wildpixel

Editor’s note: This blog post is an excerpt from a TSI commentary originally published at tsi-blog.com last week]

The financial markets were shocked — shocked, we tell ya! — by the US CPI for August. We know they were shocked because on the day of the CPI release the US stock market gave back almost all of the gain achieved during the preceding strong 4-day rebound and there was a big up-move in the Dollar Index. Before we take a look at the CPI report that caused the mini panic, it’s worth repeating the following comments from the 15th August Weekly Update:

“Over the past few weeks the financial markets have celebrated the signs of declining “inflation”, the thinking being that the evidence of an inflation reversal will lead to a Fed pivot in the short-term. This line of thinking is wrong in two critical ways.

The first way it is wrong is that the Fed’s leadership appears to have its eyes firmly fixed on the rear-view mirror. Although there is now a CPI downtick in the rear-view mirror, base effects (the CPI increases that will remain in the year-over-year calculations for months to come) ensure that the headline CPI growth numbers will remain elevated for at least the remainder of this year. For example, even though inflation most likely has peaked on an intermediate-term basis, the numbers that will stay in and drop out of the year-over-year calculations each month mean that there is almost no chance of the year-over-year CPI growth rate dropping below 6% sooner than the first quarter of next year. In fact, the year-over-year CPI growth rate reported for each of the next three months probably will still have an ‘8 handle’.

Therefore, for months to come the Fed is going to be seeing annual CPI growth rates near multi-decade highs, which will encourage it to continue tightening.

The second way it is wrong is that even after the Fed’s leadership starts to feel confident that inflation is heading towards a level that it deems acceptable, there won’t be an immediate policy reversal.”

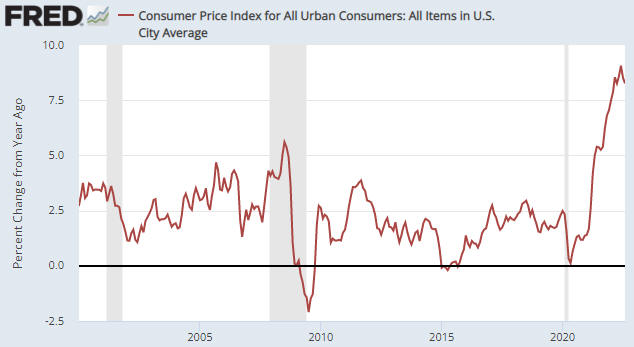

The evidence continues to accumulate that inflation is now in a downward trend, but due to the price increases that have already occurred it is reasonable to expect that the year-over-year CPI growth numbers will be near multi-decade highs for at least a few more months. Nobody should expect anything else. Certainly, nobody should have been shocked by the 8.3% year-over-year CPI growth number reported for August.

The 8.3% growth rate reported for August followed 8.5% in July and 9.1% in June. This is probably the start of a downward trend that won’t bottom until Q2-Q3 of next year. More significantly, we point out that the percentage change in the CPI over the past two months was approximately zero — the result of a large decline in the gasoline price offset by price gains elsewhere (e.g. in rent and food).

However, the monthly chart displayed below shows that the numbers remain very high relative to everything over the past twenty years prior to the past few months. This is the issue, given the tendency of the Fed’s leadership to fixate on the rear-view mirror.

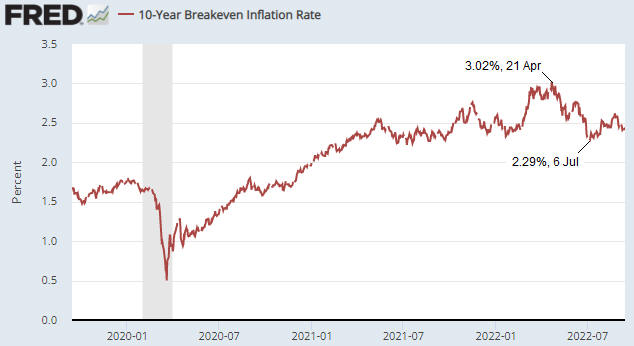

It’s worth mentioning that there continues to be a wide gap between the current CPI growth rate and the expected future CPI growth rate.

The following daily chart shows that the 10-Year Breakeven Rate, a measure of what the bond market expects the CPI to be in years to come, peaked on 21st April this year at 3.02%, made a short-term bottom at 2.29% on 6th July and currently is much closer to a 12-month low than a 12-month high. There’s a good chance that the expected CPI will drop to 2.0% or lower during the stock market’s next large multi-month decline.

The problem for the stock market bulls who take every hint of declining “inflation” as a reason to anticipate a shift from monetary tightening to monetary easing is that such a shift won’t happen within the next six months unless there is a lot more economic and stock market weakness. We think that the aforementioned monetary shift will happen during the first quarter of next year, but that’s only because we are expecting a lot more weakness in the stock market and the economy.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment