Robert Way

Shares of Li Auto (NASDAQ:LI) have revalued lower by 25% this year due to slowing growth in the Chinese electric vehicle industry as well as COVID-19 related shutdowns that have impacted factory output. Li Auto’s delivery growth slumped in August and with it the firm’s valuation. However, I believe Li Auto’s shares have once again become too cheap. The company is launching new models and although top line estimates have been falling, reflecting challenges of a more difficult macro environment, I believe Li Auto has a lot of potential to see an up-wards revaluation of its shares!

Slowing delivery growth

Li Auto is not the only electric vehicle company that has seen a slowdown in delivery growth this year. In part, the broad-scale slowdown in the EV industry was (and still is) related to new COVID-19 outbreaks in China which resulted in authorities closing down entire cities and manufacturing hubs. Additionally, inflation has been weighing on consumer sentiment, driving more careful spending attitudes.

As a result, Li Auto’s delivery growth cratered in 2022 and the EV company — which competes with the likes of NIO (NIO) and XPeng (XPEV) — delivered just 4,571 electric vehicles in the month of August. Li Auto experienced the largest month over month drop-off in deliveries of all three EV manufacturers in August at a rate of 56.1%. XPeng did slightly better with a month over month drop-off of 16.9% while NIO did the best with an increase of 6.2%. NIO’s increase in deliveries has been entirely attributable to the ramp of the ET7 sedan, the company’s first product in the sedan market, which so far has been well-received by consumers. NIO also achieved the third straight month of deliveries exceeding 10 thousand electric vehicles in August.

|

Deliveries |

June |

June Y/Y Growth |

July |

July Y/Y Growth |

August |

August Y/Y Growth |

MoM |

|

LI |

13,024 |

68.9% |

10,422 |

21.3% |

4,571 |

-51.0% |

-56.1% |

|

XPEV |

15,295 |

133.0% |

11,524 |

43.0% |

9,578 |

33.0% |

-16.9% |

|

NIO |

12,961 |

60.3% |

10,052 |

26.7% |

10,677 |

81.6% |

6.2% |

(Source: Author)

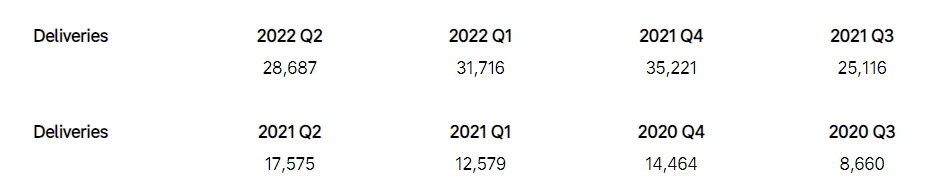

In the second-quarter, Li Auto’s deliveries dropped relative to the first-quarter due to the challenges mentioned in the previous paragraph. While total deliveries still increased 63.2% year over year, they dropped 9.6% compared to Q1’22.

Li Auto: Quarterly Deliveries

Li Auto is producing the Li-One, L9 and the L8 sport utility vehicles — the L8 is set to launch in November — and the company has an easy-to-manage production line. As Li Auto broadens the depth of its product portfolio, the company faces attractive revenue growth prospects. Li Auto is expected to grow its top line 63% in FY 2022 and 104% in FY 2023.

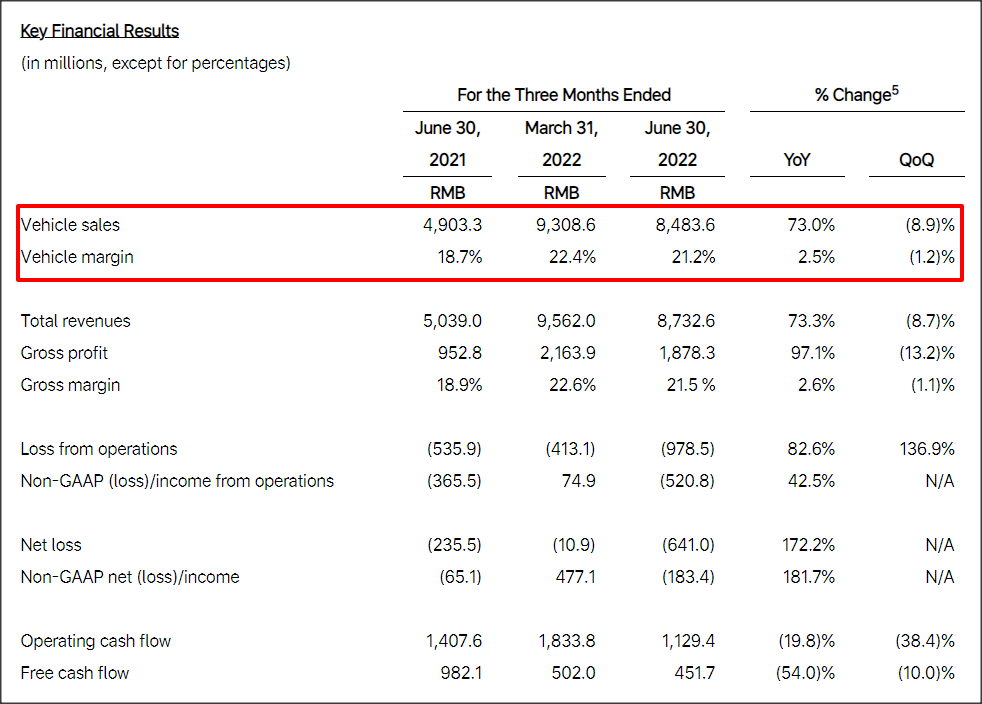

Li Auto’s vehicle sales in the second-quarter totaled 8.48B Chinese Yuan which calculates to $1.27B, showing a year over year growth rate of 73%. While Li Auto’s revenues can be expected to continue to grow fast going forward, especially as the company rolls out more SUV products, a headwind as emerged, not only for Li Auto but for the entire electric vehicle industry: Vehicle margins have started to come under pressure in FY 2022, chiefly due to higher raw material costs. Li Auto’s vehicle margins dropped 1.2 PP quarter over quarter in Q2’22 to 21.2%. NIO’s vehicle margins declined 1.4 PP in the second-quarter while XPeng’s margins slid 1.3 PP.

Li Auto: Q2’22 Financial Results

Li Auto is too cheap to ignore

Li Auto’s EPS predictions imply that the market expects the company to achieve its first small profit in FY 2022… which means Li Auto is expected to reach profitability sooner than its rivals NIO and XPeng. NIO is expected to see its first profits in FY 2024 while XPeng is expected to turn a profit in FY 2025.

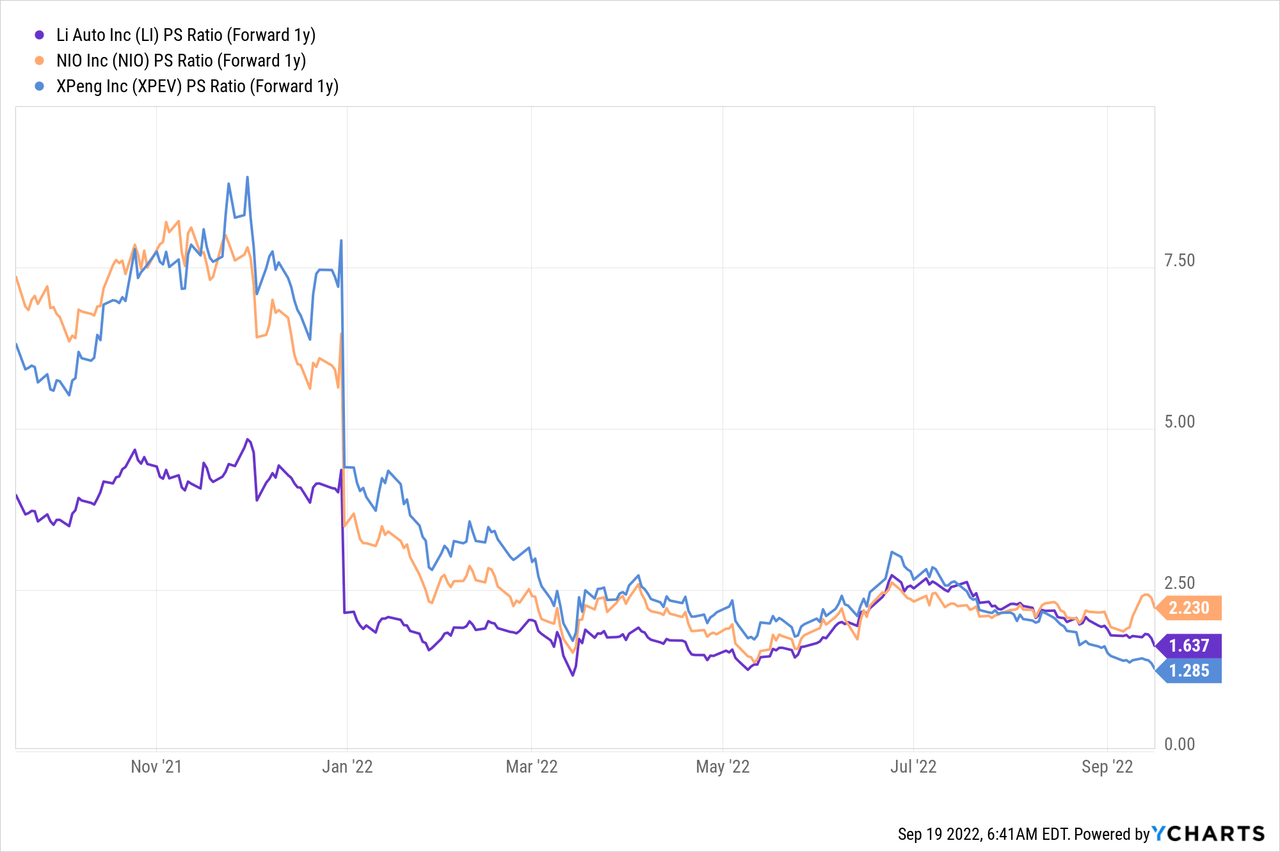

Based off of revenue predictions, Li Auto has a P-S ratio of 1.6 X which makes the EV company cheaper than NIO which has a P-S ratio of 2.2 X.

Risks with Li Auto

Li Auto has two main commercial risks: (1) The slowdown in delivery growth is set to impact the speed with which revenues are ramping up, (2) Vehicle margins for Li Auto have started to drop which indicates growing cost and margin pressures… in both cases this could translate to a lower valuation factor for Li Auto’s shares and additional losses for shareholders going forward. What would change my mind about Li Auto is if vehicle margins drastically contracted or the EV company submitted a weak forecast for FY 2023.

Final thoughts

Li Auto’s shares are too cheap to ignore. The electric vehicle manufacturer has seen a slowdown in deliveries this year through no fault of its own. Deliveries dropped off in August, but they should rebound as the company launches new products and production normalizes. Li Auto is expected to double its top line next year and although there is a growing risk of contracting vehicle margins due to inflation and cost pressures, I believe Li Auto has both an attractive valuation and a risk profile that remains skewed to the upside!

Be the first to comment