gorodenkoff

A Quick Take On Vitro Biopharma

Vitro Biopharma (VTRO) has filed to raise $18.3 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing stem cell based treatments for Pitt Hopkins syndrome and long COVID.

With its next trials not starting until late 2022 or early 2023, it will be some time before the firm can achieve a meaningful catalyst to the stock.

When we learn more about the IPO’s pricing and valuation assumptions, I’ll provide a final opinion.

Vitro Overview

Denver, Colorado based Vitro was founded to develop its AlloRx Stem Cell therapy platform that creates drug candidates from ‘culture-expanded mesenchymal stem cells sourced from the Wharton’s jelly of umbilical cords.’

Management is headed by Chief Executive Officer Christopher Furman, who has been with the firm since July 2022 and was previously Managing Director at Virtus Investment Partners.

The firm’s pipeline includes treatments for Pitt Hopkins syndrome [PTHS] and post-acute sequelae to SARS-CoV-2 [PASC].

The company expects to begin FDA-authorized trials in late 2022 or early 2023.

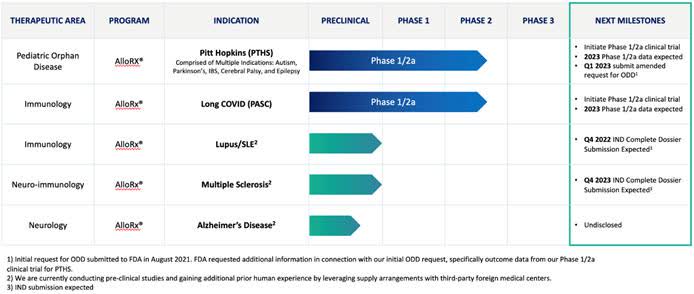

Below is the current status of the company’s drug development pipeline:

Company Pipeline (SEC EDGAR)

Vitro has booked fair market value investment of $26.5 million in equity, debt and convertible debt as of April 30, 2022 from investors.

Vitro’ Market & Competition

According to a 2022 market research report by Science Daily, the market for treatment for Pitt Hopkins syndrome is difficult to determine, as ‘only about 500 cases of the syndrome have been reported worldwide since it was first described by Australian researchers in 1978.’

The report indicated that ‘some estimates suggest that there could be more than 10,000 cases in the United States alone.’

The research report also stated that the UNC School of Medicine has shown that gene therapy may be able to ‘prevent or reverse many deleterious effects’ of the disorder.

Major competitive vendors that provide or are developing related treatments include:

-

Athersys (ATHX)

-

Brainstorm Cell Therapeutics (BCLI)

-

Celularity (CELU)

-

Corestem

-

Fate Therapeutics (FATE)

-

Longeveron (LGVN)

-

Medipost

-

Pluristem Therapeutics

-

SanBio Co (OTC:SNBIF)

-

Stemedica Cell Technologies

The company is also pursuing treatments for other, larger potential market opportunities.

Vitro Biopharma Financial Status

Below are the company’s financial results for the past 2.5 years:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended April 30, 2022 |

$ 2,208,824 |

386.5% |

|

FYE October 31, 2021 |

$ 1,310,946 |

102.1% |

|

FYE October 31, 2020 |

$ 648,708 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended April 30, 2022 |

$ 1,912,962 |

412.1% |

|

FYE October 31, 2021 |

$ 959,639 |

122.3% |

|

FYE October 31, 2020 |

$ 431,726 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended April 30, 2022 |

86.61% |

|

|

FYE October 31, 2021 |

73.20% |

|

|

FYE October 31, 2020 |

66.55% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended April 30, 2022 |

$ (880,077) |

-39.8% |

|

FYE October 31, 2021 |

$ (4,116,748) |

-314.0% |

|

FYE October 31, 2020 |

$ (1,268,464) |

-195.5% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended April 30, 2022 |

$ (2,601,630) |

-117.8% |

|

FYE October 31, 2021 |

$ (4,521,663) |

-204.7% |

|

FYE October 31, 2020 |

$ (1,562,547) |

-70.7% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended April 30, 2022 |

$ (1,192,293) |

|

|

FYE October 31, 2021 |

$ (998,187) |

|

|

FYE October 31, 2020 |

$ (779,949) |

|

As of April 30, 2022, the company had $2.2 million in cash and $4.1 million in total liabilities.

Vitro Biopharma IPO Details

Vitro intends to raise $18.3 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

to fund clinical preparation activities for AlloRx Stem Cell therapy for the treatment of PTHS through initiation and completion of our planned Phase 1/2a clinical trial, and receipt of safety, dosing/tolerability and efficacy in dosing data therefrom, and through initiation and completion of any subsequent Phase 2b/3 clinical trial, and receipt of dosing/tolerability and efficacy data therefrom;

to fund, together with our existing cash and any additional funds received upon the exercise for cash of our outstanding warrants, clinical preparation activities for AlloRx Stem Cell therapy for the treatment of Long COVID through initiation and completion of our planned Phase 1/2a clinical trial, and receipt of safety, dosing/tolerability and efficacy in dosing data therefrom;

to fund pre-clinical activities for AlloRx Stem Cell therapy for the treatment of Lupus (SLE) through completion of our IND submission, initiation of our planned Phase 1/2a clinical trial, and receipt of initial safety, dosing/tolerability and efficacy in dosing data therefrom;

to fund pre-clinical activities for AlloRx Stem Cell therapy for the treatment of MS through completion of our IND submission, initiation of our planned Phase 1/2a clinical trial, and receipt of initial safety, dosing/tolerability and efficacy in dosing data therefrom;

to fund, together with our existing cash and any additional funds received upon the exercise for cash of our outstanding warrants, the acquisition of fully automated closed system bioprocessing and other equipment and for the development of a new cGMP compliant manufacturing facility which we expect to lease; and

the remainder, if any, for working capital and other general corporate purposes.

Based on our current operating plan, we believe that our existing cash, together with the net proceeds from this offering, will be sufficient to meet our working capital and capital expenditure needs for at least the next 12 months.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said there were no legal proceedings or claims ‘currently pending against us or our officers and directors in which we are adverse.’

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Vitro’s IPO

VTRO is seeking public capital market funding to advance its pipeline of drug treatment candidates.

The firm’s lead candidates include treatments for Pitt Hopkins syndrome [PTHS] and post-acute sequelae to SARS-CoV-2 [PASC].

The company expects to begin FDA-authorized trials in late 2022 or early 2023.

The addressable market opportunity for treating Pitt Hopkins syndrome is likely very small, although the company is pursuing treatment candidates for other potentially larger markets such as long COVID.

Management hasn’t disclosed any major pharma firm collaboration relationships and the company’s investor syndicate does not include any well-known life science venture capital firms.

ThinkEquity is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (60.2%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

With its next trials not starting until late 2022 or early 2023, it will be some time before the firm can achieve a meaningful catalyst to the stock.

When we learn more about the IPO’s pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment