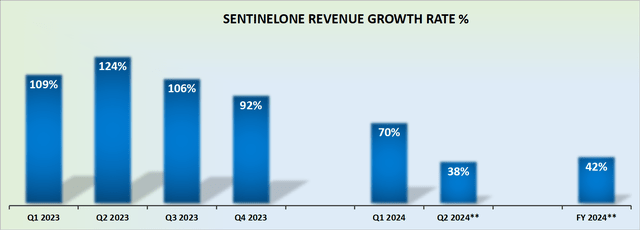

Revenue Growth Rates Decelerate

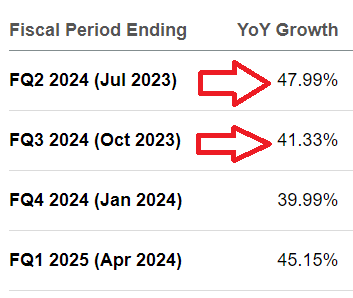

As of 90 days ago, SentinelOne was expecting to grow faster than 50% CAGR. For investors, that level of hypergrowth allowed SentinelOne to continue to be highly unprofitable and press forward with its strategy of investing for growth.

The problem now is that SentinelOne has downwards revised its full-year outlook by more than 7%, which meaningfully impacts its expected medium-term growth rates.

SA Premium

Simply put, if SentinelOne is guided for fiscal Q2 2024 to grow by around 38% y/y, this means that analysts were dramatically wrong on SentinelOne’s near-term growth rates.

And if investors’ expectations are high, and the consensus is wrong, that poses a significant problem.

Profitability Profile is the Key Bear Case

Next, we’ll address SentinelOne’s profitability profile.

S Q1 2024

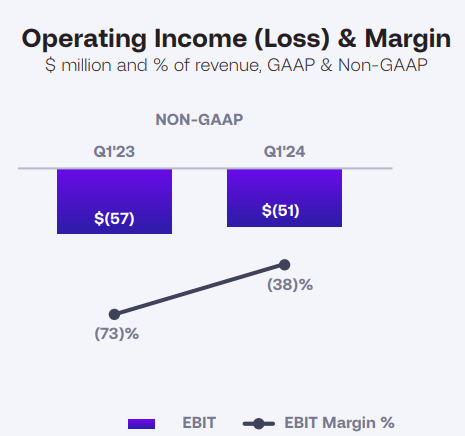

Above we can see that SentinelOne is making solid progress on its profitability profile. However, the main question that now surfaces is whether or not SentinelOne can indeed reach its free cash flow targets in fiscal 2024 as SentinelOne has been recently declaring.

This was obviously a key topic that surfaced on the call. This is what SentinelOne declared,

[…] in terms of free cash flow, I think in light of the reduced top line expectations for the year, I think the target for this year, where we said we could potentially hit it in the latter part of this year, say, Q4, I think that’s probably better off thinking of that as a fiscal ’25 activity just based on the lower top line.

Essentially, SentinelOne now believes that its free cash flow breakeven profile will be pushed slightly further back than it previously expected.

The Bottom Line

SentinelOne’s recent earnings report disappointed investors as its revenue growth rates were revised lower and the path to free cash flow breakeven was pushed back.

SentinelOne is facing challenges due to vendor consolidation and customer resistance in upselling and cross-selling strategies.

The downward revision in the full-year outlook and medium-term growth rates raises concerns about meeting high investor expectations.

While SentinelOne has shown progress in its profitability profile, achieving its free cash flow targets by fiscal 2025 may be delayed. Overall, the earnings result and outlook suggest caution for investors considering buying the dip in SentinelOne.

Be the first to comment